The United States is not FACING a crisis of hyperinflation.

The United States is not FACING a crisis of hyperinflation.

The United States is IN a crisis of hyperinflation right now!

According to Wikipedia: "In economics, hyperinflation is inflation that is very high or "out of control", a condition in which prices increase rapidly as a currency loses its value. Definitions used by the media vary from a cumulative inflation rate over three years approaching 100% to "inflation exceeding 50% a month." In informal usage the term is often applied to much lower rates. As a rule of thumb, normal inflation is reported per year, but hyperinflation is often reported for much shorter intervals, often per month."

Unfortunately, like the proverbial frog being boiled in water who doesn’t realize he’s going to die, the US has been oblivious to one of the worst inflationary runs in US history because we don’t tend to look outside our own boarders when assessing the economy. Since April 20th, we have noted a series of "stick saves" that have taken the market higher, almost like clockwork, at the end of each trading day. Whether this in natural market action or blatant manipulation, we don’t care – we now have daily "stick save plays" when our conditions are met and we haven’t missed one yet.

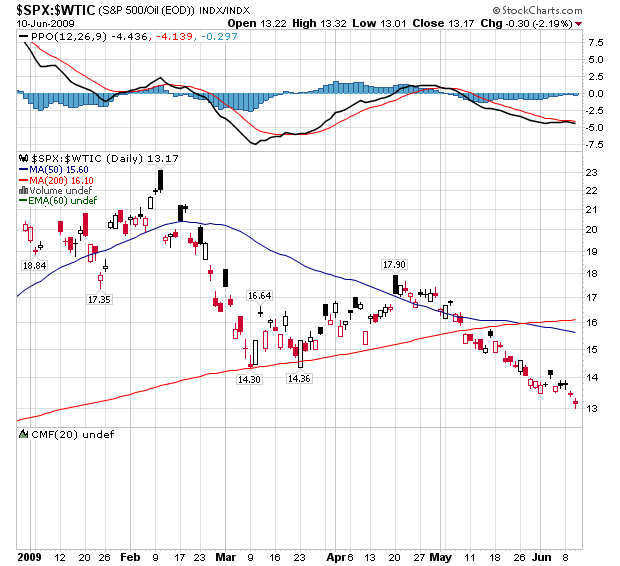

So while the general public enjoys their stock "rally" and while the media placate you with "green shoots" language, your money is losing it’s value at the fastest rate in US history. Does that sound like a bold statement? Here’s the chart:7

This is a chart of the S&P. "Hey" you may say – "MY stocks are going up". Yes, your stocks ARE going up, but they are going up against the dollar (hopefully you don’t have any of your money in those things, that would be a catastrophe!). This is a chart of the S&P priced in barrels of oil. You do buy oil right? Well if you want to convert your stocks back to barrels of oil, the stocks that got you 17.9 barrels of oil on April 20th now get you just 13 barrels today.

That’s a drop of 27.9% in 50 days, an annualized inflation rate of 203%!

And that’s measured against the S&P which, if you were 100% invested in it over that same period, seemed to go up 20%. Against cash the inflation is much, much worse and, sadly, most Americans are in cash right now. Remember that definition of hyperinflation: prices go up so fast you measure the monthly moves!

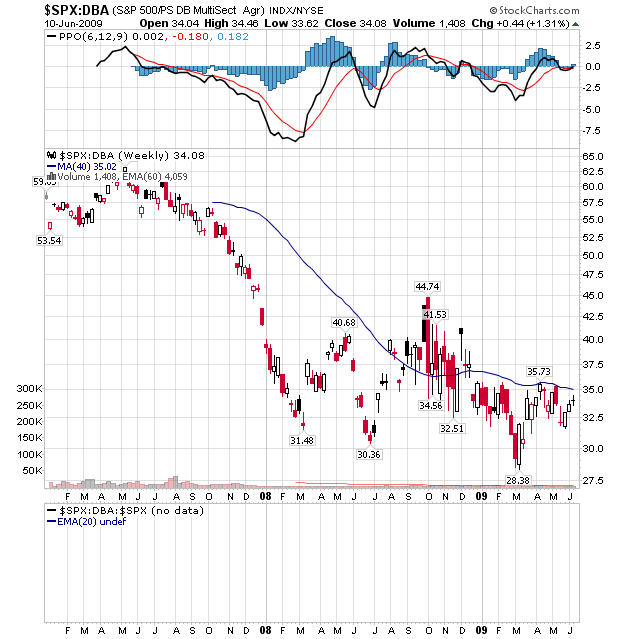

Notice back on February 10th, we could buy 23 barrels of oil – that’s 43% inflation 4 months, a "mere" 129% annualized. Perhaps you are thinking – "I don’t really use oil in my daily life so this doesn’t affect me." Well, perhaps you eat… Here is a chart of the S&P 500s performance against DBA, a basket of agriculture commodities like corn, wheat and sugar:

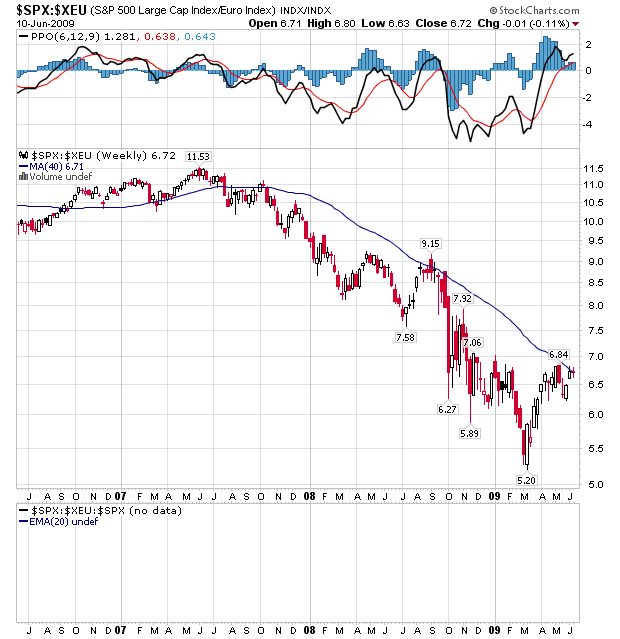

If you ever have a need to convert your dollars into one of those things, you may be interested to know that, since October (which is where the S&P has "recovered" to), you have lost 1/4 of your buying power when you go to convert your stocks back to dollars and attempt to buy FOOD with them. We are down 60% against gold, 33% against copper and, most significantly, we are down 25% against the Euro and Yen – that’s the best measuring stick of all. Here’s how our "market rally" looks to an investor pricing the S&P in Euros:

Not a very pretty picture is it?

In fact, if we do not break over this significant upside resistance shortly, there is a very good chance we will experience a significant market correction. Can we protect ourselves? Of course we can and this weekend I’m going to start a series on inflation hedging. We were very big on gold in the fall and again in April when it retraced to $875 and it may be time for us to look at gold again. There are many ways we can hedge our virtual portfolios against runaway inflation but the main takeaway from this is that cash is NOT king in this environment – your cash is being whittled away every single day.

In fact, you may be hoping home prices start to rebound yet, if you have a $50,000 salary and a $250,000 home and $30,000 in the Market and $10,000 in cash in the bank – then the current 50% annual rate of food inflation alone means your stocks, hopme and salary would need to gain 20% just to keep up. Looking at oil’s 203% rate of inflation – well, you need to pretty much double up this year to stay even.

In fact, you may be hoping home prices start to rebound yet, if you have a $50,000 salary and a $250,000 home and $30,000 in the Market and $10,000 in cash in the bank – then the current 50% annual rate of food inflation alone means your stocks, hopme and salary would need to gain 20% just to keep up. Looking at oil’s 203% rate of inflation – well, you need to pretty much double up this year to stay even.

So it’s possible that you are underpaid and it’s possible that your home is underpriced and it’s possible your stocks are undervalued but we’d better hope that oil and other commodities are overprices because it’s not all that likely that you’ll be getting a 100% raise and your stocks will double and your home will double this year is it? Of course, that’s how hyperinflation really begins – when prices get so out of control that you can no longer afford to eat or drive to work, wage inflation finally enters the cycle and companies raise their prices in order to pay you enough to get you to work. Before you know it, your government starts adding zeros to their currency!