Wow, day 10 already?

Wow, day 10 already?

What an exciting year 2011 has been already. Last Monday we predicted we’d be following the chart on the right where we had a big opening day and then some violent up and down swings that actually have the amazing net effect of LOWERING the Volatility Index (VIX) as Lloyd Blankfein continues to do God’s work by running the same Alpha 2 program he ran last year to herd the sheep into the slaughter that followed January’s option expiration day (Jan 19th).

This time, things will be different – because options expiration day is the 21st! Other than that, so far, not so different with the Dow gaining the exact same 200 points in the first week of the month, finishing on that same down note we had the first full-week’s Friday of 2010. The danger to this pattern is the dollar – which is breaking up ahead of schedule and, as discussed in-depth in this week’s Stock World Weekly, the dollar rules the markets and even the mighty Goldman Sachs’ TradeBots can’t fight the multi-Trillion Dollar daily Forex market for long.

Last year, the Dollar didn’t pop 81.50 until March, when we were already recovering from the market dip. This morning, the Dollar is already drifting over 81.50 and looks like it may head higher, as the Euro is testing it’s lowest levels ($1.28) since early September, when we were having a bit of a rough patch in the market. Since then, the Euro was up 10% and the US markets went up 10% (what a coincidence!) but now the Euro is back down 10% and the TradeBots are working overtime just to keep us on track. Who will break first? This is very exciting stuff but, it looks like the rest of the World is beating us to it so far:

Wow, that Baltic Dry Index does not look good, does it? According to Bloomberg, freight rates for commodity shipping are at the lowest price since 2002, when China’s economy was 75% smaller and the S&Ps GSCI commodity index was 67% lower. What can this mean? Well, for one thing it means that all this commodity trading that’s driving up prices has NOTHING to do with demand and is NOTHING but speculators trading bits of paper back and forth while the supply sits in warehouses, waiting fruitlessly for a customer to show up. What will break first? Will customers suddenly come bursting through the doors to buy stockpiled commodities at record high prices or will short sellers begin to dog-pile on the commodity markets and break the backs of the speculators the way the broke housing and oil and then, LEH and BSC in 2008?

The Shanghai composite lost another 1.6% this morning with the Hang Seng right behind it with a 0.7% drop. Note those blue support lines that are breaking are 20-day moving averages while the reds are 50s with the Baltic Dry, Shanghai and India already collapsing and Germany and France only a couple of bad days away from a breakdown so we’ll be watching that 23,500 line on the Hang Seng as a Global "must hold" fulcrum for the global economy this month.

The Shanghai composite lost another 1.6% this morning with the Hang Seng right behind it with a 0.7% drop. Note those blue support lines that are breaking are 20-day moving averages while the reds are 50s with the Baltic Dry, Shanghai and India already collapsing and Germany and France only a couple of bad days away from a breakdown so we’ll be watching that 23,500 line on the Hang Seng as a Global "must hold" fulcrum for the global economy this month.

Hugh Hendry, who painted a great image this weekend by saying "I see Japan as a nuclear bomb strapped onto the chest of the Global economy" is buying CDS’s betting on the default of Nippon Steel, JFE Holdings and other Japanese companies he feels have extremely underrated risk profiles due to heavy ties to China’s economy.

Hendry is now focusing his rhetoric — and investing strategy — on the bigger target: China. He’s betting that growth in the world’s No. 2 economy will collapse because of rampant real-estate speculation, sending shock waves through Asia and beyond. The problem, Hendry says, is that China’s gross domestic product growth isn’t matched by wealth creation at home. In his doom-laden scenario, a plunge in Chinese stock prices and property values will be exacerbated by a softening demand for the country’s exports, triggering an extended period of global deflation and slower growth.

A slump in the price of Japanese bank shares shows that Hendry may be on to something. The Topix Banks Index, which tracks Japanese banks, sank on Nov 1st to its lowest level since at least 1983, when Bloomberg first tracked the data, as demand for loans dropped in a sluggish economy. The index has trailed the benchmark MSCI World Bank Index since mid-2009. Hendry promoted his downbeat view on China by traveling to that country’s major cities with a video camera in the spring of 2009. His report, in which he pointed out numerous empty skyscrapers, has been viewed nearly 100,000 times on YouTube.com – a story we’ve been tracking on PSW as well.

Of course, Hendry is not the only person painting a gloomy scenario. This weekend, the American Economics Association gathered in Denver to discuss, in my opinion, way too many topics but some I found interesting including Ethics (must have been the humorous opening), Asset Bubbles, Health Insurance, Price Dynamics, Price Fixing, Environmental Subsidies, Child Development, 1931’s Currency Crisis, 100 Years of US Bank Panics 1825-1929, Business Cycle Synchronization, Sovereign Risks, Measuring Happiness as a Policy Tool, Corporate Taxation and hundreds of other papers that will take the rest of the year just to read. What I find very amusing is the way that various media outlets are using this conference to make broad points, as if thousands of economists got together and made a statement when, in actual fact, the vast majority of them were gathered in tiny little classrooms reading papers to each other although they were all very happy to speak on behalf of the majority whenever a microphone was shoved in their faces – perhaps they missed the lecture on ethics…

Hopefully, I don’t have to tell you to ignore economists. The average economist has about as much chance of being right as the average English Professor has of writing the next great American novel or the average Music teacher has of winning American Idol. This is nothing against teachers but, just because someone is "an economist" doesn’t mean they know very much about the economy. As rock-star Economist, John Maynard Keynes once said: "The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist."

Hopefully, I don’t have to tell you to ignore economists. The average economist has about as much chance of being right as the average English Professor has of writing the next great American novel or the average Music teacher has of winning American Idol. This is nothing against teachers but, just because someone is "an economist" doesn’t mean they know very much about the economy. As rock-star Economist, John Maynard Keynes once said: "The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist."

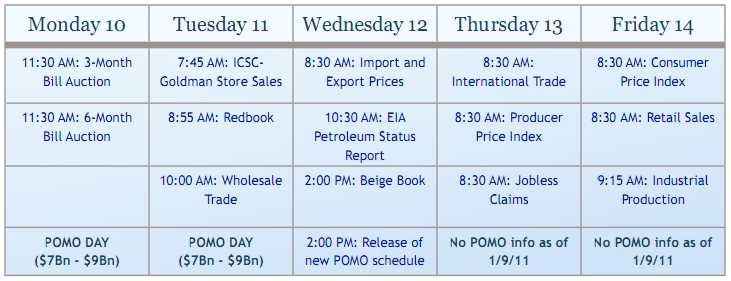

According to Stock World Weekly, POMO runs out on Tuesday with a new schedule due at 2pm Wednesday. Meanwhile, The Bernank will drop $18Bn on the IBanks today and tomorrow so don’t expect this morning’s dip to last and we also get the Fed’s Beige Book on Wednesday, which is always a good market mover we love to follow. According to SWW, the week’s economic calendar’s highlights look a little like this:

In addition to all that excitement, we finally get some earnings but it’s light this week with AA kicking off the big boys tonight bookmarked by JPM Friday morning but, other than INTC on Thursday, not too much excitement this week. NEXT WEEK, on the other hand, we have about 100 reports right into expiration day with C, CREE, IBM and AAPL all on Tuesday and a lot of financials in what is bound to be a very exciting expiration week.

We’ll see if Lloyd’s Alpha 2 can hold the markets together this week. We still have to get to Dow 12,000 and, of course, Russell 800 to make an impression that breaks last year’s scary image and that’s going to be very, very hard with the Dollar over 81.50 so step one is to pull out all the stops to break the buck. BP has already begun the process by shutting down the Alaska Pipeline, cutting off 650,000 barrels a day of oil imports to the mainland US. That has driven oil back to $90, where we’ll be shorting it again as this is a sucker’s play as the NYMEX traders desperately attempt to dump the ridiculous 600M barrels of oil they have piled up in false orders for the front three months of trading (Feb-April).

BP has already been implicated in trading scandals so let’s not get all shocked that they would cut off oil supplies to the US in order to manipulate the prices on the NYMEX when there’s an embarrassing build-up of inventory. Now, if only there were a copper pipeline someone could fake, then FCX could hold $117.50 but, as I said, it’s all about the dollar there and it will be for oil too as we seem to have hit the point ($90 oil) at which consumers stop buying oil faster than the US energy cartel can stop producing and importing it (new year-low numbers of imports again last week).

Let’s be careful out there.