THE ENRON BANKING SYSTEM

Courtesy of The Pragmatic Capitalist

Courtesy of The Pragmatic Capitalist

“Panics do not destroy capital – they merely reveal the extent to which it has previously been destroyed by its betrayal in hopelessly unproductive works”

– John Mills, “Credit Cycles and the Origins of Commercial Panics”, 1867

What happens when you take a boring little utility company, leverage it up, expand its business far beyond its original operations, give it a prop trading desk, take it public and put a few corrupt greedy men in charge? You get Enron.

What happens when you take a boring little bank, leverage it up, expand its business far beyond its original operations, give it a prop trading desk, take it public and put a few corrupt greedy men in charge? You get the U.S. banking system.

The U.S. banking system remains a vital component of the U.S. economy, but as we’ve seen over the preceding 18 months the risks these firms take not only put their own firms at risk, but put the entire well-being of the country at risk as well. As the banks have recovered Main Street continues to ask about their bailout. With 9.7% unemployment and U6 unemployment at 16.9% the U.S. consumer remains embattled and beleaguered. Even worse, nothing has been done to ensure that the banks won’t do this again. This is the ultimate slap in the face for anyone who has lived through the last 18 months. Even worse, the regulatory plan we appear on the path of passing is nothing more than a return to the status quo. Unfortunately, the status quo was the problem.

Of course, the banks weren’t the only culprits in this crisis (we’ve thoroughly covered the failings of the Federal Reserve and the financially incompetent US consumer already), but they played a pivotal role. This is not to imply that banks are inherently evil or do not provide a great deal of good for the economy, but the current regulatory structures and business model is clearly flawed. Banks are unique in the economy in that they serve as custodians of the majority of the assets the public owns and provide an absolutely vital role in providing liquidity. If these firms are able to fail due to their own incompetence, lack of proper regulation and excessive risks it creates a systemic threat to the economy.

I have no issue with banks attempting to make a profit in traditional banking businesses (3-6-3 comes to mind), but when we allow these firms to turn into effective casinos you put the entire system at risk. When we allow these corporations to risk their own capital in potentially disastrous transactions we risk the very stability of the entire economy. Letting these banks operate as if they are all Enron is exactly what helped get us into this financial fiasco and it will certainly happen again if we don’t fix the Enron banking system.

I don’t necessarily believe the problem here is one of too big to fail, but rather ensuring that all banks never take the risks that put them and their deposits at risk. A large Enron is no more unstable or dangerous than several hundred small Enrons running in the same grid. It’s allowing these firms to operate as if they are Enron that poses a systemic problem. We must make banks be banks. Of course, much of this would involve reversing the de-regulation that has occurred over the last 25 years and it appears unlikely that Congress has the gumption to do so.

I firmly believe that the near destruction of the U.S. banking system in 2008 was the free market imposing its will on this sector of the economy that has grown too large in comparison to its true productive output. Many of these firms do little more than shuffle money from one pocket to the next while shaving off fees inbetween. In the meantime we continue to funnel our best and brightest minds into these institutions which produce little, but take much. The recent panic did not only destroy capital. It also showed the banks for what they truly are – hopelessly unproductive works.

So what should we do? We should draw a distinct line in the sand between banks and diverse risk taking firms. There are always going to be Enron’s in the economy, but why should we allow our entire banking sector to mirror Enron? Taking a 30,000 foot risk management view I say something must be done to ensure these banks can never do this again. Turn banks into true banks. Hedging and exotic business models are fine. Just don’t commingle them under the same umbrella as a deposit taking “bank”. With that, a few ideas come to mind:

- Our banking system should be aligned with the goals of the nation to help “grease” the wheels of the economic growth engine of the United States. Banks should be more like utilities and less like hedge funds. Otherwise, banking becomes counter-productive and potentially destructive.

- Banks should not be allowed to exact onerous fees on the public or enact a business model which is inherently dependent on driving their customers deeper and deeper into debt. This undermines the entire goal of productive economic growth.

- “Banks” should be true lending institutions. Non-traditional banking operations and products such as CDS, “off balance sheet” finance, derivatives as collateral and such would be deemed illegal unless performed only by non banking/lending institutions (such as hedge funds) so as to insulate the public and true lending institutions from the risk taking, “hedging”, and “financial innovation” of firms such as Lehman Brothers.

If none of this is done we’re destined to repeat the mistakes of the past and we all know how Enron ended up. Unfortunately, this is looking more and more like a crisis wasted….And the next time we have a banking crisis the public will have zero pity or tolerance for the banking system. It’s necessary that we work with the banks to be proactive and best serve the future productivity and well-being of the U.S. economy before there is a “next time”.

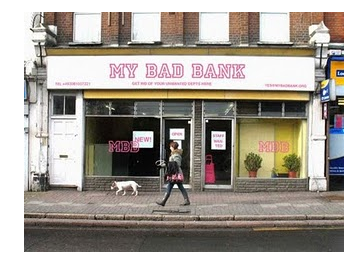

Picture courtesy of Jr. Deputy Accountant