Hey all. Happy Friday. We had a really great week this week with a number of stellar plays. Yesterday, we made it the second day in a row for three profitable trades as we closed out positions in Quidel (QDEL), Big Lots (BIG), and Verifone (PAY). Quidel was yestreday’s first Buy Pick of the Day. We got involved at 11.33, and we exited in the morning at 11.74 for a 4% gain as the company moved up with the market and an upgrade. BIG was our Play of the Week from Monday. We got involved at 36.50 on Monday, looking for 4-6% throughout the week. Unfortunately, the stock never hit 4%, so we had to settle for just a 2% gain, exiting at 37.24. Finally, we had a BIG WINNER in Verifone for our second Overnight Trade from Wednesday to Thursday. We got involved at 17.25 on Wednesday, and I exited in the morning yesterday at 18.65 for an 8.5% gain!!!

Today, I am going to cap off the week by changing things up with an investigation into the long term prospects for the solar company Trina Solar. The report will also begin a brand new Fund/Virtual Portfolio that I will be tracking long term. These plays could range from a couple months to a year to longer. I won’t be monitoring them as frequently as my other trades, but they will be followed for developments and percentage gained and lost. This will be something I will be doing every Friday.

Long Term Investment of the Week: Trina Solar Ltd. (TSL)

Thesis

Solar energy has continued to be one of the most challenging industries to predict, Many of the companies involved continueto operate with low margins and struggle to continually be profitable. The market is overcrowded with too many companies, offering mostly similar silicon photovoltaic modules, and subsidies from various governments that have helped to establish the infant solar industry are being cut. Yet, among all these risks, a handful of companies have established themselves as the market leaders with continual growth, diversification across several markets, and the most efficient products.

Solar energy has continued to be one of the most challenging industries to predict, Many of the companies involved continueto operate with low margins and struggle to continually be profitable. The market is overcrowded with too many companies, offering mostly similar silicon photovoltaic modules, and subsidies from various governments that have helped to establish the infant solar industry are being cut. Yet, among all these risks, a handful of companies have established themselves as the market leaders with continual growth, diversification across several markets, and the most efficient products.

Trina Solar Ltd. (TSL), based in China, has become a market leader in a competitive industry that has continued to grow at more than 15% every year for the past six years. The company, led by founder and CEO Jifan Gao, has continually seen its revenue and profits increase every year since its founding. The solar market is starting to become a larger part of the energy

picture with the USA looking at solar more considerably vis-a-vis the California Solar Initiative. The company offers the second-most efficient photovoltaic cell among all its peers, which has helped it to create a minute economic moat.

Further, the company has been able to reduce its production costs considerably with the ability to now turn its raw silicon into a solar panel for only $0.78 per watt, which is the lowest of all competitors. This ability to poduce a highly efficient, marketable good with the lowest costs allows Trina to continue to produce significant earnings and margins over 30%. The only other company that has lower costs than Trina is First Solar (FSLR), which uses cadmium telluride for their cells instead of silicon. In the highly competitive solar industry with similar products, the two things that matter most are costs of production and efficiency of sells. Trina is a leader in both.

Trina does face stiff competition in the solar energy market. There are over 35 public solar energy companies on the NYSE that are competition with Trina. Most of these companies are small and do not compete on the same level as Trina. For example, at the end of 2009, Trina Solar, under the California Solar Initiative (CSI), had less than 5% of the market share. With a focus on diversifying into America (the company has signed its third agreement with a US distributor as of April 2010),

the  company has quickly taken the place of many other more expensive, less efficient companies and gained 16% of the market share

company has quickly taken the place of many other more expensive, less efficient companies and gained 16% of the market share. While the company does not have a niche in the industry due to similar products. The solar industry is basically a commodities market. The cheapest company with the best product is the winner, and that has become a horse race between a handful of the solar giants, which has allowed Trina to gain a very small economic moat.

The company also faces a major crisis in Europe with the declining Euro. In 2009, the company did 90% of its business in the Germany, Spain, Benelux region. Yet, the company has realized that there is a great need for them to diversify away from the European region and move towards China and the USA.

The company plans to transport 100 MW of energy to the USA in 2010 and improve that to 150 MW by 2011. The movement into the USA, China, and other emerging solar markets will help Trina to battle the Euro woes in Europe and better diversify itself for the future. Additionally, the company has used subsidies from Germany, the current European leader for solar panel production, and other European nations for a long amount of time to keep prices even lower. Now more than ever, with Germany planning to continually reduce its feed-in tariffs (FITs), it is crucial for solar companies to be able to produce the most inexpensive solar panels, a la Trina.

Further, the outlook for solar is not at all cloudy or a bad one despite the Euro woes and Germany’s subsidy cuts.

According to Credit Suisse, the global demand for solar energy should rise from 10 gigawatts to 12.7 gigawatts on the year as economies start to recover and the price of oil remains high. The rise in demand of solar continues to increase each year. In 2008, the

demand was just 6 GW and was just 1.7 GW in 2006. This industry is growing very rapidly, and the solar shares are extremely cheap compared to where these could go in the next five years.

Finally, the latest quarter for Trina continues to show that the company is finding ways to make money in tough markets by offering the best product in a commodities market. The company in Q4 of 2009 estimated their margins below 30, which sent shares into a downfall. They commented on the Euro problems as the main reason to estimate them around 26-27. Yet, the company reported margins at 33 for Q1 2010 despite the decline of the Euro throughout the beginning of this year. While the Euro’s problems should be worrisome, this is a company that can continue to grow even in a tough market. Once the European market stabilizes and they further diversify, the prospects are very bright.

The company has continued to improve their business each year. They have increased their margins each year, in existence on the NYSE from 9.8% in 2004 to over 30% in 2010. The company has improved their return on equity from 2006 – 2010, going from 14.5% to projected 23% this year. That is a very significant ROE. The company also is becoming more and more financially healthy. They have continued to reduce their current liabilities and increase cash on hand over the past five years.

While questions remain about competition, diversification, and subsidy issues, Trina Solar has established itself as a solar leader in this market. It is a company that has the fundamentals necessary to make a significant move in the industry.

Valuation

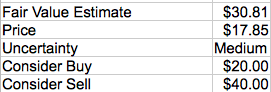

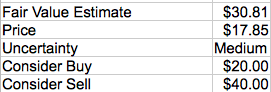

My fair value estimate for Trina Solar is $30 per share based on a discounted cash-flow analysis. The company has seen incredible growth in its operating income in the past five years, and there is really no worry that the industry cannot continue to grow as demand continues to grow. Given the development of new markets, the company’s ability to offer the cheapest product and second-most efficent, and continued growth of capacity of MW the company can produce per year, the company is continuing to offer growth in its income. My estimated available cash flow starts at $79 million for this year, which is somewhat cautious compared to estimates to help with the Euro problems. The company, however, should continue to grow those numbers with an increasing number of MW they can produce and new markets.

Risk

Risk is medium with Trina Solar. The company, in the last five years, has been able to definitely develop itself as a leader, but it is in a commodities industry. If another company can find a way to beat out Trina for watt to raw silicon production prices, then Trina will not have as much of an upper hand. Questions about the Euro and subsidies remain in the short term, but they could create long term issues for solar companies if they fall out of favor due to rising prices. Upturn in the global economy

would do wonders for solar energy.

Management & Stewardship

CEO and Chairman Jifan Gao has done wonders for his company that he has founded. He is a veteran of industry, having worked with two other chemical based companies prior to starting Trina Solar. One worry is that there is no information about salary, compensation, etc. on any of the management for Trina since the company is based in China. The inability to access that information and having foreign leaders is a slight risk to consider. Additionally, it would be better if their was a split of the chairman and CEO position that Gao currently holds.

Overview

Growth: The company has averaged 154% increases in its operating income in the past five years. These results have been pretty stable, but there was a siginificant slowdown in 2009. The company should continue to offer above 20-25% growth for years to come.

Profitability: The company should continue to maintain its operating margins above the 10% range, which is very high. The company will continue to remain profitable, but the Euro and subsidy cuts do cause some problems. The company, however, will most likely battle this in the short term with higher prices.

Financial Health: The company is in very solid financial condition. The company has decreased its current liabilities over the past five years and has a solid current ratio. The company does have some long term debt, but this is definitely expected in a high technological institution that operates large factories with expensive equipment and design.

Good Investing,

David Ristau

Solar energy has continued to be one of the most challenging industries to predict, Many of the companies involved continueto operate with low margins and struggle to continually be profitable. The market is overcrowded with too many companies, offering mostly similar silicon photovoltaic modules, and subsidies from various governments that have helped to establish the infant solar industry are being cut. Yet, among all these risks, a handful of companies have established themselves as the market leaders with continual growth, diversification across several markets, and the most efficient products.

Solar energy has continued to be one of the most challenging industries to predict, Many of the companies involved continueto operate with low margins and struggle to continually be profitable. The market is overcrowded with too many companies, offering mostly similar silicon photovoltaic modules, and subsidies from various governments that have helped to establish the infant solar industry are being cut. Yet, among all these risks, a handful of companies have established themselves as the market leaders with continual growth, diversification across several markets, and the most efficient products. picture with the USA looking at solar more considerably vis-a-vis the California Solar Initiative. The company offers the second-most efficient photovoltaic cell among all its peers, which has helped it to create a minute economic moat.

picture with the USA looking at solar more considerably vis-a-vis the California Solar Initiative. The company offers the second-most efficient photovoltaic cell among all its peers, which has helped it to create a minute economic moat. company has quickly taken the place of many other more expensive, less efficient companies and gained 16% of the market share. While the company does not have a niche in the industry due to similar products. The solar industry is basically a commodities market. The cheapest company with the best product is the winner, and that has become a horse race between a handful of the solar giants, which has allowed Trina to gain a very small economic moat.

company has quickly taken the place of many other more expensive, less efficient companies and gained 16% of the market share. While the company does not have a niche in the industry due to similar products. The solar industry is basically a commodities market. The cheapest company with the best product is the winner, and that has become a horse race between a handful of the solar giants, which has allowed Trina to gain a very small economic moat. demand was just 6 GW and was just 1.7 GW in 2006. This industry is growing very rapidly, and the solar shares are extremely cheap compared to where these could go in the next five years.

demand was just 6 GW and was just 1.7 GW in 2006. This industry is growing very rapidly, and the solar shares are extremely cheap compared to where these could go in the next five years. would do wonders for solar energy.

would do wonders for solar energy.