That was no thump.

That was no thump.

That was a pretty minor pullback and, like I said this morning, "if we hold 13,700 for the week there is nothing to do but be bullish as the chartits will rule the day."

I'm just going to go on record saying I think it is total nonsense, I feel we are following a massively irresponsible policy that is sweeping a billowing financial catastrophe under the rug but – what can you do? If everyone is going to buy into this BS there is a lot of money to be made, until there isn't and I will be starting our new virtual portfolios next week with that attitude.

We will continue to hedge to the downside as I certainly smell smoke, gold is rising out of control and the dollar is falling so fast we are pushing towards a massive inflation event in the US but, as I often say, stocks are themselves a commodity and are simply rising along with gold and oil as our ever declining dollars simply don't buy as many shares of companies as they used to.

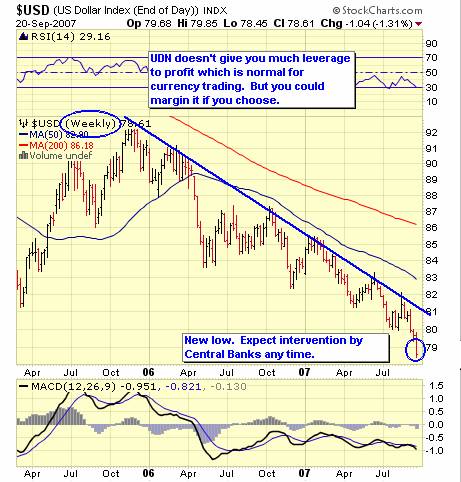

David Fry postulates that there will be intervention by the Foreign Central Banks to prop up the dollar but I'm not so sure they are ready to bail us out, they all seem to be having problems of their own.

David Fry postulates that there will be intervention by the Foreign Central Banks to prop up the dollar but I'm not so sure they are ready to bail us out, they all seem to be having problems of their own.

Notice there was some stepping in to support the dollar at 84 and 82.50 and 81.5 and 80 but we just flew past 79 without looking back and gold is continuing to fly as we hit the magic decline number (10% for the year) that will cause the World's rich to call their brokers and move out of US dollars.

No one knows how many dollars are out there. In March of '06, in preparation for the regime change to Paulson/Bernanke, the Fed stopped measuring the M3 money supply, the only reliable measure we had to see how many dollars there were in the world. At the time I postulated that they were doing this in order to begin running the printing presses at full speed so we could inflate our way out of a deficit.

How many more dollars has the Fed thrown onto the fire since last year. From they above graph $1T would not be a surprising number. And how much has the dollar declined since last year? About 10%. Well, that balances out pretty neatly. How much are the markets up? About 10%… Since 1995, we have thrown over $7T into the global economy, an increase of 175% over the early 90s.

In January of 1995 the Hang Seng was at 8,190, today it's at 25,843 – how much of that is simply the fact that our shoddy US dollars just can't buy as many Yuan as they used to? China is facing their own inflation issues as the government there is concerned they can no longer supress the price of fuel, which is regulated by the State. This will be great for Chinese oil companies like PTR and CEO by the way.

So China, who is holding 1/10th of the US Dollars in the World, may not be willing to step in and buy even more dollars, even though stopping the slide is in their own interest on many levels. Japan has already trashed its own economy trying to prop up ours and Europe has lines at the bank of people trying to get their money out while a strong Euro is the only thing that's stopping them from a massive inflation cycle driven by imported crude.

Brent Crude is roughly $5 less (6%) than we are paying. If that should start to creep up (and it is) then any move to bail out the dollar will have a very direct, very negative impact on EU consumers, who already pay the World's highest fuel prices. Even the Saudis are hard pressed to step in and their CB just announced they would NOT lower their rates as the kingdom seeks to control 4% inflation. This is despite the fact that the Riyal is "pegged" to the dollar. Kuwait decoupled the Dinar from the dollar in May to stop their own runaway inflation.

"We'll probably begin to see more countries maintaining a peg against a basket of currencies and not just against the dollar," says Richard Clarida, global strategic adviser at Pacific Investment Management Co. and an economics professor at Columbia University. "While linking a currency to the dollar can reduce volatility, it also means central banks have very little room to maneuver in fighting inflation." Qatar, Oman, Bahrain and the United Arab Emirates all tie their currencies to the dollar.

"We'll probably begin to see more countries maintaining a peg against a basket of currencies and not just against the dollar," says Richard Clarida, global strategic adviser at Pacific Investment Management Co. and an economics professor at Columbia University. "While linking a currency to the dollar can reduce volatility, it also means central banks have very little room to maneuver in fighting inflation." Qatar, Oman, Bahrain and the United Arab Emirates all tie their currencies to the dollar.

China is on the horns of a similar dilemma. "I don't know what day they're going to do it, but they've got to let the currency appreciate further, and perhaps faster," says Jim O'Neill, head of global economic research at Goldman Sachs. And those guys are definitely the "smart money!" Letting the Yan appreciate means dumping dollars, not buying them so we could be in for a very good market run as the price of US equities, at least in terms of US dollars, continues to rise.

So we may as well party like it's 1999, a year I watched many bears go broke telling us how bogus the rally was. Unlike 1999, we will continue to hedge on the way up, even if that ultimately costs us a percentage of our long-term gains as this party can end without warning at any time. Our markets are rising on weakness, not strength – the emperor has no clothes and it's going to get really cold when that fire goes out…