What’s shaking?

That was a special message for our friends in Japan, who are very shaken today with an 8.9 quake which is, of course, devastating. Here’s a picture and notice how stuff is just pulverized (before being washed away by the 30-foot Tsunami that followed (on the right of the picture):

![[1jquake0311]](http://si.wsj.net/public/resources/images/OB-MZ267_1jquak_F_20110311051517.jpg)

Somehow they are saying only 29 dead but I can’t see that. Tens of thousands of people were evacuated and 4.1M people lost power so far. Poor New Zealand was recently hit and now they have Tsunami warnings too (as does Hawaii).

![[JQUAKE]](http://si.wsj.net/public/resources/images/AI-BJ019_JQUAKE_NS_20110311020306.jpg)

At 3:24 p.m., a large aftershock struck, which could be felt standing on the ground outside of buildings in central Tokyo. People gasped while looking up at skyscrapers swaying gently and construction cranes shaking violently atop half-completed buildings. Glass panels on the ground floor of many newer buildings shimmied but few appeared to break.

Let’s hear it for the World’s strongest building code! I very much doubt US buildings would fare so well.

This will make a Japanese rate hike out of the question, probably for the rest of this year and so will be a dollar booster and EDZ will, of course, be flying. This is not the way we like to win on our bets, unfortunately but it is a very good object lesson about why it is very foolish not to always have some kind of disaster protection in your virtual portfolio – because you never do know when a disaster is going to strike.

Over time, it’s complacency that kills you…

Meanwhile, my kids are home today because their school is flooded – we are screwing up this planet in all kinds of crazy ways aren’t we? I’m sure if we ignore all this stuff or call for "further research" (funded of course by the very same businesses that cause the pollution) for another few decades it will all be fine.

Oil is way down at $99.90 – so much for the "Day of Rage," which is kind of a fizzle in Saudi Arabia – If there is such a thing as a "long-squeeze" then you may be seeing it today as speculators need to get out of oil while they can. This is another great example of why we don’t set hard stops because we had every reason to stop out of our oil shorts on yesterday’s spike except for my judgement call based on the information at hand with which I then decided to employ the "Chewbacca Defense" as what we were hearing simply "did not make sense."

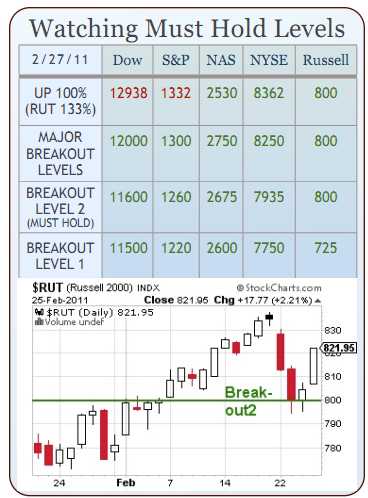

Overall, we expected Asia to sell off and we expected a bad open and the reason may have changed but the technicals didn’t although now we are below all of our Major Breakout Levels so there’s certainly nothing to be bullish about until we get them back.

Overall, we expected Asia to sell off and we expected a bad open and the reason may have changed but the technicals didn’t although now we are below all of our Major Breakout Levels so there’s certainly nothing to be bullish about until we get them back.

As I said in yesterday’s morning Alert to Members, the Nas 2,675 line is the one most likely to be tested after Russell 800 and we do not expect 11,600 to fail on the Dow or 1,260 on the S&P or 7,935 on the NYSE so we can hopefully begin a little well-hedged dip buying once oil runs it’s course.

Libya is still crazy so we’re certainly not going to short oil over the weekend and we’ll take that money and run today. The very nice thing about being mainly in cash is that it’s so easy to get back to all cash and so easy to pick up new bargains on days like today.

Best headline of the day so far is from the WSJ: "The Pain in Spain is Hard to Ascertain" although kind of a late variation of my precient "The Pain in Spain will Hardly be Contained" from last April (yes, it’s been going on that long) – which was the last time I called for getting back to cash – and that move was BRILLIANT!

We already picked up our disaster hedges on Wednesday, before it all hit the fan and it’s very rare that we get an actual, real-life disaster to cash in on but here it is -it’s going to be a crazy day with lots of decision-making but decision number one is easy – CASH IS KING! After that, we can be calm about the rest and do a little bargain-hunting which is, as Buffett and I like to say "being greedy when others are fearful" as we are now being rewarded for "being fearful while others were greedy."

Speaking of fear and greed. The greedy should be fearful that SWHC (Smith and Wesson and thanks to Stockbern for the heads up) saw a 47% increase in pistol sales and that’s probably not for rich schmucks who want to settle their differences at 40 paces but rather the poor schmucks who are fed up enough with the BS in this country to begin arming up for the revolution. While I won’t argue the merits of our most sacred right to bear arms – I will point out that people who lived in a rational society would be slightly more likely to be alarmed by a 47% increase in handgun sales during a recession than, say, we are…. Chris Rock has the best solution for this:

Unfortunately, you can reload your Glock at just $11.99 for 50 rounds (if you buy 10 boxes on special!) or about 24 cents per bullet. Which reminds me that the tweet of the year award, so far, goes to ZeroHedge (thanks Rainman), who responded to news that Saudi Police fired on a crowd yesterday by tweeting: "Rounds used by Saudi police were 5.56; analysts expected 7.62, beat expectations. BTFD (buy the f’ing dip)."

That, of course, reminds me of this cartoon, from January, as we discussed the very simple and very inescapable logic that inflation ultimately drives revolutionary forces and so we EXPECTED this to happen – the only surprise has been how slowly the people are to wake up and smell the gun oil.

That, of course, reminds me of this cartoon, from January, as we discussed the very simple and very inescapable logic that inflation ultimately drives revolutionary forces and so we EXPECTED this to happen – the only surprise has been how slowly the people are to wake up and smell the gun oil.

King Abdullah of Saudi Arabia gets this as he moves to counter protesters by handing out $36 BILLION or about $1,400 per person for each of their 25M people and that is IN ADDITION TO the $385Bn that has already been pledged in a 5-year spending plan that is aimed to "help tackle joblessness and stop young men from turning to more radical Islam." King Abdullah also battled with clerics by blocking unauthorized religious edicts, or fatwas, and allowing supermarkets to employ females for the first time.

Perhaps that’s the mistake made by the Wisconsin teachers – they should have threatened to go "radical Islam" and the money would have poured in! Meanwhile, it remains to be seen how much good even $385Bn goes towards battling Saudi Arabia’s 43% unemployment rate for people between the ages of 20 and 24 – just the age where many young men might make that big "guns or butter" decision. To keep things in perspective, Abdullah is giving his people the equivalent of $432Bn if applied to the US economy (3 times the Bush stimulus) and he’s giving it to the poorest people, not his family (the top 1%) and he’s committed the proportional equivalent of $4.5 TRILLION over the next 5 years to build the infrastructure that is required to modernize his country and make his people competitive in the global market place. If the Saudis don’t want this guy to lead them – then send him over here – PLEASE!!!

Global deficit spending is likely to be back in vogue next week as Japan is looking at many tens of Billions of dollars worth of damage. This will punish the insurance industry of course but Japan is not like America with New Orleans or the World Trade Center and they WILL rebuild their damaged cities as a matter of national pride and priority so we can anticipate a weaker Yen as the BOJ cranks up the printing presses but also a lot of economic activity as that money (again, not at all like America) is put to use creating jobs and infrastructure as the nation pulls together to help those who are suffering.

Global deficit spending is likely to be back in vogue next week as Japan is looking at many tens of Billions of dollars worth of damage. This will punish the insurance industry of course but Japan is not like America with New Orleans or the World Trade Center and they WILL rebuild their damaged cities as a matter of national pride and priority so we can anticipate a weaker Yen as the BOJ cranks up the printing presses but also a lot of economic activity as that money (again, not at all like America) is put to use creating jobs and infrastructure as the nation pulls together to help those who are suffering.

The Greek people continue their suffering despite a $153Bn bailout as 10-year bonds are already back to record highs this week. Much like America – the Greek politicians labor under a very misguided fantasy that you can solve a fiscal crisis by cutting back government services and undermining the socials safety nets without raising taxes on the rich and, of course, it all ends in disaster – except of course for those rich people who get all their assets out of the country before the second wave of the economic tsunami comes back to wipe out the rest of the working class.

“Markets are becoming more fearful of a Greek government default and are now expecting it to happen more quickly than a few months ago,” economist Ben May said. “Greece is as far away as ever from convincing investors that it can get its public finances on a stable footing.” “The onus is on EU officials to dissuade the market from the notion that a debt restructuring is inevitable,” said Robin Marshall, director of fixed-income at London-based Smith & Williamson Investment Management, which oversees $20 billion. “They’ve lost investor confidence in any resolution that doesn’t involve some form of restructuring.”

Meanwhile, Emerging markets face a “definitive danger” from accelerating inflation and should resist the temptation to impose capital controls to stem currency gains, said Arminio Fraga, the head of Brazil’s stock exchange and a former Central Bank President.

Meanwhile, Emerging markets face a “definitive danger” from accelerating inflation and should resist the temptation to impose capital controls to stem currency gains, said Arminio Fraga, the head of Brazil’s stock exchange and a former Central Bank President.

The Bank of Korea raised interest rates for the second time this year yesterday after inflation exceeded its target ceiling for two consecutive months, joining Thailand and Vietnam in lifting borrowing costs this week amid a surge in oil prices. Brazil boosted rates five times in the past year after annual inflation quickened to the fastest pace since November 2008. “There is a definitive danger and I think we have to watch it,” Fraga told investors at an event at JPM’s HQ in New York yesterday.

China’s February Consumer prices rose 4.9% and Producer Prices jumped 7.2% in February, indicating that the rising input costs are not being passed on fast enough to consumers not to be a drag on Q1 Corporate profits. Don’t say I didn’t warn you – two months from now I will be linking back to this statement and you will say "I wish I would have paid attention to that back then."

Oops – time to go to work! See you inside.

Have a great weekend and try to stay dry,

– Phil