WTF? I mean, REALLY, how can the Dems fall apart this quickly?

WTF? I mean, REALLY, how can the Dems fall apart this quickly?

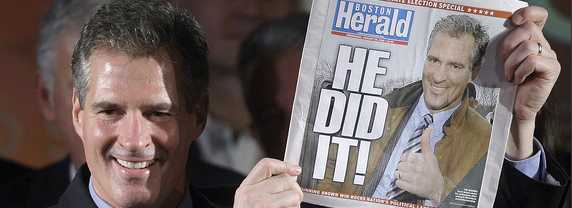

I’m not going to get into a whole political thing here – Jon Stewart already said it very well on Monday when this Senate race was looing bad but – HOLY COW, did the Democrats just blow Massachusetts? And don’t write in to tell me that technically, the Whigs and the Republicans were two different parties – Lincoln was a Whig, so if you want to keep claiming him you’d better embrace your party’s roots… The Whig party was on quite a roll at one time with Harrison, Tyler and Fillmore all holding the Presidency as Whigs but after Lincoln made it 3 out of 4 Whigs to die in office, re-branding as Republicans seemed like a good idea!

I didn’t think Brown would win yesterday and, with the Health Care sector flying in anticipation of his victory, we went short into the close – figuring that was a better percentage play anyway as the market still seems nearer a top than a bottom and we have Housing Starts at 8:30 and PPI plus a lot of questionable earnings reports but, as I said to Members, if we do get through this and are still holding our highs – it’s going to be impossible to stay bearish.

SCHW missed last night, as did PNFP but we got good reports from ADTN, CREE, CSX, IBM, SUPX and WIT. BAC is our big miss so far this morning and that was my big concern with BK, HCBK, MTB, MS, NTRS, STT, USB and WFC all on deck with them. BK, USB and STT already cleared their bar – nothing too impressive, but surviving despite still very low revenues. Low revenues still concern me – EAT beat low expectations but revenues were down 17.6% from last year and last year was terrible. COH is holding up my rich getting richer theory as business there is up 11% with earnings about the same. In-line with our theory that retail investors have abandoned the markets, SCHW reports 23.2% lower revenues than last year.

SCHW missed last night, as did PNFP but we got good reports from ADTN, CREE, CSX, IBM, SUPX and WIT. BAC is our big miss so far this morning and that was my big concern with BK, HCBK, MTB, MS, NTRS, STT, USB and WFC all on deck with them. BK, USB and STT already cleared their bar – nothing too impressive, but surviving despite still very low revenues. Low revenues still concern me – EAT beat low expectations but revenues were down 17.6% from last year and last year was terrible. COH is holding up my rich getting richer theory as business there is up 11% with earnings about the same. In-line with our theory that retail investors have abandoned the markets, SCHW reports 23.2% lower revenues than last year.

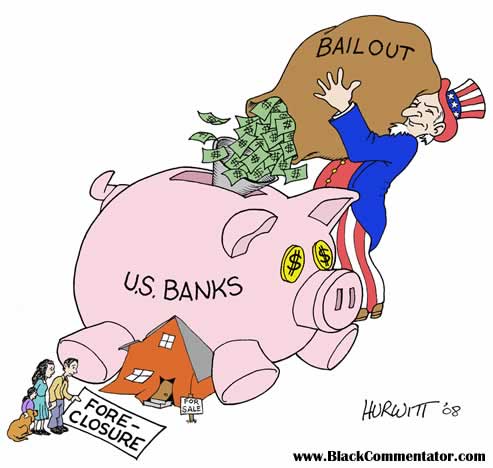

The tone of earnings so far, companies making profits on lower revenues through cost-cutting, does not bode well for the bottom 90% of society and a Global Insight study indicates that unemployment may persist above 10% in parts of this country through 2013. "What is just as alarming as the double-digit unemployment in many of the nation’s major metro areas is the lethargic rate at which it will recede once the job market turns around," the report said. In November, the last month for which city-wide data is available, 17 metropolitan areas had unemployment rates topping 15 percent, according to the Labor Department. According to Global Insight, metropolitan areas account for 86 percent of U.S. employment and 90 percent of its economic output.

Isn’t that fantastic? That means we (the top 10%) won’t have to pay them jack! They don’t need no stinikin’ health care benefits – they are lucky to have jobs. I bet we can even squeeze another 10% more productivity out of the 145M people who are working by increasing unpaid hourse and decreasing paid vacation time and other benefits and then we can lay off another 14M people – they they will come crawling on their knees BEGGING for minimum wage. Muhaha – I love capitalism!

The only thing falling faster than US Consumer Confidence (down 2 more points to -49), is German Investor Confidence, which dropped 2.5% this month to 47.20 and is now down 20% since October. Germans are understandably concerned about the ongoing crisis in Greece while Americans don’t understand where Greece is on a map and many people think it’s just a musical anyway, which is how US investors are able to plow money into the markets with such blind faith – as if nothing that happened in the past two years could ever happen again. Rational German caution running headlong into irrational American exuberance is pushing the Euro down against the dollar and that is going to be bad for the commodity pushers today.

We’ve been short oil since the $80s ($77.50 is critical) and I warned you about gold yesteray ($1,118 is their breakdown), but let’s watch copper and see if they fail the critical $3.40 level, which is a very negative sign for the market. $5.50 is breaking down in nat gas and $18.50 is silver’s silver bullet – all should fail today if the dollar gets rolling back to $1.40 to the Euro. Keep in mind that our working theory is that companies that service the top 10% will do great this earnings season but companies that rely on the masses to consume will have problems as the masses are broke and getting broker and even forced purchases like commodities are unaffordable and people are simply learning to do without (ie. demand destruction).

Speaking of demand destruction – Producer Prices are in and they are up just 0.2% and 0% at the core, indicating that producers are unable to pass along increased costs to the consumers. Housing Starts fell another 4% this month, to 557,000 annualized homes, off the 572,000 projected. Keep in mind that this is down from 2.2M starts in 2004, 2005 and 2006 so 557,000 starts would be considerably less. Keep this chart in mind when some idiot analyst tries to tell you how there are signs of improvement in the housing market…

Speaking of demand destruction – Producer Prices are in and they are up just 0.2% and 0% at the core, indicating that producers are unable to pass along increased costs to the consumers. Housing Starts fell another 4% this month, to 557,000 annualized homes, off the 572,000 projected. Keep in mind that this is down from 2.2M starts in 2004, 2005 and 2006 so 557,000 starts would be considerably less. Keep this chart in mind when some idiot analyst tries to tell you how there are signs of improvement in the housing market…

We were building 2.2M $250,000 homes back then, that’s $550Bn of economic activity and now we are building 557,000 $220,000 homes and that’s $122.5Bn so $427.5Bn (77%) LESS in that industry alone. What the hell are these people talking about on TV when they say things are turning around???

557,000 homes works out to less than 1,000 homes per month, per state. How many people can that possibly employ? How many mortgage brokers or realtors will be able to live off those commissions? How much money can the banks be making lending money on those homes? How many fixtures will your local Home Depot sell based on that number of homes? 5? 10? THAT is what the economy looks like to THE PEOPLE. Yet Sears (SHLD) is trading at 46 times forward earnings (they don’t have any current earnings) and the XHB (homebuilder’s index) is up 100% from where it was in March and only about 1/2 of where it was when we were selling 4 times more homes.

Yes hope springs eternal in the markets but I still think it’s a silly, irrational hope that has no grounding in reality and, even though we are quite content to make money on the silliness (we made 33% betting V up yesterday but got the hell out – because it was silly!), I will still do my best to keep you aware of what is really going on under the hood.

Concerns about the economic engine of China were voiced by Premier Wen Jiabao yesterday and that sent the Hang Seng tumbling 1.8% while the Shanghai fell 2.9%. “In terms of monetary policy, China’s overall trend is heading for tightening this year to keep economic bubbles from bursting, but officials are also trying to sustain and expand the economic growth with budgetary tools,” said Kyohei Morita, chief economist at Barclays Capital in Tokyo. “That’s a difficult and narrow path to walk through.” The Nikkei held up fairly well, falling just 0.25% on the day as the dollar was pumped back over 91 Yen at 10 pm (Japan’s open) but it fell right back down below it as soon as the Nikkei closed and the show was over.

Europe is down about a point ahead of our open as German Producers are also having trouble passing along increasing commodity prices with deflation still rearing it’s ugly head in the EU. On the other hand, the UK has inflated their money supply enough to create record INflation for their people, up an annualized 1% in a month to 2.9% for December and 50% over the BOE’s target. Funny how fast these things can explode up on you!

Europe is down about a point ahead of our open as German Producers are also having trouble passing along increasing commodity prices with deflation still rearing it’s ugly head in the EU. On the other hand, the UK has inflated their money supply enough to create record INflation for their people, up an annualized 1% in a month to 2.9% for December and 50% over the BOE’s target. Funny how fast these things can explode up on you!

BOE Governor, Mervyn King, said trade imbalances that helped push the global economy into its biggest recession since World War II are widening and “urgent” action must be taken to prevent more turmoil. “If countries do not work together to reduce the ‘too high to last’ imbalances, a crisis of one sort or another in financial markets is only too likely. Concrete steps to reduce the scale of global imbalances have, to date, been notable by their absence,” King said. “Smiling family photographs marking the attendance at international gatherings are no substitute for specific actions.”

So happy Wednesday to you! Looks like we’re glad we were short yesterday and we’ll have to see in chat if our levels hold up, giving us yet another chance to flip bullish and have a 2-way day or if we finally have a proper sell-off, maybe with some volume this time..