He said the usual stuff, that inflation wasn’t his fault (and what inflation anyway?), that the economy was strong but would require more free money until the Fed sees a turn around in employment. We need, Bernanke said, to get back 8.5 Million jobs that were lost in 2008 and 2009 and he notes that, although it may seem that private-sector employment showed gains in 2010. However, these gains were barely sufficient to accommodate the inflow of recent graduates and other new entrants to the labor force and, therefore, not enough to significantly reduce the overall unemployment rate. As he is saying this the day before the Non-Farm Payroll report, we can assume he’s had a peak and that U.S. unemployment is flat or down.

Doctor Bernanke says that, having exhausted the possibility of lowering rates, Quantitative Easing is their tool of choice to achieve more employment and they will keep giving FREE MONEY to the Investment Banks and speculators and the people and Corporations in the top 1% that have access to it UNTIL that money trickles down and creates jobs.

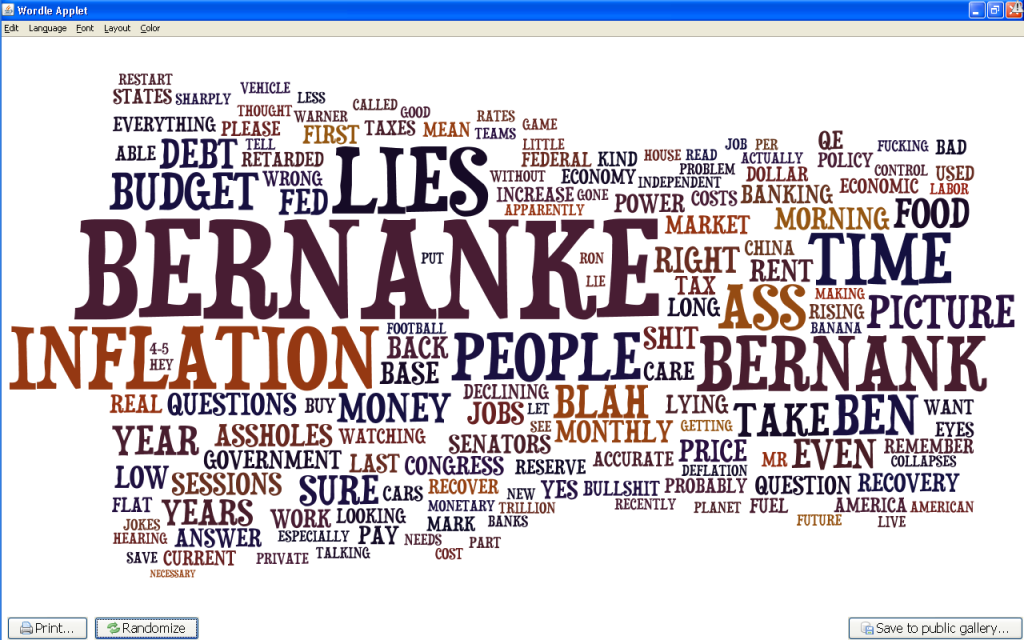

Yes, think about it. We can summarize Bernanke’s statement to be: "I will continue to give you FREE MONEY, as long as you DO NOT hire any American Workers. Just to be clear (and he was), I am telling you (nudge, nudge, wink, wink) that hiring American workers will make me stop giving you FREE MONEY. In fact, if you hire too many workers or, even worse, give the workers you currently have pay raises – I shall not only stop giving you FREE MONEY but I shall also raise the interest rates on the money you borrow." This speech was so outrageous, it called for expert analysis – from the same people who explained to us "How the US Government Manipulates Inflation Data," the same data that The Bernank bases his premise on:

Ron Paul had directly asked Bernanke to define inflation in the July of 2009, after Bernanke had said that, "obviously" the Fed would have to raise interest rates to combat inflation. Having previous dealt with Bill Clinton saying "well it depends on what the meaning of the word is is," Ron Paul was not going to let Bernanke slide on that one and said: "You are in the midst of massive inflation… You have doubled the money supply.. is that not inflation itself or are you looking at only prices?" To which Bernanke replies: "Inflation is the change in the consumer price level, which is very stable right now and there are various measure of money that are not growing quickly."

As noted in Tuesday’s post, when you see the Chairman of the Federal Reserve saying things to a Congressman that are TOTALLY untrue (watch video) regarding his intent with Treasuries, the money supply etc., then you know that fundamentals have been thrown out the window in the market place. To a large extent, that has been true since the 1980’s, when the government first began manipulating the core inflation data to mask the decline in Middle Class wealth that was sweeping through this country like wildfire.

As noted in Tuesday’s post, when you see the Chairman of the Federal Reserve saying things to a Congressman that are TOTALLY untrue (watch video) regarding his intent with Treasuries, the money supply etc., then you know that fundamentals have been thrown out the window in the market place. To a large extent, that has been true since the 1980’s, when the government first began manipulating the core inflation data to mask the decline in Middle Class wealth that was sweeping through this country like wildfire.

This was papered over at the top, as the dot com bubble burst, by the Fed, who fueled first a housing boom with low interest rates and easy money that took us through 2008 and then by even lower rates and now, money printing to the tune of $1.5 Trillion a year to help prop up a $30Tn stock market – as if the stock market is somehow a true measurement of the health of the US economy. If it were – what happened in 2008?

No, the stock market is a lagging indicator and an artificially supported stock market is a dangerous lagging indicator, like a broken blood pressure machine that fails to predict a coming heart attack. Today we get a major measure of economic health, the Non-Farm Payroll Report at 8:30 and we are expecting a miss in jobs, causing a sharp dip in the markets followed by, of course, dip buying because – that is just how the market works these days.

This action is so predictable that we now have our own PSW Trade-Bot who was able to predict yesterday’s action to a tee in our Morning Alert to Members and even gave us a trade on IWM that made 15% (twice), as noted in the Wrap-Up show. We like to have a little fun while we’re trading and it doesn’t pay to take the markets too seriously. Going into the weekend over our levels (see TradeBot) will push us (unwillingly) to swallow the bullish Kool-Aid and make some more upside bets, although the IWMs were upside bets yesterday as were MRK and HRB as we strive to find a little more balance in preparation for getting more bullish.

This action is so predictable that we now have our own PSW Trade-Bot who was able to predict yesterday’s action to a tee in our Morning Alert to Members and even gave us a trade on IWM that made 15% (twice), as noted in the Wrap-Up show. We like to have a little fun while we’re trading and it doesn’t pay to take the markets too seriously. Going into the weekend over our levels (see TradeBot) will push us (unwillingly) to swallow the bullish Kool-Aid and make some more upside bets, although the IWMs were upside bets yesterday as were MRK and HRB as we strive to find a little more balance in preparation for getting more bullish.

Keep in mind, looking at the chart above, that an inflation-adjusted return of 500% in 20 years is still 500% in 20 years. You can’t get too hung up on the difference other than to be aware of your real market returns vs. investment alternatives like long-term bonds or notes. Of course, that has been part of the Fed’s plan, right? They keep savings rates so low and bond returns so low while REAL inflation is so high that investors have no choice but to put their money into the markets. Why do they do this? Come on – you know the answer – Money in the markets makes the most fees for Banks and all the Federal Reserve is is a representative body of the member banks – it’s not a government institution at all (see or read, "The Creature from Jekyll Island").

Keep in mind, looking at the chart above, that an inflation-adjusted return of 500% in 20 years is still 500% in 20 years. You can’t get too hung up on the difference other than to be aware of your real market returns vs. investment alternatives like long-term bonds or notes. Of course, that has been part of the Fed’s plan, right? They keep savings rates so low and bond returns so low while REAL inflation is so high that investors have no choice but to put their money into the markets. Why do they do this? Come on – you know the answer – Money in the markets makes the most fees for Banks and all the Federal Reserve is is a representative body of the member banks – it’s not a government institution at all (see or read, "The Creature from Jekyll Island").

8:30 Update: HUGE MISS! Just 36,000 net jobs were created in the United States of America in January. As I mentioned to Members yesterday, we need about 150,000 jobs a month just to keep up with population growth so this is a TERRIBLE number and nothing at all like the 140,000 jobs expected. The private sector, where all this Fed money is supposed to trickle down from, added just 50,000 jobs and the Government shed a net 14,000 jobs – and we have not even begun to begin the cutbacks in that sector!

The Republicans are proposing to trim over 300,000 Government jobs through various austerity measures but the cutback in overall Government spending should un-trickle a few hundred thousand more jobs – those are the headwinds our economy faces for the rest of 2011 and, as I’ve been saying for quite some time – not at all priced into the risk analysis that is leading to some pretty extreme valuations, especially in high-flyers like CMG, NFLX, AMZN, OPEN and, of course, pretty much the entire commodity sector.

Yes, hyperinflation is coming. We are absolutely long-term bullish. In fact, I don’t think we have any short plays at all that go past June – that’s pretty bullish! Short-term, however, we think this market is way overbought and pricing in some triumvirate of perfection from the Government, the Federal Reserve and Big Business America to take our ship of state, which has just struck an iceberg and is taking on water, and win the Indy 500 with it. Sure, it makes no sense – but neither does pricing oil at $100 a barrel when this is a chart of people who need food stamps in America, where we spend a smaller proportion of our income on food and energy than any other nation on Earth.

Yes, hyperinflation is coming. We are absolutely long-term bullish. In fact, I don’t think we have any short plays at all that go past June – that’s pretty bullish! Short-term, however, we think this market is way overbought and pricing in some triumvirate of perfection from the Government, the Federal Reserve and Big Business America to take our ship of state, which has just struck an iceberg and is taking on water, and win the Indy 500 with it. Sure, it makes no sense – but neither does pricing oil at $100 a barrel when this is a chart of people who need food stamps in America, where we spend a smaller proportion of our income on food and energy than any other nation on Earth.

Even the people who are working are working less, as the average work-week for those lucky enough to have jobs fell from 34.3 to 34.2 hours. Hourly earnings were up 0.4% in January so that helped a little but we know the Fed does not like to see wages get higher even though, of course, most of the increase in earnings was from Wall Street Bonuses, which hit a new record this January. What’s really, really funny about all this is what has been, so far, 30 minutes of continuous spin on CNBC trying to tell people how missing jobs expectations by over 100,000 is nothing to worry about.

The futures, amazingly, are holding up. Why? Because what do corporations care about unemployment? More unemployment means cheaper labor and Bernanke already told them that high unemployment will keep the free money flowing so this is a time for celebration on Wall Street, not panic. The only time Wall Street panics is when the Banks lose jobs and, as I said – record bonuses. Commodities are flying in anticipation of more free money and if you are thinking to yourself – "What will it take to drop the markets, rioting on Wall Street?" – I would direct your attention to Egypt, where they are rioting in the streets while their leader prepares to leave the country with an estimated $40-$70Bn that he has accumulated on his Government salary. How is the Egyptian market responding to an overthrow of the Government, riots, looting and starvation? It’s up 12.5% this week.

I can only conclude this post with the song that is playing in my head while I watch the news from overseas:

Efficiency and progress is ours once more

Now that we have the Neutron bomb

It’s nice and quick and clean and gets things done

Away with excess enemy

But no less value to property

No sense in war but perfect sense at home:The sun beams down on a brand new day

No more welfare tax to pay

Unsightly slums gone up in flashing light

Jobless millions whisked away

At last we have more room to play

All systems go to kill the poor tonightGonna

Kill kill kill kill Kill the poor:TonightBehold the sparkle of champagne

The crime rate’s gone

Feel free again

O’ life’s a dream with you, Miss Lily White

Jane Fonda on the screen today

Convinced the liberals it’s okay

So let’s get dressed and dance away the nightWhile they:

Kill kill kill kill Kill the poor:Tonight

Have a great weekend,

– Phil

Ben

Ben