Today is going to be a fun day for us. We may get some picks right and wrong, but as I promised yesterday, I am going to make picks from now until the close. I will only be able to participate in some of the picks due to the restrictions of my virtual portfolio, but I will continue to make picks until I run out of time. You can pick and choose which ones best suit your personal investing philosophy. We will start the morning with our typical buy and sell picks and go from there.

Today is going to be a fun day for us. We may get some picks right and wrong, but as I promised yesterday, I am going to make picks from now until the close. I will only be able to participate in some of the picks due to the restrictions of my virtual portfolio, but I will continue to make picks until I run out of time. You can pick and choose which ones best suit your personal investing philosophy. We will start the morning with our typical buy and sell picks and go from there.

Yesterday, we exited at the open Climarex Energy (XEC) for a small loss. The stock went on to have a big day, but they missed earnings and revenue estimates and were looking to open down. We got involved at 70.60 and exited at 70.10 for a small loss. We also entered yesterday ON Semiconductor (ONNN). The company reported better than expected EPS at 0.24 vs. the expected 0.20, had a nice future forecasting that was within guidance estimates, but the market does not think it is enough. It is set to open right where we bought it yesterday. This is one I feel like we should let ride if the market is going to open higher, which will depend on the unemployment claims report. Check back in my Morning Levels Alert for the final decision.

Let’s get picking!

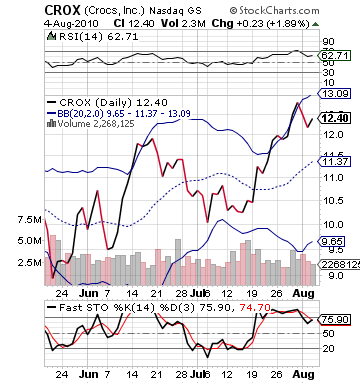

Buy Pick of the Day: Crocs Inc. (CROX)

Analysis: I know what you are thinking…Crocs? Am I serious? Yes. I am serious. Crocs looks to be a good pickup today on a possible lower open and/or early decline to the day. The company is set to report earnings per share at 0.20 vs. one year ago’s loss of 0.36 per share. Additionally, this company has had 100%+ beats 2/3 quarters, and I believe there  should be some pretty strong buying interest moving into earnings.

should be some pretty strong buying interest moving into earnings.

Other shoe companies have faired well this earnings season. Skechers (SKX), as you may remember, had an exceptional quarter blowing out earnings. Deckers Outdoor, Steve Madden, and even K-Swiss all beat earnings estimates. Retail has been good to the shoe departments this quarter, and this quarter is the bread and butter of Crocs, moving into earnings. With the industry looking strong and the company itself poised for large growth, Crocs has already attracted industry and it should continue this afternoon.

The company has become a bit overvalued on RSI, but a recent drop of 4% has given the stock some room for growth today and tomorrow. The stock has almost 10% growth room to its upper bollinger band, and it has moved into oversold territory on fast stochastics. With the market looking down this morning, CROX probably will open a bit down and drop some to start the day. This will make the valuation even more attractive.

We will have to watch this one closely out of the gate and throughout the morning, but I will be ready to signal to you when to buy it.

Go CROX!

Entry: We are looking to enter at 12.15 – 12.25.

Exit: We are looking to exit for a 2-4% gain.

Stop Loss: 3% on bottom.

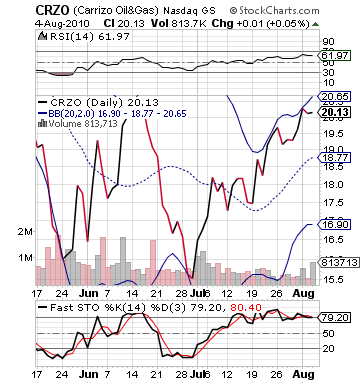

Short Sale of the Day: Carrizo Oil & Gas Inc. (CRZO)

Analysis: The market’s troubles this morning is definitely looking attractive for more short sales of some overvalued positions, especially ones that have moved outside of their upper bollinger bands. One of the best shorts that I see is an  independent oil and gas company that reported earnings this morning with a solid beat, Carrizo Oil and Gas Inc. (CRZO). The company reported an EPS at 0.34 vs. the expected 0.26 along with a solid revenue growth at 27%. The beat has helped send shares soaring close to 5% in the green this morning.

independent oil and gas company that reported earnings this morning with a solid beat, Carrizo Oil and Gas Inc. (CRZO). The company reported an EPS at 0.34 vs. the expected 0.26 along with a solid revenue growth at 27%. The beat has helped send shares soaring close to 5% in the green this morning.

Yet, CRZO is already significantly overvalued. The stock was already only 2% below its upper bollinger band. With its hefty growth this morning, a short sale and profit taking is in order. Stochastics show that the stock was already overbought, and that will move higher with a higher open. Additionally, RSI is at the short sale zone above 60.

These technicals are coupled with a market that is looking to decline this morning. Unemployment claims came in 19,000 people higher than expected, and it is the first time in weeks that they have missed so strongly. Earnings were nothing too exciting as well this morning with some pretty poor showings from a couple leaders like Unilever, Time Warner Cable, and Beazer Homes. Further, oil prices were on the decline this morning, which also does not help CRZO.

We want to get into CRZO right away this morning.

Entry: We are looking to get involved at 21.30 – 21.50.

Exit: We are looking to cover for a 2-3% gain.

Stop Buy: 3% on top.

Good Investing,

David Ristau