The primary mission of any casino is to get you to the tables. They make it fun, they make it exciting – anything to get you to put some money down because they know that, over the long haul, they WILL get your money.

Whether you win or lose you will pay a spread and a commission, so the guys running the game (cough, Goldman, cough cough) get richer and richer as they would rather scoop a 1% fee off 1,000 traders than try to be one trader trying to make 1,000%. Although that seems very obvious, it’s amazing how many of you, when given the choice of playing against the house or being the house, choose to bet the farm that you can beat the house.

Everyone wants to be Warren Buffett but very few people seem to want to put in the 60 years it took him to become Warren Buffett. Investing is committing time or capital into something that you feel will return more over time than you put into it. You go to college for 4 years with the expectation that you will derive a lifetime of benefits from the education yet once we get there (after much effort) many people are tempted to forgo that education for quick and easy pleasures. I’m not talking about dropping out but when you pay $20,000 a year to go to a good school and you decide to have just 3 classes one semester so you can start your weekend on Thursday night, you have squandered something (the chance to take another course) you will never get back.

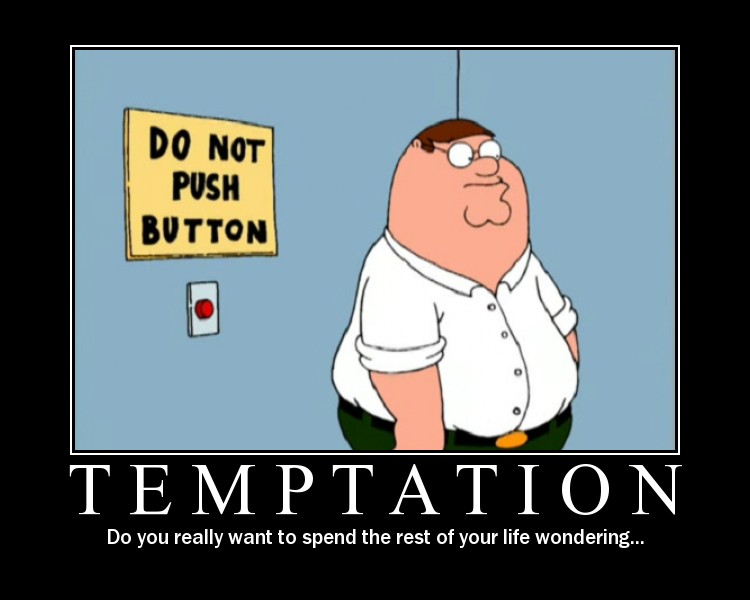

When you allow the whims of the market moment to dictate your "investing" decisions, then you are crossing the very fine line into gambling, which is defined as "To bet on an uncertain outcome, as of a contest" and "To take a risk in the HOPE of gaining an advantage or a benefit" and "To engage in reckless or hazardous behavior." I often say to members: "Hope is NOT a strategy" and we need to follow our strategies in uncertain times rather than let ourselves be tempted to gamble as the market goes up and down 100 points 3 times in a single day.

When you allow the whims of the market moment to dictate your "investing" decisions, then you are crossing the very fine line into gambling, which is defined as "To bet on an uncertain outcome, as of a contest" and "To take a risk in the HOPE of gaining an advantage or a benefit" and "To engage in reckless or hazardous behavior." I often say to members: "Hope is NOT a strategy" and we need to follow our strategies in uncertain times rather than let ourselves be tempted to gamble as the market goes up and down 100 points 3 times in a single day.

If you decided to buy Apple at $190 on Monday and Apple drops to $180 on Tuesday, you need to scale into your investments in such a way that you are thrilled to buy more at the lower price. An investor would take an initial position to start and would accumulate shares over time. This applies to options as well as to stocks. A gambler will place their entire allocation for a postion down at the outset, which forces them to sit passively and wait for the outcome while an investor has "dry powder" available to make adjustments along the way.

As a gambler, I could have bought 10 AAPL Apr $190 calls on Monday morning at $25 ($25,000) and watched in horror as they dipped to $18 yesterday and bounced weakly back to $21. I could delude myself into thinking I’m an investor by setting stops and taking my 20% loss at $20 but all that really does is make me a conservative gambler.

As an investor, I could have bought 5 AAPL Apr $190s at $25 and, since I accept the fact that I may be wrong and since I know it is better to be the house than be the gambler I would have sold 5 Dec $190s against them for $5. At the same time Apple dipped to $178 yesterday and the April call fell to $18, the Dec caller fell to .50, meaning my net loss on the spread was just $2.50. Even better, I have the opportunity to buy 5 more contracts at $18, giving me an average entry of $21.50 and my $3.50 overall loss was easily covered by selling the Dec $180 calls for $4 (net of $3.75 after buying back my first caller).

As an investor, I could have bought 5 AAPL Apr $190s at $25 and, since I accept the fact that I may be wrong and since I know it is better to be the house than be the gambler I would have sold 5 Dec $190s against them for $5. At the same time Apple dipped to $178 yesterday and the April call fell to $18, the Dec caller fell to .50, meaning my net loss on the spread was just $2.50. Even better, I have the opportunity to buy 5 more contracts at $18, giving me an average entry of $21.50 and my $3.50 overall loss was easily covered by selling the Dec $180 calls for $4 (net of $3.75 after buying back my first caller).

My net outlay on my "investment" would be $12,500 for the first 5, less $2,500 for the $190s I sold plus $9,000 for the second 5 April $190s I purchased plus $250 to buy back my original callers less $4,000 I collect against my new callers. That puts me in for a net of $15,250, which means I still have $9,750 (39%) of my original allocation still in "dry powder" waiting to be deployed. A sharp options player would point out that that $9,750 would be, at that moment, tied up in a margin spread I have created between my April $190s and the Dec $180s and that is true, but since the Decembers expire in 3 days, I’m not too concerned just yet.

As an investor, I have a plan. My plan is to look ahead to the Jan contracts where I see that my Dec $180 caller (now $4.67 after a small comeback by Apple) can be rolled to a Jan $185 caller at $10.55 or the Jan $190 caller at $8.40. Either roll will cut my margin requirement and, more importantly, reduce my capital outlay to less than 1/2 of my full commitment, meaning I would more than welcome another dip and a chance to buy Apple even cheaper. I can also INVEST some of my capital into improving my existing postion by rolling my April $190s down to the April $180s for a net of just $4.65 but there is no urgency to that as that spread will get cheaper as Apple drops and, if it doesn’t drop, then I’m very happy with my $190s where they are for now.

As an investor, I have a plan. My plan is to look ahead to the Jan contracts where I see that my Dec $180 caller (now $4.67 after a small comeback by Apple) can be rolled to a Jan $185 caller at $10.55 or the Jan $190 caller at $8.40. Either roll will cut my margin requirement and, more importantly, reduce my capital outlay to less than 1/2 of my full commitment, meaning I would more than welcome another dip and a chance to buy Apple even cheaper. I can also INVEST some of my capital into improving my existing postion by rolling my April $190s down to the April $180s for a net of just $4.65 but there is no urgency to that as that spread will get cheaper as Apple drops and, if it doesn’t drop, then I’m very happy with my $190s where they are for now.

Should things work out and Apple goes back to $190ish at expiration, then I will have my 10 April $190s back at roughly the price I originally bought them for. I would have spent less than 1/2 (including the Jan $190 caller) of what they cost and, with that position in good shape, I could take my $12,500 in cash and buy something else, to help diversify my holdings or I can patiently wait for my next opportunity to improve that position – cash always gives you lots of options…

As a gambler, you may do better on an upside "jackpot" because I have sacrificed some of that upside to my caller in favor of the certainty of collecting the premiums but next time you visit the Las Vegas Venetian hotel, keep in mind that LVS is over 60% owned by Shelly Adelson, the investor who is the world’s third richest man, and remember he got that way by collecting those premiums off of millions and millions of gamblers who were all looking for that jackpot. Whether they leave rich or poor, Shelly always gets a little bit richer on the spreads!

"The man who begins to speculate in stocks with the intention of making a fortune usually goes broke, whereas the man who trades with a view of getting good interest on his money sometimes gets rich." ~ Charles Dow, 1901

So,

So,