We're still trying to get bullish, really we are…

Yes we are reluctantly bullish and only technically bullish at that. All we are asking of the markets is for them to take out our very simple levels and hold them for more than a day or two. Those levels are (and have been since early September): Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623. These are, according to the 5% rule, the levels we need to hold in order to establish a floor in the markets that justifies setting higher upside targets. If they cannot be crossed, then these REMAIN our upside range targets and we need to start seriously considering the possibility that we may still get a pullback to Dow 9,650, S&P 1,020, Nas 2,075, NYSE 6,900 and Russell 575.

As I mentioned last week (and noted on David Fry's IWM chart), the Russell was the first to fail our 623 mark and will be our canary in the coal mine as they test 595, which is the 50 dma. A failure there and the markets have little support all the way down to our June highs, our original breakout levels of Dow 8,650 and other levels you don't even want to think about on a Monday.

$2.66 is another level we don't want to think about. That's the average price of regular gasoline this weekend. Despite 10% lower demand than last year when December gasoline averaged $1.66 a gallon. What's a dollar a gallon between friends right?

$2.66 is another level we don't want to think about. That's the average price of regular gasoline this weekend. Despite 10% lower demand than last year when December gasoline averaged $1.66 a gallon. What's a dollar a gallon between friends right?

Well, actually since US consumers use 63M barrels of gas each week, and a barrel happens to be 42 gallons, it happens to be about $10.5Bn a month taken our of consumer's pockets. That's cash, after-tax money – gone! Money they won't be able to give to all those nice Russell companies for Christmas this year. Remember how much that $160Bn stimulus helped the economy last year? How much do you think a $120Bn mugging hurts the economy this year?

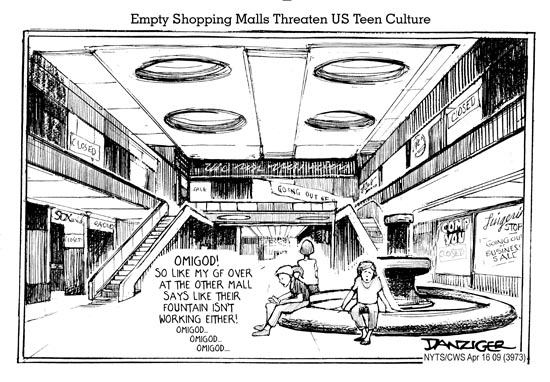

The timing couldn't be worse – last year, gas prices flew down and helped people make it to the mall for Christmas, this year already – as we can see from Amazon's great quarter, many people will be skipping the malls and buying on-line. With 10% of the workforce unable to find jobs and 10.3% of the US retail space now vacant (up from 8.4% last fall) it's kind of hard to get into the Christmas spirit, let alone the mood for a Santa Clause rally, which is what the bulls are hoping for now that there are just 58 shopping days until Christmas.

The Federal Reserve has tallied nearly 8,300 store closings announced by retailers so far this year, including more than 1,500 large anchor stores. Last year, the International Council of Shopping Centers, an industry trade association, counted 6,900 such announced closures. The next-highest annual total recorded by the trade association was 7,000 in 2001.

As demand for retail space plummeted, average retail lease rates continued to decline in the third quarter, down 3.7% to $16.89 per square foot for shopping centers and off 3.5% to $39.18 for malls. And the outlook for a recovery in the near future appears bleak. "We don't see rent levels in retail returning to 2008 levels until 2016," said Victor Calanog, Reis director of research. "If sales are flat, plus or minus, that won't be so bad, especially since our tenants are carrying lower inventories," Centro's Glenn Rufrano said. "What we're hoping against are big negative sales over Christmas."

So, big negative sales over Christmas would be bad. 59 days to go… Oil is $80 a barrel and, as I pointed out last week, this rally has been led by just 4 sectors – energy, financials, commodities and consumer discretionary. The XLE and OIH are right back where it was when oil was last at $80 and univerally thought to be heading higher. Is $100 oil ahead for us? Businessweek says "Don't Bet on It" and I simply don't see how people can afford $3 gas right now.

How about materials? Same thing – can we really afford $1,050 gold and $17.60 silver and $3 copper or is this just a reflection of speculative global money moving out of US equities (we are underperforming the global recovery by 1/3) and out of US currency (the dollar is down 20% in 6 months) and into commodities to hedge against what looks like inevitable inflation? You can see the logic for financials going up on inflation (more money!) and oil and commodities but Consumer Discretionary? That's just strange….

Oddly enough, the "recovery's" biggest enemy right now is the US dollar. Should the dollar stop dying, money will flow out of our new commodity bubbles and will cause a relative devaluation of US Equities. Also, it will make the relative labor costs being paid by US corporations soar and drive up their relative health-care costs and the cost of everything else they have to trade international revenues for to keep the doors open. So watch out for the dollar but, as long as it stays dead, this rally can continue. How's that for a bullish premise?!?

This week we get 1/3 of the S&P 500 reporting. This morning GLW beat, keeping the fire going for electronics sales. RSH, who actually sell electronics, missed however but that was more due to their general incompetence than sales, which were off just 3.1%. VZ also put in a solid report and this all ties back to the same sector doesn't it? Kindles, IPods, IPhones, Laptops and new TVs – just what a depressed population needs to stay home for the weekend. In the great depression, the film industry boomed as a downtrodden populace found a way to set aside a little money to pay for a brief escape from a depressing reality. Is that what's happening now or is this time different? 59 more shopping days should clear things up.

Big news from BIDU tonight along with earnings of interest from DTG, DRYS, MTH, OLN, RCII and WINN. Tomorrow morning we get AKS, BEAV, BJS, BYD, BP, CP, FDP, LLL, PCX, SCHN, AMTD, TXT, X, UA, VLO and WAT. In the evening we get BXP, BWLD, CEPH, NSC, NTRI, PNRA, PEET and, the biggie – V, who will give us the best read yet on what the consumers are really doing into the fall.

Tomorrow we get the Case-Shiller Home Price Index and Consumer Confidence for October. Durable Goods and New Home Sales hit us on Wednesday and Thursday is a big day with the Q3 GDP and more Unemployment. Friday we end the week with a bang (hopefully not a whimper) with Personal Income, Personal Spending, PCE, Chicago PMI, Michigan Sentiment and the Employment Cost Index. It's really all about getting past that GDP number, which is projected to be up 2.5%, downgraded from up 3.2% originally projected so we've set the bar so low on that one, a miss would be tragic (last Q was -0.7%).

Toyota INDUSTRIES (not TM) boosted the Nikkei this morning with a surprising profit, gaining 7.5% in trading. Nonetheless, the Nikkei dropped 100 points into the close as investors became nervous about the US open and the mega-pump that jammed the dollar back to 92 Yen in early trading fizzled out. “Companies’ desperate efforts to cut costs have resulted in a lower break-even point, and we’re about to see these positive effects in coming earnings reports,” said Hisakazu Amano, who helps oversee the equivalent of $19 billion at T&D Asset Management Co. China was closed for the day.

Europe is pretty flat ahead of our earnings so it's up to YOU to keep the upside momentum going in the US markets. Get out there and BUYBUYBUY stocks and knick-knacks – OR ELSE!