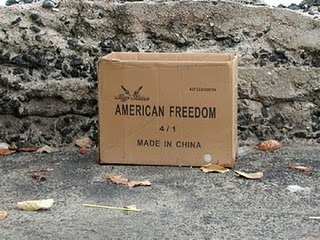

Courtesy of Russ Winter

Russ’s Blog at Winter (Economic and Market) Watch

Chinese Exporters Going Down, Western Importers Ambushed

“An empty stomach is not a good political adviser.” -Albert Einstein

“An empty stomach is not a good political adviser.” -Albert Einstein

At long last the mainstream media and Chinese advisories are picking up on the China export bust story that I have warned about for months. The New York Times ran this economic story of the decade last week, while infomercial commentators like CNBC and Bloomberg are sleeping through this bust.

The twist on the story is that Chinese suppliers are in a triple world of hurt. American buyers resisted attempts to pass on price increases of 20-50%. The NYT described the events leading up to the Chinese New Year holiday, when tens of millions of Chinese workers returned home, thusly:

“The first signs of a potential slowdown in Chinese exports have shown up in shipping. As factories closed on Friday across much of China in preparation for weeklong Chinese New Year celebrations, ports in Hong Kong and elsewhere along the coast were working long hours to meet last-minute shipments.But the annual pre-New Year rush has been nothing like that of recent years, causing shipping lines to reverse rate increases and cancel sailings they introduced last summer as the American economy improved. This winter, the scurrying started only two weeks before the holidays, instead of the usual four weeks, according to shipping executives. That is because many Chinese factories simply cut back production this month as their Western customers began resisting steep price increases.”

At the same time, the Chinese export sector scrambled to try and save its labor force with hikes of 20-30% in wages and benefits [Reuters]. Reportedly, this has had limited success, which is a moot point anyway if western buyers fail to cover these increased costs. China has a new labor law and labor unions now have the upper hand. From china-briefing.com:

Increasing militancy over labor conditions and terms by migrant workers in China is having a serious impact on South China-based businesses, as many migrant workers are refusing to return from the Chinese New Year vacation unless their demands are met. With workers becoming increasingly aware of their rights under the Labor Law, many are resorting to strong-arm tactics to “persuade” factory owners to give them more money. The situation is often exacerbated by grass roots labor union officials, who also stand to benefit via larger payments into the labor funds at their disposal if companies pay higher wages. Increasing China labor costs and worker demands are making once profitable businesses lose money and there is virtually no leeway for labor-intensive manufacturing to survive under such circumstances.

In addition to intense labor pressures, Chinese exporters have been completely crushed by the massive input goods hyperinflation supposedly created by Chinese “demand” and “growth.” One of the more revealing quotes about this “demand” came from Sharon Johnson of Penson Futures on the latest big spike in cotton: “I cannot say this clearly enough…this is not mill buying, mills cannot buy at these prices.”

Readers should be reminded that Chinese trade has amounted to $3 trillion annually. This is now headed for a major crash and the NYT suggests this is already happening.

Already, the slowdown in American orders has forced some container shipping lines to cancel up to a quarter of their trips to the United States this spring from Hong Kong and other Chinese ports..

Two weeks ago, retailer Coach (COH) stated that they were shifting their reliance on China from 80% to 50% by taking production elsewhere. It is startlingly clear that western firms have a busted model and are scrambling like chickens with their heads cut off to avoid being mowed down in this ambush. This China.org story describes labor difficulties in the interior and western provinces as well. There are plenty of whack-a-mole stories like “Crisis-hit Bangladesh Turn to Sri Lanka“ for “analysts” who bother to look. If Asian platforms think they can bridge the gap by exploiting cheap labor in India, guess again as New Delhi pushed through 17-30% wage increases for 50 million workers because of inflation. The NYT filled in the rest of the story:

But Mike Devine, the company’s executive vice president and chief financial officer, said that it would take four years to carry out the shift. Trying to move production elsewhere, some retailers are finding many factories are already fully booked: Vietnam and Thailand each have populations smaller than some Chinese provinces, while Cambodia and Laos have smaller populations than some Chinese cities.

Vietnam is cited by some as as prospect for food riots and civil uprising.

As Chinese New Years winds down, American buyers will be checking to see if their suppliers are even still in business. If they are, they may wish they had booked last month’s prices, as input goods prices have pushed even higher. Adding insult to injury is news that Chinese winter grain region is facing a major drought, which promises to put even more price pressure on Chinese labor.

In the U.S., retailers are definitely hard at work pushing through price increases with 3-month inflation running at 5% annualized, according to MIT’s “Billion Prices Project.” The problem is that the new price list out of China is not 5%, higher but a large multiple of that, thus explaining the parabolic look to this index, up 0.7% in the last month. American firms rely on short, just-in-time inventories and are therefore looking at diminished supply, actual disruptions and large margin compression.

US consumers are looking at considerable budget crushing inflationary pressure. Also as part of this perfect storm comes the news that Mexico’s vegetable and corn corp was wiped out by a rare freeze last week .

Pic credit: Jr. Deputy Accountant