I told you so (actually I told everyone on TV Tuesday afternoon). I like the fact that BNN ran a caption in the box saying "Davis: Bank of Japan May Drive the Yen Down and USD Up." The only correction there is I didn’t say "may" – I was pretty darned emphatic that is WOULD happen this week. Well, it happened last night as the BOJ stepped in and made a huge move, dropping the Yen from 77 to the Dollar to 80.27 at about 6am, which is a stunning 4.25% move in a single day in the World’s third largest currency. At the moment – everything I have to say about the market movement I said yesterday in Member Chat when we discussed the day ahead:

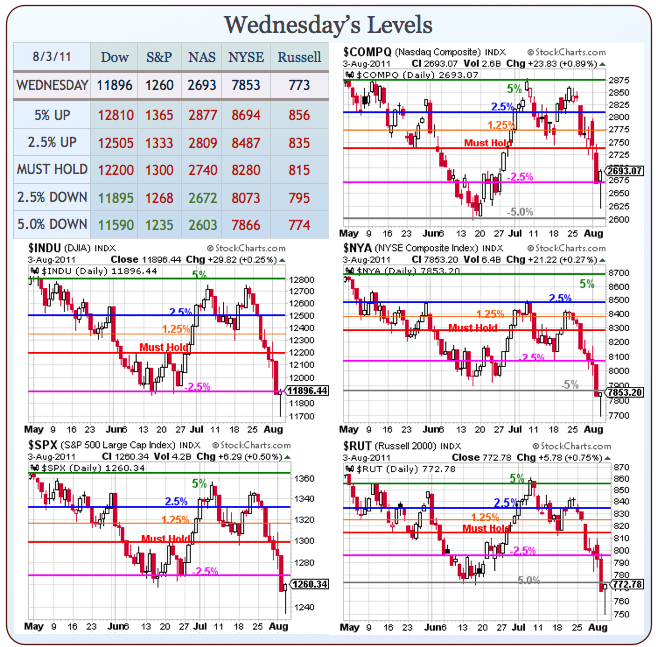

Big Chart – That’s a very nice move by the NAS! Huge tail and formed a whole candle over the -2.5% line! Unfortunately, everyone else ground to a halt at resistance but, if we gap over tomorrow and finish at Monday’s close – all will be forgiven, right? Kind of scary when you see how well these lines work – think of how long we’ve been using them. No moving average, no slanty BS no redrawing them with new levels every day – that’s the 5% Rule!

Note also the last time we sold off hard, it was the Nas that led us back over the 2.5% line and stopped at about the same place it stopped today so look for that June 28th candle to repeat if we’re on the way to a healthy recovery. It makes sense that the RUT fell out of favor as the reality of earnings favors the Nas and is not good for the RUT – who have mostly US revenues. That’s why TZA was our primary hedge at the top. Now we have to figure out how much actual damage was done to the RUT’s prospects by Q2 earnings.

I’m still very concerned that we’ll get a Yentervention and it’s going to be very difficult to pop resistance off a strong Dollar.

That’s our morning so far (7:30) but getting such a big pop in the Dollar is actually good for the markets because it’s clearly overkill so we went bullish on the futures with the Dollar at the 75 line, assuming it would be rejected and head lower to give us at least a small pop. In order to get the Yen down 4.25%, it was mostly about pushing the Dollar from 74 to 75 as the Euro fell a relative 1% ($1.42) and the Pound ($1.63) gave up about a point as well.

So that should be GOOD for equities this morning as the EU has a fairly direct effect on the Dollar as there are about half as many Euros as Dollars in circulation while there are almost 10 Dollars to on Yen, which is why just a 1% pop in the Dollar can drop the Yen 4.5%. Look for the Pound and Euro to head higher (cue Trichet!) and the Dollar to pull back but anything over the 75 line on the Dollar is bearish for equities.

We did a little bottom fishing yesterday as we had that nice dip in the morning. RIMM, IMAX, JPM, VLO and BAC all were attractive at 10:38 and we did some long-term put selling in Member Chat but I also have 2 highly leveraged trade ideas we also discussed that should be playable at the bell as downside hedges in case the Dollar is over 75 and the markets look weak. As I mentioned in yesterday’s post – you don’t have to put much money into a 1,000% trade to offset a dip in the markets:

TZA Friday (weekly) $41/42 bull call spread at .37, selling VLO Sept $20 puts for .35 is net .02 on the $1 spread. 4,900% gain if TZA finishes over $42 on Friday and the VLO puts expire worthless (VLO at $23.26 so 14% buffer). The key to spreads like this is we REALLY WANT to own VLO for net $20 in our long-term virtual portfolio so there’s not much downside risk.

SDS Friday (weekly) $22/23 bull call spread at .40, selling the same VLO puts for .35 (net .05), as we love those guys, or the IMAX Aug $17 puts for .40 for a free trade (IMAX now $18.37) or the XOM Aug $72.50 puts for .30 (net .10).

These are great plays if the Dollar is over the 75 line as that will be no good for equities but, of course, we think those levels will hold up on our short puts. The nice thing about bullish offsets is that, if the market goes up – they expire worthless and that’s how we get a free, or nearly free, hedge on our virtual portfolios. Keep in mind that this is INSURANCE, we don’t want to win because that means the markets are falling but, if they do, $100 turns into $5,000 on that TZA spread so it can’t be helped if sometimes we end up rooting for that sell-off!

These are great plays if the Dollar is over the 75 line as that will be no good for equities but, of course, we think those levels will hold up on our short puts. The nice thing about bullish offsets is that, if the market goes up – they expire worthless and that’s how we get a free, or nearly free, hedge on our virtual portfolios. Keep in mind that this is INSURANCE, we don’t want to win because that means the markets are falling but, if they do, $100 turns into $5,000 on that TZA spread so it can’t be helped if sometimes we end up rooting for that sell-off!

8:30 Update: We lost another 400,000 jobs this week and we have Non-Farm Payrolls tomorrow so perhaps a little sell-off into the open now. Big job losses can be a Dollar downer, as it puts QE3 back on the table because, as Bernanke earlier this year – as long as US Corporations DON’T hire US workers, he will continue to give them FREE MONEY. However, these were about in-line with expectations while the EU is getting worse (relatively stronger Dollar). So it’s going to be a another crazy day (we love those) with a lot of cross-currents moving the markets but it’s ALL about whether the Dollar is over or under the 75 line (over is bearish!).

Bearish bets we have plenty of (we’re reducing though) – what we’re waiting for is a clear sign to go bullish again. These bottoms (our -5% lines) need to hold up and those -2.5% lines need to be retaken or we’ll have to go a little bearish into the weekend. Hopefully the Dollar pulls back on our job news and we’re waiting for Trichet to say something to boost the Euro (which would make the BOJ happy too).

Making young Americans happy is our pal Eric, "The Incubus", Cantor, who now says it’s time for Americans to "come to grips with the fact that promises have been made that frankly are not going to be kept for many," and young people must "adjust" to a future with fewer entitlements and, by the way – there is no Santa Clause! Oddly enough, promises to very rich Americans and Corporations will be kept at all costs – even if it destroys the country that Eric claims to represent but kids? F*ck them!

Sure, promises were made, money was taken from paychecks for 40 years but it’s not like that money was put into a "lock box" or anything. I mean, it’s the people’s fault they just left that Social Security SURPLUS of $1.4Trillion just laying around where George Bush accidentally used it to pay for tax breaks for the wealthy. 10M lost jobs later, those tax breaks are long spent now and neither the jobs or the Social Security money is going to be coming back and Eric Cantor just wants to make sure you know that and don’t have any illusions that the Government will be doing anything about it but, of course, they will still remove the money from your paycheck as someone has to pay for those extended tax cuts, right?

Spain sold Bonds this morning at a whopping 4.9% for 3-year notes up over 20% from last month’s 4.05% rate. 4-year bonds went out at 5.05% vs. 2.87% in October, 2009 so perhaps a problem for Spain (Italy next). Both the BOE and the ECB left rates unchanged and the BOJ is on QE33 at this point. Meanwhile, a French court is investigating new IMF Minister, Christine Lagarde for abuse of authority but not for participating in the framing Dominique Straus-Khan so she could take his job and screw Greece over – interesting…. 😎

We went long on oil futures (/CL) off that $91 line as Over ten oil and gas pipelines lie within reach of dangerous exposure in the flooded Missouri River due to scouring, in which the greater weight and speed of the water can remove dozens of feet of the river bed by carrying sediment downstream. And also because it’s almost the weekend and they love to jack it up into the weekend. Gasoline (/RB) was also a play off the $2.90 mark in Member Chat this morning. I’m sure I’ll be liking the same Friday $36 calls I liked yesterday on USO as an options play, maybe cheaper at the open. Overall, we’re hoping to go long again but that Dollar is going to make it tough so very tight stops on the longs.

Be careful out there.