Suddenly everyone is cutting back.

Suddenly everyone is cutting back.

China plunged to the 2.5% rules (yay for our FXP and EDZ plays!) as Chinese banks have begun restricting new loans, responding to a push by regulators (and PSW) to contain credit after a surge in lending in the first half of this month. Chinese banks advanced 1.45 trillion yuan ($212 billion) of loans in the first 19 days of this month, the 21st Century Business Herald reported today, without citing anyone. That’s equivalent to 19 percent of the CBRC’s full-year target. “This round of quantitative tightening seems to be more serious than we thought after Beijing was shocked by the lending figures in the first two weeks of this year,” Credit Suisse economist Dong Tao wrote in the report. “We would not be surprised if banks imposed a monthly lending quota, as against a quarterly quota in 2008.”

The central bank has also moved to curb credit, ordering banks on Jan. 12 to raise the ratio of deposits they hold in reserve, limiting the amount of cash available for lending. The People’s Bank of China has also instructed lenders including China Citic Bank Corp. to boost their reserve ratios by an additional 0.5 percentage points. “Five major banks we have contacted today all suggested they received instruction from banking regulators last week to slow down new lending, but not stop new lending,” HSBC Holdings Plc economist Hongbin Qu said in a note today.

Gee, who’d have though China wouldn’t continue to lend at a pace of $5.5Tn a year? Oh yeah, it was us… Math is a very useful tool for fundamental traders and, it seems, even Presidents as the rumors are that even Obama now realizes we are running out of money and will be proposing a 3-year freeze on spending. Of course a freeze on spending which ran a $1.4Tn deficit last year isn’t really all that exciting but it’s been so long since ANY government acted even a little bit responsibly that it’s worth noting.

Gee, who’d have though China wouldn’t continue to lend at a pace of $5.5Tn a year? Oh yeah, it was us… Math is a very useful tool for fundamental traders and, it seems, even Presidents as the rumors are that even Obama now realizes we are running out of money and will be proposing a 3-year freeze on spending. Of course a freeze on spending which ran a $1.4Tn deficit last year isn’t really all that exciting but it’s been so long since ANY government acted even a little bit responsibly that it’s worth noting.

“We are going to have to be serious about the deficit in ways that we haven’t been before,” Obama said yesterday in an interview with ABC News. “We need a smarter government, not a bigger government, not a smaller government, we need a smarter government. And we don’t have one right now.”

The S&P Rating Service got serious with Japan last night and threatened to cut their debt rating by a notch, saying the government isn’t fixing the nation’s bloated finances as fast as expected. Lowering the outlook on Japan’s AA rating to negative from stable, S&P said, "The Japanese government’s diminishing economic policy flexibility may lead to a downgrade unless measures can be taken to stem fiscal and deflationary pressures." The BOJ just concluded a 2-day meeting where they decided to leave rates steady at 0.1%. Our own fed is beginning their 2-day meeting today – Very interesting. The Nikkei fell 1.7% to 10,325, gapping below the 5% rule (10,512) after lunch as the dollar fell below 90 Yen.

Europe is trading off about half a point this morning despite the UK putting up a positive (+ 0.1%) GDP number for Q4 but they are recovering from worse as Asia really spooked traders early on (US futures were down as well). I havd already said to Members at 6:20 this morning that I think the panic in the MSM is already overdone as this is nothing more than a very normal market correction – the same one we’ve been expecting since November and, even if we hit the 10% support levels I charted out in yesterday’s post – it’s STILL a normal market pullback after such a huge run from March.

Europe is trading off about half a point this morning despite the UK putting up a positive (+ 0.1%) GDP number for Q4 but they are recovering from worse as Asia really spooked traders early on (US futures were down as well). I havd already said to Members at 6:20 this morning that I think the panic in the MSM is already overdone as this is nothing more than a very normal market correction – the same one we’ve been expecting since November and, even if we hit the 10% support levels I charted out in yesterday’s post – it’s STILL a normal market pullback after such a huge run from March.

Nothing is happening now other than all the stuff I’ve been ranting and raving about for 3 months is finally getting some attention and the retail investors are all surprised and panicking out of their positions. As I said yesterday, we don’t pay retail for stocks – we know how to buy at a discount and we know where the bottom is so we can plan to scale into positions here on some stocks we REALLY like (yesterday was AAPL, XOM, ACOR and LVS) long-term and we’d be willing to buy more of if they should head lower. Last year we had our first Buy List on Jan 30th and we bought while EXPECTING another 20% drop. When the Feb/March sell-off hit, we took that as our cue to scale in, doubling down on a 20% dip. That gave us 2x the stocks at 10% less than where we started AND, in many cases, our covers paid for much of our losses.

If you are not prepared to buy when the market is going down, then you are doomed to never buy low. If you are not prepared to sell when the market is heading higher, then you are doomed to never sell high. Learning good hedging techniques is the key to breaking yourself of bad market habits that let you be influences into making bad decisions by the MSM and their manipulative "guest analysts," who use the media and USE YOU as cannon fodder to help them mover their own positions around.

If you are not prepared to buy when the market is going down, then you are doomed to never buy low. If you are not prepared to sell when the market is heading higher, then you are doomed to never sell high. Learning good hedging techniques is the key to breaking yourself of bad market habits that let you be influences into making bad decisions by the MSM and their manipulative "guest analysts," who use the media and USE YOU as cannon fodder to help them mover their own positions around.

The World did not suddenly fall apart last week, we are only finally dealing with the myriad of problems that have been swept under the rug during 2009 as the market mindlessly ran up 30% off our June/July consolidation without a significant break. Could things really have been that good? Of course not, it was silly. Actually it was reckless and stupid and, ultimately, damaging because, as I said in my 2010 Outlook, it causes a MIS allocation of capital away from new companies and sectors that can thrive and create jobs – instead plowing money into the same idiotic commodity investments that popped just 18 months ago.

But, you know the old saying: "Fool me once, shame on you. Fool me twice and I’m a commodities speculator." Ordinarily I wouldn’t care if a new bunch of suckers gets fleeced buying shiny bits of metal and gooey liquids but the rising commodity prices suck capital away from the entire rest of the planet and that damages the global economy. The World consumes 86M barrels of oil per day so a $10 rise in the price of a barrel of oil takes $313Bn out of global consumers’ pockets annually. Oil is up $40 since last January, that’s $1.2Tn with another $800Bn after the refiners and distributors get their cut and PRESTO – 5% of the global GDP is transferred to oil crooks! Add another $2Tn of increases in other commodities costs (copper is up 200%, platinum up 130%, gold 90%, DBA up 20%) and 10% of the global GDP is sucked out of consumers pockets and drawn away from jobs producing companies to force them to pay double for the same exact thing they were getting last year for half price.

You can’t take $4Tn and flush it down the global toilet and expect to recover from a recession (unless, of course, you are a Wall Street banker or commodity trader who makes bonuses from just that). THAT’s the fight that needs to be had with our World "leaders." China is taking the lead in cracking down on excessive speculation and it’s up to us and Europe to follow their lead. Wrist slapping the banksters and sending them back to business as usual isn’t going to do it, not when TARP-taker JPM is hiring tankers to store oil at sea (in order to fake demand, hinder supply and drive up prices).

You can’t take $4Tn and flush it down the global toilet and expect to recover from a recession (unless, of course, you are a Wall Street banker or commodity trader who makes bonuses from just that). THAT’s the fight that needs to be had with our World "leaders." China is taking the lead in cracking down on excessive speculation and it’s up to us and Europe to follow their lead. Wrist slapping the banksters and sending them back to business as usual isn’t going to do it, not when TARP-taker JPM is hiring tankers to store oil at sea (in order to fake demand, hinder supply and drive up prices).

Could their collusion with the tanker companies go as far as to engender back-door deals that led to JPM’s recent upgrades of NAT and TNK, upgrades that were worth tens of millions to those companies? Well, due to lack of any sort of investigation, we may never know and it’s not just JPM – RDS/A, BP and MS also play the offshore storage game with 168 tankers storing close over 250M barrels of crude at sea – That’s 20 days of US imports!

By purchasing oil (with the TARP money you gave them) that they have no use for, they create a false demand that drives up prices. By renting tankers (with the TARP money you gave them) they create a false impression of demand for oil tankers. By not delivering the oil that was purchased, they create both a false impression that the oil was consumed (it’s fungible global data) as well as shorting the inventory of the destination country. I have been pointing out for weeks that imports have dropped to record lows and with 168 tankers intercepted before they can make deliveries, it’s no wonder the US has been shorted over 15M barrels a week (almost an entire day’s demand per week) in order to drive up the prices so our friendly oil manipulators could book record profits and pay back the TARP money that they used to rip us off in this scam. Isn’t that special?

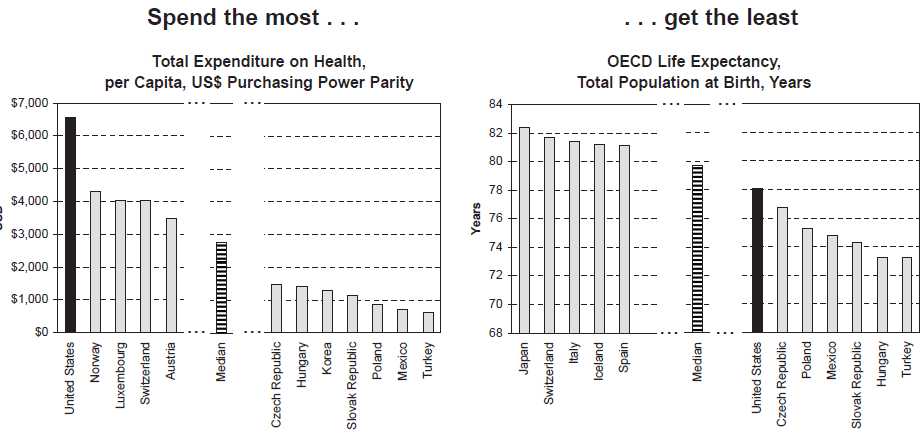

Also very special is Jeremy Grantham’s quarterly letter in which he says far from being just a harmless byproduct, proprietary trading was "of course … indeed the rot at the heart of our financial problems." He covers a wide range of topics including this very telling chart on Health Care, which clearly shows the US is #1 in per capita spending at 60% over #2 Norway (and 139% over the global median) while (and hold on because this is FUNNY) having 2.5% less life expectancy than the global average. Aren’t we just the biggest suckers on Earth?!?

Thank goodness we have so many good people fighting to maintain the status quo. We don’t need those 47M people to get health insurance in order to prosper. Health care costs have risen and average of 15% a year without insuring a single additional person and we can thank the GOP for fighting to insure many more years of profit growth in this $2.5Tn industry – I’m sure with their help, US health care expenditures ($2.5Tn) can catch up to GLOBAL energy spending ($5Tn) in our lifetimes! And that’s a neat trick as our lifetimes are shorter due to the terrible health care so they have to time it just right but we only spend $1Tn on health care when Bush the 2nd took office just 9 short years ago and we’ve increase our spending 150% since than and even LESS people are insured now than were then! So don’t tell me we can’t stick the consumers for another 150% this decade – YES WE CAN!

We’ll see how confident our consumers are at 10am with 5% less jobs than last January and 100% higher fuel costs, increasing food costs and (according to Case-Shiller) 8% lower home prices (24.5 lower in Vegas, down 14.2% in Phoenix, 12.1% in Miami but Dallas is up 1.4%). Redbook Chain Retail Sales showed a 1% year/year increase this week thanks to increased drug and food prices which offset declining demand for other merchandise as consumers were forced to make choices with thier last dollars. The ICSC Retail Store Sales index was down 2.5% looking at the same period.

Like I said, none of this is news to us as I’ve been talking about it since Thanksgiving but let the sheeple be shoked and awed by the data (maybe CRE will hit the fan next) and we’ll just pick up the bargains as they drop. It’s starting to get interesting out there!