Forget the GDP.

Forget the GDP.

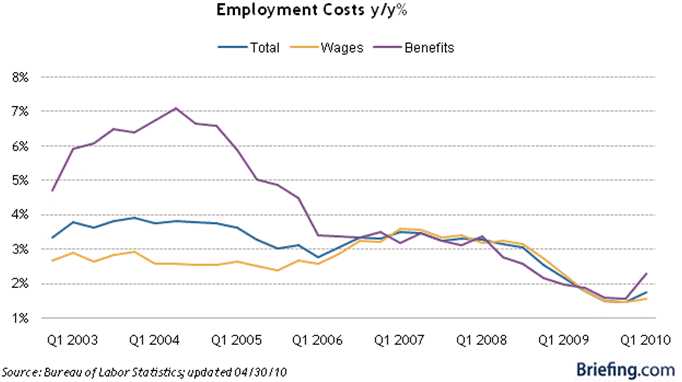

We'll get the report on Q2 GDP at 8:30 tomorrow but I'll be watching the Employment Cost Index to see if we are recovering. I know it seems like "commie talk" to my Conservative friends, but rising wages and benefits are signs of a healthy economy and you can plot the rise and fall of the stock market very neatly against how well the workers are treated.

It was Henry Ford who first "discovered" that, if you expect American consumers to buy your products, you have to pay American workers enough to afford them. In January of 1914, the Ford Motor Company announced they would pay $5 a day to its workers. The pay increase would also be accompanied by a shorter workday (from nine to eight hours). While this rate didn't automatically apply to every worker, it more than doubled the average autoworker's wage. Workers came from all over the nation and all over the world to work for Ford, who had their pick of the best and the brightest, which led to a 60-year legacy of dominance in American Industry.

Henry Ford had reasoned that since it was possible to build inexpensive cars in volume, more of them could be sold if employees could afford to buy them. The $5 day helped better the lot of all American workers and contributed to the emergence of the American middle class and that led to a massive economic boom in "the Roaring 20's" until greedy Banksters and speculators crashed the market in 1929.

Unfortunately, earning $5 a day is still a dream for much of the workforce employed by US corporations as that is more money than is paid to their tens of millions of employees and suppliers in China, India, Vietnam, South Korea, Taiwan, Indonesia, etc. Not only have American corporations "unlearned" the lessons that made this country great but they are actively involved in tearing down what is left of the American Middle Class by undermining their ability to earn and save as they ship jobs out of the country and cut wages and benefits for those few workers (135M at last count) who are left.

8:30 Update: Make that 134,543,000 workers left – as we lost another 457,000 American jobs last week. Continuing Claims picked back up to 4.56M, also more than expected but, as I said to Members yesterday, so what? We are investing in Corporate Pirates, not the victims they slaughter so when we see another 457,000 highly-paid US workers biting the dust is good news for the bottom line for the companies we invest in as they buy more slave labor overseas.

Who could care less if America dies screaming as long as new customers place enough orders to replace us? As I pointed out in my 2010 Outlook, "A Tale of Two Economies" it doesn't pay for us to focus on the "Poor Man" economy – those suckers only account for about 20% of consumer spending and the real trick for the top 10% (who are 4% unemployed and spend 66% of the money) is how to snip that dead vine away and leave themselves with just the good stuff. Look at KO’s earnings – US sucks, rest of the wold is EXCITING. That’s pretty typical and it’s not going to change as the decline of the United States of America's will merit the same historical footnote as Babylon when it all comes crashing down and 6.7Bn other people move on without us.

America is the low-hanging fruit that has been sucked dry by Corporate Pirates who have already moved on to greener pastures. The American consumer was marketed to and lent money on "easy credit" until they mortgaged, not only everything they owned but everything their children and their grandchildren are likely to own in the future and that money was converted into cash which allowed US Corporations to go multi-national and now that they can no longer get more money out of US workers than they put in – they no longer see the benefit in paying them at all when there are 6.7Bn new suckers lined up who just can't wait to go deeply in debt in order to buy a big-screen TV and a microwave.

America is over and the smart corporations are already fleeing the sinking ship. We have swept our debts under the rug ever since Nixon took us off the gold standard in 1973 and now we have both a shrinking, aging population AND deflation – a deadly combination for any empire. GDP in 1973 was $5Tn so 40% debt puhed back for two decades only hit the 1990, $9Tn GDP for 22% and 50% 1990 GDP was $4.5Tn and jamming that 20 years down the line was "just" 1/3 of the current GDP but if we sweep our now 100% debt to GDP of $15Tn under the rug where 300M people in 2010 generate $15Tn and we have 2 lost decades like Japan then in 2030, we may have 275M people, mostly retired, generating $12Tn in GDP with that $15Tn in rolled debt plus another $15Tn we rack up over 20 years so then we’re at 200% of GDP debt – JUST LIKE JAPAN. Now the funny thing about Japan is – that’s just what they did yet they not only survive but many people would still rather have Yen than dollars so the reports of the United States’ imminent demise are greatly exaggerated – it's more like a long, slow, wasting death that's eating our country away at the core.

That's why we were BUYBUYBUYing yesterday while the markets fell. We're not investing in America, anyone watching CSpan for an hour would know that's a terrible idea – even without looking at the balance sheet. We are investing in multinational corporations and companies that will still make good money even in the decline of the American empire. I mentioned CHK and UNG in the morning post and we also added long trade ideas (hedged, of course) on GLW, BYD, BAC, JEC, AA and AET while making RTP our next focus short as we think copper has gotten a bit overdone but we're scared to short it.

The Beige Book was just what we expected but, after highlighting and commenting on it for Members at 2:38, my conclusion was that we should lighten up on our beatish plays (taken in Tuesday's chat) and begin using Dow 10,500 and NYSE 7,000 as our new cut-off lines to flip back more bearish. It's both hard and sad to have to ignore the mess that is being made of our country by Corporations, Banksters, Special Interests and, of course, Politicians – but we are INVESTORS and we need to INVEST based on who is going to win. Right now, the Big Corporations clearly have the upper hand.

The Beige Book was just what we expected but, after highlighting and commenting on it for Members at 2:38, my conclusion was that we should lighten up on our beatish plays (taken in Tuesday's chat) and begin using Dow 10,500 and NYSE 7,000 as our new cut-off lines to flip back more bearish. It's both hard and sad to have to ignore the mess that is being made of our country by Corporations, Banksters, Special Interests and, of course, Politicians – but we are INVESTORS and we need to INVEST based on who is going to win. Right now, the Big Corporations clearly have the upper hand.

We still may come crashing down and we'll be taking on more disaster hedges at 10,700 and adding to those at 11,000 but, for now – let's enjoy the ride and dance to the music while we ignore that burning smell….