chubby – October 19th, 2007 at 4:11 pm | Permalink

"At 11:18 AM Phil said…”Taking profits – cash is your best friend right now. The Fed can turn this whole thing around in a second or we could drop 380 points by the days end so if you have winners, don’t think of ways to leave them in play, just knock them out and we’ll figure out the markets next week.”

OK, Phil…towards the end of the day we are down 378 Dow points; and this is close enough to 380 for me to ask where in the world did you come up with the number, several hours ahead of time…you never cease to amaze me!!! great call on that one, no matter how you did it! And by the way…Thank You!"

I never set out to be a market prognosticator.

Phil's Stock World started off as my own trading notes. I would take notes so that I could capture my thoughts, which would let me go back in time and see what I was thinking when I bought a certain stock, hopefully to help me review and correct my mistakes and, even more hopefully, avoid repeating them.

Did I misinterpret an article? Did I take a bad tip? Did I listen to CNBC or Cramer or some other pundit? Did I jump on an analyst's pick? Did I follow a certain newsletter? Did I hold to long? Did I sell too early? Did I trust the government (anyone who grew up during Watergate knows how dumb that mistake is!)… This article is one of those reviews, good for me and good for you to follow my thought process leading up to this dip.

I had a growing number of people who knew I was into trading and would ask for advice so I started sharing my notes by Email and that quickly became a bother and then a friend of mine suggested I start a blog. I tried MySpace but soon moved to Blogger (the URL of which, amazingly has been hijacked since I left), but my readership grew to over 9,000 people a day and answering questions became impossible and the workload of running the blog became more than I could handle alone. I decided I would either have to go pro or go back to trading privately (which is kind of boring) so I went pro and hired people to help. We started in WordPress before moving to the current site and just 2 weeks ago we rolled out a major new format so we could better serve our rapidly growing membership.

The mission statement of Phil's Stock World is "High Finance for Real People – Fun and Profits" as I think trading should be fun, not stressful and the strategies we teach at PSW reflect that philosophy. The site is all about teaching trading, not making picks. Making picks is easy, it's making correct picks that's difficult, and a lot of subscription services seem to get that second part wrong!

As my readers know I'm quite the fan of classic economists and a student of the Great Depression. I'm not a pessimist by nature, if you read my MySpace notes from late '05 (including my very bullish take on oil and my call for Google to hit $3,500 by 2015 ) as well as most entries of '06 (in the archives of this site) you'll see a "perma bull." While I am a great advocate of going with the flow, I learned from Ghostbusters that the door swings both ways and my personal stock market hero has always been Rodney Dangerfield in Caddyshack, who is on the phone with his broker and says "They're selling? Then buy! Oh, now they're buying? Then sell, sell, sell!"

I was recently asked by a radio host what style of investor he should introduce me as and I said, "today I'm a bull, but I may not be tomorrow." He thought that was odd and told me pretty much every guest has a certain style and they seem happy to be labeled as a bull or a bear or a contrarian… If I had to pick a style, I would have to use my own category of Bond Investing, James Bond Investing that is; something I wrote about back on June 24th. Whether you are a bull or a bear, the market isn't loyal to you – why should you be loyal to it?

I was recently asked by a radio host what style of investor he should introduce me as and I said, "today I'm a bull, but I may not be tomorrow." He thought that was odd and told me pretty much every guest has a certain style and they seem happy to be labeled as a bull or a bear or a contrarian… If I had to pick a style, I would have to use my own category of Bond Investing, James Bond Investing that is; something I wrote about back on June 24th. Whether you are a bull or a bear, the market isn't loyal to you – why should you be loyal to it?

So while I may have a bullish or bearish outlook at any given time, that doesn't stop us from taking advantage of whatever opportunities may present themselves. In fact, I want my hedge fund to be classified as an "Opportunity Fund" – whatever that means – pretty much we generally try to make money. I would think that's the goal of any fund but looking at their reports so far this year, apparently it's not!

At PSW, we take our economic predictions very seriously as it sets the tone for our trades, which we take VERY seriously! One of the things I've learned about predicting the markets is that sometimes I can be too good (and I'd like to be more modest but after this week I have to admit that I'm good!) and I see things too far in advance, too early to make the trade. Over the past couple of years I've worked on improving my timing, which has allowed me to make much more profitable options trades as timing is pretty much everything in the options game.

The week of July 23rd, with the Dow at 14,000, I made my second bearish call of the year (the first was ahead of the crash, the week of 2/19), telling readers we were going back to cash in our virtual portfolios until we had a pullback and placing a big bet on DIA puts. That week, which was an expiration week too, we posted a virtual 147% gain on 141 closed positions as we had been very, very bullish into the rally but I felt like it was a top so we cashed all of our winners (the call side) and left our losers (the put side) to ride, doubling down on many of them. That worked out exceedingly well as the Dow plunged 800 points in the next two weeks and another 600 points two weeks later.

As we had gone from 70/30 bullish to almost 100% bearish right at the top, the gains we tracked were, of course, spectacular. No matter how sure I am about the market, I generally don't go more than 70% bullish or bearish but this was very lucky as we cashed out our winners, which was pretty much all of our bullish positions. We called an interim bottom in early August but we were very skeptical of the bounce and shorted on the way up, leading to a fantastic August 9th, when we had our best single day (at that time) calling that drop on the nose.

I did not do as well on that drop, as I was on vacation at the time and had left my virtual portfolio very hedged so the second 800-point down leg of the market only yielded a 7.5% gain as I didn't touch the virtual portfolio (90% cash) for a whole week. While I was away, Happy Trading and Options Sage were making posts and I would occasionally chime in and all three of us called a bottom on August 17th, with the Dow at 12,800. I highly recommend reading the article that Sage posted entitled "Don't Just Stand There, Do Something" as well as my tongue-in-cheek response I called, "Don't Just Do Something, Stand There," two articles that did not really disagree with each other but are full of great pointers for dealing with a market "crisis."

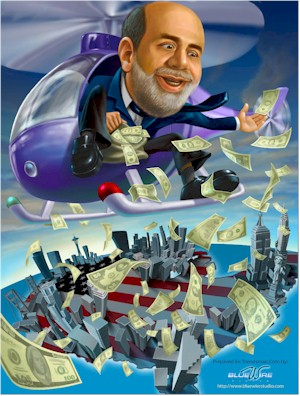

I was back that Monday and we flipped back to 70% bullish and made another double on the turn. I turned sour on the markets again ahead of the Fed meeting, where they did what I thought was a very wrong thing by lowering rates, fomenting a run-up in stocks (which the average American could care less about) AND commodities (which the average American is forced to buy). This was one of those cases where my economic foresight put me on the wrong side of a trade as I got caught short by, not just the Fed's overreaction to a mild market correction, but to the market's irrational exuberance over what was, clearly, desperate crisis management of a much deeper problem. My "Monthly Mop-Up" for September outlines how we navigated that move but the image on the right summed up my overall feelings about the market action.

I was back that Monday and we flipped back to 70% bullish and made another double on the turn. I turned sour on the markets again ahead of the Fed meeting, where they did what I thought was a very wrong thing by lowering rates, fomenting a run-up in stocks (which the average American could care less about) AND commodities (which the average American is forced to buy). This was one of those cases where my economic foresight put me on the wrong side of a trade as I got caught short by, not just the Fed's overreaction to a mild market correction, but to the market's irrational exuberance over what was, clearly, desperate crisis management of a much deeper problem. My "Monthly Mop-Up" for September outlines how we navigated that move but the image on the right summed up my overall feelings about the market action.

It was William Shakespeare who said, more or less, that a relief rally based on government intervention is "but a walking shadow, a poor player that struts and frets his hour upon the stage and then is heard no more: it is a tale told by an idiot, full of sound and fury, signifying nothing." The market enjoyed it's hour on the stage for almost exactly a month (1/12 of a year – kudos to Shakespeare on the timing), from option expiration period to option expiration period yet here we are, 31 days after the Fed call, within 100 points of the pre-Fed close.

That brings us to October. What were the signs we saw so clearly that were missed by (if you go by CNBC, pretty much everybody in the financial community) as the market flew back to 14,000 as if it didn't have a care in the world? While we were happy to enjoy the rally with the rest of the world, posting a 66% average gain on positions closed the last week of September, a 54% average gain the week of October 7th and a spectacular 159% average gain last week thanks to BIDU, one of our best plays ever.

On October 1st, Option Sage asked us to think about:

- Did I plan my trade?

- Do I have a clear goal of when to take profits?

- Do I know what I will do if the stock moves against me?

Later that day I posted the picture on the left to illustrate where I thought the markets were, stating "I’ve been saying for quite some time that the banks need to step into the confessional box and tell us just how much of the $2 Trillion drop in the value of US housing (so far) they are on the hook for. So far we’ve had a Billion here, a Billion there but the big boys have so far had their heads firmly in the sand and that means it’s time for a kick in the ass." I went on to warn that, while the major banks and brokers may weather the storm, it was the regional and local boys that were likely to bring us down as they were not diversified enough to sweep their substantial losses under the rug.

Later that day I posted the picture on the left to illustrate where I thought the markets were, stating "I’ve been saying for quite some time that the banks need to step into the confessional box and tell us just how much of the $2 Trillion drop in the value of US housing (so far) they are on the hook for. So far we’ve had a Billion here, a Billion there but the big boys have so far had their heads firmly in the sand and that means it’s time for a kick in the ass." I went on to warn that, while the major banks and brokers may weather the storm, it was the regional and local boys that were likely to bring us down as they were not diversified enough to sweep their substantial losses under the rug.

Our public trade of the day was the IMCL Jan $40s at $4.30, now $7.80 (up 81%). Monday night we threw in the towel, or actually Towelie, our official spokesman who says "I have no idea what's going on" whenever the market acts strangely. Undeterred by the strange market behavior, we loaded up (in a trade also given away on the public site) with XOM $90 puts at .70, a play that doubled by the 4th. Aside from good position management strategies, one of the things we stress at PSW is exit strategies, the very basic premise is that we use trailing stops based on the profit of the trade, to avoid giving back good gains. We often override the exits based on market conditions but, when in doubt – that's the way to get out!

I closed Monday (10/1) saying "So we’ll shop ’till the market drops, keeping our eye out for potential bumps in the road as we have the Briefing.com Economic Calendar showing us what’s ahead but, after this week, it’s earnings season, and that’s a world unto itself." I also said "We are hedging a much more bullish virtual portfolio with the sector most likely to collapse first and we are also going to continue to chase the FXI as they are going to melt down with style – but not today!" We pursued a strategy this month of putting 30% of our bullish profits in "focus shorts" like XOM and FXI as we weren't sure when the market would fall but we sure could spot overbought stocks. October 1st was indeed, not the day FXI would fall, on October 3rd it rewarded us by gapping down $10.

On Tuesday, 10/2, I said (tongue in cheek) that we had a Super Market: "It’s budget proof, oil proof, terror (threat) proof, housing proof, inflation proof and pullback proof 3 weeks in a row!" but I was still very concerned, saying "What, if anything, is our stock market Kryptonite? Why is the retail sector down 7% for the year if everything is so great? I know, I’m supposed to switch my brain off and just go with the flow but even Superman can be more effective if he knows to look out for glowing green rocks. The rational approach to this sort of market is to participate in the rally, enjoy it while we can, but keep a lookout for signs of weakness that undermines the overall strength." I went on to list a litany of concerns that I thought might start to matter in the near future. I recommend this particular post as it contains a lot of my macro thinking at the time.

On Tuesday, 10/2, I said (tongue in cheek) that we had a Super Market: "It’s budget proof, oil proof, terror (threat) proof, housing proof, inflation proof and pullback proof 3 weeks in a row!" but I was still very concerned, saying "What, if anything, is our stock market Kryptonite? Why is the retail sector down 7% for the year if everything is so great? I know, I’m supposed to switch my brain off and just go with the flow but even Superman can be more effective if he knows to look out for glowing green rocks. The rational approach to this sort of market is to participate in the rally, enjoy it while we can, but keep a lookout for signs of weakness that undermines the overall strength." I went on to list a litany of concerns that I thought might start to matter in the near future. I recommend this particular post as it contains a lot of my macro thinking at the time.

My public pick of the day was the MTB Nov $105s at $4.50, which we ended up selling Oct $105s against for a 100% gain but the combined trade is down 30% after yesterday's big sell-off spared no one in the banking sector. We took advantage of the dip on Tuesday to take about half our callers off the table as I predicted 1,540 would hold on the S&P. 53 positions were pulled Monday and Tuesday, mainly covers as we got ready for what I still termed a "pointless" run to new highs. Timing is indeed everything as my comment in the wrap-up was "We’ve been chasing the FXI up over 2,000 points now but today was the first time I’ve left that put naked, previously we had sold $8 lower October calls against it to pay for the rolls…" All in all we left 24 of 59 bullish positions in the STP uncovered, along with 20 naked calls in the LTP (a record I think). We protected that group with a large block of DIA index puts as well as our focus puts in the FXI and I said: "The purpose of the index puts is not to make money, although that happens by accident sometimes. The index puts are there to give us time, in a dip, to calmly evaluate our open positions so we can decide, item by item, whether to Stop (take it off the table), Drop (drop our option to a lower strike) or Roll (move our calls to a lower strike or farther out in time)."

Wednesday (10/3) I wasn't sure which way the market would go as the Hang Seng dropped 719 points before our markets opened but I advised we ignore it and our morning plan to cash in the PTR and FXI puts we had at the time was right on the money. COP came out with a warning on profits and that set up our premise for shorting the majors into this rally, a move that paid off in spades yesterday. I titled the Wednesday Wrap-Up "Did You Want Fries With That Shake" as we viewed the sell-off as a shake out of the retail investors ahead of a major push to get the market higher. The Dow bounced off 13,900 and finished the day at 13,968 and we called a dead bottom at 2:26 that day in member chat.

Wednesday (10/3) I wasn't sure which way the market would go as the Hang Seng dropped 719 points before our markets opened but I advised we ignore it and our morning plan to cash in the PTR and FXI puts we had at the time was right on the money. COP came out with a warning on profits and that set up our premise for shorting the majors into this rally, a move that paid off in spades yesterday. I titled the Wednesday Wrap-Up "Did You Want Fries With That Shake" as we viewed the sell-off as a shake out of the retail investors ahead of a major push to get the market higher. The Dow bounced off 13,900 and finished the day at 13,968 and we called a dead bottom at 2:26 that day in member chat.

This was not about turning bullish on the fundamentals, as I had earlier said we had to switch off our analyst brain and just "go with the flow" following the herd but it was at this time that I fell into a pattern of reminding members that the rally we were happily participating in was total BS, lest we get too wrapped up in our bullish positions to pull the plug. In the wrap up, I pointed out: "Here’s a storm cloud that’s not getting much press: TOA, a Florida-based builder with 2,000 employees and a $112M market cap (down from $1.5Bn in ‘05) has withdrawn all guidance." It took a whole week for the rest of the investment community to figure out this was a bad thing.

Thursday (10/4) I went back to one of my favorite themes, reminding members not to be sheep and blindly follow analysts (myself included) but to learn to make their own investing paths over time. I strongly suggest new and prospective members read this post as we discuss investing philosophy and expectations for our site. We prepared to cash out our FXI and PTR puts as I called a near end to the Hong Kong correction and our free pick of the day was the SNE $50s at $1, which rose to $1.60 the next day (up 60%). The fuel I saw for the mini-rally was the ECB and the BOE holding rates steady, allowing foreign money to continue to flow into US markets (again, a short-lived market fix).

I called that morning for switching our focus puts from FXI and PTR, who I saw recovering, to VNO and BXP, who I expected to give us a cheap entry before being buried by the upcoming economic news. As I mentioned earlier, the time to buy is when "they're" selling and the time to sell is when "they're" buying – the real trick is being patient enough to call the turns.

RIMM was the topic of the day with an earnings beat, we did well on our spreads (after adjusting them) as we assumed there would be a sell-off after the initial excitement. I pointed out that factory orders were scary but we stayed short-term bullish, even while initiating our planned VNO/BXP puts. On Friday (10/5), we got the "bullish" jobs report we expected and, even though I considered the numbers to be a different kind of bull, we were very happy to enjoy the little rally we had positioned ourselves for.

My comment on the jobs number was another warning not to be taken in by this "great" economic news: "Of the 110,000 net jobs added, 143,000 were service sector jobs – as I said on Wednesday, this is apropos as I cautioned that the whole dip was an orchestrated move by the funds to shake out retail shareholders before today’s big move and titled the post "Did You Want Fries With That Shake?" so congratulations to the 143,000 people who have earned the right to earn that minimum wage and let’s make sure that we, like our President, pretend that 32,000 high-paying construction and manufacturing jobs weren’t lost."

My macro observation of the morning was: "Europe is on the march this morning with strong gains across the board and we are in very bullish territory on the big chart. UK house prices fell half a point and the financial markets have tightened credit standards and will tighten further according to the ECB in a move that "most likely reflects the worsening of global credit market conditions." Still investors choose to party on. There’s nothing inherently wrong with bubbles, we loved playing with them as kids so let’s enjoy this one while we can!"

My macro observation of the morning was: "Europe is on the march this morning with strong gains across the board and we are in very bullish territory on the big chart. UK house prices fell half a point and the financial markets have tightened credit standards and will tighten further according to the ECB in a move that "most likely reflects the worsening of global credit market conditions." Still investors choose to party on. There’s nothing inherently wrong with bubbles, we loved playing with them as kids so let’s enjoy this one while we can!"

As you probably know by now, since "they" were buying, we started selling and we went back to 70% cash and covered all but 23 of our open calls, closing 83 positions for the week with a 54% average gain. My closing comment for the week: "On the whole, it was a great week, nothing to complain about but I’m still waiting for the shoe to drop – my own personal "Wall of Worry" to climb!" That weekend we moved to our new site design so it was very hectic on Monday morning!

On Monday morning (10/8), Asia had some weakness and I said "For today, I’m not buying an up move without volume confirmation and we have a lot of gains that I’d like to convert to cash so just give us an excuse and we’ll take some off the table. If we’re really going up from here, 14,500 is just around the corner and, if not – well, we were at 13,100 less than 30 days ago (and the Hang Seng and the BSE just did that drop in hours!) so let’s be careful out there!" During the day we decided to use our index puts to ride out the dip, that took the Dow all the way down (briefly) to 13,747 as we expected the Fed minutes to be yet another excuse for the bulls to go for a new record. This is another post I recommend reading as I listed many macro concerns including Ryder's poor guidance, steel sector weakness and what I called an "absolutely baseless" run-up in oil that we decided to short into: "I’m hoping for some nice runs in the oil patch that we can short into but let’s be really careful around oil inventories as we may still be a whole month away from the breakdown, which will need a dollar recovery to begin.

Our free pick of the day was AMGN Jan $55s at $4.40 in our Happy 100 Virtual Portfolio, a position that peaked out at $6 on the 15th (up 35%), but we decided to stick with it, now back around even. These were a "pre-roll" of our previous Jan $52.50s, which came off the table the next day with 116% gains, otherwise we would have been out of the new play on the pullback to $5.50 and back in at $4 per our usual rules.

Tuesday (10/9) I opened with the statement: "Fed minutes at 2pm – That's it for my take on the markets." I took the time that morning to point out the WFMI was a great example of the ridiculous run-ups that were plaguing the markets while YUM's earnings, although good, signaled serious weakness in the US consumer. We jumped on the Yahoo/Alibaba story and our public pick of the morning was the YHOO Jan $30s for $1.58, those came off the table on yesterday's sell-off at $2.10 (up 33%).

Tuesday (10/9) I opened with the statement: "Fed minutes at 2pm – That's it for my take on the markets." I took the time that morning to point out the WFMI was a great example of the ridiculous run-ups that were plaguing the markets while YUM's earnings, although good, signaled serious weakness in the US consumer. We jumped on the Yahoo/Alibaba story and our public pick of the morning was the YHOO Jan $30s for $1.58, those came off the table on yesterday's sell-off at $2.10 (up 33%).

Tuesday was such a good day that I took the time to rant about the ongoing oil con. We called for another round of profit taking into the day's rally and closed many of our profitable positions. Wednesday morning I said we needed to hold 1/2 of Tuesday's gains to stay bullish and, sadly, we didn't. My morning take was: " If the Fed is going to conduct policy based on numbers (jobs) that have a margin of error of 2,500% it’s no wonder that foreigners bailed on the dollar yesterday…" In addition to my dollar concern, I pointed out that the WSJ had finally figured out that banks were sitting on HUNDREDS OF BILLIONS of dollars in LBO commitments that could turn bad for them in the current rate environment.

We finally got the bad news I was expecting in the commercial rent sector and both VNO and BXP proceeded to drop like rocks as strip mall vacancies hit 7.4%. As I said in the morning: "that means the average strip-mall has an open store – is that the sign of a healthy economy?" Another warning sign we discussed that morning was the fact that Florida sales-tax collection had slipped, down 2.7% from the previous year in August and down 6.1% in July – this is a far better indicator of consumer spending than a retail sales report.

We also got warnings from both CVX and VLO but the energy sector seemed determined to party like it was 1999 and we shifted our focus puts back to XOM as we rolled our positions towards the Jan and Nov $95 puts. Those of you with a technical mindset may want to go over my notes on the Big Chart that day, as we discussed the levels and the warning signs we were looking for. We closed the day holding our levels but, in the Wednesday Wrap-Up I said: "We held our levels, we held our levels, we held our levels. I have to keep saying that because I feel like we’re in one of those boxes that a magician puts you in and then proceeds to plunge sword after sword into the box until you can’t imagine how the person inside can escape unharmed. That’s kind of how I view the markets every time I switch my brain back on (after trading hours only!) and read the financial news."

The Wednesday post is a must read as it was the day I decided we were going down, not necessarily that day but very soon as the mortgage issues were obviously (to me) starting to creep into the broader economy. I cautioned members not to be fooled by the market action, that was pushing oil and the Nasdaq higher while other sectors were showing strain saying: "That’s why we have Nasdaq leadership, they’ve got the mix that is least likely to be affected when it all hits the fan. Much like the Titanic, even as one end of the ship begins to fall into the water, the people on the other end start to rise – even reaching "record levels" just as money flows from one part of the market to the other – it’s a temporary effect but, wheeee, what a ride!"

Thursday morning (10/11) we had a truly ridiculous open based on a good report from WMT and I warned members off getting taken in saying: "Today we are seeing a market rally based on the fact that Dow component WMT posted better than expected results while we ignore disappointing results from JCP, TGT, JWN, M and even SKS. So American consumers are leaving the stores with better paid salespeople and heading for the discount land of minimum wage-slaves to save money – woo hoo! Sounds like a reason to rally to me, right?" It was the BOJ's turn to hold off on raising rates, which gave us another quick boost but it gets to a point where you run out of things you can do to keep a rally alive and rising import prices and weakening demand colored the day's trade report (to me, not to the MSM). That was the day BIDU broke down, another one of our focus puts, along with XOM and RIMM, we detailed the carnage in the Thursday Wrap-Up.

Friday (10/12) morning I said about Thursday's action: "Did the market just fire a warning shot across the bow of the bulls or is this the beginning of the end? On the whole, it was a mild-low volume pullback but it won’t take much follow-through to send us into a major correction so we need to be vigilant and get ready to move back to cash." Nonetheless, I saw yet another pointless rally in the works as the headline retail sales number showed a 0.6% increase but I pointed out what nonsense it was saying: "Whatever you do, don’t actually read the report, which shows retail sales were up ENTIRELY based on a 2% increase in gasoline sales, a 0.8% increase in food spending and a 1% increase in health care costs. Yipee! We’re buying stuff we need to live for much more money than last month!" This is another good post as I gave my macro take on retail as well as my issues with the growing wealth gap that is plaguing our economy – an issue most of the financial community is blind to as we generally occupy the top 1% of the nation that is actually doing well.

Friday (10/12) morning I said about Thursday's action: "Did the market just fire a warning shot across the bow of the bulls or is this the beginning of the end? On the whole, it was a mild-low volume pullback but it won’t take much follow-through to send us into a major correction so we need to be vigilant and get ready to move back to cash." Nonetheless, I saw yet another pointless rally in the works as the headline retail sales number showed a 0.6% increase but I pointed out what nonsense it was saying: "Whatever you do, don’t actually read the report, which shows retail sales were up ENTIRELY based on a 2% increase in gasoline sales, a 0.8% increase in food spending and a 1% increase in health care costs. Yipee! We’re buying stuff we need to live for much more money than last month!" This is another good post as I gave my macro take on retail as well as my issues with the growing wealth gap that is plaguing our economy – an issue most of the financial community is blind to as we generally occupy the top 1% of the nation that is actually doing well.

BEAS was another huge winner for us as a trade we had built since September 14th gave us an amazing payoff as ORCL made an offer for the software company. Option Sage urged caution in his weekend post and we had rolled back to 67% cash and closed all but 16 open calls in the STP which I pointed out were well covered by our XOM Jan $95 puts in a free public pick was trading at $4.50 on Monday morning and closed yesterday at $6.10 (up 33%). The BIDU and BEAS puts gave us a spectacular week and we closed 78 positions with an average virtual gain of 159%, our 5th major gain of the year. The Short-Term Virtual Portfolio finished up 892% for the year on the sample positions we tracked but the best week of the year was yet to come.

I'll talk about this week in the Weekly Wrap-Up but that's how we got ourselves into position for this week's big drop. For most of our members, whenever we hear someone on CNBC or another financial network say "no one could have seen this coming" we just have to laugh – we saw it coming a mile away!