Wheeeee, what fun!

Just a few more steps and we're there. I'm not quite sure where "there" is but we've been told it's a happy, happy place full of well-capitalized banks, low interest rates and low inflation as far as the eye can see and all we have to do, according to our friends at the EU, is take a simple leap of faith with them.

Sound good to you? I'm not going to re-hash the situation, that was done brilliantly in Stock World Weekly this weekend (and boy does it look good on the IPad!). What we need to do to get is through THIS week is to get our fingers on the pulse of the rumor mill, which is still grinding out market-moving stories at a mile a minute, the last one being that Sarkozy's classic tirade toward the UK yesterday ("We're sick of you criticising us and telling us what to do … you didn't want to join (the euro) and now you want to interfere in our meetings") was merely a ploy to line up votes for UK PM David Cameron to JOIN the EU (because there is nothing the English like doing better than pissing off the French).

Meanwhile, Bank of France Governor Christian Noyer says French lenders would need less than a €10B capital raise to bring their ratios up to the 9% level agreed to by EU FMs over the weekend. He claims this can be done privately without state assistance. Whuck??? That is not at all what we've been hearing from the media nor is that in any way indicated by the 30-year bond spread, where France is paying 124 bps more than Germany to borrow money.

Who's to say what's true anymore – these are just some of the statements jamming the market up and down this morning. At 2:30 am, the Dollar was way down at 76.25, below Friday's lows on Euro-enthusiasm. Then, the Euro-zone October PMI report came out and they really sucked, falling to 47.2 from an already contracting 49.1 in September. "The deterioration signalled a second successive monthly contraction of the private sector economy and the fastest rate of decline since July 2009," says Markit.

Who's to say what's true anymore – these are just some of the statements jamming the market up and down this morning. At 2:30 am, the Dollar was way down at 76.25, below Friday's lows on Euro-enthusiasm. Then, the Euro-zone October PMI report came out and they really sucked, falling to 47.2 from an already contracting 49.1 in September. "The deterioration signalled a second successive monthly contraction of the private sector economy and the fastest rate of decline since July 2009," says Markit.

SELLSELLSELL you say? NONONO I say because what happened in July of 2009? STIMULUS!!! We LOVE stimulus, don't we? At the time (7/22/09), I predicted we we would be completing a decade-long consolidation range that would top out around 11,700 on the Dow.

Here we are, two year's later and still consolidating around 11,700. It's been over 11 years since we first tested this level back in January of 2000 and that first test did not end well. Our second attempt took us over the line in September of 2007 but that was based on Government stimulus and we all know how that ended. We took another little run over the line early this year with mixed results so far but at least we're finally getting some proper consolidation – hopefully before our next attempt to break out, back to that 14,000 mark, which is the top half of our broader range (100% up from the 7,000 base). Even if you didn't buy my premise then, you would have done well to buy BA, which was our featured pick that day with a net $36.60 entry on a short put play (the Jan $40 calls finished at $17 for a net 14.90 gain, up 709%).

Just a side note, as I was looking back on July of 2009, I happened to browse past a very informative article called "China GDP – Are You Kidding Me?" which outlines a lot of our points that are only now being realized about the China Growth Bubble – makes for interesting retrospective reading in light of new facts.

Speaking of great trade ideas, I'm in the process of updating our September's Dozen Buy List and there are still a few actionable trade ideas left (ie. trades we were wrong about so far!) so it's a good idea to check there today and tomorrow as it also includes our first pick for our White Christmas Portfolio, which is going to be the GNW Jan $5/7.50 bull call spread at $1.10, offset with the sale of the Dec $6 puts at $.85 for net .25 on the $2.50 spread. We're doing 10 in this fairly aggressive virtual portfolio who's aim is to turn a $15,000 Christmas budget into a $25,000 Christmas budget in time for the Holidays. Of course this is meant to be a risk allocation of a larger, more conservative portfolio, like our low-touch Income Portfolio, which is running over 6 months ahead of schedule already.

Speaking of great trade ideas, I'm in the process of updating our September's Dozen Buy List and there are still a few actionable trade ideas left (ie. trades we were wrong about so far!) so it's a good idea to check there today and tomorrow as it also includes our first pick for our White Christmas Portfolio, which is going to be the GNW Jan $5/7.50 bull call spread at $1.10, offset with the sale of the Dec $6 puts at $.85 for net .25 on the $2.50 spread. We're doing 10 in this fairly aggressive virtual portfolio who's aim is to turn a $15,000 Christmas budget into a $25,000 Christmas budget in time for the Holidays. Of course this is meant to be a risk allocation of a larger, more conservative portfolio, like our low-touch Income Portfolio, which is running over 6 months ahead of schedule already.

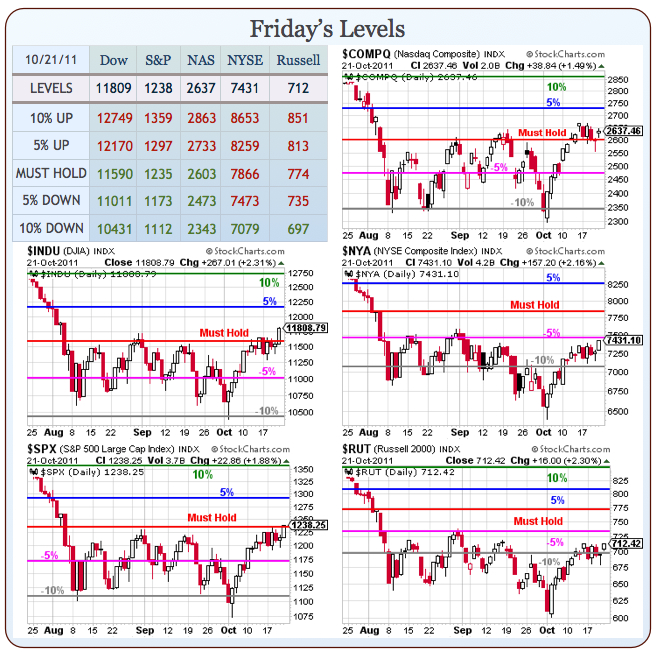

Notice on our Big Chart, that we are just on the cusp of a major breakout, back over our Must Hold levels (which have not held in quite a while) and gearing us up for a nice Santa Clause rally as the G7 Ho-ho-heaps on the stimulus, beginning (so I'm told) with the EU deal on the EFSF signed, sealed and delivered on Wednesday (but sung by Little Stevie Wonder over 40 years ago).

Until then, rumors still rule the intra-day and the trading is sure to be choppy. We cashed out our $25,000 Portfolio after 9 months, hitting our $100,000 with a virtual $30,000 to spare as it just wasn't worth risking into what's sure to be a crazy week. Our Income Portfolio is hedged to about neutral as well and, in fact, is a bit more bearish now that the short DIA puts we had sold expired worthless (100% gains!). So, while I am excited to be back at these levels – we are also recognizing that these are the levels we have FAILED at – over and over again. If it's a real rally, we're not going to miss much by waiting to get a proper confirmation by seeing ALL 5 of our major indexes conquer their Must Hold levels but, for today, we'll just be happy to see the S&P hold 1,235!

That's not asking too much, is it?

It's all about Europe, of course, but then the spotlight will come back to the US and our own budget battles. Treasury has a boatload of T-Bills to peddle this week, beginning with 4-week, 3-month and 6-month notes this morning around 11 with 2, 5 and 7-year notes on Tuesday, Wednesday and Thursday. Housing dominates our data flow this week and we'll also get the Chicago, Richmond and Kansas City Manufacturing Reports along with Consumer Confidence (Tuesday), Durable Goods (Wednesday) and GDP + Consumer Comfort (Thursday) but none of that matters as they are all buried under the barrage of over 1,000 earnings reports. It's going to be a fun week – especially when you are in cash and don't really care which way things go!

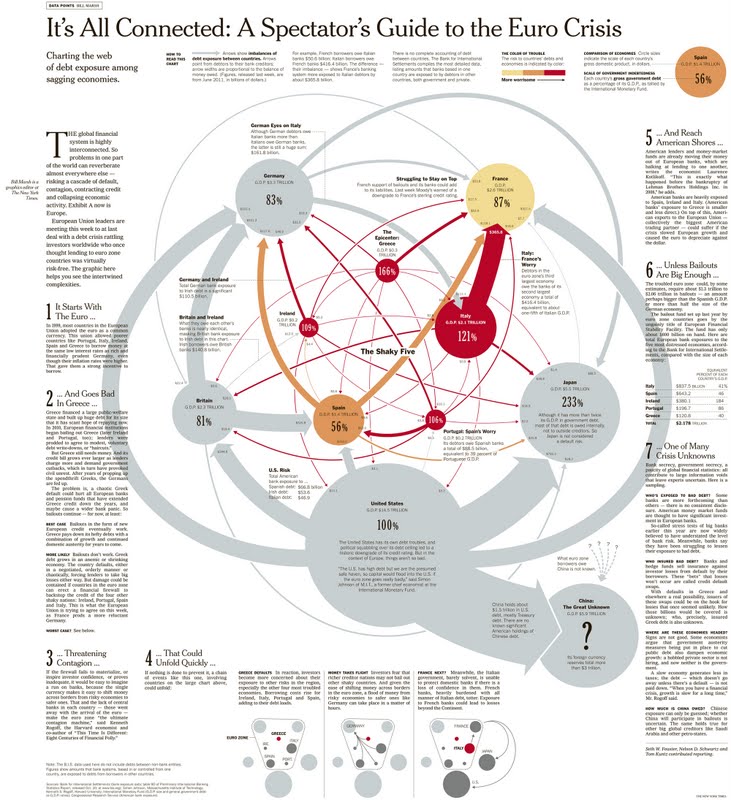

If you do care at all about Europe, I'd take a look at the NYTime's "Overview of the Euro Crisis" with an image below from Barry Ritholtz that you can click on for a quick view.