Once again it was only what we expected so no big deal as we went into last weekend ready for the bear if the stimulus plan failed to give us a boost. Even so, finishing back near the November lows is downright depressing. On Friday, the 6th I said the energy sector could be a drag on the markets and the dollar bouncing back could exert additional downward pressure and you can see from these charts, we got our dollar bounce AND the energy sector was a serious underperformer and, unfortunately, acting like a weight around the neck of the broader indexes. We've been discussing this for weeks – The XLE alone is now 14% of the S&P. Coupled with the OIH group makes over 20% of the market then energy sector, which dropped a combined 7% last week, accounting for over 1.5% of the total market drop.

The financials are still 10.23% of the S&P as of Friday but they started the week at 11.25% and knocked a full point off the markets in just 5 days as they fell 10% for the week. Healthcare (XLV, 16%), which we've been playing for a few weeks now, actually outperformed the indexes last week as has technology (XLK, 21%), which we play through the Qs and has quietly crept up to become the new leaser of the S&P by a pretty good gap. THIS, people, is the rotation we have been playing for. I did not sugar-coat it – I said it would be painful but it is what we wanted – the end of the endless moving about of shiny bits of metal and worthless pieces of paper that siphoned money away from the many to the very, very few and left us with nothing but a bubble economy, sucking jobs and capital out of real industries that we are supposed to build an economy on.

This is not the end of capitalism – this IS capitalism. Survival of the fittest, of the companies that actually provide goods and services people want, triumphing over the middlemen who seek to tack on commissions and fees to every possible step in the transactions which they add nothing to. Of course a fee is deserved for going to the great effort of taking a company public, but should it really be 10% of the offering? Commodities aren't supposed to be speculative vehicles, commodity hedging was developed to smooth over price variations, not raise them by a factor of 10.

This is not the end of capitalism – this IS capitalism. Survival of the fittest, of the companies that actually provide goods and services people want, triumphing over the middlemen who seek to tack on commissions and fees to every possible step in the transactions which they add nothing to. Of course a fee is deserved for going to the great effort of taking a company public, but should it really be 10% of the offering? Commodities aren't supposed to be speculative vehicles, commodity hedging was developed to smooth over price variations, not raise them by a factor of 10.

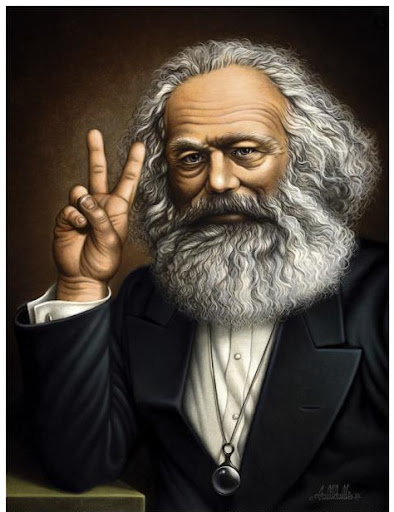

Marx defined capitalist profits as the product of "surplus labor" the difference between the value of the goods produced and what the capitalist pays the workers (with labor treated itself as a commodity). What Marx did not dream of, even in his wildest nightmares, was that the system would be manipulated to the point where a very select group of financial workers would be paid untold Billions of dollars for, not only producing nothing, but for ultimately destroying Trillions of dollars worth of other people's surplus labor – that, in a nutshell, is how Wall Street destroyed the global economy.

Actually though, the global economy is not destroyed. This is something Marx understood, the vast proletariat of the World, all 5.9Bn of them will continue to wake up, eat breakfast, put on clothes, go to work using some form of transport, eat lunch, go home using some form of transport, eat dinner and then, in what leisure time they have left, will use some percentage of their discretionary income to make their lives a little more comfortable. If 5.5Bn people spend just $20 a day doing those things we have a $40Tn global economy. That kind of puts your $100 Valentine's Day roses into perspective doesn't it? Those 5.5Bn people do not give a rat's ass about the value of your home or how much it costs you to fly the family to Disney this summer because, for 5.5Bn people, Disney is something rich people do after they win the Super Bowl as opposed to something they personally aspire to. The great wheel of the global economy keeps on spinning despite the dislocation of the life at the rarefied top.

Think about it – what blew the game for the manipulators last year? They can rip off us rich folk all they want by churning the markets and skimming profits off bloated speculation on housing, metals for our shiny buildings and oil BUT, when they messed around with the price of food, the whole thing fell apart very quickly didn't it? The guy on the right doesn't give a damn about the price of oil or copper for that matter nor is he particularly worried about how many 3,000 square-foot homes Toll Brothers is stuck with as he heads home to the 3-room house he built with his own bare hands.

This guy is going to get up tomorrow and work in the fields and pick enough whatever that is to feed his family and trade or sell so he can buy another blue shirt when this one wears out and maybe have enough money at the end of the week to go see a movie (and no, he doesn't spend $8 for a bucket of popcorn and a soda like you suckers do). This is the real global economy – we live on the very rarefied upper crust of it and all we see is chaos but, just below the surface, is a very solid base that changes very little from year to year, regardless of what we call "economic conditions." In 2000 the Global GDP was $41Tn, in 1980 it was 18.8Tn, 1960 $6.8Tn, 1940 $3Tn, 1920 $1.7Tn, 1900 $1.1Tn, 1850 $360Bn, 1800 $175Bn, 1700 $99Bn, 1500 $60Bn, 900 $30Bn, 1 $18Bn…

This is per year by the way. Even if we were to assume that GDP dies, stays dead flat for the first time in history for the next 5 years. Then the economy will produce "just" $250Tn worth of goods and services between last year and 2013. Right now, the "investor class" is in a panic because the $20Tn US housing market and the $20Tn EU housing market and the $8Bn Asian housing market may have been overvalued by 30%. That's going to knock $16Tn off the $250Tn (6.4%) economy over 5 years! Will our farmer friend forgo his next blue shirt or will you forgo your next blue Mercedes? The losses are just as concentrated as the gains were but IT IS NOT THE END OF THE WORLD – just a little disruption to your part of it. As you can see from this diagram, we failed to build a solid base below us so it's very easy for the top to spill a bit as our economic cup runneth into overkill.

This is per year by the way. Even if we were to assume that GDP dies, stays dead flat for the first time in history for the next 5 years. Then the economy will produce "just" $250Tn worth of goods and services between last year and 2013. Right now, the "investor class" is in a panic because the $20Tn US housing market and the $20Tn EU housing market and the $8Bn Asian housing market may have been overvalued by 30%. That's going to knock $16Tn off the $250Tn (6.4%) economy over 5 years! Will our farmer friend forgo his next blue shirt or will you forgo your next blue Mercedes? The losses are just as concentrated as the gains were but IT IS NOT THE END OF THE WORLD – just a little disruption to your part of it. As you can see from this diagram, we failed to build a solid base below us so it's very easy for the top to spill a bit as our economic cup runneth into overkill.

Let's bear that in mind as we wade through the week ahead and let's not kid ourselves that we are saving "the global economy" – it's our own little economy we are saving and we are borrowing from the future to save our present. It's not anything that previous generations haven't done to us and it's not something we can't grow our way out of (in 15 years the global economy will be over $80Tn and US GDP will be $20Tn annually, even without inflation) but we are not a patient people and we demand quick solutions and, because we have no crops to grow or wood to chop, we can't just get on with our lives in the downturn – if the world economy contracts 10% and 10% oft the people lose their jobs, it will be us 1Bn paper pushers getting the boot, not the 5Bn farmers. That's something the G7 is acutely aware of as they meet this weekend.

On Monday morning I said: "We’re getting that pullback we expected – let’s hope it doesn’t go too far!" We had both a watered-down stimulus package and the same BS politics we had last week and I pushed for me 3% mortgage solution as a quick idea to get a plan on track that would ACTUALLY HELP PEOPLE IMMEDIATELY, rather than add back jobs over time. We ran the Big Chart and I noted that only the Dow was above 45% off it's highs and it was more likely we'd be pulled down than up. As I said: "We really need to hold 8,217 if we want to see the other indexes playing catch up" and, although we did hold it most of the day, we blew it at the close and that turned us pretty bearish. Also, following through from a discussion that began the previous Friday – we all expected Thursday to be a disaster anyway…

NYX was the play of the morning post Monday with a hedged $16/18 entry and we're pretty much on target there after the dip but we had a much better entry point during chat. LUFK is right on target and GOOG $360 puts for $5.75 were a hell of a two-day trade. Those were the only trade ideas of the day in what was mainly a "watch and wait" session for us. Obama spoke to the nation on Monday night and decided to try the truth. In Tuesday morning's post I said "we can't handle the truth" and boy was that an understatement as the market dove almost 400 points. Tuesday morning there were no picks in the post and we hedged the SKFs and picked up DRYS again at a hedged $3/4 and that is one crazy mofo stock! Although slow on the trigger selling the FXP puts was an easy winner and we hedged into UYG for $1.52/2.76, which is looking less than totally safe at $2.98 at Friday's close. GOOG was an easy day trade but selling the USO March $25 puts for $1.20 wasn't low enough – now $1.73 but we still like the play. DDM $27s were to cover the possible bounce that never came and BAC seemed like a good idea with a hedged $3/4 entry. As I said at the time "have to take that one!" Right before wthe bell we liked AXP hedged at $12.35/13.68 – it's been a bumpy ride but I still like that one.

Wednesday morning I called the post "Will We Bottom Wednesday" and I pointed out that John Stewart had pretty much summed up the mood of the markets, calling it "The Death of Hope." Still expecting a drop, the play of the morning was the DIA spread of the Apr $80 puts at $5.55 (now $5.58) and the Feb $79 puts for $2.15 (now $2.09). This is good – we don't WANT to make money on a cover play – that means the rest of our virtual portfolio is going down. If you are in a nice spread of hedged positions though, what it means is the calls and puts you sold are losing their premiums as the deadline of expiration day is upon them – just what we're aiming for in a generally flat market. I predicted right at the end of that post: "We may be able to get back to yesterday’s -3.5% levels, which would be Dow 8,000, S&P 840, Nas 1,550, NYSE 5,300 and Russell 450. Failing to take those levels back today is BAD." Well, we didn't get those levels back and it was BAD.

Nonetheless, a little toe dipping was in order and we picked up AA hedged at $6.20/6.85, XOM March $80s are a mistake so far as they finally picked a week to stay dead but we still like them due to the rollover cycle that's pushing the market. Don't forget we were running bearish since the prior week so at some point you MUST hedge with some upside bets – just in case. We hit a fairly conservative BWLD spread ahead of earnings that paid off 20% the next day – too bad we were a little too conservative but it was hard to be bullish given the circumstances. ATVI worked out perfectly as an earnings play and CHK did indeed outperform EOG, as predicted. That was it for the day, notice this week was nothing like last week, when there were tons of plays we liked.

I titled Thursday's post "The Day We Feared" and we were very justified as the data and earnings and uncertainty surrounding the bailout were too much for the market to bear. We did hold the levels I set in the morning post and the second shot at selling the USO March $23 puts for $1.25 is working out much better than our earlier entry so far. I mentioned at the end of the post that we hadn't yet done the bottom fishing we wanted to as I wasn't feeling it yet but we got a nice spike down and went for QLD right at the open, selling the March $27 puts for $2.95, already $2.28. CSCO was an obvious entry with a hedged $14/15 and we had our usual fun day trading Google. At 11:30 I turned bullish on BTU and VLO with hedged entries but FAS was too rocky to hold onto, which was unfortunate as they did jump $1 into the close. DBC was put up at 11:58 and that's a play everyone should take a look at and BNI was a nice pickup so far with those leaps already up 4% in 48 hours. WFR at $11.70/13.35 was a winner the very next morning as we got a huge gap up and shorting SKF at 2:21 at $147 was just off the top but a great entry for the day trade. NYX got cheaper so I picked it again as the last trade idea of the day.

I titled Thursday's post "The Day We Feared" and we were very justified as the data and earnings and uncertainty surrounding the bailout were too much for the market to bear. We did hold the levels I set in the morning post and the second shot at selling the USO March $23 puts for $1.25 is working out much better than our earlier entry so far. I mentioned at the end of the post that we hadn't yet done the bottom fishing we wanted to as I wasn't feeling it yet but we got a nice spike down and went for QLD right at the open, selling the March $27 puts for $2.95, already $2.28. CSCO was an obvious entry with a hedged $14/15 and we had our usual fun day trading Google. At 11:30 I turned bullish on BTU and VLO with hedged entries but FAS was too rocky to hold onto, which was unfortunate as they did jump $1 into the close. DBC was put up at 11:58 and that's a play everyone should take a look at and BNI was a nice pickup so far with those leaps already up 4% in 48 hours. WFR at $11.70/13.35 was a winner the very next morning as we got a huge gap up and shorting SKF at 2:21 at $147 was just off the top but a great entry for the day trade. NYX got cheaper so I picked it again as the last trade idea of the day.

By Friday we felt better enough about a bottom to hit the Buy List. I predicted a close at 7.850 at 9:41 and we closed at 7,850 on the nose, so nothing to complain about but we did go bearish and uncover the DIA puts – just in case over the long weekend. 18 of our $40 watch list stocks were good to go on Friday, mainly with hedged entries as they are all long-term plays, or as close to long-term as you can dare to get in this market! We messed around day trading GOOG, MA and our DIA putters as well as another quick short on the SKF. Despite our negative attitude into the close, VNO got silly low and I highlighted the sale of the March $40 puts for $3.60 as I'd be happy to be in them long-term for $36.40 if put to me. WMT also got crazy cheap and we did an earnings spread on them, buying the March $47.50s for $1.61 and the Feb $45 puts for .52 and we'll see on Tuesday how that works out. The final plays of the week at 3:47 were another sale of USO puts and the naked DIA Apr $81 puts to cover – just in case.

![[jimcramershortbusoq6.jpg]](http://3.bp.blogspot.com/__6QsTcq39pA/R8XKXg1toyI/AAAAAAAAAA8/m1DEfmvwkbo/s1600/jimcramershortbusoq6.jpg) All in all it was a very rough week but it does look like we have another stimulus bill plus whatever Geithner finally comes up with. I though the fact that the Republicans once again were 100% against the bill in the house was a big reason there was so much pessimism. That and the long weekend into the G7 conference gave us plenty of reason to worry but I expected a rally into expirations as we finished the last period at 8,281 and I'm just not seeing 400 points worth of damage done in the past month now that we're past earnings. As Robert Cringly so rightly points out – the public is gripped by fear that is being hyped by the media to such an extreme that they print blatantly wrong charts that exaggerate the crisis yet, a full month later, none of the financial "geniuses" on Wall Street seem to notice their data is wrong by a factor of 10.

All in all it was a very rough week but it does look like we have another stimulus bill plus whatever Geithner finally comes up with. I though the fact that the Republicans once again were 100% against the bill in the house was a big reason there was so much pessimism. That and the long weekend into the G7 conference gave us plenty of reason to worry but I expected a rally into expirations as we finished the last period at 8,281 and I'm just not seeing 400 points worth of damage done in the past month now that we're past earnings. As Robert Cringly so rightly points out – the public is gripped by fear that is being hyped by the media to such an extreme that they print blatantly wrong charts that exaggerate the crisis yet, a full month later, none of the financial "geniuses" on Wall Street seem to notice their data is wrong by a factor of 10.

Whitney and Roubini have the markets so cowed that they are willing to believe things that are patently ridiculous and that's what the market is trading on. As Cringly says: "How could this be? It’s because Wall Street doesn’t work the way we think it does — the way we are led to believe it does. Wall Street is a marketplace, a selling ground where everything from ideas to stocks and bonds are on sale every day. And there is nobody easier to sell to than a salesman. Come up with a good chart that’s ALMOST within an order of magnitude of reality, put a disclaimer on the bottom, and let ‘er rip. No wonder we’re in a global financial crisis. The people we count on to understand what’s going on can’t even read a chart."