I have a dream too.

I have a dream too.

My dream is that one day the markets will be left alone and we can get back to trading on fundamentals that can be measured like: "Does the company make a good product that is in demand at profitable and sustainable margins" rather than "How much stimulus money can they get their hands on and is their stock a good candidate for the next pump and dump program run by the IBanks using our taxpayer dollars to make the price of both equities and commodities much more expensive than they should be while depressing interest rates so we are also grossly underpaid for our savings."

We used to look at the Russians and wonder how they could put up with a corrupt Government that falsifies data and puts pressure on the press to spin the news in a positive light while the people suffer and the oligarchs line their pockets, committing blatant crimes with the blatant attitude of people who know that their political connections keep them above the law.

Well, as John Mellencamp once pointed out: AIN’T THAT AMERICA? Or, as Ronald Reagan warned us in 1983:

Leaders have openly and publicly declared that the only morality they recognize is that which will further their cause… that they repudiate all morality… or ideas that are outside class conceptions. Morality is entirely subordinate to the interests of class war. And everything is moral that is necessary for the annihilation of the old, exploiting social order. The refusal of many influential people to accept this elementary fact… illustrates an historical reluctance to see totalitarian powers for what they are. We saw this phenomenon in the 1930’s. We see it too often today.

It was C.S. Lewis who, in his unforgettable "Screwtape Letters," wrote: "The greatest evil is not done now in those sordid ‘dens of crime’ that Dickens loved to paint. It is not even done in concentration camps and labor camps. In those we see its final result. But it is conceived and ordered (moved, seconded, carried and minuted) in clear, carpeted, warmed, and well-lighted offices, by quiet men with white collars and cut fingernails and smooth-shaven cheeks who do not need to raise their voice."

Well, because these "quiet men" do not "raise their voices"; because they sometimes speak in soothing tones of brotherhood and peace; because, like other dictators before them, they’re always making "their final territorial demand," some would have us accept them at their word and accommodate ourselves to their aggressive impulses. But if history teaches anything, it teaches that simple-minded appeasement or wishful thinking about our adversaries is folly. It means the betrayal of our past, the squandering of our freedom.

Reagan was, unfortunately, not warning us about Investment Bankers at the time, he was banging the fear drum and driving the US to the largest peace-time arms build-up in history as he trashed Carter’s START initiative where we had mutually agreed with Russia to cut our nuclear arsenal by 50%. Reagan instead insisted that Russia could not be trusted to live up to an agreement, therefore it was our patriotic duty to increase spending by 66% during his term while the 9/11 wars, now entering their 10th year, have driven the base military budget (not counting war costs) to near WWII inflation-adjusted highs of over $650Bn per year.

Reagan was, unfortunately, not warning us about Investment Bankers at the time, he was banging the fear drum and driving the US to the largest peace-time arms build-up in history as he trashed Carter’s START initiative where we had mutually agreed with Russia to cut our nuclear arsenal by 50%. Reagan instead insisted that Russia could not be trusted to live up to an agreement, therefore it was our patriotic duty to increase spending by 66% during his term while the 9/11 wars, now entering their 10th year, have driven the base military budget (not counting war costs) to near WWII inflation-adjusted highs of over $650Bn per year.

Another American President, Five-Star General Dwight D. Eisenhower, had warned us in 1960, not indirectly or subtly but DIRECTLY and POIGNANTLY that:

We have been compelled to create a permanent armaments industry of vast proportions. Added to this, three and a half million men and women are directly engaged in the defense establishment. We annually spend on military security more than the net income of all United States corporations.

This conjunction of an immense military establishment and a large arms industry is new in the American experience. The total influence — economic, political, even spiritual — is felt in every city, every State house, every office of the Federal government. We recognize the imperative need for this development. Yet we must not fail to comprehend its grave implications. Our toil, resources and livelihood are all involved; so is the very structure of our society.

In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the militaryindustrial complex. The potential for the disastrous rise of misplaced power exists and will persist.

We must never let the weight of this combination endanger our liberties or democratic processes. We should take nothing for granted. Only an alert and knowledgeable citizenry can compel the proper meshing of the huge industrial and military machinery of defense with our peaceful methods and goals, so that security and liberty may prosper together.

Did America listen to the often-decorated military leader who fought in World War I and helped lead us to victory in World War II – the man who derailed Robert Taft’s platform "Against Communism, Korea and Corruption" and instead won by a landslide and used his mandate to end the Korean War, sweeping Joseph McCarthy out of office? Did we listen to the man initiated the "Space Race," shepherding those who we still call "Our Greatest Generation" by emphasizing science and research to keep our nation competitive while expanding the scope of Social Security and putting Americans to work with the massive Federal Highway Act of 1956? No, as it turns out, we listened to the cowboy actor, who was best known for partnering with a monkey, and look where it got us!

Did America listen to the often-decorated military leader who fought in World War I and helped lead us to victory in World War II – the man who derailed Robert Taft’s platform "Against Communism, Korea and Corruption" and instead won by a landslide and used his mandate to end the Korean War, sweeping Joseph McCarthy out of office? Did we listen to the man initiated the "Space Race," shepherding those who we still call "Our Greatest Generation" by emphasizing science and research to keep our nation competitive while expanding the scope of Social Security and putting Americans to work with the massive Federal Highway Act of 1956? No, as it turns out, we listened to the cowboy actor, who was best known for partnering with a monkey, and look where it got us!

This is not a political statement – this is the background to our current national economic reality as Congress opens their delayed session (delayed due to a shooting spree) where the chart on the right will be gone over as they look in that bottom 47% of the discretionary spending pie for places to make further cuts while our military portion grows from 53% to 55% to 60% to, hopefully (I guess) 65% of our discretionary spending if the Republicans are to achieve their goal of shaving $250Bn off the discretionary budget without cutting the military.

At what point do you admit that you are living in a military state? Is that when the military budget crosses 75% or does it have to get to 90%? When do you admit to yourself that your duly-elected government’s main priority is not Health (5%), Transportation (7%), Education (7%), Housing (3%), Science (2%) or, God forbid – the Environment (3%) but is, in fact, running what is by far the largest peacetime army in the history of the Earth – a budget that is now almost 50% of the rest of the planet’s ENTIRE military budget and that includes our allies, who make up another 25%?!?

Are we "smart" for maintaining massive military superiority or fools for squandering the development of infrastructure, education, science, research and development that could keep our nation great (not to mention EMPLOYED) long-term? Instead we pursue short-term military solutions that resolve nothing while our overwhelming military presence makes the US a much-resented powerful-looking target to the poor and powerless nations of the earth.

Again, I’m not looking to have a political debate but ALL of the decisions our Government will be making are very tied up in this central issue, of course. After all, it is 53% of our discretionary budget already and our Treasury is borrowing $140Bn PER MONTH to support that budget as well as the stimulus spending or tax cuts or whatever it is you want to call the cause of our nearly $2Tn 2011 budget deficit.

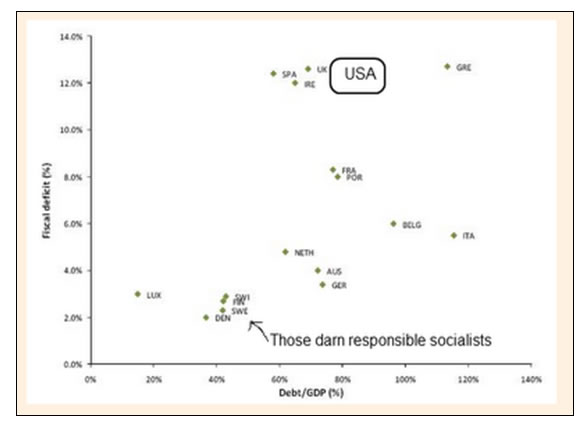

When you look at Ireland and Greece and Portugal and you shake your head and go "tsk, tsk" at the silly little countries that can’t control their budgets – keep in mind that ONLY Greece has a deficit AND debt to GDP ratio that is comparable to the US.

When you look at Ireland and Greece and Portugal and you shake your head and go "tsk, tsk" at the silly little countries that can’t control their budgets – keep in mind that ONLY Greece has a deficit AND debt to GDP ratio that is comparable to the US.

Although the UK, Spain and Ireland have current deficits that approach our 12% annual mark, none of them have our 90% debt to GDP ratio and while Italy and Belgium have 100%+ debt to GDP ratios, they are only adding to their problem at a rate that is 50% below the snowballing disaster we are running. In a fair and open marketplace, our debt would be treated as junk and interest rates would soar and our economy would cool.

Clearly that is not happening so let’s consider the mechanics that go into manipulating (and there is no better word) a "better" outcome and also consider how long this manipulation can be kept up as well as whether or not our supported economy will be able to eventually stand up on its own (and, if so, when) or if we are simply killing the patient with this particular "cure" that masks the symptoms well enough but encourages the growth of the underlying disease.

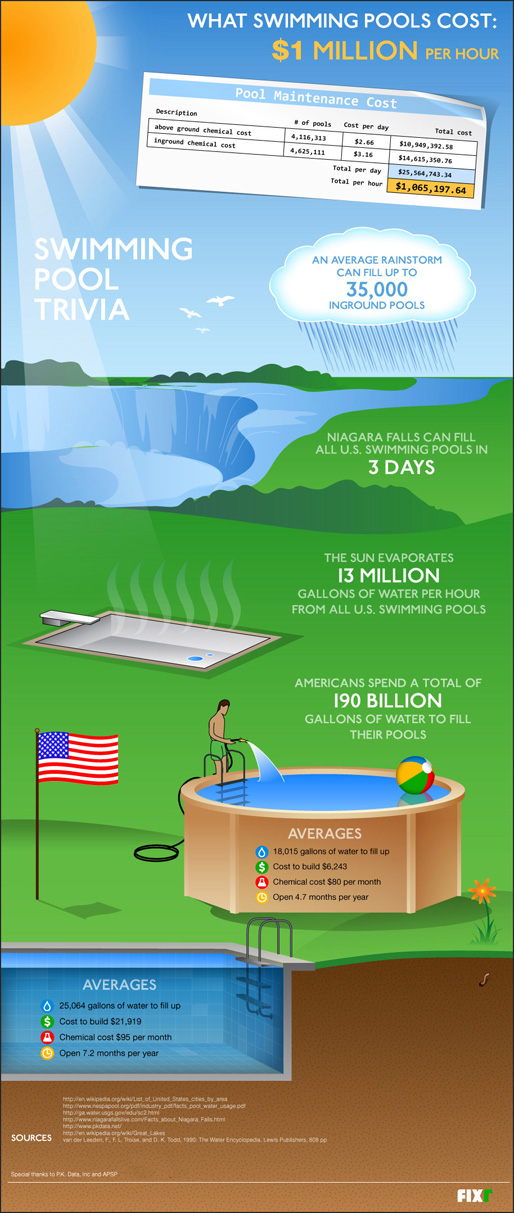

What is the disease? Well, it doesn’t take Hugh Laurie to figure out that we are dealing with a collapsed economy. Like a collapsed lung, it has suffered a traumatic shock (blame whatever/whoever you like) and is unable to work on it’s own. Not to get all medical but generally a collapsed lung suffers from deflation (sound familiar?) and the goal a doctor has is to re-inflate the lung but that cannot be done until the pressure that caused the lung to collapse is dealt with first. Another example I use with members is comparing the economy to a swimming pool with a large hole in it. You can keep pumping in water (stimulus) and, if you do it enough you can keep the level stable or even make it rise but it’s a false positive because, as soon as you stop pumping (stimulus) – if you have not fixed the hole, the water simply rushes back out again and you have another collapse on your hands.

So, sticking with the swimming pool, if you have a 100,000 gallon pool with a 50 gallon a day leak, every month you will lose 1.5% of your water or about 1,500 gallons and if you need 1 gallon of water per goldfish (jobs) then 1,500 goldfish die each month as well. Now most pool men will come by and do a few tests but, as often as not, they will tell you that the best way to treat the leak is to let the pool drain out and fix it properly when it’s dry. This is pretty simple and obvious but perhaps you are having neighbors (investors) over the next weekend (or an election next year) and you don’t want them to see an empty pool. So what do you do? You fill it. You pump 50 gallons a day back into the pool and maintain your water levels and save 350 goldfish per week and the pool looks great and all your friends vote for you and make you neighborhood party coordinator but, unfortunately, that means they’ll be coming back next week too.

So, sticking with the swimming pool, if you have a 100,000 gallon pool with a 50 gallon a day leak, every month you will lose 1.5% of your water or about 1,500 gallons and if you need 1 gallon of water per goldfish (jobs) then 1,500 goldfish die each month as well. Now most pool men will come by and do a few tests but, as often as not, they will tell you that the best way to treat the leak is to let the pool drain out and fix it properly when it’s dry. This is pretty simple and obvious but perhaps you are having neighbors (investors) over the next weekend (or an election next year) and you don’t want them to see an empty pool. So what do you do? You fill it. You pump 50 gallons a day back into the pool and maintain your water levels and save 350 goldfish per week and the pool looks great and all your friends vote for you and make you neighborhood party coordinator but, unfortunately, that means they’ll be coming back next week too.

Now, let’s think of our "leak" as being measured by our deficit spending. Lack of jobs, lack of business activity, stupid tax policies, etc. cause low levels of collection – there is no "rain" to fill up the pool, the normal hoses are not working and the system cannot sustain itself. We have a trade imbalance that leads to more losses, like evaporation on hot day as money simply disappears and leaves the country – another way we end up with a hole to fill and, of course, we drain "water" out of th system through deficit spending as interest rates and other liabilities pile up on us.

There are many factors and many ways to place blame but the FACT is that we, as a country are losing $140Bn a month. That is our own $5Bn per day leak that needs to be filled and we fill it by selling Treasury bills which is money we are borrowing from our neighbors, who keep lending it to us as long as they don’t think we have any problems with our pool.

There are many factors and many ways to place blame but the FACT is that we, as a country are losing $140Bn a month. That is our own $5Bn per day leak that needs to be filled and we fill it by selling Treasury bills which is money we are borrowing from our neighbors, who keep lending it to us as long as they don’t think we have any problems with our pool.

But we do. We have serious problems because our leak is getting bigger. It gets bigger every year because we keep ignoring it and keep filling the pool but that just allows more water to pour out and erodes the hole, making it ever bigger and harder to fill. Clearly it’s madness to believe we can just keep filling and filling because, eventually, the leak will become bigger than our ability to fill it. As you can see from the crises in Europe – that spot happens roughly at 12% of GDP – that is the point at which your Global neighbors are going to lose faith in your ability to keep the pool filled to the water line.

Our neighbors have already lost faith in our ability to pay and, if it wasn’t for Uncle Ben and his giant hose – there wouldn’t be enough water now to keep our pool filled. The Fed is artificially keeping money flowing into treasuries at a rate of $100Bn a month. This flow of seemingly free money from the Fed masks the size of our leak but, since the Fed is ultimately just another debt we will eventually have to pay – it also masks the growing size of our deficit by taking on what is now heading towards $3Tn of debt IN ADDITION TO our "known" debt of $15Tn.

Even with the help of Uncle Ben, our hole is getting bigger, at $1.8Tn this year – up from $1.4Tn last year. What can screw us is the same thing that screwed Ireland and Greece and, almost Portugal (until Uncles China and Japan stepped in for them last week) is rising interest. When your Debt is as much as your GDP and you are already spending 12% of your GDP on your current deficit (filling the pool) then a 1% rise in interest rates WILL (and this is an inescapable mathematical fact) raise your deficit by 1%.

Through demonstrated actions, bond holders have shown us that they do not have faith in a country able to sustain a 12% deficit. The US is right on that line and, whether it is through cut-backs in spending or improvements in revenue collection (come on everyone, click your heals together 3 times and say: No New Taxes!) then we remain right on the brink of collapse.

Our Federal Reserve has the unique ability to print more money than most Central Banks but we are in untested waters here – never before in the history of the planet Earth has a nation gone this far funding it’s own debt without setting off an inflationary spiral that ultimately sends rates skyrocketing and sets off a de facto default. Certainly never an economy the size of the United States of America!

Our Federal Reserve has the unique ability to print more money than most Central Banks but we are in untested waters here – never before in the history of the planet Earth has a nation gone this far funding it’s own debt without setting off an inflationary spiral that ultimately sends rates skyrocketing and sets off a de facto default. Certainly never an economy the size of the United States of America!

Is America "too big to fail"? Does the rest of the World have no choice, as China and Japan are now doing for Europe, but to do their best to keep the money flowing so all those Billions of goldfish can keep swimming around as if there is no problem? It certainly seems that way and there’s no reason for this party to stop as long as "they," who in this case are the Global Central Banks and their partners in crime – the IBanks – keep filling up the leaking economies.

Meanwhile, it’s our job to monitor the flows, look for additional leaks in the system and wade through the Government BS to figure out the size of the leak we currently have. As I pointed out above, discretionary spending is only 1/2 of the Federal Budget and only 47% of that is non-military spending. You can cut 100% of it and we’d still have a massive deficit. In reality – you are perhaps going to be able to cut 5% of 25% of our deficit for a whopping 1.25% reduction. If interest rates rise 1.25% or if all the government workers we lay off or the government spending we cut back leads to a 1.25% decrease in internal revenue collections – then we will be forced to borrow above that 12% ceiling anyway.

If our currency begins to devalue at a rate of 1.25% a year, then people buying our debt will want 1.25% of interest to compensate. The dollar has been rising since November of 2009, when it bottomed at 74.23. We topped out at 88.71 and TBills, measured at TLT’s 10-year notes, topped out at 107.52. Those notes are now 91.76, down 15% in 6 months yet we expect another $140Bn worth of buyers to show up next month and pick up our notes again. So thank goodness for Uncle Ben, who is currently buying all but $40Bn of those notes and Uncle China and Uncle Japan are buying the rest. Hu Jintao will be meeting with Obama this week and this video pretty much sums up the issue quite nicely:

"Extend and pretend" is the "new normal" for Global Economic policy. We "couldn’t" allow BAC, C, WFC, GS, MS, etc. to fail so we plunged our nation into unimaginable debt to prevent it and now the rest of the World, SO FAR, has decided they can’t allow America to fail so China ignores the $1Tn we owe them and Japan ignores the $1Tn we owe them and Europe ignores the $1Tn we owe them even though they themselves need every Euro at the moment. Unless a fleet of spaceships come in for a landing – there are no outside auditors to call an end to this global farce so we can pretend to be solvent and our bankers can pretend that our loan is solid as long as no one asks any questions and nobody will as long as the monthly bills keep getting paid.

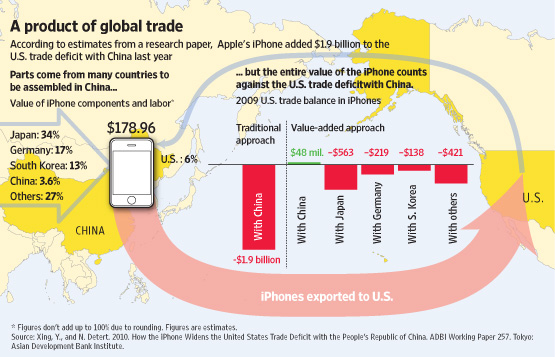

Unfortunately, this Global policy of easy money pushes inflation through the system and that increases the size of the hole in everyone’s pool yet again. With the US, it shows up in our trade imbalance as we import 300M barrels of oil per month so every $3 increase in the price of oil increases our leak rate by $1Bn a month. Our overall trade deficit is $600Bn, almost half of our total leak and it would be much worse if not for the fact that we are currently pushing massive food inflation out to the rest of the World. With no manufacturing base remaining in this country – it’s very hard to see what is going to be done to turn these numbers around with the following chart being an excellent example of how even a "fine American product" like the IPhone only serves to add to our deficit:

There are no easy fixes and what bothers me about the market is that it’s priced like there are. Perhaps the market is simply priced to account for the inevitable inflation and that is a valid investing premise but, so far, inflation is not coming on fast enough to support the values the market has been hitting. Don’t worry though, despite the jokes in the video above, this week’s meeting with Hu Jinatao is pretty much exactly that – we need to know how much China is willing to take as Uncle Ben looks to "kick it up a notch" with QE 3, 4 and 5.

Japan is on board as they still have DEflation so their attitude is "Sure, print however many dollars you want as long as you spend them buying our cars and electronics." Japan isn’t likely to have food riots anytime soon but, as I pointed out in chat this weekend – many other countries already are and, frankly, Uncle Sam don’t give a damn as long as it’s not a country we need to borrow money from or sell something to and THAT is why Hu Jintao will once again meet with Obama this week and that will very much set the macro tone for the rest of the first quarter. Clearly those bets are already in and Wall Street figures we are back in business in 2011 – so let the good times roll (for now):