The dollar is diving and the futures are flying this morning!

The dollar is diving and the futures are flying this morning!

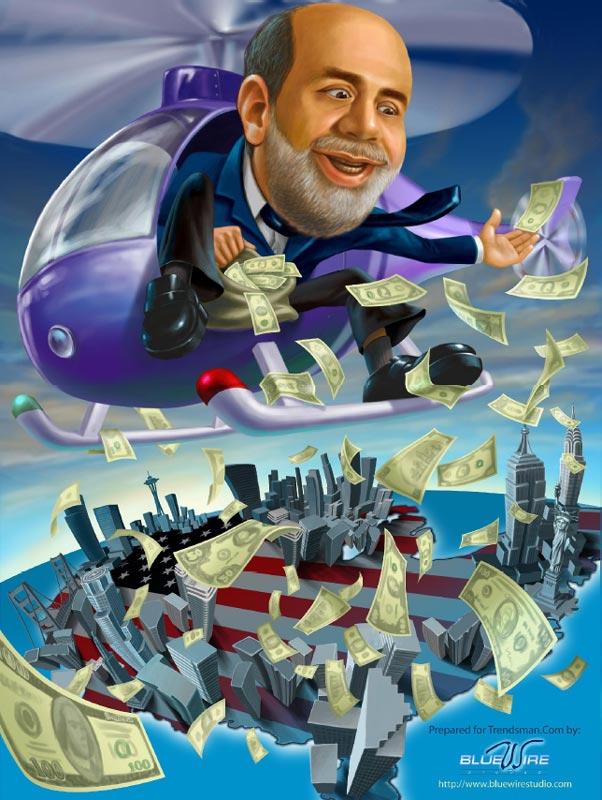

Word is that the Fed will remain doveish in their 2:15 statement today with no sign of tightening in the near future. That has (as of 7:30) rallied gold 1.5% to $1,115 and oil is back over $80 and copper is $3.35 again while the Euro jumps back to $1.375 and even the British Pound squeezes the hell out of the shorts as it flies from $1.497 at 3:30 to $1.514 (1%) in 4 hours, which is a pretty big move for FOREX!

The EU also helped themselves by laying out a groundwork for a financial lifeline to debt-stricken Greece, breaking a taboo against aid to cash-strapped governments in order to avert a crisis for the euro. Officials from the 16 countries using the currency worked out a strategy for emergency loans in case Greece’s plan for 4.8 billion euros ($6.6 billion) in tax increases and wage cuts fails to stave off fiscal disaster. “We clarified the technical arrangements that would enable us to take coordinated action which could be swiftly put into place in the event it is necessary,” Luxembourg Prime Minister Jean-Claude Juncker told reporters late yesterday after leading a meeting of Euro-area finance officials in Brussels.

The EU is also meeting to discuss ways to reign in hedge funds and credit-default swaps but the revised bill from Chris Dodd is now so watered down by compromise that it no longer requires regulators to agree that excluding a swap from being cleared “is necessary and appropriate for the reduction of systemic risk.” So what’s the point? The problem is that there are $605 TRILLION Dollars of CDS’s written against a Global GDP of $50Tn. Usually, it’s a red flag for the police when a person insures their home for 12 times what it’s worth, right?

Hexagon Securities LLC and at least 19 other financial firms are pressing regulators to force swaps clearinghouses to lower entry barriers in order to improve competition in a $605 trillion derivatives market dominated by the world’s biggest banks. They also seek tougher conflict-of-interest laws to ensure that a bank’s derivatives desk doesn’t influence clearinghouse decisions that could shut out new competitors. ROFL – move to Russia, you Commies! This is America, where big banks rule and "firms with less than $5Bn net worth" drool! See, my daughters taught me that one – wins every argument!

Speaking of people who rule our lives – Saudi Oil Minister, Ali Al-Naimi said at the OPEC meeting yesterday. “The price (of oil) has stayed very well in the range of $70 to $80. It is in a very happy situation… There are no shortages, investment is going on, demand looking forward is going to continue to rise, so everyone is happy,” Al-Naimi told reporters as he arrived at his hotel in Vienna yesterday evening. He said he’s pleased with OPEC’s quota compliance and foresees no need to change production. OPEC officially supplies 40% of the world’s oil but Bloomberg estimates that quota cheats are producing "the equivalent of a supertanker of crude a day."

Speaking of people who rule our lives – Saudi Oil Minister, Ali Al-Naimi said at the OPEC meeting yesterday. “The price (of oil) has stayed very well in the range of $70 to $80. It is in a very happy situation… There are no shortages, investment is going on, demand looking forward is going to continue to rise, so everyone is happy,” Al-Naimi told reporters as he arrived at his hotel in Vienna yesterday evening. He said he’s pleased with OPEC’s quota compliance and foresees no need to change production. OPEC officially supplies 40% of the world’s oil but Bloomberg estimates that quota cheats are producing "the equivalent of a supertanker of crude a day."

Buoyed by high prices, the group’s members are paying less attention to quotas and achieving only about 53 percent of their promised 4.2 million-barrel-a-day output cutback, according to a March 10 report from the OPEC secretariat. The monthly report also estimated that OPEC’s current production is 1.5 million barrels a day more than the demand for its crude in the second quarter, after analyzing non-member production and global consumption. Shokri Ghanem, chairman of Libya’s state-run National Oil Co., told reporters yesterday in the Austrian capital “there’s no need for any change” to quotas. The market is “oversupplied” and Libya will press for greater compliance with official supply limits, he said.

Keep in mind that none of this stuff is bad for us top 10% investors. I’ve been guilty the past week of letting my bleeding-heart liberalism blind me to the glorious profits that can and will be made as the great Capitalist machine of the "free" markets grinds the last few Trillion dollars out of our great, unwashed proletariat masses but, hey – a Trillion is a Trillion and if we don’t grab it, someone else will so instead of worrying about the way these events are undermining the American way of life and crushing our middle class under a burden of debt their grandchildren can never hope to repay – LET’S GET OUR SHARE!

So, my Capitalist comrades, I am happy to report that both Housing Starts (-5.9%) and Building Permits (-1.6%) are still dropping while the rising dollar in February dropped import prices by a glorious 0.3% which should force the Federal Reserve to keep the money spigot open full throttle as they can point to how cheap everything must be for the American consumer, which means inflation is "well contained" and there is no reason not to keep giving their banking pals free money (at the expense of the American consumer) so they can buy another $100 Trillion in Credit Default Swaps while raising lending requirements to the point where you have to be in the top 10% to even qualify for a loan – not that we’re building anything in the US anyway…

Woops, this just in (9 am): Palestinians and Israeli forces are clashing over construction projects in East Jerusalem. This happens pretty much once a week and neither the Palestinians nor the Israelis have a single drop of oil but oil just jumped $1.50, back to $81 and gold zipped up to $1,125 despite OPEC saying there is a surplus of oil and despite all the fantastic economic news that is driving investors to fearlessly put money back into the stock markets and despite the underlying assumption that LOW INFLATION will keep the Fed in a loose monetary policy that will aid the markets. If all this seems contradictory to you, you may be too sane to invest in the markets. My suggestion is to drink heavily and come back when you see small animals taking to you.

Meanwhile, we’ll be celebrating the marching boot of Capitalism as it stomps out competition as our boys at Goldman Sachs (GS) and JPMorgan (JPM) are using their dominance in the OTC derivatives market to force hedge funds to put up more cash collateral while Goldman and JPM put up less of their own. This is generating billions of dollars in cheap funding for the two firms. Neither firm looks particularly cheap but we were picking up C on sale yesterday and we’ll be upping our investments in XLF once we confirm the Fed’s benign status this afternoon. We already have XOM and we picked up some UNG while it’s been down as we’re sure there will be a rainshower in the Gulf this fall that doubles prices in the very least.

Meanwhile, we’ll be celebrating the marching boot of Capitalism as it stomps out competition as our boys at Goldman Sachs (GS) and JPMorgan (JPM) are using their dominance in the OTC derivatives market to force hedge funds to put up more cash collateral while Goldman and JPM put up less of their own. This is generating billions of dollars in cheap funding for the two firms. Neither firm looks particularly cheap but we were picking up C on sale yesterday and we’ll be upping our investments in XLF once we confirm the Fed’s benign status this afternoon. We already have XOM and we picked up some UNG while it’s been down as we’re sure there will be a rainshower in the Gulf this fall that doubles prices in the very least.

Asia was mixed this morning ahead of the Fed report but Europe is jumping as word spreads that the Fed will continue to be on hold through most of 2010 – AT LEAST. SNE just gave Michael Jackson $250M to make 10 albums over the next 7 years AND HE’S DEAD so there’s no excuse for you, with your fancy pulse, not to get out there and grab some of the cash that’s flying around!

Today is a glorious day to celebrate the complete lack of any improvement whatsover in our economy. Retail sales are up 3.2% but there’s a lot of seasonality involved in that number with Easter much earlier this year but that won’t stop the MSM from treating it like the Consumer is going hog wild and buying everything in sight so who am I to argue? Let’s just get out there and take advantage of the madness, following through on our plan to short into the open ahead of the Fed – just in case EVERYONE is wrong!