We are now officially Japan – Domo arigato Mr. Bernanke!

We are now officially Japan – Domo arigato Mr. Bernanke!

Yesterday can be summed up as "The Fed offered to refinance my debt at 0% and the markets barely gained 5% – what a major disappointment!" In the Weekend Wrap-Up I said the Fed would cut at least half a point and I said that anything less than 9,100 on the Dow and 912 on the S&P at the end of Tuesday would be a disappointment as we need a strong move to flatten the declining 50 dma (see Trader Mike's chart) at around 880 on the S&P and 8,650 on the Dow, allowing us to put in a proper floor to build off. The S&P finished the day at 913 but the Dow fell far short of our mark at 8,924 and that kept us a bit bearish – despite all the excitement in the afternoon.

The gap between the Dow and the S&P can be explained by the lack of an auto bailout, which I said would be necessary to get us over the top but, overall, it is very unlikely we are going to get to 9,500 for the week and that is what is required to push us to the bullish side of the market as we roll (downhill) into the holidays. Just one hour after the Fed announcement, the dollar fell 2.5%, a massive single-day drop and we are now down 5% on the week, testing 80 today with another 2.5% very likely by the week's end. The Euro flew over $1.40 and you will only get 88 Yen for a dollar, a 40% drop in the past 12 months.

Did the price of a Camry go up 40% in 12 months? Well, then you can see what TM's problem is with that… Exporters are dragging down Asia this morning as they already have 60 days worth of good en route to the US that will be paid FOB 20% less Yen, Yuan or Euros than they thought they were getting when they loaded the ships bound for the US. Of course they are happy we are buying anything at all and this is how the whole world is caught in the same trap as the slowdown in China and Europe has pinned the world's hopes squarely on the backs of the US consumer, who are used to shouldering that burden.

Can zero interest loans get us to step up to the plate and start buying again? A consumer with $300,000 of home and credit card loans at an average of 9% pays $2,200 a month over 30 years, a very large chunk of the take-home pay of US families with a median income of $42,000. Refinancing those debts at 4% drops the monthly payment to $1,432 putting more than $750 per month back into the consumer's pocket. Even a $500 reduction in monthly debt payments for consumers would yield over $50Bn a month in additional spending power. It won't be enough to retire on but it just may be enough to revive our economy.

Can zero interest loans get us to step up to the plate and start buying again? A consumer with $300,000 of home and credit card loans at an average of 9% pays $2,200 a month over 30 years, a very large chunk of the take-home pay of US families with a median income of $42,000. Refinancing those debts at 4% drops the monthly payment to $1,432 putting more than $750 per month back into the consumer's pocket. Even a $500 reduction in monthly debt payments for consumers would yield over $50Bn a month in additional spending power. It won't be enough to retire on but it just may be enough to revive our economy.

We can expect a program like this to be rolled out in the spring, allowing small businesses and individuals to, not get out of debt (only inflation will solve that) but to be able to service their debt. Of course, none of that matters if people don't have jobs so another $1Tn will be spent to keep people working and, hopefully, we will be able to turn the corner by the year's end but the end game is certainly still to come as the only real way for consumers to get out of $300,000 worth of debt is to make their $300,000 home worth $1M so they can sell it and pay off their loans (this is how our parents were always able to tell us how financially savvy they were as homes they bought in 1975 for $60,000 were sold for $300,000 15 years later). This is also the plan for the US government, who will be about $16Tn in debt next year but will be able to pay it off against a very inflated $45Tn GDP. Have I mentioned I like gold lately?

Our parents were inflated out of debt in the 70s as Nixon inflated his way out of his disastrous tax policies that favored the wealthy at the expense of the middle class as well as his massive war debt (for another conflict we shouldn't have been in and couldn't win) by taking us off the gold standard and plunging the dollar's value against international currencies as well as commodities, which included the homes our parents lived in. Those that managed to keep their jobs and homes through the recession were richly rewarded by home prices that went up close to 5 times in 10 years and Nixon's massive government debt of $500Bn seems like a rounding error by today's standards. Keep in mind that debasing the currency was the beginning of a 10-year hole for the US economy, not the end, so there may be light at the end of the tunnel but it's a very long tunnel!

Our parents were inflated out of debt in the 70s as Nixon inflated his way out of his disastrous tax policies that favored the wealthy at the expense of the middle class as well as his massive war debt (for another conflict we shouldn't have been in and couldn't win) by taking us off the gold standard and plunging the dollar's value against international currencies as well as commodities, which included the homes our parents lived in. Those that managed to keep their jobs and homes through the recession were richly rewarded by home prices that went up close to 5 times in 10 years and Nixon's massive government debt of $500Bn seems like a rounding error by today's standards. Keep in mind that debasing the currency was the beginning of a 10-year hole for the US economy, not the end, so there may be light at the end of the tunnel but it's a very long tunnel!

Asia's response to our rate cut was muted at best with a 2% gain on the Hang Seng and a half-point gain at the Nikkei and Shanghai. Hong Kong was led by property companies and banks other than HBC, who are still down over their Madoff exposure. Auto stocks pinned the Nikkei down as all exporters are going to have to rethink their strategies if they involve accepting dollars in exchange for goods. HMC cut their earnings forecatst and Sony has already been forced to raise prices in Europe to stop exchange losses over there and the US is certainly next. Deflation – what deflation?

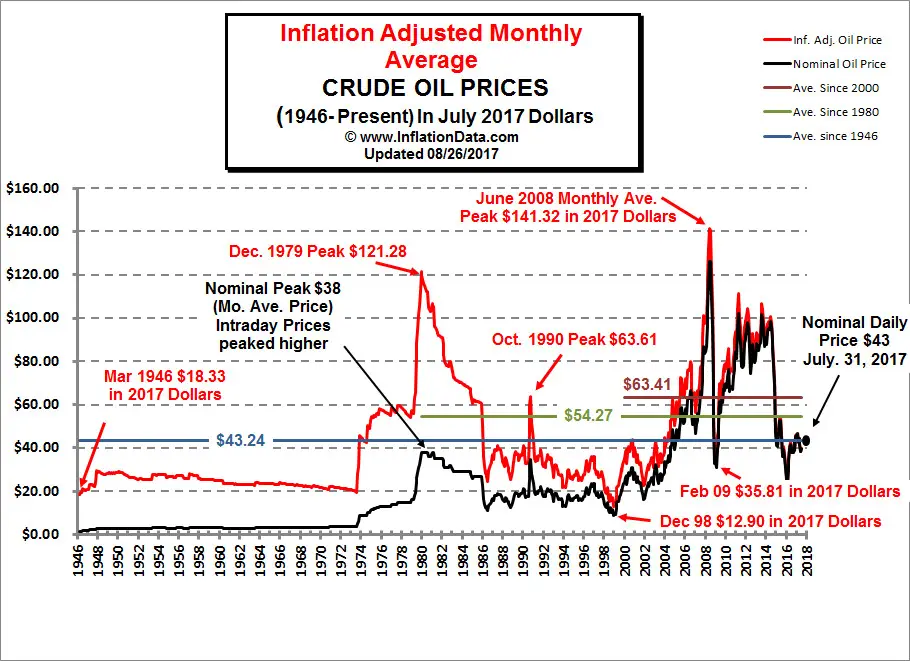

Oil does continue to deflate as OPEC got a global "ho-hum" as they pledged to stop producing 2M barrels a day that nobody wants anyway. In related news, CROX said they will stop making mauve shoes due to lack of demand and Clamatto will no longer come in a party box… The 2Mbd cut in production is the largest production cut since the 70s, when oil plunged from an inflation adjusted $106 down to $20 between 1979 and 1986, where it flatlined for 15 more years until GS, MS and other ICE founders, Enron et al got together and turned commodity trading into a multi-Trillion dollar Ponzi scheme that has done far more damage to the world economy than a hundred Madoffs could have done.

When demand is destroyed you are left with over-production and it takes a long time to reverse that trend. Keep in mind that the dollar fell 2.5% yesterday alone so anything less than a $1.15 gain over $45 represents an additional loss in oil today and surely no one is holding oil thinking that in March the dollar will be worth more than it is now. Unless OPEC does something drastic, we are very likely to test $40 before finding a floor and this is before Obama has rolled our his new energy policy (creating jobs that lower our use of foreign fuel) or gotten his hands on the SPR, which is filled to the brim with 700M barrels of oil, 140 days of the 5Mbd we import from OPEC member nations.

OPEC alone now has a spare production capcity of 5Mbd while non-OPEC nations have also significantly shut down production leaving close to 9M barrels, over 10% of global oil production capacity, sitting idle. According to the WSJ: "Demand has gone so slack that many oil traders, as well as big oil companies such Royal Dutch Shell PLC and BP PLC, are simply stashing supply in supertankers. The amount of oil in floating storage off Texas, West Africa, Iran and other big producing regions has more than doubled in the last two months to at least 40 million barrels, oil analysts say. OPEC's challenge now will be to cut swiftly enough to soak up excess supply [estimated to be over 400Mb] and perhaps drive prices back above $50 or $60 a barrel."

OPEC alone now has a spare production capcity of 5Mbd while non-OPEC nations have also significantly shut down production leaving close to 9M barrels, over 10% of global oil production capacity, sitting idle. According to the WSJ: "Demand has gone so slack that many oil traders, as well as big oil companies such Royal Dutch Shell PLC and BP PLC, are simply stashing supply in supertankers. The amount of oil in floating storage off Texas, West Africa, Iran and other big producing regions has more than doubled in the last two months to at least 40 million barrels, oil analysts say. OPEC's challenge now will be to cut swiftly enough to soak up excess supply [estimated to be over 400Mb] and perhaps drive prices back above $50 or $60 a barrel."

Europe has no idea which way to go this Wednesday ahead of the US open and is trading flat with EU banks leading the decliners as their US competitors are being armed with free money to flood the international markets with. The UK announced they will be out of Iraq on May 31st, yet another shoe thrown at Bush this week. France surprisingly is NOT in a recession yet as the economy there grew in Q3 but thier finance minister kept a damper on things and predicted they will post declining numbers in Q4.

We do, of course, expect a pullback of at least 20% of yesterday's gains but this run started at 8,400 on the Dow so a pullback to 8,800 or less in the morning will keep us optimistic that we may yet get to our goals but we need to add 200 points a day between now and Friday to get bullish for the next expiration period and that's going to be a tall order. Of course we're still looking to hold our mid-points or we do get a little more bearish. Of course 8,650 on the Dow must hold as should 885 on the S&P, who need to stay over 900 for this Fed rally to have any legs at all. The Nasdaq faces a big test at 1,550 but we need them to lead us over 1,600 to make upside bets while the NYSE just needs to hang onto 5,700 to be making progress and 480 remains our line in the sand on the Russell and anything lower than 470 is failure.

We have to have high expectations as we were just given pretty much all the Fed has to give to push this market higher – let's see what we can do with it today.