17-Month Highs!

17-Month Highs!

Those are the kind of numbers we’re putting up in Europe and Asia and the US is not too far behind, climbing the steep wall that was September of 2008 to race back to those all-time high valuations for pretty much any stock – Banks, Builders, Oil Companies, Miners, Manufacturers, Importers, Exporters, Agriculture, Technology, Consumer Staples, Consumer Cyclicals, Health Care, Biotech… Everything is as great as it has ever been in the markets and our all-time highs are just over the ledge and there seems to be an endless number of people willing to pay more and more money every day for these stocks.

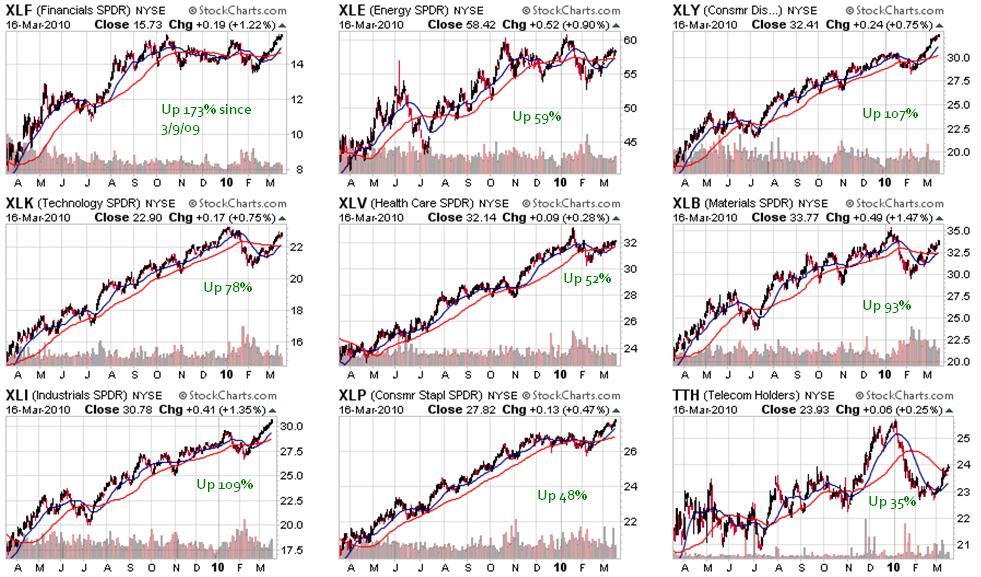

What? I’m not going to say anything. It’s amazing, it’s incredible, it’s fantastic. There’s not a single sector that isn’t on fire. The only major sectors that is are not up at least 48% in the last 12 months are Telco (35%) and Utilities (XLU not shown at up 39%) and three are now up over 100%:

I’m not worried because this kind of stuff happens all the time, doesn’t it? In fact, I see a group of charts like this and I hear the people in what used to be called "the idiot box" but is now called a "home entertainment center" and I’m not going to get on the wrong side of EVERYBODY by badmouthing TV because it looks like I was already wrong about 3D TV as Panasonic says they are SOLD OUT of their $2,990 50-inch plasma TVs and ISuppli is already projecting $20Bn in 3D TV sales in 2011.

So the TV-buying public is clearly not worried because the people on TV tell them how great everyhing is and the markets go up and up and up because, I guess, it turns out we were RIGHT in 2008, when we all got stimulus checks and the market climbed back towards its all-time highs and it’s all those sellers that were wrong with their silly worrying about Bear Stearns, Lehman, Iceland, AIG, the GSE’s, the sub-prime meltdowns, the credit crisis, Trillions of dollars in debt, high commodity prices, hundreds of banks being seized for lack of funds, the almost total loss of the US auto industry and the millions and millions and millions of people who lost their jobs – WHAT FOOLS!

So the TV-buying public is clearly not worried because the people on TV tell them how great everyhing is and the markets go up and up and up because, I guess, it turns out we were RIGHT in 2008, when we all got stimulus checks and the market climbed back towards its all-time highs and it’s all those sellers that were wrong with their silly worrying about Bear Stearns, Lehman, Iceland, AIG, the GSE’s, the sub-prime meltdowns, the credit crisis, Trillions of dollars in debt, high commodity prices, hundreds of banks being seized for lack of funds, the almost total loss of the US auto industry and the millions and millions and millions of people who lost their jobs – WHAT FOOLS!

So here we are, back at levels we hit before the Bush stimulus program rallied us to the all-time highs. Maybe Obama can send us all $3,000 for a new 3D TV and then everyone can be happy as we boost the Tech sector and settle down in our living rooms for another 5 years of Mad Money – yeah, that’s the plan… In fact, I am now so convinced by the market motion that the fundamentals must be good that I am willing to go out on a limb and say that this rally has as sound a footing as we had back in 2008, maybe even better as we have TRILLIONS in stimulus – back then we only had Billions.

Now 2007 was a pretty good year, if you got the hell out in October! Otherwise, not so much and 2008 was good from the announcement of the stimulus checks (Feb 13th) until about May, when the wheels really started coming off the wagon! In October of 2007 we were at S&P 1,560 and we fell to 1,275 (down 18%) by March but then back to 1,458 by May (up 14%) at a cost of ‘just" $152Bn. So it costs about $10Bn to move the S&P up 1% – good to know.

Now 2007 was a pretty good year, if you got the hell out in October! Otherwise, not so much and 2008 was good from the announcement of the stimulus checks (Feb 13th) until about May, when the wheels really started coming off the wagon! In October of 2007 we were at S&P 1,560 and we fell to 1,275 (down 18%) by March but then back to 1,458 by May (up 14%) at a cost of ‘just" $152Bn. So it costs about $10Bn to move the S&P up 1% – good to know.

Another thing that moved up on stimulus spending was oil, which jumped from $90 in February to $140 by the end of June. America was consuming 20Mb of oil per day at the time and that extra $50 a barrel just so happens to work out to an even Billion Dollars a day. Hmm, there were 150 days between Feb and June and we got a $150Bn stimulus and oil went up to $1Bn a day – gosh, I wonder where that bailout money went?

So if $150Bn can give us 15% on the S&P then it stands to reason that $700Bn can give us 70% and 170% of the 666 low is 1,132 so we are right on track and everything makes sense. Of course, $700Bn is just the stimulus they talk about, we got the good news from the Fed yesterday that they will keep lending money at "0-0.25%" for "an extended period of time," which is perfect because that’s about how long we’ll need it.

Of course, the Government can’t borrow money at 0.25%, we sell 10-year notes for about 3.5% so the 3.25% LESS we charge banks on Trillions of dollars in loans is another sneaky way we send hundreds of Billions in cash to the banks. That money is taken out of the consumers pockets in the form of National Debt that we’ll pay for the rest of our lives. The banks, ever so thankful for our assistance, turn around and charge us 5% for a mortgage and they MAKE hundreds of Billions of Dollars lending us the money they borrowed from us at 0.25%. Sure you may think: "Why not cut out the middleman and lend ourselves money to buy homes at 0.25%" – Well that’s just crazy talk that will get you thrown out of office silly!

Of course, the Government can’t borrow money at 0.25%, we sell 10-year notes for about 3.5% so the 3.25% LESS we charge banks on Trillions of dollars in loans is another sneaky way we send hundreds of Billions in cash to the banks. That money is taken out of the consumers pockets in the form of National Debt that we’ll pay for the rest of our lives. The banks, ever so thankful for our assistance, turn around and charge us 5% for a mortgage and they MAKE hundreds of Billions of Dollars lending us the money they borrowed from us at 0.25%. Sure you may think: "Why not cut out the middleman and lend ourselves money to buy homes at 0.25%" – Well that’s just crazy talk that will get you thrown out of office silly!

Japan knows who to suck up to and they have DOUBLED their existing 10 Trillion Yen stimulus program ($111Bn) to 20 Trillion Yen but, very much like US banks, the Japanese banks take the money and play commodities or just store it in treasuries, making a very safe spread on their money without all that risky "lending it to consumer" stuff.

The BOJ’s efforts may have little impact because banks aren’t boosting credit growth, Joseph Stiglitz, the Columbia University professor and Nobel laureate, said in an interview in Tokyo today. The bank is suffering from a “liquidity trap” where fund injections may have little effect, he indicated. Central banks in Japan and elsewhere should consider ways to “make banks go back to being banks” and restart the provision of credit, Stiglitz said. Japan’s recovery has also been “impeded” by gains in the yen, and it “makes sense” for authorities to try to reduce its value, he said.

Japan’s consumer prices slid for the 11th consecutive month in January and the gross domestic product deflator, a broad measure of prices, tumbled a record 2.8 percent in the fourth quarter. Falling prices undermine corporate earnings and make debts harder to pay off: bank lending has contracted for three straight months amid diminished demand for credit. US producer prices are right behind them, falling a whopping 0.6% in February, led by falling fuel costs (oil hit $69.50 in early Feb). “Disinflation is going to be with us for a while,” Julia Coronado, a senior U.S. economist at BNP Paribas in New York, said in a Bloomberg Radio interview. “That’s going to allow the Fed to stay on hold for a lot longer than the market is expecting.”

Of course, all this news sent the Asian markets up about 2% this morning and Europe is up half a point ahead of the US open so we can only conclude that things must be great becasue the markets are going up. I’m starting to lean towards what I wish I did in July of 2007 – cashing out and taking a vacation! In the very least we are going to keep lots of cash on the side but we will be able to make more bullish bets next week as we now have a nice set of levels to signal a breakdown.