The last Beige Book report was on January 13th.

At the time the futures were flying and we were bullish but Dow was looking toppy and I thought we were going too far, too fast and called for caution – despite our "Meatball Market" at the time. Just like yesterday, I was not happy with the fundamentals to the point where I felt it necessary to keep pointing them out while the parade of analysts at CNBC et al told everyone to BUYBUYBUY at the 10,750 top. I don't like to be Chicken Little but sometimes the sky is actually falling! The January book had very little "good" news to report (see my analysis for Members that day) and we took our money and ran on the long side. Although it wasn't until the next Tuesday that we actually went down – it was a doozy and we fell over 500 points in 3 days, all the way to 10,165 (our 5% rule) and we continued weakly through 2/8, when we bottomed out at 9,900.

Whoever said this charting stuff was complicated? Just follow the 5% rule, draw some lines and PRESTO – we know what's going to happen! Well, at least we hope we know what's going to happen because I've spent a good portion of my week so far telling Members NOT to trust the rally we've been having and to expect a downturn with today's Beige book a possible catalyst for a correction. From experience, we know there is not generally an immediate reaction to what is essentially a collection of anecdotal evidence about the state of the economy but it does give us an overview of the nation and I haven't seen much news in the 6 weeks since the last report to make me think this one will be showing any great improvements.

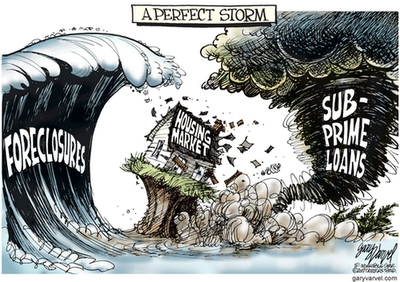

It's a tough call at the moment because there is clearly a determined effort to get the markets to move up but we are loaded up with bullish plays from our visit to 9,900 so it pays to be a bit more bearish with our short-term plays as we test the top of our MAYBE range. We have had some good news this morning with MBA Mortgage Applications up 14.6% as rates fell back under the magic 5% mark and, of course, that's a rebound off of last week's TERRIBLE showing, probably weather related.

It's a tough call at the moment because there is clearly a determined effort to get the markets to move up but we are loaded up with bullish plays from our visit to 9,900 so it pays to be a bit more bearish with our short-term plays as we test the top of our MAYBE range. We have had some good news this morning with MBA Mortgage Applications up 14.6% as rates fell back under the magic 5% mark and, of course, that's a rebound off of last week's TERRIBLE showing, probably weather related.

69% of the activity was refinancing, which is nice but it doesn't move homes or employ any construction workers (nor does it require any commodities other than trees for documents). "We are seeing positive signs of some form of life, but it is not significant and the recuperation period is going to be significant because these are dramatic declines" in housing and employment, said Vickie Lester, president of mortgage servicing at RoundPoint Financial Group.

Other good news we got was the February Challenger Job-Cut Report with "just" 42,090 planned lay-offs and that's a 41% improvement from January's 71,482 and the lowest since July, 2006. The ADP Jobs Report also came in better than expected with just 20,000 jobs lost in February vs, 60,000 in January but it should be noted that, in February, ADP told us that just 22,000 jobs were lost and this is a 172% upward revision from last month but don't expect the MSM to tell you this because it doesn't fit into a cute headline like "ADP job losses down 63% from January." See how they manipulate statistics? They make January look good by misreporting it by 172% and then they make February look good (possibly the same under-reporting) by comparing it to the upwardly adjusted January numbers – BRILLIANT!

So we shall see what the day shall bring. We are above our bounce levels and holding them will be technically bullish and we COULD rally back to the top of our range where I would absolutely cash out again and go CRAZY SHORT but, at the moment, I'm betting we are in for a month of consolidation into next earnings season. We didn't go crazy short yet but we did take advantage of yesterday morning's rally to take on some disaster hedges ahead of the BBook and this week's REAL jobs data – Friday's Non-Farm Payroll Report (8:30). Today we also have ISM Services at 10 and expectations there are for 51.3, up 1.5% from last month's 50.5.

So we shall see what the day shall bring. We are above our bounce levels and holding them will be technically bullish and we COULD rally back to the top of our range where I would absolutely cash out again and go CRAZY SHORT but, at the moment, I'm betting we are in for a month of consolidation into next earnings season. We didn't go crazy short yet but we did take advantage of yesterday morning's rally to take on some disaster hedges ahead of the BBook and this week's REAL jobs data – Friday's Non-Farm Payroll Report (8:30). Today we also have ISM Services at 10 and expectations there are for 51.3, up 1.5% from last month's 50.5.

Asia had a generally good morning with the Hang Seng taking a rest at 20,876 but the Shanghai added .75% to 3,097 and the Nikkei creeped up to 10,253 and the Bombay continues to tear up the joint with another 1.4% gain to 17,000 on the button. Asia is rallying on expectations that Greece will be dealing with their debt issues but the rally is still led by commodity pushers, which is still my least-favorite kind of rally and it's kind of funny that we are rallying on Greece dealing with it's debt while ignoring the fact that China is hiding mountains of local-government debt that threatens to push debt to 96% of GDP next year according to Northwestern's Victor Shih.

Surging borrowing by local-government entities, uncounted in official estimates of China’s debt-to-GDP ratio, is the key reason for Shih’s concern. Harvard University Professor Kenneth Rogoff said Feb. 23 that a debt-fueled bubble in China may trigger a regional recession within a decade, while hedge-fund manager James Chanos has predicted a Chinese slump after excessive property investment.

Surging borrowing by local-government entities, uncounted in official estimates of China’s debt-to-GDP ratio, is the key reason for Shih’s concern. Harvard University Professor Kenneth Rogoff said Feb. 23 that a debt-fueled bubble in China may trigger a regional recession within a decade, while hedge-fund manager James Chanos has predicted a Chinese slump after excessive property investment.

By Shih’s count, China’s debt may reach 39.838 trillion yuan ($5.8 trillion) next year. His forecast for debt-to-GDP compares with an International Monetary Fund estimate for China of 22 percent this year, which excludes local-government liabilities. The IMF sees Spain at 69.6 percent, the U.S. at 94 percent, Greece at 115 percent and Japan at 227 percent.

Now, amid the risks of asset bubbles, soured loans and resurgent inflation, officials are reining in credit growth. One focus of concern is lending to the investment companies set up by local governments to circumvent regulations that prevent them borrowing directly. Shih estimates that, already, borrowing by such entities may result in bad loans of up to 3 trillion yuan ($439 billion). China’s mounting debt may hamper policy makers’ ability to maintain “many more years of high growth through stimulus, and slash growth to between 5 and 7 percent annually over the next decade,” said Michael Pettis, former head of emerging markets at Bear Stearns Cos. That’s “still healthy but much lower than the more than 10 percent growth rates of the past decade,” Pettis said.

Over in Europe, they are excited about the Greece plan to save $6.6Bn by cutting civil service salaries and entitlements along with a 2% increase in the Greek sales tax. This will, of course lead to more strikes so don't expect this to be the last word but at least the government is trying, or pretending to try which, as we know from watching our own government, is about as good as it gets. "This is what the cabinet has decided. They are painful but necessary measures that will appease our European Union partners and hopefully the markets," an EU official said. "The prime minister described it as a state of war," the official added.

Now that Greece is "all better" we can turn our attention to the Ukraine, whose parliament collapsed yesterday as their own budget disaster boils over. Let's not worry about that today though (the China thing is a million times more scary anyway) as we continue to enjoy the "Somebody Else's Problem" effect and our futures are up, led by rising commodities as the Pound and Euro recover and send the dollar below 80 for the first day in 10 with copper leaping back to $3.44, gold at $1,140, silver at $17.22, oil at $80.22 and natural gas at $4.71.

We have the oil inventory report at 10:30 this morning and, due to the storms, we should see a draw in distillates of at least 1M barrels while an offsetting 1Mb build in crude is expected along with flat gasoline numbers. So anything more than a net 1Mb build will not support $80 oil and that's how we'll be playing (we took the short money and ran on yesterday's short oil play) but I'll be looking to short gold out of the gate with GLL, hopefully picking up the Apr $9 calls for about .65.

Be careful out there!