Good Monday to all. It is week two of the earnings season, and we are looking forward to more and more and more earnings.  Last week, we had some more ups and downs as we got into the earnings season. We are looking to make up for some misses this week. On Friday, we positioned ourselves in a brand new longterm position with Paychex Inc. (PAYX). We have a fair value estimate in the mid-40s, while the stock is trading at around $26.

Last week, we had some more ups and downs as we got into the earnings season. We are looking to make up for some misses this week. On Friday, we positioned ourselves in a brand new longterm position with Paychex Inc. (PAYX). We have a fair value estimate in the mid-40s, while the stock is trading at around $26.

Let’s get into today’s Overnight Trade.

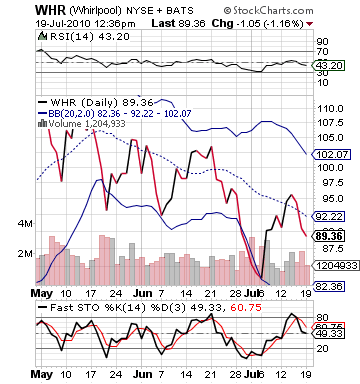

Overnight Trade of the Day: Whirlpool Inc. (WHR)

Analysis: Appliance giant Whirlpool Inc. (WHR) will be reporting their earnings tomorrow morning. The company is expected to report earnings at 2.13 per share. This would be an over 100% improvement from one year ago. That type of year-over-year improvement was the first thing that attracted me to Whirlpool. At the same time, however, the company could definitely beat those estimates. For much of 2008 and 2009, consumers have avoided big items, such as washers, dryers, and dishwashers. Yet, 2010 has shown a return to these items. Whirlpool has shown gains in earnings for four straight quarters, and if the company wants to make it five, then the company will have to beat earnings estimates.

This latest quarter should be a good one for Whirlpool as sales of appliances rose 16% in the month of May. One reason for the gains is the slow recovery of most economic sectors, but another is that the US government has been giving rebates to consumers buying energy efficient appliances. It is a great way to get a discount for life from less energy costs along with less energy and a rebate. In fact, the latest appliance company to report was Electrolux from Sweden. The company makes the Frigidaire line among others. They saw 10% growth in sales year-over-year in the USA. A foreign company will probably be slightly less than Whirlpool, and WHR does most of their business here in America versus overseas.

Frigidaire line among others. They saw 10% growth in sales year-over-year in the USA. A foreign company will probably be slightly less than Whirlpool, and WHR does most of their business here in America versus overseas.

From January to May, appliance sales grew 12%. The Q1 EPS for WHR was 2.13. The increase in sales seen in April and May that most likely cooled off slightly in June should help to propel WHR above that 2.13 rate. Additionally, just because home sales have not seen a huge increase so far in 2010 that does not mean home owners are not making improvements. In fact, like the car industry, many car improvement companies are doing exceptional despite lower sales. Sales have improved even in the Q2 in April. While they declined in May and June, the sales were still significant enough compared to 2009. Improvement is inevitable year-over-year, and we can be confident in an earnings beat.

The future, though, should be good for Whirlpool. Fitch Ratings commented that they see home improvement sales to continue to rise over 3.5% for the rest of the year. This continued investing into appliances will continue to improve Whirlpool. Additionally, Moody’s recently commented that they believe Whirlpool is in a great position. The company has significant free cash and cash on hand that will help the company continue to have a solid credit rating. Both of these pieces of information lend me to think that Whirlpool will be able to guide at least to meet future estimates. Whirlpool continues also to acquire new companies and move into  supplying other companies, such as Horton Homes, that will continue to allow the company to improve.

supplying other companies, such as Horton Homes, that will continue to allow the company to improve.

Now, Whirlpool is also a good play because the company is significantly undervalued currently. The company has declined just under 15% since the beginning of June. After a nice rise with the bull market two weeks ago, WHR has given up just under 10% in the past three days. That sort of decline has allowed WHR to become undervalued on RSI and drop into a neutral overbought/oversold category. A beat will definitely help WHR move to the upside as it has sold off into earnings. The energy program for appliances is the big catalyst, but guidance should also continue to be solid.

We want to get involved today and wait for a solid report and beat tomorrow to take away some solid gains.

Good luck!

IN PROGRESS

Entry: We are looking to get invovled at 88.50 – 88.70.

Exit: We are looking to exit tomorrow morning after earnings are reported.

Stop Loss: None.

Good Investing,

David Ristau