Here’s Jesse’s take on the charts from Zero Hedge showing a significant portion of gains in stocks has been due to low volume trading in the futures after hours. This is also why it’s difficult to get excited about the market’s bullish behavior. Nothing in the system has been reformed; perhaps the greatest difference is the house of cards upon which valuations are built is now more visible to those who look. – Ilene

The US Bull Market in Smoke, Mirrors and Gullible Investors

Courtesy of Jesse’s Café Américain

We have given quite a bit of coverage to the somewhat ‘thin’ veneer of recovery being spun by misleading government econmic statistics in the US.

And we have certainly noted the almost blatant manipulation in many US markets, including stocks and commodities where the banks and hedge funds have been pushing prices around, sometimes with the help of the government, in a disgraceful repudiation of any notion of reform.

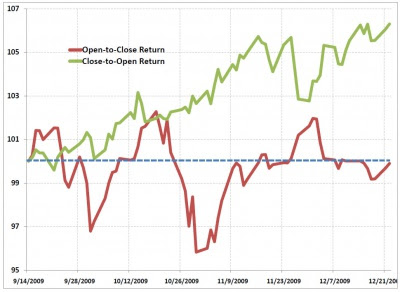

Thanks to the Tylers at ZeroHedge we have two very nice charts to present the case that the recent continuation of the US stock market rally is due in large part to a Ponzi-like price manipulation largely in the after hours markets when trading is thin.

After Hours Verus Prime Hours Cumulative Trading Gains from September 2009

After Hours Versus Prime Hours Cumulative Trading Gains from March 2009

And a Ballooning Price-to-Earnings Ratio as a Result

Its pretty much a Ponzi scheme, and not all that well hidden. This is probably why insiders continue to sell in large numbers.

If the US market breaks it will go badly for many average people who do not understand how their government has failed to protect them.

But do not underestimate the power of the Bernanke Fed and its enablers in the central banks to continue printing enormous amounts of unfunded dollars and hiding the effects. This may buoy the US markets for longer than we might think, as it did in 2003 to 2007.

But at some point the payments will come due, value will be revealed, price discovery will assert itself, the US dollar and the bond will fail, and then comes the deluge.

Watch what India and China do with their reserves. They know full well what is coming and unlike the US are seeking to protect their people.