Happy anniversary market crash!

Happy anniversary market crash!

One year ago, in September, the market started falling in earnest. A lot of people were caught by surprise by that drop as many thought we had just had a major correction and the worst was over. We had bounced off 10,800 on July 14th and had made it all the way back to touch 12,000 on August 14th but that day I warned my members in the morning post:

We’re really through the looking glass when you see investors stampede right back into oil and other commodity stocks at the first sign of a bounce off a 20% drop. I guess they’ve never seen a pullback off 20% before so it makes sense that Cramer would hit the BUYBUYBUY button on anything that smells like crude. I wish I had access to the tapes of all these same idiots telling you to BUYBUYBUY housing stocks and mortgage companies when they made their first bounce on the way to 80% losses.

It’s not just oil that is expensive, now it has to compete for consumer dollars with food and airline fares and tobacco prices and consumer goods etc. Oil was able to bubble up because people were enjoying a robust economy and it was the ONLY thing that was rising out of control. Metals began to follow it as that didn’t affect the average person but then companies had to start passing on the increased costs and the banks stopped lending money and the consumers were forced to stop using their home’s equity (if there was any left) like a piggy bank and *poof,* suddenly there isn’t enough money for oil. This isn’t going to change because there’ s a hurricane or a shut down pipeline or anything else.

Oil was trading at a still ridiculous $115 a barrel that day, down from $147 on July 1st but still choking the life out of the economy. We were very bearish on oil and natural gas ($14 at the time) as the fundamentals simply didn't support the price of oil at $115 as much as they didn't support $147 a month earlier. I had gone negative on oil too early though, as we thought $120 was surely the top back in May. Sometimes fundamentals can get you too ahead of the market. Our man Ben was between a rock and a hard place as he HAD to do something to bring down oil prices before the entire economy came to a screaming halt. On Tuesday, Aug 19th I posted:

Anything that even smacks of a rate cut is death to the dollar so it’s going to be up to Bernanke to show us a strong hand and respond with some strong dollar comments. While this is a natural place for the dollar to pause and consolidate, as the rally was getting a little out of control and beginning to worry US exporters, it’s a very fine line between keeping US goods cheap and bleeding consumers for gas and food prices.

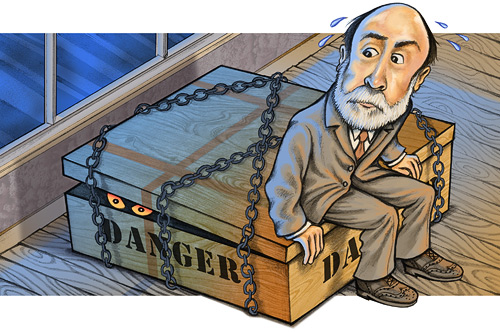

On September 2nd of last year the Dow was still at 11,500 and oil and the Dow were bouncing almost daily in what we did not yet call "stick saves" but I did run this cartoon to depict my skepicism of the market action. September 7th last year was a Sunday and I took the time to lay out why the government takeover of FRE and FNM was going to end in tears, concluding:

What will FRE and FNM look like, how will it affect global liquidity, how will it affect home values in America? Effectively what we have here is a giant $500Bn stimulus package disguised as a necessary bail-out that saddles US taxpayers with all the risk that was already being borne by the private sector. This will be fantastic for our bullish positions on the financials but I’m going to be wary of riding what’s looking to be a massive relief rally too far. Let’s enjoy it while we can though – we’re sure paying for it in the form of a lifetime of future debt!

On Sunday, September 14th, Alan Greenspan said "This is the worst economy I've ever seen" and he was not chomping on a cigar and impersonating Groucho Marx when he said it either! I commented on the 16th: "That’s a pretty bold statement from the guy that built it! …It will be interesting to see what Bernanke has to say today in the FOMC minutes, clearly we can’t just keep throwing more money at this problem but that’s never stopped this administration before which is why we are favoring some hedging in gold, in case our government’s solution is another $250Bn or so tossed onto the fire. It is shocking that, still, no one seems to be addressing the actual problem – people cannot afford their mortgages."

That was the day I proposed a very simple way that the Bush administration could have saved the entire economy for just $70Bn and they could have done it right away but, sadly, no one in the White House returned my calls and the the crisis expanded rapidly and the economy went straight to hell. Well, not straight to Hell… On Wednesday the 17th, the government spent their (our) first $85Bn bailing out AIG and BCS "walked away" (now it seems Paulson chased them away) from saving LEH and my comment in the morning post was:

That was the day I proposed a very simple way that the Bush administration could have saved the entire economy for just $70Bn and they could have done it right away but, sadly, no one in the White House returned my calls and the the crisis expanded rapidly and the economy went straight to hell. Well, not straight to Hell… On Wednesday the 17th, the government spent their (our) first $85Bn bailing out AIG and BCS "walked away" (now it seems Paulson chased them away) from saving LEH and my comment in the morning post was:

In another beheading, BCS walked away from saving LEH over the weekend and are now happily picking up the good parts, leaving the junk for the bankruptcy court to deal with. While 10,000 jobs may be saved, 10,000 jobs will be lost, not to mention many Billions in pensions that were wiped out with Lehman’s stock. This is another straw on the camel’s back of the NY economy and shorting NYC apartment prices might be a good play for the next quarter or two if we can’t turn these markets back up and create jobs that can pay for $1,000 per square foot condos.

Cramer says "Don’t push the panic button" but it seems like someone already gave it at least a nudge with even GS dropping 19% on the day. The Dow is down 7.1% for the week and all 30 components were red today led by AIG (-45.3%), JPM (-12.2%) and C (-10.9%). The Nasdaq finished down at the 5% rule at 2,098, not a good thing at all and the S&P was down 4.7% at 1,156, down 7.6% for the week. Things were bad enough that the SEC issued rules to curb short selling but they did little to cheer investors up and we closed at the lows of the day.

Now, let's take a step back to the future and think about all this in retrospect. We had pumped up market that was based on what can only be called, in retrospect, totally BS earnings by the Financials which led to people feeling rich enough to pay $100 to fill up their gas tanks and drive to the mall where they would pay $50 for a custom teddy bear, while sipping a $5 latte and eating a $3 pretzel. Sounds kind of silly now but that was consumer life in 2008 and it was a lifestyle that our government had extended by a few months by handing out $160M in stimulus checks.

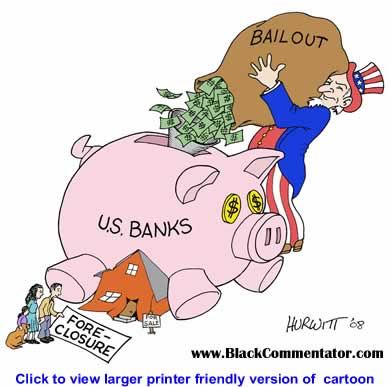

Without those checks, we may have had a more normal market bottom that summer but the checks allowed us to put blinders on which, sadly, did not cover us all the way through the election and they made the inevitable move lower seem all that much sharper when those checks ran out and consumers finally realized they weren't getting another one for Christmas. The government did step in again in September and spent money like mad – not on the people but on the bailouts. My comment about the stiuation on September 20th was:

Without those checks, we may have had a more normal market bottom that summer but the checks allowed us to put blinders on which, sadly, did not cover us all the way through the election and they made the inevitable move lower seem all that much sharper when those checks ran out and consumers finally realized they weren't getting another one for Christmas. The government did step in again in September and spent money like mad – not on the people but on the bailouts. My comment about the stiuation on September 20th was:

Did the government really do enough to save us or is this just like throwing a few more sandbags in front of the levee during Katrina? There are two very different schools of thought and both have their points but most people focus too much on the US economy which, although about 23% of the global economy, will not be able to rise on it’s own. We still have the power to take the world down with us if we slip into the abyss but we’re not likely to turn things around if the other 77% of the world is already sliding down anyway.

On the morning of Thursday, September 26th the government was assuring us that all was well and the bailout was coming any moment. That morning I commented:

Speaking of the bailout, things seem to be going well and we are told to expect something to be signed this weekend, which would be an amazing accomplishment considering the vast scope of the plan. As we discussed in last night’s post, the issue is so important that McCain and Obama issued a joint statement saying: "Now is a time to come together – Democrats and Republicans – in a spirit of cooperation for the sake of the American people. The plan that has been submitted to Congress by the Bush Administration is flawed, but the effort to protect the American economy must not fail."

We really thought we had the hyenas (my term for the funds that were attacking the weak financials) on the run but, just 8 hours later, things had gotten much worse as the House Republicans turned the "unity" meeting into a trench war as they showed up, not to shake hands and sign the bailout proposal as expected but instead proposed an entirely new proposal and WALKED OUT OF THE MEETING! This ended up with WM giving up and failing into the open arms of JPM and I asked that evening: "Was this planned sabotage and, if so, who benefits?" Paul Kedrosky summed up the Republican action nicely: "Some men aren’t looking for anything logical, like money. They can’t be bought, bullied, reasoned or negotiated with. Some men just want to watch the world burn." My commentary that night was:

I am so disgusted I cannot even bring myself to write about it. This is a monumental failure of government, of our leadership especially, at the exact moment we are facing the greatest crisis in our nation’s history. Apparently regulators had been holding off on WM until they saw if the relief package would help them but this 4pm mutiny by Boehner and company and the FDIC decided they couldn’t count on Washington anymore either and siezed $307Bn in assets (leaving the debt), selling them to JPM for $1.9Bn. It’s a damn good thing you can’t short the financials because that would be the play of the day tomorrow. The SKFs may break $200 yet, especially if the government doesn’t get a deal on the table this weekend, which is going to be hard with all the radical political posturing that is now going on."

The next morning I was still in a very foul mood. We were early watchers of the LIBOR rates, which bothered us long before the bothered the MSM (too complicated to put into sound bytes I suppose) and my hedging play for members in the morning post of 9/26 was the SKF Jan $115s at $17, which turned out to offer excellent virtual portfolio protection as SKF climbed to $303 in November, putting those calls over $188, up 1,100%. As additional protection I suggested the FXE Nov $147s for $2.65 and that trade failed but the FXY pair side (the Dec $94s for $2.53) were up 800% by expiration day. My morning commentary was:

Let’s not sugar-coat this, this is a crisis and the only reason everything did not fall apart this week is because the global markets were under the impression that the US had a plan, now panic is setting in and LIBOR jumped to 4.4% overnight, meaning liquidity is quickly freezing up, grinding all the world’s wheels to a halt. “It’s just a complete breakdown of the interbank lending market,” said Sean Maloney, a fixed-income strategist at Nomura International Plc in London. “We are now in a very fear-driven environment. Banks are no longer lending to each other.”

As I’m writing this, Rick Santelli just concluded a heated exchange on CNBC by actually walking away from the camera in disgust. Hopefully someone can find a clip later but Rick, who sits on the trading floor and feels what is about to happen in less than an hour at the open, is trying to convey to the guys in the studio the total sense of panic that the government’s actions (or lack of it) is causing among traders. We will, no doubt, have a huge sell-off and it may lead to a huge relief rally if we do solve the problem but, as Warren Buffett said on Wednesday – "If the government does not act then WE WILL go over a precipice." It’s all up to our leadership, only the government can save us now and that’s a very scary thought!

By Tuesday morning we had some form of a bailout package but I had already titled the 9/29 post "Monday Mourning – Too Little, Too Late?" The broader market downgrades had already begun and I noted that morning that MS and RBC had both dropped their price targets on AAPL significantly and I said: "If this is the kind of downgrades we are going to be getting on the best of tech companies, it will not be a pretty picture at all in the rest of the markets." Monday night I put up our Political Post of the Week. which I titled "Congress Assassinates the Markets" and the entire post was quite simply:

By Tuesday morning we had some form of a bailout package but I had already titled the 9/29 post "Monday Mourning – Too Little, Too Late?" The broader market downgrades had already begun and I noted that morning that MS and RBC had both dropped their price targets on AAPL significantly and I said: "If this is the kind of downgrades we are going to be getting on the best of tech companies, it will not be a pretty picture at all in the rest of the markets." Monday night I put up our Political Post of the Week. which I titled "Congress Assassinates the Markets" and the entire post was quite simply:

I have nothing to say about this, I’m still in shock but I can’t wait to hear everyone defend their party’s handling of this debacle. $1Tn in market value was lost today – good thing they didn’t spend that $700Bn, right?

By the morning of Tuesday, September 30th, we had come full circle to where I began this article – The government was providing stimulus which was boosting the markets and once again I found myself in the not very fun position of having to be the "bad cop" in my outlook. I warned my members that morning as the Dow tried to retake 11,000:

We’ve had improvements in the pre-market but do not be easily led into temptation.

It is very normal to get a 20% bounce off a harsh drop, while that would give us 150 Dow points and 40 Nasdaq points and 20 on the S&P, that is nothing to get excited about. Anything less than a 40% recovery is pretty much a continuing downtrend. The last play we looked at yesterday, at 3:43 was a speculative bounce play on the QQQQ $38s at $1.69 but, as I said to members at 11:20 yesterday (with the Dow was still up over 10,800) when we were still looking for bearish plays: "Technicals on all the indexes say we are doomed and TA has been very good at predicting lately. If this bailout doesn’t give us traction soon, we probably are doomed so don’t go too crazy on the long side, I’d have to say that calls are still the speculative plays as the preponderance of evidence is against them.

That day the VIX was well above 40, something that screamed DOOM to us option traders. That Tuesday I called the wild market action a day trader's paradise but Wednesday morning, October 1st, I reiterated my bearish market outlook, made more urgent as the Republicans, once again, proposes and "alternate" bail-out plan – exactly what we said would be the worst thing they could possibly do to market confidence! People say I came across too political when I pointed out what a complete bunch of self-serving jackasses the Republican Congress was and that the way I thought they were destroying our nation to further the interests of their corporate masters was over the top so I don't say that any more. So, to be as politically correct as possible, I'll just say: On October 1st of 2008, I had a "bad feeling" about the markets and wrote a post for members titled: "Hedging for Disaster."

Much like my post of Monday, August 24th 2009 (2 weeks ago), I was concerned the markets were going to fall to the point where I laid out a series of sensible, protective hedges. You can read that virtual portfolio for all the trade logic and my reasons for being short (warning to Republican readers – you may not like my reasons) at the time but they were, in summary:

Much like my post of Monday, August 24th 2009 (2 weeks ago), I was concerned the markets were going to fall to the point where I laid out a series of sensible, protective hedges. You can read that virtual portfolio for all the trade logic and my reasons for being short (warning to Republican readers – you may not like my reasons) at the time but they were, in summary:

SKF Jan $100 calls at $19, which were over $203 just over a month later, putting that particular hedge up 1,020%.

DXD Apr $55 calls for $14.20. DXD jumped up to $110 just 10 days later, an 800% return on those calls.

SDS March $77 calls at $9.95. Like DXD, the SDS made a tremendous run over the next 10 days and topped out at $130, driving the calls over 1,000% higher before pulling back.

On Tuesday, October 7th, with the Dow failing 10,000, I attended the Value Investing Congress in NYC and wrote and article entitled "What Is Value?" where I posited that the "experts" at the conference lived in a fairly isolated world and did not realize how bad things really were "out there" where most of us live. "What is the value of a share of IBM stock to a person who needs to make a mortgage payment on Wednesday?" I said. In that article I pointed out:

On Tuesday, October 7th, with the Dow failing 10,000, I attended the Value Investing Congress in NYC and wrote and article entitled "What Is Value?" where I posited that the "experts" at the conference lived in a fairly isolated world and did not realize how bad things really were "out there" where most of us live. "What is the value of a share of IBM stock to a person who needs to make a mortgage payment on Wednesday?" I said. In that article I pointed out:

Stocks have "value" as long as investors believe that the economic conditions are temporary but, especially for the non-dividend payers, they are simply not worth the paper they are written on to someone who needs to eat. Gold is a slightly different story as we are not trapped on a desert isle and, as global currencies are falling fast, gold still holds it’s position as the one thing we can all agree on and there is plenty of room for it to run if the dominoes really start to tumble.

We are going to get massive, coordinated action from the global central banks and they will boost the market but the quesiton will be- for how long? As long as we can change perception (maybe Cramer will stop telling people we’re going to 8,000) then we have a chance to arrest this crisis but the cost of global action to prop up the markets is already staggering and I’m simply not sure we can turn these ships on a dime so approach "values" with caution.

Gold was down at $700 at the time and we jumped all over that play! The very next morning we got the massive global stimulus I was expecting. I think it was a sign of how bad things really were that within 24 hours after I expected it, a G20 bailout, in the form of a coordinated rate cut, was in effect. My conclusion that day was sadly prophetic:

Gold was down at $700 at the time and we jumped all over that play! The very next morning we got the massive global stimulus I was expecting. I think it was a sign of how bad things really were that within 24 hours after I expected it, a G20 bailout, in the form of a coordinated rate cut, was in effect. My conclusion that day was sadly prophetic:

I think we are seeing panic but there’s no telling when that panic will subside. If we can’t put in a bottom today and recover to hold back over 9,800, we may be a long way from any sort of proper bottom and those downside plays will be great moneymakers but I can’t imagine what solace that will be in a world where the markets are that devastated.

The stimulus seemed to be working but on Friday October 17th, I was once again worried and wrote "Hedging for Disaster – Part II," which I won't bore you with here as it was similar to Part 1 but we had begun to do a little bottom fishing as well. We targeted some companies we loved for the price like X at $40 and VLO at $21, but in hedged positions that allowed for downside. Those picks became the cornerstone of our first Buy List a month later. Warren Buffett also started bying that day so we felt that we were in good company but I warned members:

Do not mistake what Buffett is saying for hitting the BUYBUYBUY button. You need to plan on doubling down on the Valero shares you buy at $17.50 when they hit $8.75 but picking some entries here on strong companies that you don’t mind owning NO MATTER WHAT THE TICKER SAYS, is a prudent way to play these volatile markets.

Bush is actually right in his speech this morning. There is no instant fix but Buffett and I see signs of improvement that keep us out of the global depression camp. Significant action has been taken, even California was able to find $5Bn in funding yesterday, earnings are simply not bad enough to justify the discounts applied to the stocks. GOOG is a great example, already over the $360 target we set in yesterday’s morning post. It’s not all roses, Housing Starts are the worst in 17 years and building permits aren’t being filed but THAT’S GOOD – we need to burn off inventory and we’re not going to do that if we keep building homes!

That was my thinking at the time, it was very possible the markets COULD go lower but, if they did, they would be wrong and our plan was to BUYBUYBUY at Dow 8,000, using good hedging strategies that would allow us to wait out the downturn. Still, we were not expecting a smooth ride and that weekend I put up a chart indicating we were likely heading into a prolonged, rangey consolidation that was similar to what the Nikkei experienced after their crash. I reminded members of the warning I had made a year earlier when I first became alarmed at the Fed's poor policy decisions: "If our government pursues Asian-style Central Banking policies they will subject our markets to Asian-style market swings."

On Monday, October 27th we had nice test of Dow 8,000 on a massive global sell-off and during the day, in Member Chat, I called a bottom saying:

I’m not saying anything will turn around right now but the point is we can buy low and get paid to wait by selling premiums. We’ve seen how fast this market can whipsaw up and I wouldn’t be too surprised to see even the anticipated Fed cut Weds boost us 1,000 points by Thurs. Whether or not we hold it is another story but this is starting to look more and more like rotation out of commodities and into some very beaten down stocks. Can they get more beaten down? Sure – but then we buy more and sell more premium. Don’t forget there is the old saying that "you can’t fight the Fed" but this isn’t just the Fed, this is the entire G7 acting in unison to move the markets. Perhaps the global crisis is so severe that not even that will help but, if so – then nothing really matters anyway does it?

Two weeks later, the market was up 1,500 ponts (20%) and we had a new President so this is as good a point as any to take a break in our review. You can read Part 2 of this series HERE and Part 3 HERE.