Word is our Fed Chairman will be reappointed this morning.

Word is our Fed Chairman will be reappointed this morning.

This is good news for the markets,who hate uncertainty and settling this matter well ahead of Ben’s Jan expiration date and I agree with Calculated Risk’s take on the subject: "As Fed Governor Bernanke supported the flawed policies of Alan Greenspan — he never recognized the housing bubble or the lack of oversight — and there is no question, as Fed Chairman, Bernanke was slow to understand the credit and housing problems. And I’d prefer someone with better forecasting skills. However once Bernanke started to understand the problem, he was very effective at providing liquidity for the markets. The financial system faced both a liquidity and a solvency crisis, and it is the Fed’s role to provide appropriate liquidity. Bernanke met that challenge, and I think he is a solid choice for a 2nd term."

So congratulations to Bernanke who still has a chance to oversee the Great Depression Part II according to our friend Nouriel Roubini, who is getting very little US coverage for his warning that "the recovery is likely to be anemic and below trend in advanced economies and there is a big risk of a double-dip recession." Of course the MSM is in IGNORE mode when it comes to economic bad news this month, even media darling Meredith Whitney was swept under the rug this weekend as she predicted 300 bank failures ("only" 81 so far) while at the conference in Jackson Hole, where she was shouted down with happy talk by – you guessed it – Ben Bernanke!

“There will be over 300 bank closures,” Ms. Whitney said. “The small-business owner on Main Street continues to see liquidity come away. Many banks may be OK for while, but the real driver for the economy, which is consumer spending, I don’t expect that to come back anytime soon.” That figure sounds about right to me, especially after looking over the American Banker’s list of 150 Banks Ranked by Commercial Real Estate Loans topped by BAC ($1Tn), WFC ($888Bn), JPM ($720Bn) and C ($685Bn). Not on the list AT ALL with (presumably) less than $5Bn in commercial real estate loans are the smartest guy in the room, the market manipulating team of GS and CS while their partners in crime at MS have just $13Bn in commercial loans.

So the guys who MAKE money wouldn’t touch CRE with a 10-foot pole but our too big to fail crew is sitting on Trillions. I know Trillions is a tough concept to get your head around but let’s just say that 1% of $3Tn represented by just those 4 banks is $30Bn in losses if, for some crazy reason, 99% of the commercial loans they have written are not quite as good as gold. If your bank has "just" $1Bn in CRE and 1% of that goes bad, that’s $10M they won’t be seeing again so use caution when shopping for "bargains" off the list of the top 150 banks to say the least!

So the guys who MAKE money wouldn’t touch CRE with a 10-foot pole but our too big to fail crew is sitting on Trillions. I know Trillions is a tough concept to get your head around but let’s just say that 1% of $3Tn represented by just those 4 banks is $30Bn in losses if, for some crazy reason, 99% of the commercial loans they have written are not quite as good as gold. If your bank has "just" $1Bn in CRE and 1% of that goes bad, that’s $10M they won’t be seeing again so use caution when shopping for "bargains" off the list of the top 150 banks to say the least!

We’ll get a peek under the skirt of residential real estate this morning with the Case-Shiller Home Price Index but keep in mind it’s the data for June, when Existing Home Sales were still bouncing sharply off the bottom. May’s report was a classic case of "getting worse more slowly" as the report stated: "Although still negative, the annual rate of decline in the 10-City and 20-City Composites improved for the fourth consecutive month in 2009." That was on July 28th and, after a poor initial reaction that day, the Dow managed to add on 200 points for the week, from 9,100 to 9,300 and that was our first real breakout over our watch levels.

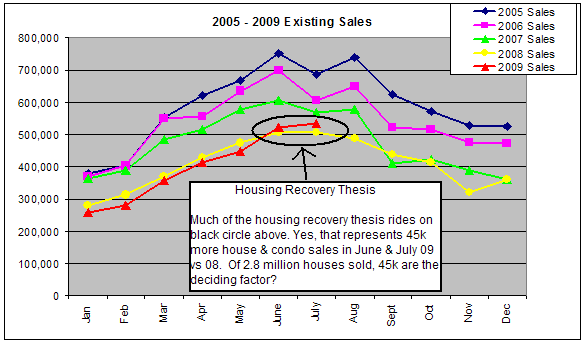

Of course, as we pointed out in yesterday’s post when we looked at housing data, this is just plain stupid. As the chart on the right clearly indicates, we ALWAYS have 4 consecutive months of improvement in home sales from February to May – it’s called SEASONALITY! I mean really, investors, have we really gone so far away from market fundamentals that we now can be fooled into thinking perfectly normal cycles are somehow "trends?" I suppose if we ever switch to solar power as a principal source of energy in this country I will be able to amaze people with my predictions that energy production will trail off in the late afternoon and pick up again in the morning so maybe I shouldn’t complain – apparently there are millions of television-watching investors who consider those kinds of observations to be brilliant…

Of course, as we pointed out in yesterday’s post when we looked at housing data, this is just plain stupid. As the chart on the right clearly indicates, we ALWAYS have 4 consecutive months of improvement in home sales from February to May – it’s called SEASONALITY! I mean really, investors, have we really gone so far away from market fundamentals that we now can be fooled into thinking perfectly normal cycles are somehow "trends?" I suppose if we ever switch to solar power as a principal source of energy in this country I will be able to amaze people with my predictions that energy production will trail off in the late afternoon and pick up again in the morning so maybe I shouldn’t complain – apparently there are millions of television-watching investors who consider those kinds of observations to be brilliant…

Looking at this chart of 5 years of home sales, I’m going to go way out on a limb and predict that Q4 home sales will show a decline, which may cause what is already a record amount of homes on the market to LOWER their prices, reversing the Case-Shiller happy train in their late October report, which is when we’ll first get the August data. Yes, you can quote me on that and I’ll be happy to go on all the talk shows and tell everyone how clever I was for predicting this housing downturn way back on August 25th and then I’ll jet off to Stockholm to receive my Nobel Prize for Not Being An Idiot in Economics – something that hasn’t been given to a member of the US Financial Media since Art Laffer proposed that raising the tax rate does not necessarily raise tax revenues (this was actually originally proposed in 1377 but Ibn Khaldun was notoriously camera-shy and never became famous for his "Khaldun Curve").

Also suffering from lack of media exposure is a report from Fitch Ratings which shows a 50% increase (6.6% vs 4.5%) above the normal number of delinquent U.S. mortgage holders, in part because falling home prices leave borrowers owing more than their properties are worth. Leading the downturn in this leg are Prime and Alt-A mortgages, previously thought safe from the downturn. "Prime had previously been distinct for its relatively high level of delinquency recoveries,” Fitch Managing Director Roelof Slump said in a statement. “By this measure, prime is no longer significantly outperforming other sectors.” Almost a quarter of U.S. mortgage holders owed more than their homes were worth in the three months ended June 30 and the figure may hit 30 percent by mid-2010, Zillow.com said in an Aug. 11 report. Home values dipped in the second quarter from a year earlier in almost 90 percent of the 161 U.S. metropolitan areas surveyed by Zillow.

Also suffering from lack of media exposure is a report from Fitch Ratings which shows a 50% increase (6.6% vs 4.5%) above the normal number of delinquent U.S. mortgage holders, in part because falling home prices leave borrowers owing more than their properties are worth. Leading the downturn in this leg are Prime and Alt-A mortgages, previously thought safe from the downturn. "Prime had previously been distinct for its relatively high level of delinquency recoveries,” Fitch Managing Director Roelof Slump said in a statement. “By this measure, prime is no longer significantly outperforming other sectors.” Almost a quarter of U.S. mortgage holders owed more than their homes were worth in the three months ended June 30 and the figure may hit 30 percent by mid-2010, Zillow.com said in an Aug. 11 report. Home values dipped in the second quarter from a year earlier in almost 90 percent of the 161 U.S. metropolitan areas surveyed by Zillow.

In other insane economic news: Unused

.jpg) Speaking of oversupply, NYTimes reporter Keith Bradsher points out that China, Japan and other export nations have been faking demand for US Treasuries by placing orders though British investment houses with a whopping $50Bn worth of US securities purchased in June alone, one of the key factors in those "great auction participation" numbers that have been touted as an indicator of our strength by CNBC. Japan was the second largest buyer in June with "just" $34Bn in purchases while Brazil picked up $11Bn (more no-question banks) and Luxembourg (always a powerhouse) added $8Bn, which is 10% of their previous holdings. Switzerland (say no more) was also in the 10% club, exposing that nations total exposure to US Treasuries by $8Bn in a single month.

Speaking of oversupply, NYTimes reporter Keith Bradsher points out that China, Japan and other export nations have been faking demand for US Treasuries by placing orders though British investment houses with a whopping $50Bn worth of US securities purchased in June alone, one of the key factors in those "great auction participation" numbers that have been touted as an indicator of our strength by CNBC. Japan was the second largest buyer in June with "just" $34Bn in purchases while Brazil picked up $11Bn (more no-question banks) and Luxembourg (always a powerhouse) added $8Bn, which is 10% of their previous holdings. Switzerland (say no more) was also in the 10% club, exposing that nations total exposure to US Treasuries by $8Bn in a single month.

Speaing of blatant market manipulation, the Hang Seng finished down just 100 points today after being rescued from a double dip to our 20,200 "must hold" level after lunch. The Nikkei fell 1% for the day and all that was a brilliant mask to save the Shanghai from falling below the 2.5% rule (they finished down 2.6%), led down by surprisingly weak earnings from Jiangxi Copper and Aluminum Corp of China despite the massive government stimulus that has specifically been propping up demand in their sectors. Wen Jiabao, the nation’s premier, said yesterday that excess industrial capacity may limit growth and authorities can’t be “blindly” optimistic.

“Companies aren’t yet seeing the signs of improvement coming through, even though the market is anticipating it,” said Matt Riordan, who helps manage about $3.8 billion at Paradice Investment Management in Sydney. “We need to start seeing some pretty broad profit upgrades coming through driven by revenues rather than cost cutting. Until then, we’ll be cautious.”

Europe is flat just ahead of the US open but our futures are up a full percent from lunch in China and I am, quite fankly, bored with pointing out how fake and manipulated these futures are. We went into yesterday’s close half covered, a very wishy-washy position and we have a very wishy-washy open ahead that won’t get interesting until we take out yesterdya’s highs. We did well playing for a drop after the very pumped up open yesterday morning and we know enough to take our bearish bets quickly off the table so this morning will be another opportunity to pick up some quick wins on the short side while we wait and see how long they can keep these plates spinning.