What insanity!

What insanity!

300 points up in the Dow yesterday (as predicted – thank you very much!) then a 200-point drop early this morning at the EU open (3am) then back to yesterday's close (up 200) and now (8am) kind of in between.

Yesterday's big rumor was Italy, who had a terrible Bond Auction yesterday that went off at 4.15% vs 2.96% a month earlier (up 35% in 30 days), would be bailed out by China – who seem to be tired of waiting for the EU to get their own act together and seem willing to deploy their $3.2Tn in foreign exchange funds through CIC and SAFE (China's State Administrator of Foreign Exchange) to make, according to the Financial Times, "significant purchases of Italian Bonds and investments in strategic companies."

That drove the markets higher yesterday afternoon even though the actual meeting was over 2 weeks ago and Italy just, in FACT, had a tragic bond auction just hours before this "news" popped the markets back up – MADNESS! As I said to Members just before the close:

This market is just ridiculous at this point – jumping up and down 100 points because China will or won’t buy $8Bn worth of bonds in a $60,000Bn global economy. People are just out of their minds…

This morning's market-dropping rumor was started in Uncle Rupert's Journal where an Op-Ed piece published this morning began with this shocker:

'We can no longer borrow dollars. U.S. money-market funds are not lending to us anymore," a bank executive for BNP Paribas, who declines to be named, told me last week. "Since we don't have access to dollars anymore, we're creating a market in euros. This is a first. . . . We hope it will work, otherwise the downward spiral will be hell. We will no longer be trusted at all and no one will lend to us anymore."

Apparently, Rupert isn't done unwinding his Euro short position yet. That's why he taps the Director of the Conservative French Institute for Economic and Fiscal Research, Nick Lecaussin – a man who Iconomie calls "France's Worst Enemy" to write about high-level but anonymous sources at BNP who tell him the Bank can't access Dollars anymore – a ridiculous statement that was immediately denied by the Bank but – TOO LATE – the Damage is done and Uncle Rupert made another $100M on his Euro shorts (coincidentally, I'm sure!). The Bank (who lost $3Bn of market cap this morning) stated:

Apparently, Rupert isn't done unwinding his Euro short position yet. That's why he taps the Director of the Conservative French Institute for Economic and Fiscal Research, Nick Lecaussin – a man who Iconomie calls "France's Worst Enemy" to write about high-level but anonymous sources at BNP who tell him the Bank can't access Dollars anymore – a ridiculous statement that was immediately denied by the Bank but – TOO LATE – the Damage is done and Uncle Rupert made another $100M on his Euro shorts (coincidentally, I'm sure!). The Bank (who lost $3Bn of market cap this morning) stated:

BNP Paribas categorically denies the statements made by this anonymous source and confirms that it is fully able to obtain USD funding in the normal course of business, either directly or through swaps (see attached document (46 ko)).

BNP Paribas is surprised that the Wall Street Journal published this opinion containing both statements from an anonymous source, and a large number of unverified assertions and technical errors, without contacting the bank for verification.

Surprised? I guess BNP is in trouble if they don't know how the game of Capitalism is being played these days! As we discussed in yesterday's post, EVERYBODY is lying to us these days and it's creating market turmoil on a daily (and intra-day) basis. Much like in 2008 – unscrupulous investors can make a fortune in a single day by floating a rumor like the one above and there is just as much money to be made on the way back up as the rumor is denied and the stock recovers.

Surprised? I guess BNP is in trouble if they don't know how the game of Capitalism is being played these days! As we discussed in yesterday's post, EVERYBODY is lying to us these days and it's creating market turmoil on a daily (and intra-day) basis. Much like in 2008 – unscrupulous investors can make a fortune in a single day by floating a rumor like the one above and there is just as much money to be made on the way back up as the rumor is denied and the stock recovers.

This is the kind of market where my many years of media cynicism really pay off. What we all need to be aware of when we hear a "market-moving" rumor is what venue is releasing the information (who owns them?), who is the person reporting (who owns them or what do they have to gain) as well as whether or not the rumor makes sense as well as whether or not the reaction makes sense. As I pointed out to Members yesterday – whether or not China buys $8Bn out of 60,000Bn worth of global debt from Italy is really not something that should move the US Dow Jones Industrial Average (also owned by Uncle Rupert!) over 1% 20 minutes, is it?

The game this fall is rumors and innuendo and that game can be played through earnings in October when facts will, for however brief a moment, once again rule the day. For now, we need to do our best to cut through the BS and simply find good companies to invest in.

It's not that complicated really – will BNPs credit issues stop someone from buying a McDonald's Shrimpburger in downtown Tokyo? Will Greece leaving the EU stop 3Bn Asians from buying cell phones this decade? Will Italy's credit woes get the World off fossil fuels any sooner? No, there are certain Global fundamentals that will not change and when a ridiculous rumor-driven market drives good companies, especially blue-chip stalwarts like MCD, KO, AA, XOM, MMM, PFE, etc. down to bargain-basement prices – that's when we do BUYBUYBUY, no matter what idiot Cramer is saying.

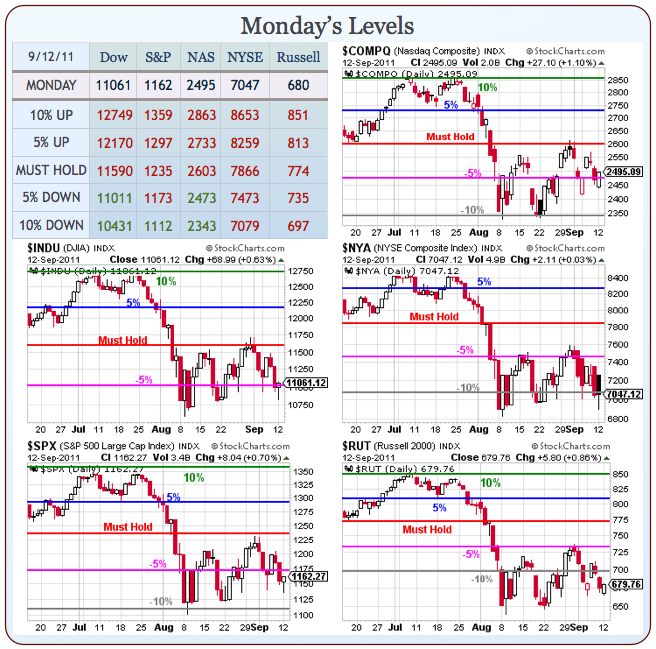

We are, at the moment, staying the course but we do need to make progress back over our Big Chart levels in order to maintain our bullish stance (which we flipped to yesterday morning). We still expect a string of announcements from the G7 nations in the form of stimulus and bailouts to mark the second half of the month and it's just one week until the Fed Meeting where it will literally be QE3 or bust! This week we have August PPI and Retail Sales tomorrow, followed by August CPI and the usual job losses on Thursday. We also have Empire Manufacturing, where anything better than negative will be an upside surprise as well as CPI, Industrial Production, Capacity Utilization and the Philly Fed (also with negative expectations) – all on Thursday morning! Friday will seem anti-climatic with TIC Flows and Michigan Sentiment.

Data trumps rumors and QE3 or whatever stimulus we get trumps everything else so we'll simply keep our eye on the Big Chart and hopefully we can hold those -5% lines on the Dow (11,011) and the Nasdaq (2,473) while waiting for the S&P to hit 1,173. As for the NYSE – we'll be thrilled to see a 50-point gain to take the -10% line at 7,079 and the same goes for the Russell, which needs 697 and deserves it if the Dollar is strong as that's good for smaller companies so no reason for them to be lagging like they are.

If the S&P breaks over 1,173, then the TNA Sept $40/43 bull call spread at $1.30 becomes an interesting play and that can be offset by the sale of the RUT Sept $610 puts at $1.22 for net .08 on the $3 spread. The Russell is currently at 680 so it would take a 10% drop in the RUT by Friday for those puts to take a loss so that's the bet with a massive upside bonus. We'll discuss other potential offsets in Member Chat but it's time to get to work.

Be careful out there!