Forward, backward, inward, outward

Come and join the chase

Nothing could be drier

Than a jolly caucus raceBackward, forward, outward, inward

Bottom to the top

Never a beginning,

There can never be a stopTo skipping, hopping, tripping fancy free and gay

Started it tomorrow

But will finish yesterday'Round and 'round and 'round we go

Until forevermore

For once we were behind

But now we find we are be-Foreward, backward, inward, outward

Wheeee – this is FUN!

Up we go again, getting close to 100 points pre-market – once again punishing anyone who was foolish enough not to buy the F'ing dip. How dare you short this market!!! Like the Wall Street Pelican in the cartoon says: "You HAVE to run with the others if you want to get dry." Of course it's impossible for the participants (the bottom 90%) to get dry as they are not on the rock with a warm fire and simply keep getting wet over and over again but the Wall Street Pelican keeps playing his tune, giving himself a ready supply of dancing fish to snap up whenever he gets hungry.

Of course, for those who miss the subtlety of the Caucus race, Disney also puts in the story of the Walrus and the carpenter. "The time has come" the Walrus said, "to speak of many things. Of ships and shoes and ceiling wax and cabbages and kings."

The carpenter reminds me of the Tea Party, enabling their fat-cat (or fat-walrus) allies, only to get screwed over in the end. Walt Disney, don't forget, had gone bankrupt early in his career and had also got screwed by big business when Universal Studios took control of "Oswald the Lucky Rabbit" – the original Bugs Bunny from Disney. "Alice Comedies" were and earlier work of Disney's that culminated in the eventual release of Alice In Wonderland, with much of his early sarcasm and frustrations with the system still intact.

Yesterday, the part of the Walrus was played by Doctor Ben Bernanke, who's Beige Book (see my commentary to Members) refers to "non-wage input costs" which have "increased for manufacturers and retailers in most Districts." Callooh! Callay! The Fed may as well be saying as they come up with brand-new words in order to avoid saying "INFLATION," as that may have been inconvenient, what with the Chairman testifying the same day that such a thing does not exist. "The time has come," Bernanke said, "to talk of many things. Of shoes and ships and sealing wax – of cabbages and kings. And why the sea is boiling hot and whether pigs have wings."

Those were just some of the topics covered in Bernanke's testimony to Congress over the past two days but what he doesn't talk about – what is not mentioned ONCE in the ENTIRE Beige Book summary, is – INFLATION. Really, I am not just joking for effect – the Federal Reserve's Beige Book Summary of March 2nd, 2011 – a day when oil topped out at $102.95 per barrel – does not mention the word "inflation" one time. Do I really need to say more?

As I said a couple of weeks ago on "Fandango Thursday," we may as well resort to just saying random gibberish as that's pretty much the kind of nonsense we are getting from our "leaders" these days. Now that I look back on that post – I was referring then to the release of the minutes of the Fed's 1/26 meeting and today it was the Fed's Beige Book that is setting me off so there's at least some consistency to my reactions…

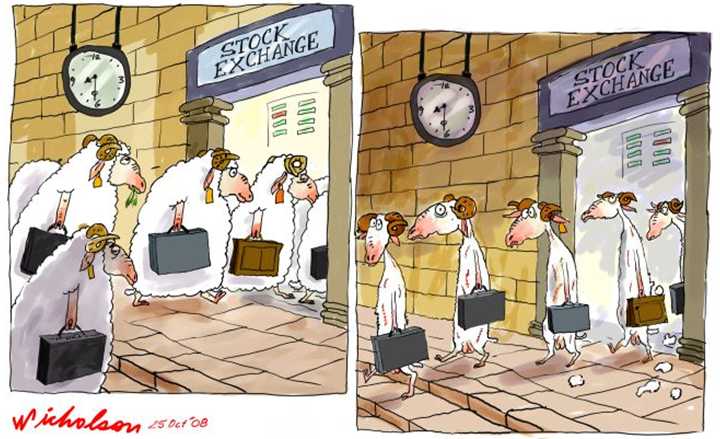

So, let's see – my frustration peaks out on February 17th, the market takes the Fed's word for it that things are better ("The night is fine," the Walrus said) and the S&P topped out at 1,334 on Friday before falling off a cliff on Tuesday (Monday was MLK day and I had warned that equities were "Rising On a River of Blood"). So now we are reloading our short positions on the way up, just as we knew to cash them out and flip long on the way down. We can't beat the system, so we may as well just play along with the Banksters as they line up another round of sheep to fleece:

"It seems a shame," the Walrus said,

"To play them such a trick,

After we've brought them out so far,

And made them trot so quick!"

Of course, other than my moral outrage (some deep seated Liberal thing that my Conservative doctors assure me can be treated with time and money) at what is being done to my fellow countrymen – this is a REALLY good scam. I pointed out yesterday how the earnings of people in the Financial industry have risen 50% more than the wages of other people in America and, of course, THAT's why I work (and play!) in the Financial Industry.

That's why you participate in the Financial Industry too. Just like the Carpenter, you hope to get yours by following the fat-cats around and you sit there, watching them take and take and take and take and it doesn't bother you because you think that will be you one day. It's the American ideal – all you need is a Dollar and a dream, right?

I pointed out that 10 Hedge Funds made $28Bn for their 1,000 members – that's $28M per person in profit, while our top-tier Financial Firms: GS, JPM, C, MS, BCS and HBC made "just" $26Bn but they have 1M mouths to feed so "just" $26,000 in profit per person there. Even among the "wealthy" the disparity is staggering between the top 1% and the top 0.1%. You need $1M liquid to even be ALLOWED to put your money in a hedge fund and, if you have a 401K – you are not even allowed to sell a short put in your account without incurring significant margin penalties. One of the most basic hedges in the world is forbidden to those who could benefit most – all saved to feed the never-ending desires of those who already have it all.

Just take a look at my not so "Secret Santa's Inflation Hedges for 2011" – it's only March and the average trade idea I published for the general public on Christmas day is up over 250% already. It should not be this easy to make money! If it is this easy to make money – something is wrong with the system but, as I said at the time – if people are out there making money like this then you'd BETTER get yours before you find the money you do have – your cash assets – have become worthless.

Just take a look at my not so "Secret Santa's Inflation Hedges for 2011" – it's only March and the average trade idea I published for the general public on Christmas day is up over 250% already. It should not be this easy to make money! If it is this easy to make money – something is wrong with the system but, as I said at the time – if people are out there making money like this then you'd BETTER get yours before you find the money you do have – your cash assets – have become worthless.

Since January 10th, the Dollar has fallen from 81.32 to 76.37 this morning – that's 6.1% in 60 days. That means the buying power of EVERYTHING you have that's measured in Dollars has dropped 6.1% in relation to the buying power of other people living in developed nations. That is, in effect, the Global judgement of our Government's Fiscal policy.

Despite Ben's Jedi Mind Tricks ("this is not the inflation you are looking for"), those of us who are not "weak-minded" Congresspeople can clearly see that the price of everything is moving higher so let's not get all excited about the 6% rise in the S&P corresponding with a 6% drop in our currency – unless you are 100% invested in the stock market – you are losing out to the inflation Bernanke denies three times – even after inflation has risen.

So we are thrilled that our dip buying of the last few days is paying off so well, so quickly but we'll be taking this opportunity to once again "get cashy" into the weekend and press a few bearish bets – just in case 1,333 fails us again and the market takes us, once more, into the breach.

Be careful out there!