What to Buy: HOTT

Courtesy of David of The Oxen Group

Courtesy of David of The Oxen Group

The Oxen Group is trying out another new style of investing tomorrow. In this market, finding a single day trade you can count on pretty difficult. Tomorrow, however, we are fairly confident the market should have a solid increase. Alcoa earnings came out kicking for the beginning of Q2 earnings, and the market has responded with some of the first green futures we have seen in quite some time. With bargains in the market, Alcoa looking great, a positive report from the Fed about consumer credit, and the possibility of positive earnings from a number of tech companies,I would say this Thursday is looking as good as the market can look.

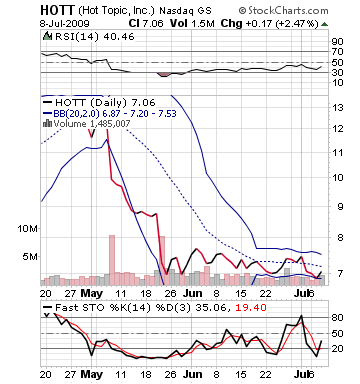

Therefore, Hot Topic Inc. (HOTT) may be a very nice play for some large movement. The company actually had very negative after hours news, lowering their Q2 earnings outlook and lowering their revenue estimates. The company will definitely take a stumble tomorrow morning on the news, with a 6% decline in after hours. However, if the market really does make a move up tomorrow, Hot Topic may be in a position where it can significantly move up from valley. The stock is very near a lower bollinger band, it is oversold, and it really has little room for downward momentum.

The Oxen Group is confident the stock should bounce off a bottom and move upwards from there. How low it goes is the challenge, but we think a 2 to even 3 percent move downwards should be a nice play to buy in. The stock is not a great long term play, but it is a nice play off a bottom tomorrow.

Entry: Recommend buying in around 2-3% decline from opening price or 20-45 minutes in.

Exit: We recommend exiting after a 2-4% increase.

Stop Loss: We recommend a 3% stop loss on all buy in prices

Upper Resistance: 7.25