I'm dreaming of a white Christmas – how about you?

I'm dreaming of a white Christmas – how about you?

Of course too much snow ahead of Christmas is bad for retailers and airlines as flights and even (gasp!) trips to the mall can be canceled by a big storm. This is a La Niña year, which means the Pacific Ocean is colder than average and that can lead to much more snow than we've had in the past few years. Accu-Weather's long-term forecast already predicts at least 1 inch of snow for 50% of the country on Christmas Day (when did weather forecasting get this precise, one wonders?).

Accuweather’s chief long-range forecaster, Joseph Bastardi, said recently that a series of storms crossing the country before Christmas will deliver snow to the northern half of the United States. He also said the weather pattern is set up in the middle of this month to bring what he calls a “blockbuster” storm with 6 to 12 inches of snow and strong winds to the northeast. All in all, it's just another of the many, many factors we need to stay on top of this holiday season.

Of course the oil and gas crowd are loving the cold weather so far but that's due for a big flip as lots of snow from La Niña (and take this from an old ski bum) generally leads to a pretty warm winter overall. Right now, heating oil and natural gas is being extrapolated based on our recent cold snap (much worse in Europe) to be enough to work off the massive inventory overload but we are right at the top of the 5-year range in natural gas inventories and it's going to take a bit more than a week or two of cold weather to reverse this trend:

Of course, this is nothing compared to the ridiculous over-supply of crude in the United States:

This is something you never hear covered in the MSM, as they give you their "news" between commercials for energy companies. It should go without saying that GE, a company who has tens of Billions of dollars in profits riding on ever-increasing energy prices, is NEVER going to tell you anything but how scarce oil is and how lucky we are to be allowed to pay $100 a barrel for it.

The fact that we have 10% more oil than the high end of the 5-year average or 20% more oil than the low end doesn't come as a shock to PSW readers – we track this stuff all the time but it should come as a shock to consumers, who are paying 50% above the last 5-years' average of $59.60 in the first week of December. THEY should be paying US to take some of this excess oil off their hands!!!

We are so swimming in oil that we are EXPORTING 2.1M barrels of refined products a day. This is over a 100% increase in the past 5 years and a 50% increase in the last two years and is a favorite trick of the commodity pushers as it creates both a false impression of demand for crude by US consumers (+10% a day) as well as a false impression of use of that oil (consumption) as US refiners send fuel out to other markets and then they turn around and tell you that their is tight capacity – which is another total lie entirely. Even if all this BS manipulation doesn't surprise you, does it at least make you angry enough to ask your brand new Republican Congressman to investigate? You can contact you newly elected champions of the people right here – I'm sure they'll get right on it because it's not like the re-election of the Republicans directly resulted in a 10% jump in the price of oil as the speculators once again decided they can go back to raping the American people as they once again fall under the lazy eye of "friendly" regulators.

We are, in fact, using LESS gasoline now than we did in 1983 or, of course, any year since. Gasoline consumption this year has been averaging 10% LESS than 2009 with 43.8 gallons/day delivered in September (the last month counted) by US refineries vs. 48.6M in Sept 2009 and 53.4M in Sept 2008 and 57.7M in Sept 2007 and 59.7M in Sept 2006. Feeling ripped off yet? We, as a country, have cut back our consumption of gasoline by 16M gallons a day (26%) in 5 years yet the price of gasoline is going HIGHER. Not only that, but the US consumed an average of 60M gallons a day between 1995 and 2004 when oil was $20-30 a barrel and gas was $1 so we are now consuming almost 30% less fuel and paying 200% more for the privilege. Are we, in fact, the World's biggest suckers? Is the lack of regulation in America nothing more than a way for Big Business to rip off the American consumers (while paying no tax on their profits)?

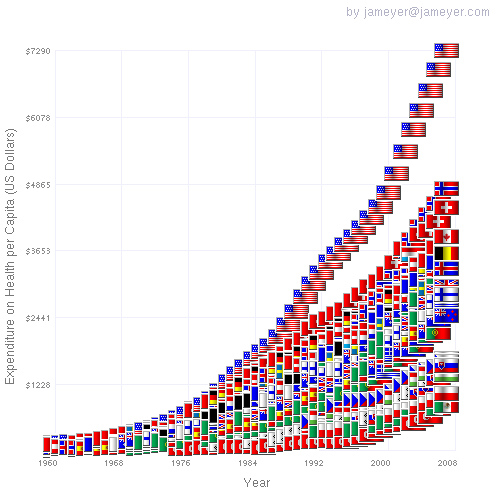

Let's look at health care, as another example. Here's a nice chart from The Incidental Economist (via Barry) that neatly sums up US Health Care Costs vs the rest of the World. That's just two countries above Canada and the rest of the World below their $3,700 per capita Health Care Spending while we are proudly over $7,300 per person, and that was two years ago, when things were much cheaper! Even more interesting is the chart of Health Care broken down by Presidential terms but that chart makes it so blatantly obvious that Republicans have been selling this nation down the river for decades that I don't want to even put it up here or people may say I'm somehow biased.

Let's look at health care, as another example. Here's a nice chart from The Incidental Economist (via Barry) that neatly sums up US Health Care Costs vs the rest of the World. That's just two countries above Canada and the rest of the World below their $3,700 per capita Health Care Spending while we are proudly over $7,300 per person, and that was two years ago, when things were much cheaper! Even more interesting is the chart of Health Care broken down by Presidential terms but that chart makes it so blatantly obvious that Republicans have been selling this nation down the river for decades that I don't want to even put it up here or people may say I'm somehow biased.

So we'll just move along and pretend that there's no real way to know who's responsible for runaway health care costs or spiraling commodity prices as it must be some gigantic coincidence that the Dems take control of Congress (along with the regulatory and investigative committees) in 2007 and the commodity boom finally loses some steam and then the Reps take control back in 2010 and – well, here we go again.

As I've said before, I am trying really hard not to give a damn – let's just make our money and get out before it all hits the fan!

Look at all these lovely countries we can move to and save 50% or more on health care costs. Virtually none of those nations has anywhere near the debt levels of the US and most of them have great public transportation and more public services than we do so many, many fine places to retire (US ranks 15th, very sadly beaten by Columbia at 13!) after we join the commodity pushers and the Gang of 12 in squeezing every last dime from the suckers that are going down with this sinking ship. If they can't be motivated to send an Email off to complain about it then they get exactly the government they deserve, right?

Enough about what's wrong with America – let's talk about a much more serious economic issue – the misuse of cartoon bears! It's only been a month since the Bernanke Bears hit the big time with their hit viral video, "Quantitative Easing Explained," which was brilliantly done and contained some great economic information presented in a humorous fashion. There have been a couple of other good ones since but (and here is the BIG problem), there have also been dozens of bad ones. The problem with using Avatars or even aliases on the Web is your work can be co-opted. This is why you're reading Phil's Stock World – I protect my brand by being a known entity, something most of the major players do as well.

Unfortunately, we don't know the name of the guy who did the original Bernanke Bears and, even more unfortunately, since he used a generic cartoon maker – ANYONE can use these characters to say anything they want. Ordinarily, this is not a problem but now these bears have gained a certain amount of "credibility" so, when they tell you that the Fed is pumping money into JP Morgan in order to artificially depress the silver market and keep the dollar down – people actually believe it. So much so, in fact, that goldsilvergold.com has SOLD OUT of ALL products it has been pushing in it's own bit of Teddy Bear Propaganda.

Of course, maybe they are not sold out – these are obviously (well, to us) unscrupulous, lying, manipulative bastards who should be waterboarded by the SEC or the CTFC or SOMEONE (at this point, I would even condone the use of JPM's storm troopers) for the blatant misuse of bear economists as well as the blatant manipulation of the silver market. It's funny how the "smart" bear calls the other one a "sheeple" (and kudos to me for that catching on!) and then goes on to herd him off into the next foolish investment. Amazingly, it doesn't occur to the brown bear to ask the other one why he wants to sell silver for $25 an ounce when it's a "sure thing" that it's going to $500. What could the tan bear possibly be doing with the cash that will give him a 2,000% return when the dollar is crashing and silver is getting squeezed through the roof that he would want to give up his precious silver for?

Like any great lie, there is a grain of truth to it. The Fed is flooding the world with dollars, JPM is a known manipulator of silver and the historic gold to silver ratio is 16:1. Of course, if you believe silver is going to $500, then gold is going to $8,000 based on that premise so it's still better to go long on gold. On the other hand, I think that silver is actually priced right at $25 and it's gold that should be coming down to $400, not the other way around! Of course, that's what makes a market, right? Also, like any good rumor, it gets a lot of legs when the company the rumor is based on is known for not commenting and it's very doubtful JPM will be "clearing the air" about their exact position on silver to answer the accusations of cartoon bears.

This, my friends, is EXTREME manipulation. The same kind of ridiculous manipulation we had at the top of the meltdown in 2008 with idiotic statements coming out like "Oil $200," "Gold $5,000," "GOOG $2,000" and $1M for 1Br Miami apartments – all designed to chase the last round of suckers (aka "bagholders") into the market "before it's too late." Well, here we go again! Once it was sock puppets, now it's cartoon bears driving our investment decisions – I'm going to propose a show where I put 8 finger puppets in an "octo-box" to debate monetary policy – should be a big hit…

As I said last week, we're now in a market that is driven by the latest rumor and I'm sorry to be such a Grinch but I've ridden this ride before and I know how it ends and so have you all but you just seem to forget every 6 months – which I find very strange but that's OK – it's my job to remind you and help to try to keep a little perspective on things. There is nothing worse than "missing" an opportunity and that's what it feels like to us when the market ticks up instead of down and we're not playing but our friend Mr. Buffett sat out the dot com rally and he sat out the 2007 rally and he didn't make any major deals (much to the chagrin of his shareholders) until November 2007 through April of 2008 – when he decided to go on a buying spree. Now, you may think he's old and slipping but who's been paying you $2.6M to have lunch with them?

Getting back to 2007 – I've also ridden a ride where we thought it was over but it just kept on going up and up and up. That happened in 1998-1999 as well. The end-stages of bubbles can give you the biggest gains but boy do they pop hard and fast so it's a tricky thing to time. We had a couple of "toe-dipping" plays on Friday that have massive returns if the market does move higher. With the Fed and now the ECB pumping about $2Tn more into the global economy – the cartoon bears may yet have their $500 silver one day but let's just keep in mind that it's all fake and it's all being manipulated and it's all going to end very, very badly unless we create 10M jobs, reflate housing, refund pensions and stop global warming.

OK, maybe that last one is a myth but the other 3 are VERY real and should not be ignored (like we do global warming).

Market Tamer thinks we're trading in a range through the end of the year and this is still the top of it – that fits in with what I'm seeing but it's still all about the dollar in the end. The real question is: Can The Bernank drop the value far enough and can the Euro stay strong enough to get the Dollar back under 78.50, where it needs to be to pop the market higher? I'm sure they will try their best this week and a lot is riding on the Irish vote so let's keep an open mind in either direction – that's what we're supposed to do when we're in cash. If we're not going to be open to the possibility that the market could go either way – then why aren't we invested now?

A cash call is all about uncertainty and this is one MoFo of an uncertain market!