I really can't take all this AIG talk in the media anymore.

I really can't take all this AIG talk in the media anymore.

I'm not looking to defend the bonuses or argue the point but gee America, can we move on? We have TONS of problems that need solving yet the "finest minds" the media can assemble spend all day long on TV discussing whether or not to punish AIG workers retroactively. On top of that, turning this into a referendum on Tim Geithner after 60 days on the job is simply ridiculous.

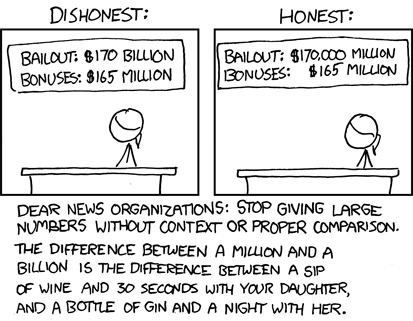

I mentioned Friday that the real problem is Congress passing retroactive tax laws, which will do far more economic damage to this country than the 90% of $165M they are using the legislation to go after. What really cracks me up is the LACK of outrage at the 85 REPUBLICAN Congressmen who voted for the 90% clawback tax. I'm outraged at the Democrats, this is ridiculous populous pandering and if this bill actually goes through I'll be very, very disturbed about what is happening in this country. I am still hoping cooler heads do prevail.

I put in my mandatory Fox viewing time this morning (their "Cost of Freedom" block) and, if you wonder why people are still worried about the economy, all you have to do is spend a half hour listening to these talking heads ramble on for a segment and you too will be heading down to the nearest bomb shelter will all the canned food, guns and gold you can carry before the government comes to take it all away from you! What I have learned this morning from Rupert Murdoch's Fox News is that Geithner must resign now because he knew about the bonuses on March 3rd, not on March 10th as he indicated when he said "last Tuesday." I also learned that no one who voted for TARP read the bill and that that is Obama and Geithener's fault – even though they weren't in office at the time. I learned that our deficit is really $3.6Tn, not $1.7Tn and that Obama hates the handicapped.

I know all of this is true because the people who agree with these points are much louder than the people who disagree. Also, Rupert Murdoch's Wall Street Journal agrees as well and that legitimizes the whole thing, right? My favorite part is the girl who keeps interrupting in the deficit segment saying "this is supposed to be fair and balanced" to justify the fact that she wouldn't let the guy with the other point of view complete a sentence. What is MOST interesting though is that Rupert Murdoch's New York Post, read by people in NYC who may actually understand this issue in more detail than the average American, has an article today that points out that NOT paying the $165M bonus package would have triggered a default on $1.6Tn worth of derivatives so NOT paying those bonuses or "taking them back" could have been the straw that broke the camels back for this country.

The bottom line is, these are REALLY complex issues and they cannot be reduced to sound bites or slogans scrawled on posters but the frenzy in the media makes it seem like there is evil afoot and must be stamped out. Thank goodness for our system of checks and balances where (hopefully) cooler heads in the Senate may prevail over our go with the flow Congress and shame, shame, shame on the 85 Republicans who unanimously voted against Obama's budget but somehow decided that the 90% tax bracket should be brought back.

Moving on to real news: Here's a great summary of what is known about the Geithner plan, expected to be unveiled next week. The bottom line is this: All $2Tn of toxic assets that are currently choking the books of our nation's banks (there may be more later if the economy worsens) will be replaced with CASH. $1Tn will be removed through the use of $150Bn of leveraged TARP money combined with what looks like way too little private capital ($30Bn) – although that is a debate for another day. The other $1Tn is coming from the Fed so TECHNICALLY the Fed is simply buying $1Tn worth (we hope!) of mortgages for $1Tn. If they sell those mortgages down the road for $1Tn, it's not that inflationary. If the private investors that risk $30Bn can turn a 10% profit on the $1Tn worth of loans they are buying – someone will get a 300% return on that investment but, also, it's not that inflationary in the end. On the whole, it's really pretty clever!

Just in case the government having a plan makes you bullish, here's "10 Reasons Why We Still Haven't Hit The Bottom", including the very good point that if you lose 25% of your household income, you lose 80% of your discretionary income. Of course, that was my argument for why $4 gas and 100% increases in food staples meant we were hitting a top when I wrote "$200 Oil – Who's Going to Pay For it?" which is a good thing to read and think about as we come off (hopefully) the bottom in the commodities market (CRB is 1/2 of where it was at the time). This is a good example of my primary flaw in fundamental analysis – the market clearly can stay irrational far past the point where I think we've gone too far. Note the 200 dma in the weekly chart did top out right where I said there was a top but that didn't stop the CRB from going up 15% higher over the next 4 months. This was mainly due to the $165Bn stimulus package that rescued the commodities market but – it's always something…

DBA was a call-away last week as was DBC. Niether one is worth a buy/write now but they have very low premiums in the 2011s that make them interesting. DBC $15s are $7.60 ($1.70 premium) and you can sell 1/2 the Apr $21s for .85. Those should easily roll to May $23s when they hit the board and boom – we're in the money! We could get a pullback in commodities if people decide the dollar is oversold but, over the long haul, probably not and .42 a month for 21 months is a $8.82 ROI so as long as a half sell brings in .80 (and there are strikes every $1), we're in good shape. DBA just doesn't have a set-up that attractive, which makes the DBC that much more so.

When we take a trade like this we need a goal. Here the goal is to pay off the $1.70 in premium and hopefully sell $3 a year in calls on the way up to $25 (what used to be the norm before the bubble). In the very least, we want to sell $3 a year to get most of our money back. As with the gold trade, you want to leave money for 1 roll down and perhaps a DD if we get back to the $17.94 lows. So minimum commitment here is $760 + $250 for the roll + a DD at $525 (the price of the 2011 $20s). Our goal is to get back $882 in opion sales and finish $1,100 in the money so ROI of $1,982 on $760 if all goes well and we never DD or roll.