There's hardly any point doing a wrap-up as hardly anything has been happening.

If you are buried in the daily gyrations of the market, lots of stuff happens during the day but, as soon as you step back and look at the action – you'll notice nothing really happened at all. After a catastrophic downturn on Monday, we pretty much bottomed out at 8,250 on Tuesday until Thursday's 200-point bump and here we are, back at good old 8,450 – which is where we bumped along for pretty much all of May.

Indeed our best plays have, by far, been our premium burning plays, as attested by the very nice performance of our $111,659 Virtual Portfolio, our exercise in conservative hedging that is outperforming most risk-based strategies in this very choppy market. The other winning strategy in this annoying market has been Day Trading, and we've had fantastic performance from our Oxen Group picks each morning and Ilene has a good article what David looks for in "The 5 Keys to Identifying a Fundamental Day Trade." Combine that article with our Strategy Section and my article on scaling in and you have your own little day-trader's manual!

This will be useful next week as we have a 4-day week (Friday is the observed 4th of July) and there's no way we want to go into the 3-day weekend with too many positions so it's going to be a lot of in and out trading once again. I probably shouldn't, but I keep focusing on these silly fundamentals like Bespoke's GDP chart on the right. These are FACTS, which are the things being ignored as you hear things like Friday's Michigan Consumer Sentiment hit 70. I often point out that these are the same consumers – 60% of whom, when polled, believe their homes have held their value or gone up in value. Just because they are all chipper for the pollsters, does not mean they will be out there turning these economies around.

US consumers are the New York Yankees of global consumption. They are indimidating, they are record-setting and, from an historical perspective, they give the IMPRESSION of being unbeatable – but I grew up in New York and remember a streak from 1965 to 1975 when they didn't win a single pennant. That's a team that has averaged one World Series Title every 3.3 years since 1923 (26 Times World Champs) and one League Championship every 2.3 years over the same time period. Like the US consumer, you come to EXPECT the Yankees to be in contention and you may make your bets that way out of habit, but that storied history of performance is NOT going to stop you from hitting a 10-year losing streak is it?

Like the Yankees, the media EXPECTS the US consumer to win. After so many consecutive years of stuffing our faces and shopping until we drop, the global media simply refuses to believe that the US consumer can do anything more than stumble slightly before getting right back on the horse and refinancing or whatever it takes to get out there and start charging once again. As the US consumer makes up 70% of our economy, it's no wonder all the sentiment polls think prosperity is just around the corner because everyone believes the US consumer is simply resting. The homebuilders telll us things will rebound, the manufacturers tell us things will rebound and the companies reporting earnings, who are "beating" expectations by only doing 35% worse than last year, are all giving us sunny outlooks as well because the US consumer is coming to save us all.

Like the Yankees, the media EXPECTS the US consumer to win. After so many consecutive years of stuffing our faces and shopping until we drop, the global media simply refuses to believe that the US consumer can do anything more than stumble slightly before getting right back on the horse and refinancing or whatever it takes to get out there and start charging once again. As the US consumer makes up 70% of our economy, it's no wonder all the sentiment polls think prosperity is just around the corner because everyone believes the US consumer is simply resting. The homebuilders telll us things will rebound, the manufacturers tell us things will rebound and the companies reporting earnings, who are "beating" expectations by only doing 35% worse than last year, are all giving us sunny outlooks as well because the US consumer is coming to save us all.

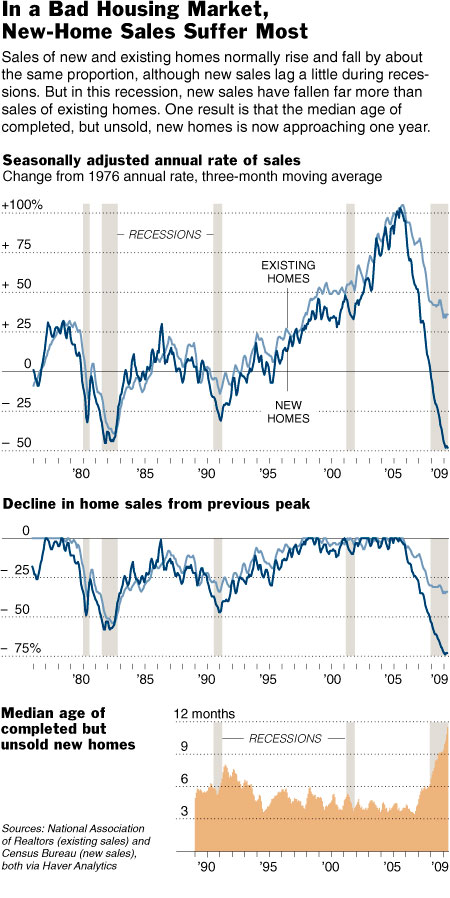

I was in a mall yesterday and I came away less than encouraged and I can't find any data to support a positive outllook but it's the DOMINANT view in the MSM – that things will be turning around in Q3 or Q4. Barry Ritholtz posted this NYTimes chart this morning and commented that "new-home sales are now running at only about a quarter of peak levels, a fall far deeper than anything seen since the statistics began being collected in the 1960s," yet look how many people are playing this like it's just an ordinary recession and applying all their very ordinary analyticals to measure it.

We had terrible consumer numbers from Japan and Germany last week and this weekend the OECD dropped the UK's GDP forecast to -4.3% due to a sharp slowdown in consumer spending over there and California, which is still part of America, has a 75% increase in personal bankruptcies in the first 4 months of this year and that's AFTER 2008 numbers had already doubled from 2007. Sure, we put Babe Ruth, Lou Gherig. Earle Combs, Tony Lazzeri and the rest of the 1927 Yankees' "Murderers Row" out on the field and the fans can get very enthusiastic in anticipation of the new season but the FACT that they have all been dead for 40 years or more means that fans may be slightly disappointed with the actual performance of the players! That's the kind of disconnect we have in economic outlook. Everyone is counting on that old US consumer to step back up to the plate and hit one out of the park to save the game but the US consumer was clearly taking steriods in the form of low-interest loans for the past 5 seasons and they are getting a little long in the tooth to be expected to carry the ball by themselves.

Then there is the myth that China or India will step up and carry the ball of consumerism. My whole life I've heard of the "limitless potential" of the Asian markets and, until we discouver life on other planets, they always will be the focus of Western marketing efforts but most of China's growth of the past decade has been in taking over the US's manufacturing base as well as their own massive infrastructure push as they redied for their Olympic moment last summer. This year, China is growing their GDP by 7% ($630Bn) entirely on the back of about that much government stimulus. Stimulus is the new global steriod, everyone is doing it, even after seeing how badly all this ended for the US economy.

In other news:

Here's Ron Paul, making progress now on his bill to audit the Federal Reserve in an interview with US News and World Report.

IN PROGRESS