What a strange week.

Overall, it was a big, ugly "W": We began the week at about 8,100, fell to 7,800 Tuesday morning, rose to 8,050 on Wednesday (hump day), fell to 7,800 again on Thursday and then back to 8,100 on Friday. In summary – NOTHING HAPPENED! We have that gap to fill on Monday around 8,000 (last Monday's gap down open) and, unlike this past week, next week is going to be chock-full of scary data points including Consumer Confidence and Case/Shiller Home Prices on Tuesday, GDP and the Fed on Wednesday, Jobless Claims and Personal Income and Spending along with the Chicago PMI on Thursday and Friday is still busy with Michigan Sentiment, Factory Orders, ISM and Auto Sales for April.

It's going to be fun, fun, fun next week as another 25% of the S&P 500 are set to report and early on, we'll be keeping our eyes on the following:

It's going to be fun, fun, fun next week as another 25% of the S&P 500 are set to report and early on, we'll be keeping our eyes on the following:

- Monday: BEAV, CHKP, GLW, ENR, HUM, LO, ONB, QCOM, SII, TZOO, VZ & WHR. Evening: AXS, BIDU, FNF, FADV, HLTF, HXL, MAS, MTH, OLN, RCII, SWN, TUES, UHS, WRE, WRI and XL

- Tuesday: AG, AMFI, AMED, AM, BDX, BMS, BMY, BCO, CRDN, CCE, CVH, ELNK, FMD, BEN, FDP, HCP, HL, KELYA, LAZ, LCAV, LVLT, MHP, NWPX, ODP, OXPS, ORB, PCAR, MALL, PCZ, PFE, SMG, SBNY, SPAR, STFC, TLAB, X, UA, VLO and WAT. Evening: ACE, BLDP, BWLD, CRI, ETFC, FIS, HTZ, MEE, NAL, PNRA, PRAA, RFMD, SUNH, JAVA and VFC.

So plenty to keep us busy but earnings last week were way better than expected overall and guidance was not too depressing so we'll have to see what kind of follow-through we can now get on that and if there is any gas left in the market to finally punch through that 8,200 mark or if we are still doomed to correct back to 7,632 in the very least.

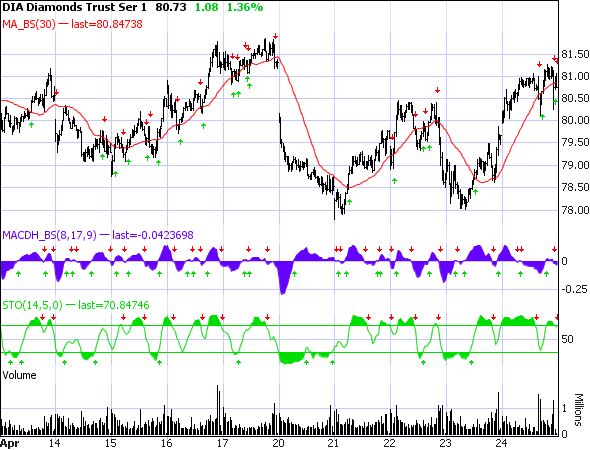

As I mentioned in last week's wrap-up, we called it right by entering the weekend 55% bearish despite the fabulous stick save of Friday the 16th. In fact, I should have gone with my gut at 3:43 that day when I said to members: "DIA – 1/2 cover into the close it is then. I wanted to go more bearish but the levels won’t let me!" Thank goodness we stay bearish though because, as you can see from the chart above, there was no time to adjust on Monday morning as we gapped down almost 200 points in the first few minutes and fell another 100 points into the close.

I'd love to act clever and say Monday was no surprise – I even called the morning post "Monday Market Meltdown" so there was no ambiguity about what we expected but, as I said at the time: "I thought I was going crazy" as we kept going bearish into the weekends and it was surprising that it finally worked. Nonetheless I can no more take credit for being right this particular Monday than a broken clock can for being right twice a day…. I was right that oil was a total joke at $52.28 and we had shorted them in the futures and they fell to below $47 before staging a comeback on the June rollover (which we also expected). Our long-suffering OIH puts finally paid off on Monday too and, fortunately, we had the good sense to get out with a small win.

I'd love to act clever and say Monday was no surprise – I even called the morning post "Monday Market Meltdown" so there was no ambiguity about what we expected but, as I said at the time: "I thought I was going crazy" as we kept going bearish into the weekends and it was surprising that it finally worked. Nonetheless I can no more take credit for being right this particular Monday than a broken clock can for being right twice a day…. I was right that oil was a total joke at $52.28 and we had shorted them in the futures and they fell to below $47 before staging a comeback on the June rollover (which we also expected). Our long-suffering OIH puts finally paid off on Monday too and, fortunately, we had the good sense to get out with a small win.

Our theme all month has been to switch off our brains and watch our levels and the critical levels this week were outlined in Monday's post as: Dow 7,900, S&P 833, Nasdaq 1,580, NYSE 5,225 and Russell 444 (and they remain so until properly broken). We never fell below 2 at the same time other than Tuesday morning's brief spike down so we never got too bearish despite the scary dips. FXP continues to fascinate me as the May $21s were still $2 at 9:51 on Monday even as the Dow was plunging and they jumped 40% in an hour. I think at this point we are all trained to look at FXP whenever we are late to short the Dow but it's also one you need to take the money and run on as it reverses much faster than the DIAs do.

PCLN was a good idea for a vertical but we got stopped out before filling. I still like them short with the July $80 puts at $4.15, looking for $6.50+ on a sell-off. We had our usual fun with the DIA puts all week of course and generally those went very well as our levels were good guides on both the bottoms and tops of the ranges. A lot of this week's trades were day trades, like the VNO $40 puts for $3 at 11:15 on Monday that flew to $4 that afternoon, hit $5 the next morning but now are at $1.25 and actually looking tempting again. Much as we'd rather not day-trade the market – what choice do we have when it's going to gyrate like this?

Our first bullish play on Monday came at 12:25 when we hedged into UAUA at $3.54/3.57 with the stock at $5.84 – that's looking good as we survived their earnings. BAC got interesting at 1:58 and selling the July $8 puts naked for $2.29, now $2.02 is a great example of how we can take advantage of dips without too much risk. I said the same about FAZ at 3:09 when I said to members: "Speaking of bullish though – Selling FAS $7 puts for $1.45 – how can we not?" Those puts fell to $1.10 and seem fairly safe with FAZ closing the week at $8.28. We took a chance into Monday's close to full cover our put side as the May $77 puts were fetching $2.20 and we were 1/2 covered with the $81 puts and felt 7,700 would hold.

Tuesday morning we were optimistic despite the morning dip and I said right in the post: "We’ll be selling some BAC puts to start a posiiton this morning. I wouldn’t say there are bargains out there just yet but big drops in fiancials and a high VIX are things we can certainly take advantage of, even if we are heading lower!" Also in the morning post I called for taking the money and running on our FXPs and they were kind enough to spike up into the open before falling off a cliff as the markets recovered.

GOOG chased us out of the final put leg of our earnings spread and that was a bullish sign at 10:10 and, at that time, I alerted members it was time to execute the plays for the $100K Virtual Portfolio we had reviewed over the weekend. By 10:36 I had sent out an ALERT for Members detailing all the adjusted trade prices so that was pretty much a firm bottom call as they were 100% bullish plays (we already had bearish hedges in place that were going well). I've already done a full review of our $100K Hedged Virtual Portfolio this weekend so no sense in writing about it here other than to say NAILED IT! We still thought BAC was a gift at $8.30 at 11:28 and I put up a buy/write at $4.50/6.25 as well as the naked sale of the $7.50 puts at .83 (now .58). So far so good for the banks but we'll see who really passes the stress test on May 4th.

HCBK was a good earnings gamble with the July $12.50s for $1 (now $1.35), which we have since covered with the May $12.50s at .75 as we're feeling good about them holding the line here. At 12:17 we went to full cover with the DIA $79 puts as they were way up at $2.75 (now $1.71) and we were pretty confident 7,850 would be holding for the week. LULU was a 1:07 trade idea at $13.32 (now $14.35) and we hedged it down to $10.14/10.07 just looking to hold $12.50 so all good there. We took an AAPL spread ahead of earnings, selling May $120 puts and calls for $12.50 (now $9.80) while paying $13.10 for our June positions (now $11.85) so a net .60 spread now $2.05 is not a bad way to play earnings! Our last plays of the day were MGM and LVS buywrites at $5 and both of those stocks flew up 20% and 48% respectively.

We felt good about being bullish Wednesday Morning and I laid out my bullish premise for the market (we had extensively discussed it in Tuesday night's chat) but the run-up was a little quick for our tastes and lacked conviction so we became cautious by mid-day. We did grab BA at $36.87 (now $38.72) with a hedge down to $31.97/32.49 which we felt good about at 9:44. At 10:10 I still had ZION fever (a winner from last week) at $10.35 (now $12.08) and we hedged those $2.65 lower so we just love that stock. WMT hit our buy target at $49.29 (now $47.87) with a hedged entry at $44.05/$45.76 targeting the June $47.50s and I still like that play. We do not hold grudges and at 10:32 FAZ came down and we sold those $7.50 puts for $1, now $1.10 but we got out at .60 with a 40% profit. In that same post I noted that a big build in oil inventory would hurt that sector and kill the rally and that was the top of the Dow until Friday morning.

We pressed our OIH puts and they paid off the next day. PFE hasn't gone anywhere since we picked them but the spread is right where we want it for now as are the naked puts. WFR hasn't moved much off our $15.32 entry but we hedged that one down to $12.07/13.04 and they held it together through earnings, which is all we needed. We turned a little bearish at 12:23, adding the QID June $40s at $3.80, which hit $5 the next morning and are back to $3.40 now. At 1:08 I said to members: "Dow looks ready to break to me, back to Monday’s low at 7,850 looks likely." We didn't quite get there on Wednesday but it was just right for Thursday morning's dip. That put us bearish enough to plan to take out 1/2 the DIA put covers at 1:55 and, as we "recovered" at 2:59, I called the dead top, sending out an Alert to remind Members: "That was a gift for taking out putters ahead of tomorrow’s data – I hope you guys took advantage of it!"

We pressed our OIH puts and they paid off the next day. PFE hasn't gone anywhere since we picked them but the spread is right where we want it for now as are the naked puts. WFR hasn't moved much off our $15.32 entry but we hedged that one down to $12.07/13.04 and they held it together through earnings, which is all we needed. We turned a little bearish at 12:23, adding the QID June $40s at $3.80, which hit $5 the next morning and are back to $3.40 now. At 1:08 I said to members: "Dow looks ready to break to me, back to Monday’s low at 7,850 looks likely." We didn't quite get there on Wednesday but it was just right for Thursday morning's dip. That put us bearish enough to plan to take out 1/2 the DIA put covers at 1:55 and, as we "recovered" at 2:59, I called the dead top, sending out an Alert to remind Members: "That was a gift for taking out putters ahead of tomorrow’s data – I hope you guys took advantage of it!"

Our last trade idea of the day was selling FSLR $160 calls for $7.20 at 3:19 as FSLR spiked over $150. Selling calls into spikes is a great way to be a contrarian, taking advantage of irrational exuberance during an unsustainable run. Those calls fell to $4.50 the next day, now back to $5.75. We totally enjoyed the late sell-off as we were positioned for it and my closing comment to members was simply "Wheeeeeee!" as there really was no need to adjust anything. As we planned on doing some bottom fishing on Thursday, I thought it was a good time to update "How To Buy A Stock For A 15-20% Discount" – something every member should be familiar with it as it's the basis for about half our plays in this choppy market.

Thursday morning was just weird as the pre-markets were crazy high but, even as I was noting the action in the morning post, we weren't really buying it. In the end, there was a brief blip up before we continued down to our 7,850 target. The action in the pre-markets was so fake looking that I used the picture on the left to express my feelings. I also felt the Ken Lewis/Hank Paulson scandal would be a big deal but, thankfully, we remembered to switch off our brains and use our levels to guide the trades or we may have gone bearish into the dip!

Thursday morning was just weird as the pre-markets were crazy high but, even as I was noting the action in the morning post, we weren't really buying it. In the end, there was a brief blip up before we continued down to our 7,850 target. The action in the pre-markets was so fake looking that I used the picture on the left to express my feelings. I also felt the Ken Lewis/Hank Paulson scandal would be a big deal but, thankfully, we remembered to switch off our brains and use our levels to guide the trades or we may have gone bearish into the dip!

Fortunately we got out of the OIH trade that morning as they reversed sharply the next day but we stopped out a little early at 10:36 (but happy). Since we saw a reverse in oil in the works, our first trade of the day turned out to be selling ICE $75 puts naked for $3 (now $2.15) at 11:32 along with buying the June $90 calls for $5 (now $5.50) but that play was to take $6 (20%) and run and that mission was accomplished at the close. We sold FAZ and FAS puts (June $7s) for $3.35 (still $3.30) as we're happy to hold either at net $3.65. By 1:33 we were satisfied enough things were recovering that I sent out an Alert to members with trade ideas to buy more ZION at $10.38 (now $12.08), LVS at $6.04 (now $7.42), MGM at $5.50 (now $6.08), UYG at $3.27 (now $3.58), F at $4.39 (now $5), selling DIG and DUG puts (like the FAZ/FAS play) and selling TSO naked June $15 puts for $1.55, now $1.30 and looking very promising as TSO has gained $1 since then.

We went back to the well on HCBK at $12.20 (now $12.81) with a $10/11.25 hedged entry at 3:04 but we made our first closing mistake of the week by not fully covering our DIA puts into the close, keeping the 1/2 covers DESPITE our level being broken. Once again, thinking got us into trouble! As I said at 3:53: "Well it’s 7,950 but I can’t go fully covered on DIA over a ridiculous last-minute pump job but ouch!"

Friday came up fast and we knew we were going to have a strong open as everyone seemed so excited about the stress tests looking fairly easy to pass. I pointed out in the lead chart that the Nasdaq was looking to break up and that's just what we got but, as we were coming into the weekend, we stayed pretty evenly balanced (55% bearish into the close) as we just did not trust the rally and we figure there will be plenty of time to switch if this thing is going to keep going next week. I pointed out the similarities between this rally and the ill-fated attempt to recover off the November lows and, until we break that pattern, we're going to continue to exercise good caution. As I said about the 55% bearish posture into the weekends – broken clocks are right twice so we still have one coming to us!

Friday came up fast and we knew we were going to have a strong open as everyone seemed so excited about the stress tests looking fairly easy to pass. I pointed out in the lead chart that the Nasdaq was looking to break up and that's just what we got but, as we were coming into the weekend, we stayed pretty evenly balanced (55% bearish into the close) as we just did not trust the rally and we figure there will be plenty of time to switch if this thing is going to keep going next week. I pointed out the similarities between this rally and the ill-fated attempt to recover off the November lows and, until we break that pattern, we're going to continue to exercise good caution. As I said about the 55% bearish posture into the weekends – broken clocks are right twice so we still have one coming to us!

We sold more FAZ naked puts but bought DIA puts early on and that didn't work at all. I was guilty of way too much thinking as we expected a pullback in the morning ahead of the stress test announcement but it never came. Still we sold more FAZ and FAS puts (we don't care which, we just want the premiums) and we caught a nice butterfly on SLG. I actually did predict at 11:46, that we would test 8,130 ahead of the stress test, drop 200 points on the release and then "THEY" would say "Oops – we misread paragraph 4 on page 62" and take them back up after killing all the retailers. That is pretty much exactly what happened except we only dropped 100 points before the big reversal.

We found a very nice long vertical on HOV that could be good for 400% or so – those are always fun, I noted Europe had a good close at 12:40 and that raised our expectations for the afternoon, leading us to be disappointed that we didn't break 8,130 in the end. Amazingly, we sold even more FAZ puts and we added the FXP $20s at $1.80, just in case China wakes up in a bad mood on Monday. At 2pm I wisely called for naked DIA puts (our long hedge) and, after holding the line, I called for going back to full covers with DIA $81 puts at $2.55 at 2:45 and they are still the same price but we did flip back to a 1/2 cover for the weekend as planned.

So that was another wild week but, as I said above, nothing actually happened in the macro view. We continue to watch the same levels we were watching last week and I still don't think thinking is going to be of any help at all so tell your brain to extend it's vacation and ignore all those nasty old facts they're discussing this weekend. I went to a seminar yesterday and The Donald says he's buying properties again so maybe it is a bottom or maybe he's finally lost his mind – only time will tell…