The nice thing about decimation is it's a fractional way to die.

The nice thing about decimation is it's a fractional way to die.

The word decimation is derived from Latin and means "removal of a tenth." The Romans would "decimate" their deserters as well as soldiers who performed poorly in battle by dividing the men up into groups of 10 and having them draw lots. The losing group was then killed by the winners, who were still punished only they felt like winners by virtue of still being alive. As I said, the system has it's advantages as a General who has to decimate 1,000 men must put 100 to death but a General with less to work with, say 100 men, only needs to mark 10 to die.

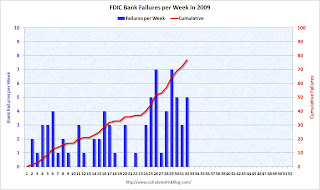

Does this system leave the remaining 90% healthier? Well, it certainly means there's more food left, more medicine, more weapons, more supplies for the remainder. Decimation is exactly what happened to the Financial Sector as 119 Financial Institutions have failed and dozens of others merged out of existence since NetBank kicked off our current crisis on Sept 28th, 2007. There are currently another 416 "troubled" banks as of Aug 27th and that number was revised up from a count of 305 given in May. Sill, there are over 8,246 Financial Institutions remaining with $13.5Tn in cash assets and the FDIC has a $500Bn line of credit to draw on should the need arise. So, to put things in perspective – we haven't even lost one in 10 and almost all that we've lost has been absorbed by another functioning institution. I wanted to put this up front on this section because this is the fulcrum of the misconception that started this crisis.

$1,000,000,000,000 is a lot of money. It's very hard for a person who has worked their whole lives to save $100,000 to wrap their heads around a number that is 10,000,000 times bigger than that and seeing our government talk about bailouts that START at $700Bn and grow to, arguably, $7,000,000,0000,000 in a matter of months is certain to push some emotional buttons. As a fundamentalist, I try to give our members perspective on the markets and perhaps the best way to view what happened to the economy is to think about an accident victim.

The GDP of the United States is roughly $14Tn a year. Usually, that money cycles around through the body of the economy and we don't think much about what a big number that is. Likewise, the human body has about 5 or 6 quarts of blood in it and, like money in our economy, it mostly just circulates around safely. What we had in our economy was a tragic accident – you can blame who you want to but that doesn't change the fact that we were bleeding capital and needed an infusion to stay alive. This was obvious to economists but, sadly, not to certain members of Congress (or, if they did understand it, then they had their own reasons for withholding treatment). A person can get in an accident and lose almost half their blood and still be saved if transfused quickly but it's the speed of the action that most determines it's success.

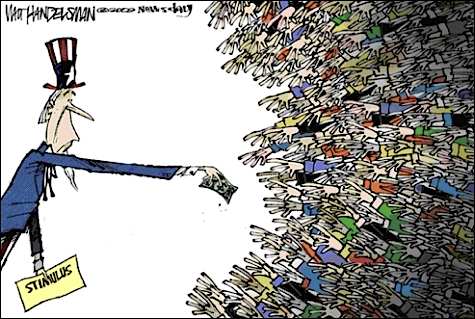

In our last post, note that we were facing a critical loss of capital and we needed an emergency transfusion. Just as you may be shocked at the amount of blood lost at an accident, people were shocked at the amount of capital that was needed to revive the economy. Of course some of the capital put in was wasted. When a person in losing blood the doctors immediately put more blood in THEN they look to see where the bleeding is and try to stop it. Standing around and debating what caused the bleeding and how much blood you need to put to save the patient while the patient continues to bleed is too stupid for even the worst-written medical show on TV but it is standard operating procedure in Congress and they had let the situation go from bad to worse by the time they finally got around to doing something.

In our last post, note that we were facing a critical loss of capital and we needed an emergency transfusion. Just as you may be shocked at the amount of blood lost at an accident, people were shocked at the amount of capital that was needed to revive the economy. Of course some of the capital put in was wasted. When a person in losing blood the doctors immediately put more blood in THEN they look to see where the bleeding is and try to stop it. Standing around and debating what caused the bleeding and how much blood you need to put to save the patient while the patient continues to bleed is too stupid for even the worst-written medical show on TV but it is standard operating procedure in Congress and they had let the situation go from bad to worse by the time they finally got around to doing something.

I don't know what people were expecting to happen but what did happen is the Dow went all the way to 9,650 on Monday, November 3rd but I was worried that we were nowhere near the bottom in terms of the P/E ratio on the S&P. My comment that morning was:

I don't know what people were expecting to happen but what did happen is the Dow went all the way to 9,650 on Monday, November 3rd but I was worried that we were nowhere near the bottom in terms of the P/E ratio on the S&P. My comment that morning was:

Currently, the S&P is trading at a P/E of roughly 17, pretty high if the deflation hawks turn out to be right. Lower prices lead to lower earnings, even if the companies do manage to improve margins due to lower input costs. Spiraling deflation leads to wage deflation and that is the path to disaster and, although that is clearly pricing into commodities – the markets are not pricing this in…if the NYSE can’t take back 6,232 – this is not a rally at all.

We can expect drift into the election but let’s be careful out there, energy rallied on Friday and can take us back down today as it was nothing more than blatant NYMEX manipulation – something Congress has seemed to have taken their eye off as they got distracted trying to stave off a global economic collapse but one that was triggered by those same NYMEX crooks who happen to be the same crooks who oversaw the financial crisis (*cough* Goldman! *cough* *cough*).

We were cautious heading into the election and that turned out to be a good thing as the Dow fell 1,600 points, almost 20%, back to 7,500 by November 20th. The wild market action kept us on the sidelines mainly but on November 12th, we began to take advantage of the massive VIX numbers and initiates our Buy/Write Virtual Portfolio, led off by my article "How to Buy Stocks for a 15-20% Discount" that laid out our bottom-fishing strategy, which offered us 20% additional downside protection on our entries – in theory protecting us all the way to Dow 6,500 (from 8,000). Little did we know we'd be needing every penny of it by March!

This represented a strategy shift for us but that is what you need to do to stay on top of the markets – adjust your trading strategy for the current conditions. We were officially declared in a recession that same day and I reminded members that: "It is VERY important to keep in mind that, when we do pick stocks to play with, they are in the context of virtual portfolios that are always at least 30% bearish (currently we are 60/40 bearish but looking to hopefully rebalance as we retest 8,200). Our downside plays are often ultra-shorts like DXD and SKF, which do very well on the way down – especially in this crazy market!" This is not at all unlike what I'm saying to people today, which is one of the reasons we're doing this review – we've been here before so let's remember what worked and what didn't.

The markets dove off a cliff on Nov 20th and we could not have been more thilled as our 60% bearish virtual portfolio was loaded with ultra-shorts. That morning we called for a possible bottom and a move to 50/50 balance with a lot of bottom fishing being done in the daily chat. My comment on what was already looking like an awful morning was:

While we made a new low on the S&P in dollars, in Euros we are not there yet with 3% left to go so let’s keep a very firm eye on our 2.5% rules today as I predicted a bad open and it looks like we’re going to get it (546,000 jobs lost last week!) but, if we can bounce off here back over 8,000, especially if we get back to 8,200 without a big pullback, then it may finally be time to rebalance just a little more bullish. If not, DIA puts and DXD calls can still go a long, long way for us.

That night we did a Big Chart Review and set our upside levels and a week later, by Thanksgiving Weekend, we were up 1,300 Dow points from the bottom – madness! By the way, you'll notice our last post was very much driven by fundamental events while post-election we entered what I like to call a "Bugs Bunny" market – where investors are stampeded in and out of the markets for no obvious reasons and that nonsense continued through early January, however I did warn on December 12th, when the Auto companies were NOT bailed out, that:

The bankruptcy of GM was one of the three things I said could take us down to 7,000 – I’m VERY glad we went bearish on Wednesday although the writing was very obviously on the wall from our perspective. While this was easy to see coming, what we didn’t see coming was former Nasdaq chairman Bernie Madoff being arrested by Federal agents in a "$50Bn swindle" that may be more damaging to investor confidence than the failure of the Big 3. "Our complaint alleges a stunning fraud that appears to be of epic proportions," said Andrew M. Calamari, associate director of enforcement in the SEC’s New York office. If this triggers another round of frantic hedge fund redemptions, we may be wishing to hold 7,000!

We did indeed get coal in our stockings for Christmas with the Dow back at 8,468 on Christmas Eve – not the usual "Santa Clause" rally. My Christmas Eve note to readers was more optimistic though and my seasonal commentary was:

We are getting a charismatic leader and a fresh start on January 20th (just after options expiration day) and I think that a slight change in attitude will open the monetary flood-gates and spark a rally, as well as inflation as MUCH more money begins chasing more limited goods and services (and I believe I have mentioned how much I like gold as a hedge here).

Gold was one of the gifts of the wise men and I’m pretty sure my wife will like that better than frankincense or myrrh this Chrismas so we can say that it is the gift that has stood the test of time. I’m sure that if Balthazar were giving gifts today, he’d probably rethink the myrrh and give the newborn king some high-dividend yeilding blue-chip stocks or perhaps some ETFs in finance and commodities because Jesus may have chased the money changers out of the temple 2,000 years ago but cockroaches have nothing on capitalists when it comes to adaptability and survival.

We did get a nice pop back to just over 9,000 in early January but we were skeptical of the low-volume move and it did quickly reverse and we were back at 8,000 just two weeks later. On January 14th, in an attempt to get oil back over $40, Osama Bin Laden declared a Jihad against America, Hamas attacked Israel, Nigerian Rent-A-Rebels attacked a pipeline and, of course, TBoone coordinated all this with a morning spot on CNBC predicting oil would go back to $100. As noted above, we were bullish on commodities too but, unlike Mr. Pickens, we don't take joy in shaking down US citizens for Billions of discretionary consumer dollars as we fake a shortage in an overly abundant commodity. Despite the artificial "crisis" we were in "don't panic" mode and I said to members:

All in all, we should be retesting our lows off of this news and we are right back where we were on December 29th, as reflected in our last Big Chart Review so no need to rerun the numbers, as they are all right in that post. Until we break significantly below our 8,200 floor, we are range-bound and nothing more.

I did a nice summary post on Jan 24th and it's interesting to see what we were buying and selling at the time and on Feb 1st, I wrote an Economic Overview for 2009 where I wrote:

The mood of the markets is clearly negative but the ISEE put/call indicator shows a rising moving average, showing there are 20% more bullish options bets placed now than there were in November. That’s not necessarily a good thing but it’s the most bullish options have been since June and we’re coming off a low last March of 85 (85 calls to 100 puts) back to 120. There are, of course, other factors – like perhaps these are bull hedges on bearish positions…

Despite the bearish situation, my longer-term outlook was that we were going to get through the crisis and concluded: "For good or inflationary ill, the Fed has a virtually infinite supply of ammunition to fight this downturn and they are determined to use it. It was Archimedes who said of using leverage "give me a place to stand and I shall move the earth." Well I think if we give the new administration more than a week to get their footing and apply some economic leverage, we will be able to move the markets. Even Whitney and Roubini are down to forecasting the last $2.5Tn in losses for the banks… Only $2.5Tn?!? That’s what the kid in Zimbabwe is holding to go buy some milk at the grocery store!" Little did we know just how much leverage the government and their bailed out buddies would be able to move the markets once they got their footing!

Despite the bearish situation, my longer-term outlook was that we were going to get through the crisis and concluded: "For good or inflationary ill, the Fed has a virtually infinite supply of ammunition to fight this downturn and they are determined to use it. It was Archimedes who said of using leverage "give me a place to stand and I shall move the earth." Well I think if we give the new administration more than a week to get their footing and apply some economic leverage, we will be able to move the markets. Even Whitney and Roubini are down to forecasting the last $2.5Tn in losses for the banks… Only $2.5Tn?!? That’s what the kid in Zimbabwe is holding to go buy some milk at the grocery store!" Little did we know just how much leverage the government and their bailed out buddies would be able to move the markets once they got their footing!

After that report we, of course, went bearish and we were waiting for a big drop on Feb 5th, having no idea how BIG of a sell-off was actually ahead of us. I still felt that government was not adequately addressing the key issue of homeowners who couldn't afford their mortgages and on Monday, Feb 9th, I advocated a 3% mortgage solution, something that would still work. On that Monday night, Obama didn't use my solution and instead made the rookie mistake of telling the American people the truth in his first major address saying:

The plan is not perfect. No plan is. I can’t tell you for sure that everything in this plan will work exactly as we hope, but I can tell you with complete confidence that a failure to act will only deepen this crisis as well as the pain felt by millions of Americans… We don’t know whether we need additional money or how much we need, until we see how successful we are in restoring confidence.

Huge rookie mistake and the markets totally freaked out. This worked out very well for us as we were bearish but not so good for investors as the Dow sank from 8,270 that day to 6,500 on March 6th. My commentary the next day on the market mood was:

I said yesterday "Can we handle the truth?" It certainly seems investors can’t since the truth is that the Administration is not promising a quick fix and they do see massive problems ahead and they’re not sure they are doing the right thing but they want us to bear with them as they try to get a handle on the situation. Clearly that was NOT what the markets wanted to hear after 8 years of hearing how great everything was – even when it wasn’t. Yesterday I said Obama was acting like a cardiologist giving you bad news and while Geithner was speaking yesterday I said, rather than playing the hoped-for role of "good cop," he came across more like the rehab nurse who tells you she’s really not sure when you will be able to resume a normal life.

The entire following month of trading is best summed up by my Feb 23rd Big Chart Review where I said:

Once again we are in a market that environment that reminds me of the Simpsons episode where Homer jumps over a gorge, crashes, is taken up by a helicopter (Ben) smashing against the wall along the way only to fall all the way from the top again. Pain, pain and more pain every time we try to get long. Today we finished near 11-year lows on the Dow and S&P, so much for that decade of savings….

What happened next is in Part III of this little series. Connect to part 1 HERE if you missed it.