.png) Happy Monday to all! Hope everyone had a great weekend. We are set to begin a fantastic week of stock picking, analysis, and conversation about everything financial. Last week was a bit of a rough week for us investors as we got hit by some poor news from the Euro and several key economic indicators. You can read my entire synopsis of the week and my seven picks from last week here. We had 2 winners, 2 losers, and 3 neutral plays, which is not bad for a week when the market drops 5%.

Happy Monday to all! Hope everyone had a great weekend. We are set to begin a fantastic week of stock picking, analysis, and conversation about everything financial. Last week was a bit of a rough week for us investors as we got hit by some poor news from the Euro and several key economic indicators. You can read my entire synopsis of the week and my seven picks from last week here. We had 2 winners, 2 losers, and 3 neutral plays, which is not bad for a week when the market drops 5%.

Let’s get into today’s plays…

Buy of the Day: Pulte Homes Inc. (PHM)

Analysis: I am surprisingly not that worried about the market’s futures this morning. I think it is definitely some worries over Europe that are driving futures down on the Dow over 70 points, but it is also simply some profit taking that is occurring as investors who made money on Friday don’t want to lose their gains. Well, I think they would have been better off hanging onto some of those stocks because the market is going to turn around today. For one, we have some undervalued news coming our way this morning about existing home sales, which has continually risen year-over-year  thanks to a tax credit. This is the last month of the tax credit, and the analysts are only thinking it will rise 6% above the numbers from last year. The total number of existing homes sold is expected to be 5.65 million, which is 300,000 more than the numbers for March. I think this piece of economic data alone should give a boost to a number of stocks, especially homebuilders themselves, who have been heavily oversold over the past few weeks.

thanks to a tax credit. This is the last month of the tax credit, and the analysts are only thinking it will rise 6% above the numbers from last year. The total number of existing homes sold is expected to be 5.65 million, which is 300,000 more than the numbers for March. I think this piece of economic data alone should give a boost to a number of stocks, especially homebuilders themselves, who have been heavily oversold over the past few weeks.

My selection for today, therefore, is PulteGroup Inc. (PHM). Pulte is a typical middle-class residential homebuilder that specializes in neighborhoods built on developed land. While the company does not benefit greatly from the rise of existing home sales, a rise here shows that the market for homes is strong, which means that new buyers are building. This statistic should go along with a reminder to investors that new housing starts were also better than expected in April, which is further good news for PHM.

The news about the home sales should be released at 10 AM. I am expecting that PHM and other stocks that are closely linked to the statistic will probably actually have a strong first thirty minutes, so we want to get involved with this one right away. We may even be able to make 2-3% before the announcement just in case it is really awful; however, I am pretty confident that any rise from last month will be taken very well.

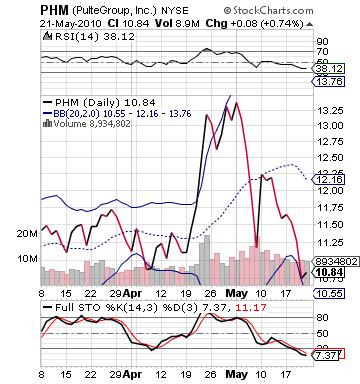

Additionally, what is helping this stock is the fact that it is so undervalued like the rest of the market. The stock is heavily oversold, undervalued on RSI, and right at its lower bollinger band. How much further can it decrease? As you look at any sector or company, they are all oversold and at the bottom of those bollinger bands even after a slight pop on Friday. The market, technically, just does not have enough momentum to carry it lower on the same news about the Euro and Europe. I think investors are ready to move onto something new. Look to the existing home sales, some good earnings from Campbells and Yingli Green, and IBM’s M&A with ATT to all help spark this market.

Get in early and watch for the 10 AM announcement.

Entry: We are looking to get involved with PHM at 10.95 – 11.05.

Exit: We are looking to exit on a 2-3% gain.

Stop Loss: 3% on bottom.

Short Sale of the Day: Proshares Ultrashort Financial (SKF).png)

Analysis: Along the same lines as the first article. I am expecting the market to rise from a bottoming this morning. The market rose on Friday, and it has created a short term selling spree in pre-market, but the Euro and Europe story is dried up. I think investors will look at the acquisition IBM took on today, the existing home sales, and some solid earnings from a couple smaller companies as just a number of bullish factors. Yet, it comes down to technically we just do not have the momentum to continue lower. There are too many bargains, and the first sign of any bullish fundamentals (like Friday), this market will take off.

With that said, I think shorting some of these volatile inverse ETFs is a great idea. SKF is one of those quiet ETFs for awhile since financials seem to have slipped under the radar over the past couple weeks. During that time, SKF has seen its price rise around 30%. It is heavily overvalued, and it is ready to come down. The stock has too many buyers, and as those buyers turn into short interest this one is going to fall hard and fast.

Yet, SKF cannot just fall for no reason. I think to help fuel this one, besides the market approach, is the new financial rules that Congress has passed. While the law has flaws, it does give more strength to the financial industry by providing some more stringent rules to help cause the banking industry not to falter. While some interpret this as harder for the banks to make money, it is not that way. This law is designed to basically do away with the types of malpractice that started this whole process of unfolding. Money that banks are making now is smarter and safer, and this law does not affect that money. Further, Goldman Sachs gave an upgrade to Citi (C) today, and the projected costs of the TARP legislation are seen to be lower than previously thought.

Those are all good signs for the financial industry and should help lend a hand in bringing down SKF.

Entry: We are looking to get involved with our short sale at 21.45 – 21.55.

Exit: We are looking to cover on a 2-3% gain.

Stop Buy: 3% on top.

Good Investing,

David Ristau