War!

War!

War is always a fun way to shake up the markets and oil is flying this morning as Israeli jets attack Hamas targets in Gaza for the third day in a row in retaliation for last week’s rocket and mortar attacks from Gaza into Israel which started pretty much the minute a 6-month cease-fire expired. Israel has a lame-duck Prime Minister so the military is calling the shots and we have a lame duck President so it’s less likely there will be another brokered cease-fire and more likely Israel will move into a ground assault in order to create a buffer zone to stop mortar attacks from reaching their border cities.

The only other country who are usually able to mediate for the two sides is Egypt, an OPEC member who are seeing a 10% rise in the price in oil pre-market trading today – so Hamas has accomplished something OPEC could not, they finally put a floor in the price of oil and, at $344M a day in additional global barrel fees ($4 x 86mb), it’s hard to imagine any OPEC member rushing to secure the peace.

Of course, this is sparking a global commodity rally, led by our pals in the energy sector who welcome the re-flation of the terror premium that had been washing out of the price of oil of late as OPEC’s surplus production capacity rose to record levels as members begin to make moves to cut cartel production to 24.8Mbd, 10Mbd less than they were producing in January of 2007 (when their surplus capacity was, at the time, estimated at 2.5Mbd)! By 2010, OPEC’s production capacity is estimated to hit 38Mbd so, at their current 25Mbd target, over 1/3 of their production capacity is off-line but the world is producing 84Mbd and OPEC is making themselves less relevent as their cutbacks have left them producing just over 1/4 of the world’s oil. Possibly the worst thing that can happen to OPEC right now is for this war to drag on and oil DOES NOT go back to $45 a barrel.

There is currently so much oil in the world that it would take a record supply disruption to change the fundamental picture – there is a good reason the terror premium has washed out of the energy market – OPEC’s greed has set in motion a movment away from the world’s dependence on their disruptable supply and the cartel’s recent actions to increase prices only serve to strengthen the resolve of global leaders to fund long-term energy projects, even in the face of declining prices. At the same time, consumers are cutting back fast and things have gotten so desperate in the natural gas world that Russia, Venezuela, Egypt, Iran the UAE and 9 other natural gas producers have formed their own cartel (GECF) to attempt to control the price of natural gas although it will be quite some time before they get properly organized.

There is currently so much oil in the world that it would take a record supply disruption to change the fundamental picture – there is a good reason the terror premium has washed out of the energy market – OPEC’s greed has set in motion a movment away from the world’s dependence on their disruptable supply and the cartel’s recent actions to increase prices only serve to strengthen the resolve of global leaders to fund long-term energy projects, even in the face of declining prices. At the same time, consumers are cutting back fast and things have gotten so desperate in the natural gas world that Russia, Venezuela, Egypt, Iran the UAE and 9 other natural gas producers have formed their own cartel (GECF) to attempt to control the price of natural gas although it will be quite some time before they get properly organized.

Interestingly, this could all backfire on both the GECF and OPEC as the two cartels (with similar but different member bases) compete to supply fuel to the world. I suppose eventually nuclear producers, wind producers, coal producers, solar producers etc. can all get together and form cartels of their own at which point we will need a cartel to keep all the other cartels coordinated.

The global steel manufacturers don’t have a cartel yet steel production is down 10%, the biggest 1-year decline since the end of World War II. OPEC has cut less than 5% so by OPEC’s logic the price of steel should be going through the roof OR MAYBE OPEC NEEDS TO CUT ANOTHER 5% TO GET SERIOUS! While we stopped shorting oil and the energy sector at $40, there is no way we are joining the sheep as they are herded back into energy stocks this morning over the latest outbreak in a war that’s been going on pretty much since Israel was founded in 1948.

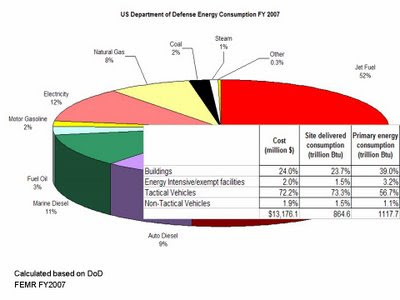

Similarly, we are not going to get excited about a commodity-based market rally as this is not the sector rotation we need to see for the markets to improve. Speaking of rotating out of wars, what if – just what if, the Iraq war ends. Not that war IN Iraq will ever actually end but what if the US pulls out our 150,000 troops along with our 180,000 "contractors," who not only cost the US $2Bn a week (just the contractors) but combine to consume over over 2M barrels of oil per week in fuel (a B-52, for example, burns 3,334 gallons per hour). According to a DOD study: "Of all the cargo the military transports, more than half consists of fuel. About 80% of all material transported on the battlefield is fuel." No wonder HAL made out like bandits on this war…

Similarly, we are not going to get excited about a commodity-based market rally as this is not the sector rotation we need to see for the markets to improve. Speaking of rotating out of wars, what if – just what if, the Iraq war ends. Not that war IN Iraq will ever actually end but what if the US pulls out our 150,000 troops along with our 180,000 "contractors," who not only cost the US $2Bn a week (just the contractors) but combine to consume over over 2M barrels of oil per week in fuel (a B-52, for example, burns 3,334 gallons per hour). According to a DOD study: "Of all the cargo the military transports, more than half consists of fuel. About 80% of all material transported on the battlefield is fuel." No wonder HAL made out like bandits on this war…

Long-term, I am bullish on oil at $40 but, short-term, don’t mistake this for the "game changer" that will send oil back to $60. Hong Kong traded up about a point this morning but Japan finished their last full trading day of 2008 flat at 8,747 with just a half day tomorrow. The Shanghai was also flat but slightly red, making it 6 days in a row in the red. With 562 Chinese firms publishing earnings forecasts for 2009 so far, 14% predicted a fall in profits and 23% projected losses for the year. "Investors in China are still pessimistic about the overall economy, especially after the [European Union] economy entered a recession," said Castor Pang, strategist at Sun Hung Kai Financial. "Most Chinese enterprises are expected to have a difficult year in 2009." Officially, China is still forecasting 9% growth next year – if that doesn’t happen, it will be difficult to fuel a commodity rally.

EU markets are up about 2% ahead of the US open, led by their energy and commodity sectors. Gold is up to $875 again and the dollar continues to weaken, perhaps in part due to a Russian professor’s prediction that the US will literally fall apart in 2010, "that an economic and moral collapse will trigger a civil war and the eventual breakup of the U.S." While we may not take this seriously, I will remind you that the single biggest group of global currency traders is Japanese housewives so the man doesn’t have to be right – he just needs to get some attention…

It still looks like we are going to be drifting into the close of the year. Volumes are very thin around the world but let’s keep an eye on the S&P, who are down just about 2.5% on the month at 875 so that will be a critical line but what we really do not want to see is this energy rally catching hold – hopefully our traders are a little bit smarter than that!