What a crazy month we've been having!

What a crazy month we've been having!

We were fortunate enough to go bearish at the beginning of the month, when I cautioned we could correct 20% from our highs and then we became "Cashy and Cautious" for the next couple of weeks because we anticipated the middle of our W pattern, leading up to the Fed's hinting at QE3 in Jackson Hole so we could repeat the rally we got last year, on QE2. It was all looking good - from our bottom call of the 19th until the last day of the month, when we we now see that my Tuesday title "Breaking Higher or Dressing Windows" seems to have been answered with the latter.

This, however, is not an article about that. This is a good time, I thought, since we came off a very cashy bias - to talk about how we look to make additions and subtractions to our portfolios over time (in this case, the past two weeks). Of course we are talking about virtual trades and virtual portfolios - keep that in mind, we're just going to do our best to see what trade ideas worked, which ones didn't and which ones COULD have been used to build up a balanced collection out of the many, many trade ideas we have each week.

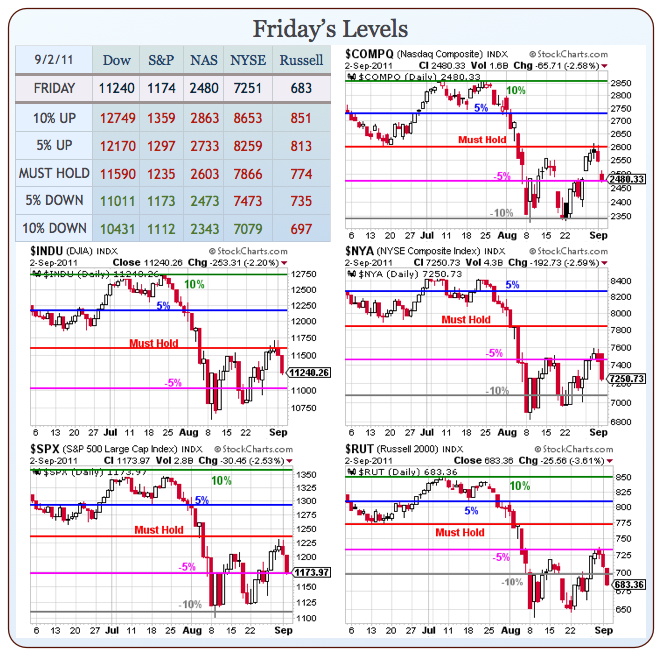

Keeping our eye on the Big Chart and thinking about where we were each day, I'll try to lay out the trade ideas in order and comment when appropriate so bear with me as this article will have loose structure as it's main goal is to begin a conversation about trade selections.

Also, Elliot (our Stock World Weekly Editor) has designed a cool graphic to give us a quick view of our virtual asset allocations.