Is it time to buy the buck?

As noted by Andrew Wilkinson on Wednesday, there was a huge volume surge in UUP call options, the ETF that tracks the US Dollars index value, ahead of the FOMC statement. 155,000 November call options were bought at the $23 strike level and another 155,000 were purchased at the December $23 strikes. The November calls came in at around .15 and are now .25 (up 66% in one day on UUP) and the December calls were executed around .25 and are now .40 (UUP up 60%) – this is not bad for a day's work but was it just a day's work or are we betting on a trend?

As you can see from David Fry's chart, it's not just the 300,000+ options (controlling 30M shares) that have been trading bullishly around the dollar – there has been a stunning surge of volume buying that has built up since mid-October as the dollar index skates along our own target low of 75.

So strong was the demand for shares of UUP that we noted in Member Chat that the PowerShares DB US Dollar Index Bullish Fund (UUP) was halted pending clearance of their request to register another 100M shares "in order to meet investment demand."

“There’s been a lot more interest in this ETF because investors are using it as a hedge on the dollar,” said David Stec, an ETF options trader at Group One Trading on the Chicago Board Options Exchange floor. “Yesterday, with the amount of options volume they saw, they probably have to add some shares. The ETF is based on the dollar versus a basket of currencies, so if there aren’t enough shares it might trade at a premium.”

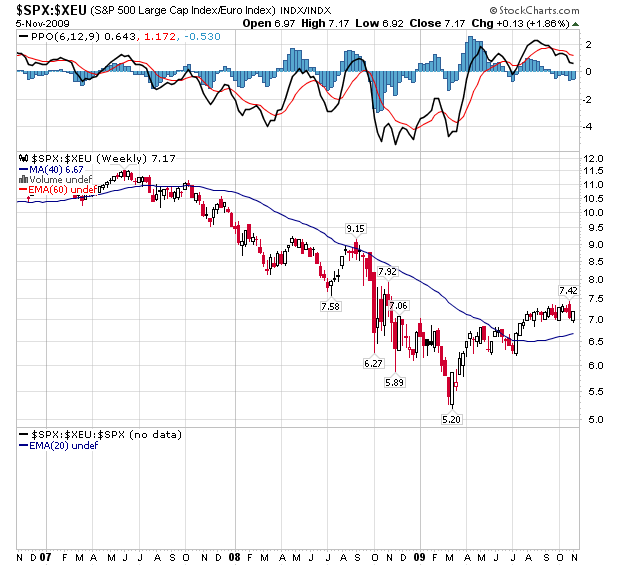

The Dollar trading at a premium? Surely you can't be serious! Well, I am serious and don't call me Shirley… While this may be contrary to what you've been hearing in the MSM, where dollar bashing has become a popular blood sport, it's the main reason we've been having trouble buying into this commodity-led rally, which has been primarily based on the 15% pounding the Dollar has taken since March. As I often point out to members, if you adjust the S&P to reflect a real currency, like the Euro or the Yen, then you'll find that our "spectacular" 60% rally in the S&P since March is really just a 27% rally and looks like this to a foreign investor (S&P value converted into Euros):

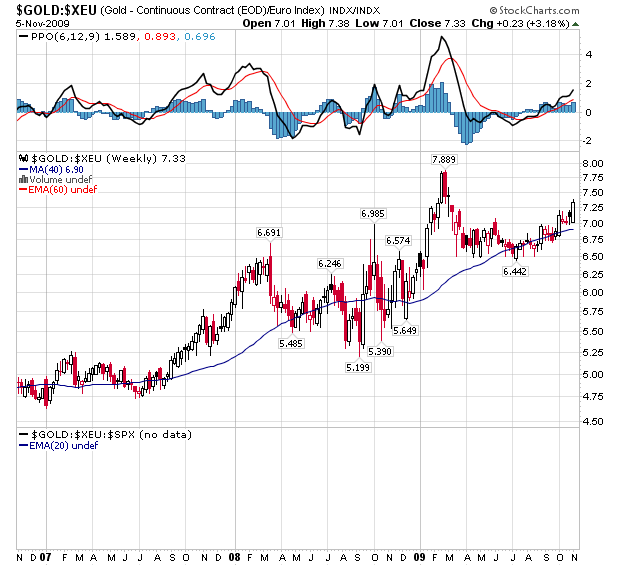

Even mighty gold, which seems unaffordable to impoverished Americans at $1,095 an ounce (where we shorted the gold futures just this morning), has still not retaken it's highs against the Euro from March and is, in fact, over 4% below that level:

So let's say that gold can climb another 5% to $1,150 before European and Japanese traders see it as a double top. That's why we went short on gold as very much ado was made about nothing when India purchased 200 tons of gold from the IMF this week. India is only buying at the "top" when priced in Dollars – as priced in Rupees, India is paying 20% less than they would have last year, when a dollar could buy you 39 Rupees (now 47).

Sadly Americans are fairly clueless about currency conversion and the gold bulls prey on that ignorance and put up all kinds of charts and draw trends and attempt to baffle you with statistics because they can be fairly confident that not for one moment are we going to step back and look at things from a global perspective. Oil is scammed in a similar fashion but, unlike oil – the gold market is heavily dependent on physical demand and they can only drive up the futures as long as they have fresh suckers to reel in but the price of gold collapses like quite the house of cards as soon as anyone tries to unload their shiny bits of metal.

That's why you see non-stop advertising telling you to buy gold coins as an investment. The speculators need someone to take physical gold off the market, just like the Krugerrand craze that was used to drive up the price of gold. That's why India's purchase was such a relief and sent gold up 7.5% in the last 5 sessions – there had been a fear that the IMF would have to sell gold on the open market. China was originally targeted to be the gold buyer but the Yuan is pegged to the dollar and China had no interest in paying such a ridiculous price to store gold while India's currency is just rolling off their 2-year high and they are using gold to lock in their gains.

As Goldman Sach's head of commodity research said on Wednesday: "It's not a weak dollar that's driving up crude prices – it's higher oil prices that are driving the dollar down, sending metals and softs soaring. Oil represents 40-50% of the U.S. current account deficit, so a higher oil price represents an outflow of dollars that pushes the currency lower." Goldman is, of course, one of the most despicable commodity pushers on the planet and I will detail this weekend how the global population is having their pockets picked in the great global oil scam but Currie does get to the heart of the matte – there are NO fundamental supporting the price of oil, gold or any of the other racing commodities, this game is all about the weakness of the dollar and heaven help them if that play begins to unwind and they try to exchange their black goo and shiny bits of metal for a very scarce supply of dollars.

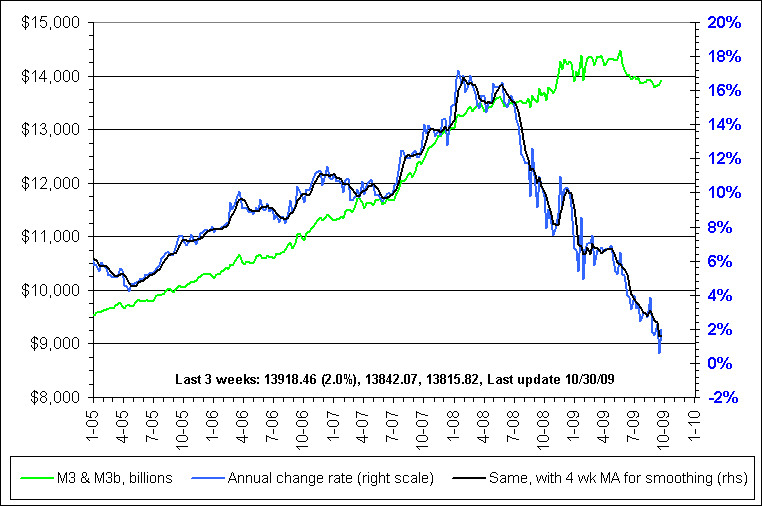

Scarce dollars? What is this guy smoking, you may wonder? Well, this is something we've been tracking since July and here we have a chart of the M3 money supply that clearly shows that, since July, $750Bn have come OUT of circulation, reversing over half of the run-up in dollar float that begian last year with the passage of the TARP spending, that took M3 from 13.5Tn to $14.5Tn over 12 months:

"Hey wait", you may say, "this is not what they've been telling me on TV". No, it isn't. That's because the $2Tn that was injected into the economy wasn't injected into a healthy economy, it was injected into a badly damaged economy and $1Tn of that money has already been used to repair the damage (mortgage defaults, credit-card defaults, derivative losses, Madoff scams) that has already been done to the system.

The very notion that putting $2Tn into the economy causing you to immediately have $2Tn of surplus cash to spend assumes that there was no need for the money in the first place. That's like saying that you have a car that needs 1 quart of oil (TARP I) and you put in two quarts of oil – how much oil will be a surplus? Obviously the answer is one quart and that, of course, assumes you don't have a leak or are not burning off a lot of oil as your economic engine continues to smoke. Unfortunately, the commodity bulls have the sheeple (who are terrible at math) convinced that there are two EXTRA quarts and that those quarts will somehow breed and multiply and create a third quart of stimulus until the world is simply awash in dollars and the only thing we will be able to count on is their black, sticky goo and shiny bits of metal to save us. What nonsense!

The very notion that putting $2Tn into the economy causing you to immediately have $2Tn of surplus cash to spend assumes that there was no need for the money in the first place. That's like saying that you have a car that needs 1 quart of oil (TARP I) and you put in two quarts of oil – how much oil will be a surplus? Obviously the answer is one quart and that, of course, assumes you don't have a leak or are not burning off a lot of oil as your economic engine continues to smoke. Unfortunately, the commodity bulls have the sheeple (who are terrible at math) convinced that there are two EXTRA quarts and that those quarts will somehow breed and multiply and create a third quart of stimulus until the world is simply awash in dollars and the only thing we will be able to count on is their black, sticky goo and shiny bits of metal to save us. What nonsense!

Like an accident victim needing a blood transfusion, this economy NEEDED $1,000,000,000,000 just to stay alive last year. Whether or not the additional stimulus was really necessary remains to be seen but the fact is that, as clearly illustrated on the above chart, the "excess" supply of dollars is being sucked up at a rate of $150Bn a month since June. The prior administration pumped the money supply up from $7Tn to $13.5Tn over 8 years and caused a MASSIVE commodity (including housing) bubble that burst with great fanfare last year. Just like any balloon, the economy expanded as money was poured into it, giving us the illusion of strength right up until the moment it burst. Now we have taped up that balloon and we are trying to reinflate it but that doesn't mean we are going to go right back to push it to the breaking point again does it?

What's really funny about gold in all this is that there are 5Bn onces of gold in the world that have already been mined, and pretty much all of it is still in circulation as gold is not generally destroyed. In the past two years, the "value" of that gold has gone up from $3.25Tn ($650 per ounce) to $5.5Tn ($1,100 per ounce), a gain of $2.25Tn or pretty much ALL the money in the world that has been created since that time. That would, I suppose, make sense if gold was the only thing on Earth we spent money on but (funny thing) oil went up too – from $45 a barrel last fall to $80 a barrel today. Now oil is a little trickier than gold because we actually use it but let's say that we consume 85M barrels of oil a day globally so a $35 increase in the price of oil costs us an extra $1.1Tn a year and, even better than that, the 2Tn barrels of oil that are in the ground gained $70,000,000,000,000 in value or 1.5 times the entire global GDP.

Isn't that fantastic? I'll bet you never realized how rich we were that we could afford to spend $72.5Tn on just oil and gold this year. Kind of puts that piddly $700Bn stimulus into perspective doesn't it? Of course, oil and gold weren't the only commodities clamoring for those "extra" Trillion dollars – the entire CRB, valuing oil, gold, copper, lumber, food etc rose 37% since March. 20% of the global GDP ($45Tn) is spent on Food alone so that 37% of $9Tn or a $3Tn bump in your annual food bill to go with the $1.1Tn bump in oil prices and another $1Tn spent on industrial metals (although no one is actually buying cars or houses, so that impact is limited).

Isn't that fantastic? I'll bet you never realized how rich we were that we could afford to spend $72.5Tn on just oil and gold this year. Kind of puts that piddly $700Bn stimulus into perspective doesn't it? Of course, oil and gold weren't the only commodities clamoring for those "extra" Trillion dollars – the entire CRB, valuing oil, gold, copper, lumber, food etc rose 37% since March. 20% of the global GDP ($45Tn) is spent on Food alone so that 37% of $9Tn or a $3Tn bump in your annual food bill to go with the $1.1Tn bump in oil prices and another $1Tn spent on industrial metals (although no one is actually buying cars or houses, so that impact is limited).

Where is all this money coming from, you may ask? Well, as I said yesterday, this money is not excess money at all, this money is being squeezed out of the pockets of the labor force, who have been forced to accept not only the same pay but LESS pay in dollars from their employers, driving their standard of living down a stunning 12% in just one year while their corporate masters make stunning "productivity" gains as they get much, much more for much, much less.

What happens if these workers wise up and ask for money? That would create a demand for dollars to pay them with as the 10.2% of the US population who are now officially unemployed would themselves require $500Bn of those scarce dollars in order to go back to work. A simple 6% raise given to the working population – just enough to get them 50% of the way back to their 2007 standard of living, would suck up another $1Tn of global "surplus."

An ounce of gold is only worth $1,000 if you value 20 of them more than you do a new Toyota. An ounce of gold is only worth $1,000 to a person who values it more than a month's worth of food for his family. An ounce of gold is only worth $1,000 if people have nothing better to do with $1,000 than buy a shiny bit of metal. If your boss decided to give you an ounce of gold this week instead of your paycheck – what would you do? You would go change it for dollars! What then, is more "valuable"?

So it is not the dollar itself that is worthless, rather that a lack of competition for available dollars has driven the price of commodities sky-high along with a prolonged attack on the dollar by the commodity pushers, who also happen to be the currency pushers, who also happen to be the experts the MSM turns to when trying to make sense of something as complex as International Exchange Rates. Once there is a real demand for the dollar – whether is is to buy labor or machines or cars or refrigerators – suddenly the "value" of black sticky goo and shiny bits of metal will normalize and don't forget that a resurgence in the price of US real estate can also pull dollars away from our runaway commodity sector.

Sadly, the majority of our market rally is based on commodities and it's very likely that, priced in dollars, that stocks will find equilibrium closer to that 27% up level we see for the S&P priced in Euros than the 60% level we're currently at priced in dollars. Let's say we level out at the 40% line, which would be right about 940 on the S&P and 9,650 on the Dow – not too far off from where we are now and, if we can hold that line against a rising dollar, then we may be able to rotate out of this mess but only if commodity prices come down to reality and stop sopping up all of our global liquidity.

Non-Farm Payrolls were a slight disappointment this morning with 190,000 jobs lost but it is the 10.2% unemployment figure that is spooking the markets. Fortunately we went bearish into yesterday's hyper-active close as I said to members at 3:40: "Boy I just cannot bring myself to sell a DIA put! I figure a 100-point pop into the open will cost .50 and then I’d have to pay .50 to roll up to the $104 puts and sell 1/2 the Dec $100 puts for $2.60 (now $3.05) so that’s my plan – risking a 20% loss on the DIAs to leave the Jan $103 puts naked overnight. Still only about 55% bearish with that but I just can NOT get behind this very low volume move today."

Non-Farm Payrolls were a slight disappointment this morning with 190,000 jobs lost but it is the 10.2% unemployment figure that is spooking the markets. Fortunately we went bearish into yesterday's hyper-active close as I said to members at 3:40: "Boy I just cannot bring myself to sell a DIA put! I figure a 100-point pop into the open will cost .50 and then I’d have to pay .50 to roll up to the $104 puts and sell 1/2 the Dec $100 puts for $2.60 (now $3.05) so that’s my plan – risking a 20% loss on the DIAs to leave the Jan $103 puts naked overnight. Still only about 55% bearish with that but I just can NOT get behind this very low volume move today."

As we expected, October hourly earnings are creeping up much faster than expected (0.3%) as we are have very likely reached the end of the productivity gains (which were for Q3, which ended in Sept). We still have Wholesale Inventories to look at at 10 and we'll see how much credit consumers lost at 2pm. Next week there is not much data and we are not going to be greedy on our short plays unless we see some volume conviction to the selling.

Our upside target levels remain as they were all week: Dow 9,962, S&P 1,066, Nas 2,097, NYSE 6,955 and Russell 580. Those will determine how we feel going into the weekend but I am pretty sure that 55% bearish will be the answer unless we get a huge sell-off that we want to cover.

Have a great weekend,

– Phil