Was this a "good" week for the markets?

Yesterday morning I put out an Alert to Members regarging our level watch: "Keep in mind that our 2.5% levels represent a 5% run from the bottom since last week so it’s natural that we get a 1% pullback from there so the key is to hold the 1.5% line – THAT will be our bullish indicator:"

- Up 2.5% (we hope): Dow 10,455, S&P 1,100, Nas 2,255, NYSE 7,000 and Russell 650

- Must hold at 1.5%: Dow 10,353, S&P 1,086, Nas 2,233, NYSE 6,902 and Russell 644

- Middle Range (MUST hold): Dow 10,200, S&P 1,070, Nas 2,200, NYSE 6,800, and Russell 635.

As you can see from David Fry’s SPY chart, it was an interesting day and we did pull an aborted stick into the close which kept us over 1,100 on the S&P and 7,000 on the NYSE and , as you can see, our 1.5% lines did pretty much hold up as a bottom test, other than the Russell, which we had already given a pass to in the morning post as they’ve been so pathetic we’re just proud of them if they try.

We had shorted PCLN in the same Alert (congrats to all who took that one!) and the inventory report chased us out of our upside oil plays (but not nat gas) at 11 and that initiated the market slide along with, as Dave notes, a poor Treasury Auction that finally got TBT back over $33 (I had also mentioned shorting TLT several times in the past few weeks). Is this the beginning of the end of the free money express – stay tuned for more action next week!

We had shorted PCLN in the same Alert (congrats to all who took that one!) and the inventory report chased us out of our upside oil plays (but not nat gas) at 11 and that initiated the market slide along with, as Dave notes, a poor Treasury Auction that finally got TBT back over $33 (I had also mentioned shorting TLT several times in the past few weeks). Is this the beginning of the end of the free money express – stay tuned for more action next week!

This week’s action isn’t done yet and we still need to hold our levels. As I said yesterday, the best time to take disaster hedges is when we’re testing our 2.5% tops, as we were in the morning. The Dow topped out just over 10,455, tested it until about 12:45, then failed BEFORE the auction, the S&P topped out at 1,110 and held its 2.5% floor, the Nasdaq hit 2,255 on the button at the open, the NYSE also held their 2.5% line as a bottom, and the Russell fell hard but then played around the 635 line in the afternoon so we continue to watch and wait on that one.

I am not TA guy but If I were a bear, I’d be pretty darned concerned about the charts as it looks to me like the 20-day moving averages are registering a short-term mistake in a generally rising trend. If you hold these charts upside down, it does look like a head and shoulders pattern is forming so we’ll be looking for oil to pop up (but not too high – $77.50), gold to come down (but not too far – $1,150) and the SOX to hold 320 and get over that 340 mark (we picked up some Semis this week and I like USD, now $24.71, as a general SOX play).

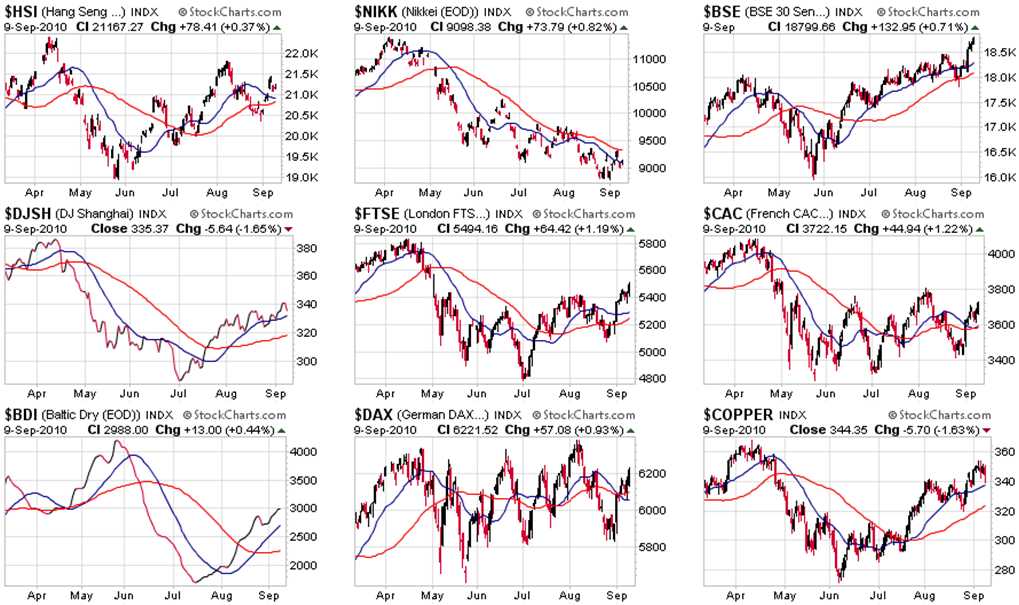

Europe and Asia are also looking much improved, with rising 50 dmas everywhere but Japan so EWJ makes a fun upside bet as that index is off about 10% since April. EWJ is just $9.73 with the Nikkei laying around 9,200 and the March $10 calls are just .40 with a delta of .40 so they will double if the Nikkei gets back to their April high in the near future and, as long as they do it by March, we can hope EWJ follows back to their April high of .60. Since the reasonable goal on a trade like this is to make 50% and the best expected case is a double – we should be quick to take a 50% gain off the table if it happens unless things look super-bullish.

Copper is a very important indicator for us. If they can’t hold their lines – then we get worried again. Also we need to watch the Baltic Dry Index as they test that 3,000 mark, which provided good support in the spring. Asia was up across the board this morning and China had a huge 35.2 increase in imports, which poped the Nikkei 1.5%, the BSE gained 0.7% and the Hang Seng added 0.4% (again) and the Shanghai bounced 0.26%. China still has a $20Bn trade surplus but this is very good news with China spending $119Bn on other people’s stuff in August – a new record – and that makes all their trading partners a little bit happier.

Housing prices in Hong-Kong are back to their 1997 highs and even Japan’s economy is slowing less than anticipated, with Q2 GDP revised up 225% to 1.5% from 0.4% although prices still dropped 2.5% in the quarter. Prime Minister Kan rolled out a 920Bn Yen stimulus package today and everyone was very excited until they realized that was just $11Bn so back to the drawing board on that one…

Housing prices in Hong-Kong are back to their 1997 highs and even Japan’s economy is slowing less than anticipated, with Q2 GDP revised up 225% to 1.5% from 0.4% although prices still dropped 2.5% in the quarter. Prime Minister Kan rolled out a 920Bn Yen stimulus package today and everyone was very excited until they realized that was just $11Bn so back to the drawing board on that one…

Europe had a rough open but recovered to flat as of 9am – there were merely reacting to our disappointing fizzle yesterday. Greece’s budget deficit fell 32.2%, year-to-date and that’s well ahead of their 26.5% goal and on their way to a 39.5% cut for the year. "The progress of deficit reduction has been temporarily hampered over the last two months because of a buildup in interest payments which amount to 40% of the year’s debt-reduction target," the ministry said in a statement. Also improving in Europe, UK house prices hit a 6-month high. This is good news for us as they began failing about 6 months before we did so hopefully we can follow them out of the hole we followed them into.

We’re not expecting much from the markets today – lots of reading to do this weekend ahead of next week’s heavy data and there will be lots to talk about but, for today, we’ll just sit back and see how the indexes perform around our levels, which we’ll be happy just to hold into the weekend.

Have a great weekend,

– Phil