Well, well, well, karma works in mysterious ways. – Ilene

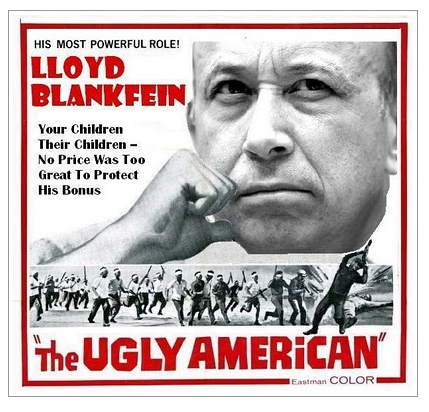

The Ugly Americans: Wall Street Excluded from European Government Bond Sales

Courtesy of JESSE’S CAFÉ AMÉRICAIN

Courtesy of JESSE’S CAFÉ AMÉRICAIN

It will be interesting if Asia and South America pick up this theme of banning the Wall Street banks on ethical considerations.

The cheating going on in the financial markets is really getting to be outrageous.

Guardian UK

Europe bars Wall Street banks from government bond sales

By Elena Moya

Monday 8 March 2010 21.36 GMT

European countries are blocking Wall Street banks from lucrative deals to sell government debt worth hundreds of billions of euros in retaliation for their role in the credit crunch.

For the first time in five years, no big US investment bank appears among the top nine sovereign bond bookrunners in Europe, according to Dealogic data compiled for the Guardian. Only Morgan Stanley ranks at number 10.

Goldman Sachs doesn’t make the table. Goldman made it to number five last year and in 2006, and number eight in 2007, the data shows. JP Morgan was in the top ten last year and in 2007 and 2006 but doesn’t appear this year.

"Governments do not have the confidence that the excessive risk-taking culture of the big Wall Street banks has changed and they still cannot be trusted to put the stability of the financial system before profit," said Arlene McCarthy, vice chair of the European parliament’s economic and monetary affairs committee. "It is no surprise therefore that governments are reluctant to do business with banks that have failed to learn the lesson of the crisis. The banks need to acknowledge the mistakes that were made and behave in an ethical way to regain the trust and confidence of governments."

European sovereign bond league tables are now dominated by European banks such as Barclays Capital, Deutsche Bank, and Société Générale, the Dealogic table shows. Their business model is usually seen as more relationship-based, while US investment banks have traditionally been focused on immediate deal-making. (A euphemism for customer face-ripping – Jesse)

Being left out of government bond sales means missing out on one of the top fee-earning opportunities this year, given the relative drought in mergers and acquisitions and stock market flotations. Western European governments need to raise an estimated half a trillion dollars this year to refinance debts and pay for bank bailouts and rising unemployment….

Investment banks insist their business areas are separated by confidentiality walls, but countries have been furious about some of their trades appearing to conflict – either on their own books, or on behalf of clients.

Goldman Sachs said its overall position in the European sovereign bond market had improved this quarter once US dollar denominated deals were included. It said its own data showed it ranked fourth in European sovereign bond sales this year…

"The power of big investment banks was a factor in the banking crisis, and it’s up to regulators and customers to stand up to them, and not picking them is one of the ways," Augar said…

The EU is also trying to curb US financial power by creating its own monetary fund – a replica of the Washington-based IMF. The need of a European fund has emerged during the Greek crisis, as European politicians have insisted financial troubles should be resolved at home.