What a fantastic week!

Just when I thought I was starting to lose my mind, after two "Fuhgeddaboudit" Fridays in a row we finally found a problem(s) that investors could not simply ignore. Only a week ago, we had to have a philosophical debate as to whether we should take profits on our 566% plays off the table at "just" 300% – THAT's how insanely bullish people were 7 days ago. Fortunately, we made the correct call (and how is taking profits off the table at 300% ever a wrong call?) and this week, no one argued at all when we killed a similar play on Thursday with "just" 200% profits as we anticipated a lower high and no third Fuhgeddaboudit Friday in a row.

We had 72 trade ideas for members last week and our 16 losing trades were, of course, mainly our downside hedges. We cashed out our bull side winners Tuesday morning and that left us very bearish and look how well channel trading has played out for us as now our "losers" are, for the most part, losers no more:

- GS 2012 $70 puts at $2 (fell to $1.91), now $4 – up 100%

- AAPL May $260s sold at $3.60 (rose to $14.20 and were split to 2 June $270 puts), now $13.80 – down 283% (part of a pair trade)

- GSK 2012 $40/45 bull call spread at $1.60 (fell to $1.30), now $1.75 – up 10%

- OIH $131 calls sold for $3.45 (rose to $3.80), now $1.65 – up 52%

- LEG May $22.50 puts at .50, out at .20 (now .10) – down 60%

- NFLX May $95 calls sold at $2.60 (rose to $7), now $6.40 – down 146% (part of a backspread)

- NFLX June $115 calls at $1.45 (fell to $1.25), now $2.10 – up 44% (new cover for backspread)

- SBUX $24 puts for .38 (out at .10), now .15 – down 60%

- TZA June $6 puts sold for .70 (rose to .94), now .47 – up 32%

- VNO May $80 calls sold at $2.30 (rose to $3.90), now $4.60 – down 100%

- IYR May $52 puts at $1.30 (fell to .79), now $1.20 – down 8%

- TNA May $69 calls sold for $3.10 (rose to $5.10), now $2.05 – up 34%

- QID May $16 calls at .32 (fell to .27), now .53 – up 65%

- QID May $15 puts sold for .32 (rose to .37), now .16 – up 50% (pair trade)

- GOOG Sept $750 calls for $1.10, now $85 – down 22%

- GOOG May $590 call sold for $1.85, now .75 – up 60% (pair trade, 5:1)

I often say to new Members, especially those with smaller virtual portfolios (who need to make sure they read "Smart Virtual Portfolio Management I – the $10,000 Virtual Portfolio"), is that one of the best ways to enter a trade at PSW is to wait for us to miss one and, if we're sticking with a loser or, even better, rolling or doubling down on a losing position, THEN take the entry because you are getting in a lot cheaper than we did! ALL of last week's losers improved this week… In Member Chat, we spend tons of time discussing adjustments to trades that we've already made. For those of us hedging, turning 8 of our losers into winners is just gravy on gravy – of course when you are hedging you are going to have some losers. If not, you are probably doing something wrong!

We thought the rally was wrong, too and I titled the Weekly Wrap-Up "Why Does This Rally Give Me the Creeps" and I immediately began getting hate mail from bulls for daring to question the rally. It seems it doesn't matter so much if I question the rally in the body of my posts BUT, put it in a headline and we've suddenly hit the attention span of the average investor, who sometimes make it all the way to the end of the headline before making their decisions (see, I can say that here with impunity because they have already clicked away by the 5th paragraph). I won't get into my list of "creepy" indicators again but I think the biggest new one that bothered me is the breakdown of unemployment that showed that, while only 3% of the people making over $150,000 a year (pretty much all of the analysts) are unemployed, 31% of the poor people in this country (who nobody listens to) are unemployed.

I read that and I read "The Economic Elite vs. the People of the United States of America," (Parts 1-3 and Parts 4-6) and I know it makes me a bad capitalist but I care about these things and, even worse, I do believe it does damage the overall system to decommission the middle class. I've been saying to members for some time that the capitalists are in the latter stages of slashing and burning the Americas and are ready to leave this train-wreck of an economy and move onto exploiting what used to be the Third World but is now our customer support center. Steve Wynn looks like the first of our top .0001% to move on as he announced plans to shift his operations to Macau, where the 68 year-old Billionaire should have a much easier time buying replacement parts…

So, it was with a fairly skeptical outlook that we went into the weekend but over the weekend I decided we were being greedy and should get the hell out before it all hit the fan. Even in the weekly wrap-up I found it necessary to give the masses a FREE disaster play, using TZA as our hedge of the moment to replace the 566% plays we were cashing in with a 1,900% play: Buying the Oct $6/10 bull call spread for .50 and selling the Oct $4 puts for .30 for a net .20 entry – protection cheap enough ($20 per contract) for any virtual portfolio. That spread is already .43, up 115% in a week so pretty good protection, wasn't it?

Mega Earnings Monday – 1,000 Reports This Week!

Mega Earnings Monday – 1,000 Reports This Week!

"What a crazy week this is going to be!" – How's that for a Monday morning prediction? I had mentioned to Members over the weekend that I had more candidates for a Sell List than I did for a new Buy List and in Monday's post I said: "I’ve been researching our new Buy List but I’m not pleased with what I’ve been seeing so far and this week’s tidal wave of earnings, with 1,000 companies reporting means we’re in no hurry to dip our toes in the water."

Our new worry for the week was the unwinding of the carry trade, something I've been worried about since the Fall but now Bloomberg readers are worried about it, so it suddenly matters. We talked about oil and Goldman, which I know everyone is sick of discussing but, as I said with GS still at $157 on Monday morning: "I know – Blah, blah, blah, Goldman is evil, blah, blah. As I said in the wrap-up, I’m sick of it myself but I see a lot of Members trying to bottom-fish GS and I’m still more in favor of shorting them at least down to $140 and, of course, last week we highlighted some plays that will do very well if we break below that mark." Once again it cracks me up when people say "why don't you ever make stock picks?" If I'm buying 2012 $70 puts on Goldman and paying a $2 premium, you can be damn sure I'm short on the stock, right? You can go right ahead and short GS at $157 and you would have made a not too shabby 8.2% on this week's pick but we limited our risk by buying the puts for $2, had no margin issues and made 100% in the same week.

If you were going to short 10 shares of GS you would get hit for $750 in margin and you would have made $80 while 5 2012 $70 puts at $2 tied up just $100 and made $100 and there was no possible way to lose more than $100 no matter what GS did (and it went up before it went down, giving us a great opportunity to scale into a bigger position at a lower average price). So if you want to play the stock, play the stock – but we like to make the trades that we feel have the BEST chance of making a good return with the LEAST chance of losing – just our crazy strategy, I guess…

If you were going to short 10 shares of GS you would get hit for $750 in margin and you would have made $80 while 5 2012 $70 puts at $2 tied up just $100 and made $100 and there was no possible way to lose more than $100 no matter what GS did (and it went up before it went down, giving us a great opportunity to scale into a bigger position at a lower average price). So if you want to play the stock, play the stock – but we like to make the trades that we feel have the BEST chance of making a good return with the LEAST chance of losing – just our crazy strategy, I guess…

Monday's crazy strategy was revealed at the bottom of the morning post where my battle plan was: "We shall see what’s what and, meanwhile, we have our levels to watch and our upside plays to ride but I’ll be looking for some shorts into the 10 am top. The 1% move in Europe is simply a catch-up play to our own big move on Friday so it will take more than that to impress us. Once the EU markets close, the excitement may fade for US equities as the S&P hits the 5% rule for the month (meaning we’re looking for a 1% pullback)."

- Oil futures short at $85.50, out at $84 – up $10 per penny per contract

- DIA May $110 puts at $85, now $1.75 – up 105%

- TZA May $5 calls at .53, now .95 – up 79%

- OIH May $131 calls sold for $3.90, now $1.58 – up 61%

- BIDU complex Sept/May ratio backspread – on target

- TASR Jan complex spread – on target

- ICE May $120 calls sold for $4, now $3.50 – up 12%

- QQQQ May $50/51 bull call spread at .55, out at .45 – down 18%

- C 2012 complex spread – off target

- Oil futures long at $84, out even

- ZION May $28 puts at $1.15, out $1.65 – up 43%

- DNDN 2012 complex spread – on target

- DNDN Jan complex spread – on target

- APPY Sept $2.50/5 bull call spread at .95, still .95 – even (Pharmboy Trade)

This was an easy one for us as all went according to plan. So much so that my 9:59 Alert to Members, aside from having the first 3 short plays of the morning, had set bounce levels for the week at: Dow 11,065, S&P 1,200, Nas 2,493, NYSE 7,645 and RUT 718. Our final tally for the week was Dow 11,008, S&P 1,186, Nas 2,461, NYSE 7,474 and RUT 716 – not bad targeting considering at 10 am on Monday the Dow was at 11,234 and heading higher. It's very easy to predict the market is heading down AFTER it turns down but, sadly, that's not how you make money, is it? It just didn't seem likely that Tuesday would be a good day with GS testifying before Congress.

Tuesday – Loveable Lloyd and Fabulous Fab Testify!

Our premise going into the day was simple – the market would sell down into the testimony but Lloyd would do his job and spin things well enough for his MSM lackeys to pretend everthing was going to be all right and we would flip bullish – mainly because people love BS! My comment that morning was:

Blankfein’s prepared comments are short as his major job, the one he is getting the big bucks for, is damage control. By getting the last word, Lloyd will be able to "spin" the prior testimony and give his supporters some talking points…

I don’t care if the charges are frivolous or not frivolous from the perspective of my outlook on GS stock. There IS a scandal, it WILL distract executives, it WILL disrupt business, it MIGHT damage their reputation, it MIGHT cost them deals, it MIGHT cause investors to lose confidence, the WILL be other lawsuits. This is not a reason to BUYBUYBUY Goldman Sachs.

My closing commentary was: "So lots of drama but Greece can be fixed in an instant and the post-Senate analysis could be a crushing victory for Goldman Sachs and the Fed can say nice things and we still have 900 earnings reports to chew the green shoots of this week so I guess it’s time for another 566% play this morning. It’s the perfect strategy for the "Wonderland" market – just do the opposite of what everyone else is doing…"

- Oil futures long at $84, out at $84 – even

- TBT Sept $43 puts sold for $1.50, now $1.86 – down 24%

- Oil futures long at $82, out at $83 – up $10 per penny per contract

- DIA May complex spread – out with profit

- GOOG Jan complex spread – on target

- XOM June $67.50/70 bull call spread at $1.25, now $1.02 – down 18%

- XOM June $67.50 puts sold for $1.54, now $2.10 – down 36% (pair trade)

- FAZ July $12/16 bull call spread at $1.10, now .96 – down 13%

- FAZ July $10 puts sold for .70, now .75 – down 7%

- SSO May complex spread – out with a profit

- UGL Oct $49/54 bull call spread at $2, now $2.10 – up 5%

- GLD March $90 puts sold for $1.20, now $1.10 – up 8% (pair trade)

- BAX Aug $45 calls at $4, now $3.85 – down 3% (Pharmboy Trade)

We were playing both sides of the fence with our hedges and the weak finish left us unenthusiastic about Uncle Lloyd saving the markets (the testimony was still going on at the close). So we left both sides on the table into the close but I wrote a special new post in our "Hedging for Disaster" series with "5 Plays that Make 500% if the Market Falls." Like any insurance – we hope we don't need them but it's foolish not to have them…

Which Way Wednesday – Fed Edition

It's all summed up in my statement that morning as we looked over the index charts: "We stand ready today to flip or flop – frankly we don’t care which way the market goes but we do LIKE to be bullish so we’d like the market to crash so we can buy stuff an be bullish for the long-term. Get it?" In a perfect world, we like to take advantage of short-term market opportunities to generate some cash so we have the opportunity to buy some long-term positions. We WANT to be long-term investors but the market just doesn't seem to want any…

We expected a boost from the Fed and we got it in the afternoon as Bernanke used his universal cure-all for any and all situations – MORE FREE MONEY!

- MON June $65 puts sold for $3.75, now 3.65 – up 3%

- BWLD Sept $40/45 bull call spread for $2.20, still $2.20 – even

- BWLD Sept $35 put sold for $1.70, now $1.80 – down 6% (pair trade)

- VZ 2012 buy/write at $21.30/23.15 – on target

- VZ 2012 $30 calls at $2.20, now $2.25 – up 2%

- VZ 2012 $20 puts sold for $1.1.0, still $1.10 – even (pair trade)

- TASR Jan buy/write at $2.95/3.98 – on target

- EDZ June $38/44 bull call spread at $2.80, now $2.50 – down 10%

- EDZ June $35 puts sold for at $1.25, now $1.50 – down 20% (pair trade)

- DIA May $112 calls at .95, out at $1.25 – up 31%

- BIDU June $660 calls sold for $22.80, now $53 – down 132%

- BIDU Dec $530 puts sold for $40.50, now $29.80 – up 26% (pair trade, 2:1)

- AMAG June $30s sold for $1.20, now .80 – up 30% (Pharmboy Trade)

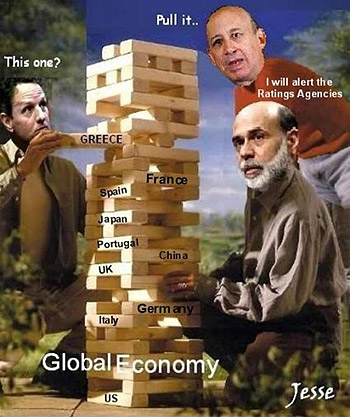

We got word of the Spanish downgrade at about 11:30 and I made a 12:11 comment to Members: "This downgrading of countries is a dangerous game. How can you say Spain is cut but not US, Japan, UK? I seriously, SERIOUSLY recommend cash, hedges and more cash as we head through a very rough week or two. Bearish is dangerous but so is bullish right now… I find it disturbing that something like that can be ignored. It’s kind of like sitting in a room with a bunch of guys in suits waiting for a job interview and a door opens up and a dozen rattlesnakes come out and everyone sits there and does nothing. If you do nothing are you smart or are you as big of an idiot as the rest of the crowd?"

Thursday – The Pain In Spain will Hardly be Contained

Thursday – The Pain In Spain will Hardly be Contained

Well I love musicals but nobody seems to get my references. Still it was a great summary of my from the previous Chat session and, despite the market's insistence on ignoring the issues – I decided it would be prudent to initiate some of our disaster hedges and take advantage of the madness to get out of our bullish plays. I put up a set of foreign-market charts in a 6-month view and commented: "If this set of charts made you spit coffee on your keyboard, you are not alone – that’s what happened to me when I pulled up the 2-month set this morning! Yes, this is the planet Earth – although obviously not a part of the planet covered by the US media, nor part of the planet where the FOMC (not you Hoenig – you are my hero!) says:

- Economic activity has continued to strengthen

- Business spending on equipment and software has risen significantly

- Financial market conditions remain supportive of economic growth

- Inflation is likely to be subdued for some time

- The Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability

We discussed the "Debt Bomb" as well as Goldman's 93% winning percentage in 2009 trading days and my cynical (yet very accurate) outlook for the day was "As I said though, today the play is back to cash. We took our unhedged plays on both sides off the table yesterday as the Spain downgrade got me nervous and this morning it looks like we’re going to have such a nice pop that we’ll be back to asking ourselves, as we did (thank goodness!) on the weekend: "Should We Take Profits At 300%?" on our more complex spreads like the one above (and I’ll save you some trouble – the answer is "YES"). Cash doesn’t mean sitting on our hands, cash means flexible. Cash means being able to grab opportunities like the chance to sell BIDU calls to suckers this morning and the chance to short oil at $85 again. Whatever you do, just be careful out there!" The 566% play I referenced was the complex DIA spread above, which cashed out up well over 200% on the nice run!

- BIDU June $720 calls sold at $35, now $24.70 – up 26% (2x roll of June $660 short calls and new naked play)

- Oil futures short at $85, out at $85.05 – loss of $10 per penny per contract

- USO May $41 calls sold for .95, now $1.30 – down 37%

- EDZ Oct $38/44 bull call spread at $1.90, now $2 – up 5%

- EDZ May $38 puts sold for $1.15, still $1.15 – even (pair trade)

- BIDU Dec $600 puts sold for $42, now $51.20 – down 22% (1/2 hedge to short June calls)

- DVN Jan complex spread – on target

- SPWRA June $17.50/20 at .65, still .65 – even

- SPWRA June $16 puts sold for .95, now $1.10 – down 15% (pair trade)

- VLO complex spread – on target

- Oil futures short at $85.15, out at $85, up $10 per penny per contract

- OIH May $131 calls sold for $4, now $1.58 – up 60%

- SMN June $30/34 bull call spread for $2, now $2.30 – up 15%

- TBT Sept $43/48 bull call spread at $2.60, now $2.25 – down 13%

- UNG June $6/7 bull call spread at .62, now .60 – down 3%

- MON 2012 $50/65 bull call spread at $8, still $8 – even

- MON 2012 $50 puts sold for $4.30, still $4.20 – even (pair trade)

- MON July $60/65 at $2.45, now $2.55 – up 4%

- MON July $60 puts sold for $2.25, now $2.20 – up 2%

- DNDN Jan $40 puts sold for $5.50, now $3.33 – up 39%

- DCTH May $15 puts sold for $1, still $1 – even (Pharmboy Trade)

- SPPI at $5.16, now $5.17 – even (Pharmboy Trade)

My 11:56 comment to in Member chat reiterated my call to cash: "Cash Jordan – Absolutely the way to go. This bullish move was a total gift to get out of anything you couldn’t get out of ahead of the big drop (maybe because you were busy testifying in Washington)." At 1:17 I reiterated: "Unless we break up to new highs, especially NYSE 7,700 this is just more churning. I’m too scared to be bearish but no way will I go bullish because I would feel like a total moron if I was stuck in a bunch of longs and some catastrophe (pick one) took all my money. Cash, cash is good, cash is nice, cash is, indeed, king."

Cash is why we have so many trade ideas this week – it's fun to take little pokes at things while we're waiting for the market to show us a real direction. Notice our longs are generally LONG-TERM entries into positions we intend to scale into and own for quite some time while our short-side plays are more short-term AND more aggressive. Ideally, we get a big drop and use the cash from our short side to buy more long-side plays on the cheap. If the market breaks up sharply, then we have a long time to make money on our longs and overcome thins short-term loss on the short side.

GDWhee Friday – Could be a Wild Ride!

For those of you versed in Greek mythology, the picture of Icarus that I used in Friday's post says it all. I emphatically called the top in Thursday's Member Chat so the pre-market move looked fairly insane to me. This time I listed 33 stocks to short right in the top of the morning post and EVERY SINGLE ONE dropped significantly that day. Some services give you 33 winning trades in a year – we don't go 33 for 33 every morning but we do OK – how's that for a sales pitch?

I even reiterated Monday's DNDN hedges and those were still buyable at the open due to the huge volatility. The GDP report "sounded" good but I didn't like the the Real Disposable Income numbers, especially with the way consumer spending now accounts for OVER 70% of our GDP. Very simply, I concluded: "Like last Friday, we’re going to let the markets run but unlike last Friday, I’m didn’t wait until the weekend to decide to get out. We’ll see if I was right."

- Oil futures short at $86, out at $85.50 – up $10 per penny per contract

- USO $41 calls sold for $1.29, now $1.30 – down 1%

- EUO complex spread – on target

- ONTY Nov complex spread – on target

- ABX 2012 complex spread – on target

- Oil futures short at $86, out at $85.25 – up $10 per penny per contract

- MEE June $38 puts sold for $3.50, now $4.20 – down 20%

- DBA 2012 complex spread – on target

- QID June $14/16 bull call spread at $1.15, now $1.20 – up 4%

Well, here it is Sunday and we still don't know if it was right to cash out our longs (and most of our shorts) we had 19 losing trades out of 66 (not counting the 33 shorts on Friday morning) so not as good as last week but not terrible considering the swings… Has the market finally gotten the straw that breaks its back or is this just another bump in the road back to 14,000? We had a pretty good idea that Greece would once again be "solved" over the weekend but Government of Greece agreeing to an aid package and the People of Greece accepting the terms of that decision are two very different things!

Aside from everything else, Spain's unemployment topped 20% and we'll just have to wait to see how much of a pop Asia can give us in the morning with the dollar looking to open strong, which should boost the Asian exporters. Whatever happens, it's going to be another crazy week and we are very glad for the flexibilty of cash as we have plenty of nice positions on both sides that we can scale into once we get a real break.