Wheee, that was great fun!

Well we certainly needed that but what was it? I was really happy until 7,685 at 3:33 when I made a call to short the Dow as the run was looking kind of excessive. That was 90 points too early but we went into the close 60% bearish, with no covers on our long DIA puts. I would be thrilled to see us keep going but 7% in one day is not normal.

Of course, what also wasn't normal was the forced sell-off on Friday, that took us down from a nice consolidation at around 7,450 and 7,775 is just a bit shy of a 5% move off that line, which would be 7,822. That puts things in a bit better perspective and 2.5% over 7,450 is 7,636 so let's watch that line and see if we can hold it this morning on a pullback (call it 7,650).

Remember last week I went bullish at 7,400, looking for a breakup and we ended up 55% bearish on Friday as we had that disappointing loss of our levels in the afternoon. That was easy to remedy yesterday as we quickly covered our long DIA puts right out of the box (a call that was so obvious I sent out the alert at 6:49 am) and those puts got spanked so badly that we were able buy them back cheap and roll up our longs and then sell a whole new set of puts (who also got spanked) mid-day. So when I say we went naked on our long puts – they are much better puts than we half-covered with on Friday. In that same alert we tried to to buy the RUT 398 futures but, sadly, they gapped away from us before we could get in and the Russell zoomed up to 430 – at $10 per tenth of a point per contract, that's 420 ticks!

In the morning post (and remember, you MUST register for a Free Sample Membership to keep getting these) I mentioned we had picked up FAS at $5 and sold the naked $5 puts for $1.20 on Friday. FAS finished at $7.07 (up 41%) and the $5 puts finished at .65 (up 45%) so nice gains all around. Of course we flipped on those now and are playing FAZ off these lows ($19.20 now) with a long spread as an entry we like. Other than having fun with our ultra financials, there wasn't much to do as we made our bull-side plays last week and, once we went past our breakout levels, we just enjoyed the ride. Now we see how well those levels hold today and we'll be watching those 2.5% lines off last week's bullish consolidation to hold. Those are Dow 7,636, S&P 805, Nas 1,525, NYSE 5,075 and Russell 420. The S&P and the RUT both have 10% levels (775 and 402) that are lower than these so those would be the ones to watch for signs of a breakdown if they fail their 10% marks as that would be an almost certain sign that the rest will be pulled to at least a retest.

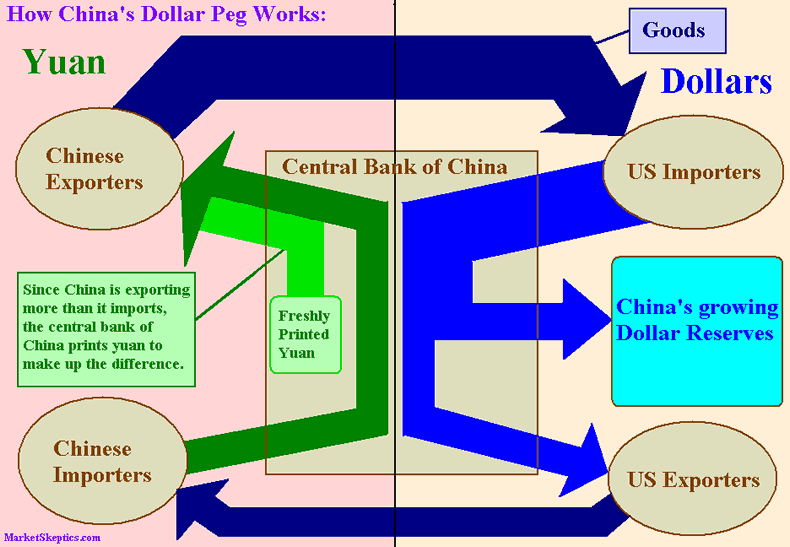

The dollar is holding up surprisingly well despite China calling for a new World Reserve Currency to replace the dollar. If you were sitting on $1.95Tn dollars of questionable value that you couldn't possibly dump on the open market (there are less than $1.5Tn Euro reserves in the entire world) – you'd be calling for a change of the rules as well, especially when your biggest customer keeps dumping more of them in your country every day. "The outbreak of the crisis and its spillover to the entire world reflected the inherent vulnerabilities and systemic risks in the existing international monetary system," BOC Governor Zhou said. The increasing number and intensity of financial crises suggests "the costs of such a system to the world may have exceeded its benefits."

The dollar did manage to hold the line at 83, down 7.5% in two weeks and accounting for 1/3 of the market's 20% run so we are not "bullish" yet, despite what the pundits are saying on TV. Japan managed to push the dollar back to 98 yen in a huge save (and they had to buy a lot of bucks to make that happen!) and the Nikkei celebrated with a 3.3% gain, bringing them right to the 8,500 line despite an AWFUL sales forecast from the Auto industry and yet another drop in the Baltic Dry Index (which we tried to ignore yesterday). The Hang Seng added 4.8% and the Shanghai rested, up .6% as did the Bombay, up half a point. Generally banks were very strong and miners were pulling back.

The FTSE is down a point at 7:45 but the rest of Europe is generally up about half a point. The UK got bad inflation news with a 3.5% gain in February and, since their bank MUST fight inflation, it pretty much takes additional stimulus off the table and lends credence to Trichet's statement, which we discussed yesterday morning. That drove the Euro higher, dropping the Yen to a 5-month low to the Euro – also good for Japan. That news rescued the miners in Europe but not too much as German GDP is, if possible, looking worse than ours – with a 6-7% decline predicted for the full year.

Those are the kind of fundamentals that keep us skeptical of 7% daily market gains. We went from oversold to overbought very quickly (see David Fry's Chart) and, as you can see from a comparison to the 6-month Dow chart – that is not something that should be taken lightly at this level (100% overbought).

Don't forget our fear last week was that we would get to 7,450 and then sell off to retest our March 9th lows, possibly lower. Well the Fed stepped in and tossed $2Tn onto the fire and that dropped the dollar 7.5% so we raise our top target by that much and say we could get a run to 8,008 – call it 8,000. We topped out at 7,775 yesterday, just 225 points shy of 8,000 and 225 point over 7,500 but don't forget those last 90 points looked very forced so we're not going to take them seriously at all.

As we've been doing for 2 weeks, let's keep the emotions out of this and keep a close eye on our levels. Similar plan to yesterday, if we hold 805 on the S&P and 420 on the RUT we can sell DIA puts to cover and flip back to bullish, using those levels as our on/off switch for the day. The 8:30 futures have the Dow right around our 7,636 line too (isn't that convenient?) so that would make a really good test if we pass it and a very obvious signal if we fail that we may have gone a little too far yesterday.