Hello all. Good Wednesday. What a great day we had yesterday with our Buy Pick of the Day DSW Inc. and our Short Sale of the Day Career Education Corp. Additionally, our Overnight Trade worked out wonderfully for us this morning. We got involved with Exide Technologies (XIDE) at 3.85 yesterday, and we sold this morning at 4.12. That was a great gain of 9% that we made on XIDE. Hope some of you were able to get involved on the great trade. Our Buy Pick of the Day was worth 3% with a buy at 27.00 and a sale at 27.71. Our Short Sale of the Day was worth 2.5% with a short at 29 and a cover at 29.28. Finally, our other open position, from Monday, is our Play of the Week in Big Lots Inc. (BIG). We bought into this one at 36.50, and we are at just about even now after losing quite a bit yesterday.

Hope you were able to take advantage of some of those great positions. We are looking to continue our success with another Overnight Trade today. Attached on the right is a follow-up to yesterday’s Daily Musing, which I think is just interesting to see that Apple is one of the lowest in R&D, but one of the most successful…interesting.

Overnight Trade today. Attached on the right is a follow-up to yesterday’s Daily Musing, which I think is just interesting to see that Apple is one of the lowest in R&D, but one of the most successful…interesting.

Overnight Trade: Verifone Systems Inc. (PAY)

Analysis: Verifone Systems (PAY) is today’s Overnight Trade of the Day. I am pretty excited about this company as I was Exide (XIDE) yesterday. Verifone is an payment solutions company that has developed a secure electronic payment register for merchants and produced the payment system that the iPhone uses to buy applications and many other products. The company is in an industry with few competitors and has seen a lot of success and growth over the past year. I believe the company will continue to impress with their earnings report in after hours today. The company is projected to report an EPS of 0.26 vs. one year ago’s 0.17.

Technology is one of those industries that, as I said yesterday with Exide, has done fairly well in this Q1 of 2010. Companies are beginning to revamp their reinvestments into technology to increase profitability and reliability. Payment systems have done exceptional in this past quarter. Business equipment has seen 5/6 of the major comapnies produced surprise profits over the past month. Verifone’s competitors, Hypercom (HYC), NCR (NCR), and Ingenico have all produced huge surprises on earnings. HYC was at 300% and NCR was above 200%. Verifone is extremely well positioned in this market and the  market leader. The company makes a margin everytime someone pays for something based on how expensive something is. PAY has developed a lot of high end clients and mixed that with some great growth areas in the USA and BRIC countries. They are the sole leader in registers and payment systems in Brazil, which is such a growing market with people starting and using credit cards and debit cards.

market leader. The company makes a margin everytime someone pays for something based on how expensive something is. PAY has developed a lot of high end clients and mixed that with some great growth areas in the USA and BRIC countries. They are the sole leader in registers and payment systems in Brazil, which is such a growing market with people starting and using credit cards and debit cards.

I am confident in this company, and they tend to underestimate earnings. The company upped their earnings estimates to 0.25 – 0.26 EPS after last quarter’s earnings. The company has seen great growth over the past year, which should continue into this quarter. Over the past four quarters, they have increased, sequentially, their revenue, their profits, their cash, and otal assets. The company has reported 0.26 EPS for three straight quarters, but they are looking to increase revenue by another 3-4% in this quarter over last, and they should be able to beat that 0.26 EPS. The company took on a lot of new stock in Q4 of 2009, which reduced EPS. They did not in Q1 of 2010, and so, it should increase over 0.26.

The surprise will help, but I also think the company has some great future prospects. They are heavily involved in the BRIC, Switzerland, the USA, and Germany. The strong European nations and the growth of those emerging markets is a great virtual portfolio. Further, the company has tons of free cash flow on hand. They consistently have between $50 – $70 million in free cash flow every quarter. That is money that can be used for expansion and development.

Finally, another great sign that this is a company that can definitely continue to shine is that they are receiving upgrades. One of these came from the S&P back in March. The S&P commented the company has a lot of growth potential, great liquidity, and a strong market position. The upgrade from the S&P is a sign of great future growth, and I think that should begin to shine in this quarter.

of these came from the S&P back in March. The S&P commented the company has a lot of growth potential, great liquidity, and a strong market position. The upgrade from the S&P is a sign of great future growth, and I think that should begin to shine in this quarter.

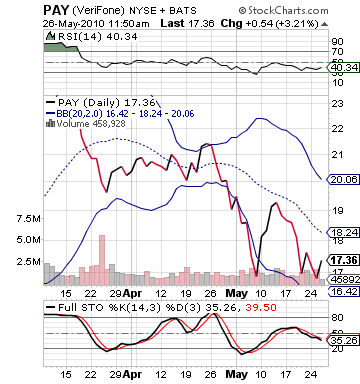

The reason this makes for such a great play is not all just strong fundamentals, but also the technicals of the market. The company is very undervalued. It is only at 75% of its 52-week high. PAY is right at its lower bollinger band, it is oversold, and it is undervalued on RSI. The company has made some movement upwards today on the good day, but you would have to expect some movement upwards on such a great market day. I have adjusted entry to try to maximize our gains. The company has about 20% to the upside to its higher bollinger band, and it has dropped over 10% in just the past two weeks on just market movement. This is a strong company that is undervalued.

Get in now and let’s hope for some great returns.

Entry: We are looking to enter between 17.25 – 17.40.

Exit: We are looking to exit tomorrow morning at the open after earnings have been released.

Good Investing,

David Ristau