The Dollar fell from 77.515 at 3:15 yesterday to 76.835 at 7:30 this morning.

That, my friends, is the story of the markets. A 0.9% drop in the Dollar overnight is a huge move, something that once upon a time would have made headlines as America's $100Tn worth of household wealth has $1,000,000,000,000 shaved off of it in some overnight catastrophe. But there was no overnight catastrophe, just the horribly normal, shockingly ordinary destruction of the US Dollar, which has now become the plaything of International Market manipulators who boost it to pump the Asian markets up overnight and then crash it to goose the US markets in the morning. It's MADNESS but we are loving it because, at least it's predictable madness.

In yesterday's post I reminded you about our $87.50 short on oil futures and we hit it again this morning and that's exactly what I said would happen in my 2:21 comment to Members when I predicted they would run oil back up into inventories. We LOVE ranges – they are so much fun to play. Gold is now 20% above our $1,150 line and at the top of that range ($920-$1,380) we've been watching since March of 2009 so I updated our "Spinning Straw Trades Into Gold" post with a whole new set of trade ideas to help protect our cash if the dollar keeps getting weaker and gold keeps heading higher.

As I said to Members in yesterday's Morning Alert, it's all a huge sham but it's the only game in town so we just need to learn the silly rules and figure out how to win if we want to keep playing (although I am currently advocating mainly cash and playing just for fun as we test our upside). We did go for an ABX trade in Member Chat on Friday, a play that was also made available to Stock World Weekly readers over the weekend (last chance to subscribe before we're out of Beta and the rates double!) and ABX is, of course, flying as gold broke through the $1,400 mark yesterday. So we like gold as a small hedge against inflation eating into our sidelined cash but, on the whole, I'd rather short it – I just want to be clear about that.

We can't short gold with Benny and Timmy running the printing presses day and night so we're picking on oil off the $87.50 line in the futures. There is no demand for oil, it's pure speculation and I don't think the World Bank is going to come out and tell people that we should start using oil for currency any time soon so it's safer to play oil to get real than gold. At least with oil, we get an actual inventory report with demand numbers every week – copper, unfortunately, is based on a lot of guesswork and copper has shot up to $4.02 and also makes a compelling momentum short below the $4 line as that's another unrealistic number as we are back to 2008 highs despite the fact that, GLOBALLY, 10% less people have jobs than in 2008 and 75% less commercial and residential construction is going on. So what is this copper being used for? IT'S NOT – IT'S TOTAL BS SPECULATION!!!

This is a chart from Q2 and you can see the record stockpiles even then. The stockpiles haven't gone down, of course but the price of copper has jumped another 33% in the past 3 months – completely disconnected from the fundamental supply and demand curve. How long can this last? Until the suckers run out of money of course!

We learned our lesson in 2008 not to bet against the sheer stupidity of commodity speculators as oil went from $100 to $140 a barrel as if people could actually afford to pay $100 per tank for gas (not to mention the impact on food prices). The market delivered a very harsh lesson that fall as consumer spending ground to a halt once the stimulus money ran out and, when people could no longer refinance their homes to pay for gas, the whole ball of wax came undone at record speeds. Well, here we are just over 2 years later and I can say with virtual certainty that WE HAVE LEARNED NOTHING! I mean really people – this isn't some academic discussion about tulips in Holland in 1637 – this just happened, TO US, 2 YEARS AGO.

Well, not "us" exactly as we were short oil at the time of the crash but US as a country and it really saddens me to see how we can simply repeat the same mistakes over and over again. What we, at PSW, did learn is not to go too crazy shorting the madness. Oil took 6 months to fall from $140 to $35 in 2008 and gold fell from $1,000 back to $700 in 7 months so there is no major need to get in right at the top. What there is a need for is cash as we need to be flexible and ready to go with that downward flow once it gets going.

Well, not "us" exactly as we were short oil at the time of the crash but US as a country and it really saddens me to see how we can simply repeat the same mistakes over and over again. What we, at PSW, did learn is not to go too crazy shorting the madness. Oil took 6 months to fall from $140 to $35 in 2008 and gold fell from $1,000 back to $700 in 7 months so there is no major need to get in right at the top. What there is a need for is cash as we need to be flexible and ready to go with that downward flow once it gets going.

Keep in mind that a weak Dollar does lift all ships so it's all about the dollar bounce. If the dollar does fail the 76 line, which may happen if the G20 don't take action to stop it over the weekend, then we will be right there – betting with the idiot speculators but we'll be the ones nervously looking over our shoulders, waiting for the other shoe to drop. Our new gold plays are step one towards making sure we don't miss out if the markets do pop our breakout levels but so far, they haven't and we will wait PATIENTLY for a proper test.

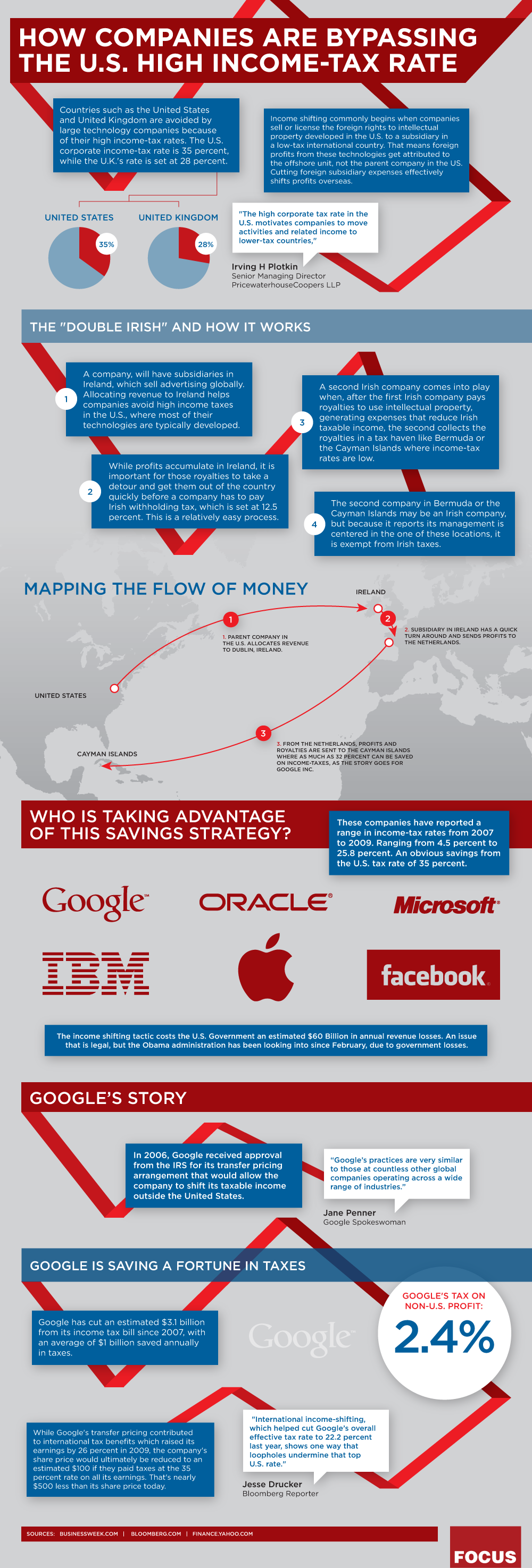

Here's something you MUST read. I keep getting attacked as a liberal and I am to a large extent but my issue in tax policy centers around the top 0.01%, the people AND corporations who make over $100M per year and pay less than 15% taxes. If this group alone paid 35% like most people, then the bottom 99.99% could pay 30% less AND we would have a balanced budget AND we would be able to pay off our debt with the surplus as we're talking $2Tn in unpaid taxes here! Barry Rhitholtz had a great chart showing how companies like Google, IBM, ORCL and MSFT use loopholes to pay 2.4% tax on foreign income (which is 1/2 of the S&Ps income):

In an unrelated matter, PSW will be moving it's publishing center to Ireland but our main office will be in the Netherlands and if you need me, I'll be on the beach at Ritz-Carlton, Grand Cayman, where my tax savings should pay for a year-round suite! That's right, screwing the government over isn't just for the big boys so thanks to Barry for the how-to chart and thanks to voters for making sure these loopholes will never close – see ya suckers!

Hopefully the Caymans will be a safe haven when it all hits the fan and the fan is already hitting something as the life-support system that the EU is using to support Greece, Ireland, Portugal and Spain is under pressure in the current credit squeeze and all 27 member states of the EU have now agreed that revisions need to be made to the Lisbon Treaty in an attempt to stop things over there from spinning out of control — Again… At the same time, the World Bank (the guys who are pushing for the gold standard) now says Asia may need capital controls to control the bubbles that are forming in the region’s stock, currency and property markets thanks to US QE practices. Real-estate prices are a concern in China, Australia and parts of Southeast Asia. Japan, Thailand and Malaysia have seen their currencies surge more than 10 percent against the dollar this year, while some of the region’s stock markets have jumped more than 50 percent, Sri Mulyani said. Sri Lanka’s benchmark stock index is up more than 90 percent this year, while the measures for Thailand and Indonesia have exceeded 40 percent.

Hopefully the Caymans will be a safe haven when it all hits the fan and the fan is already hitting something as the life-support system that the EU is using to support Greece, Ireland, Portugal and Spain is under pressure in the current credit squeeze and all 27 member states of the EU have now agreed that revisions need to be made to the Lisbon Treaty in an attempt to stop things over there from spinning out of control — Again… At the same time, the World Bank (the guys who are pushing for the gold standard) now says Asia may need capital controls to control the bubbles that are forming in the region’s stock, currency and property markets thanks to US QE practices. Real-estate prices are a concern in China, Australia and parts of Southeast Asia. Japan, Thailand and Malaysia have seen their currencies surge more than 10 percent against the dollar this year, while some of the region’s stock markets have jumped more than 50 percent, Sri Mulyani said. Sri Lanka’s benchmark stock index is up more than 90 percent this year, while the measures for Thailand and Indonesia have exceeded 40 percent.

According to the WSJ: "Global controversy mounted over the Federal Reserve's decision to pump billions of dollars into the U.S. economy, with President Barack Obama defending the move as China, Russia and the euro zone added to a chorus of criticism. Mr. Obama returned fire in the growing confrontation over trade and currencies Monday in a joint news conference with Indian Prime Minister Manmohan Singh, taking the unusual step of publicly backing the Fed's decision to buy $600 billion in U.S. Treasury bonds—a move that has come under withering international criticism for weakening the U.S. dollar."

It's a good week to watch and wait. The bullish premise remains the devaluation of the dollar and, as far as bullish premises go – it's a very good one but there are plenty of negative overhangs and this is NOT the time to tie up your capital in stocks so cash remains king and we have many, many ways to go short (like selling PCLN Jan $450 calls for $16) once this rally exhausts itself.

Keep being careful out there!