As we expected, the BOJ has once again intervened on the Dollar.

As we expected, the BOJ has once again intervened on the Dollar.

I mentioned in this weekend's White Christmas Portfolio update that the reason we cashed out our bullish positions and went bearish into the weekend was based primarily on our FUNDAMENTAL expectation of intervention by the BOJ to support the Dollar which, as we all know from reading Stock World Weekly, is going to put a dent in US equites and commodities which are, of course, priced in US Dollars.

On the whole, so far this morning (8am) there has not been too much effect. A 1% bump in the Dollar has caused a 1% drop in the futures – if anything, that's a sign of how strong the markets were after last week's spectacular rally.

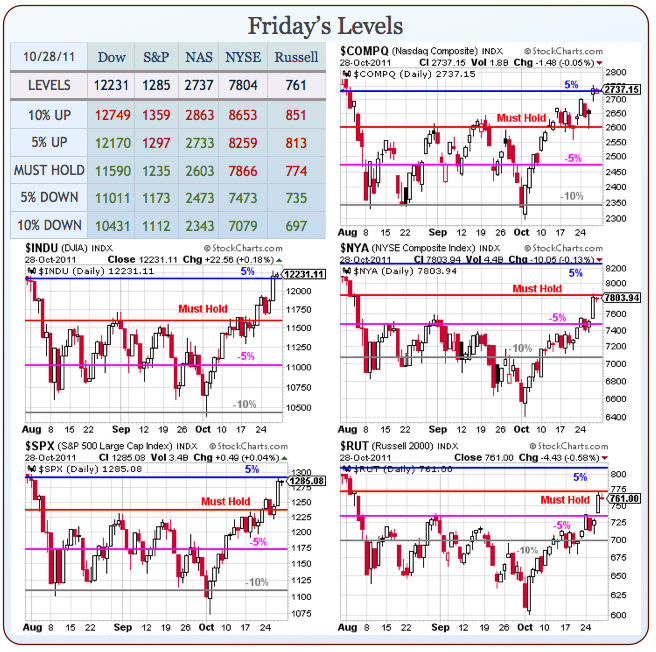

We're up about 15% for the month of October with a day left to go so it would be a shame to blow it. As you can see from our Big Chart, we're flirting with our +5% lines on the Dow, S&P and Nasdaq and just under the Must Hold lines on the NYSE and the Russell. It's the fact that we could not pop those lines, coupled with our expectation of Yentervention that kept us bearish at the end of Friday's session:

The Yen was at 78.80 per dollar as of 4:57 p.m. in Tokyo after earlier trading as high as 75.35. Japanese Finance Minister Jun Azumi pledged to continue to intervene until he is “satisfied,” adding that an appreciating yen threatens the nation’s rebound from the March 11 earthquake.

“There was growing frustration among exporters” amid a strengthening exchange rate and flooding in Thailand that has impaired production, said Martin Schulz, a senior research fellow at Fujitsu Research Institute in Tokyo, who used to do research for the Bank of Japan. “The government wanted to show that they get the message.”

NOW things are going to get interesting because, while Japan may want a stronger Dollar – neither the US or China does. The US, of course, owes A LOT of Dollars to other people and China because they sell a lot of stuff to people who have Dollars. Currency wars like this are exactly what we expect in the early stages of a hyperinflationary environment (see "When Money Dies").

This is the BOJ's 3rd attempt to weaken the Yen this year and the last time they did it was August 4th (and I predicted that one on TV too!) and that sent the markets plunging back to their lows but it was artificial and we bounced back as rumors of QE3 took the market back in the other direction.

Of course, now that we have a quantifiable amount of EU stimulus, this weekend we got the inevitable "too little too late" nonsense with the EFSF now being spun as if it doesn't work without China, which is beyond ludicrous as the EU economy is $16Tn (bigger than ours with far less debt) and China is about $6Tn so people in the Euro-zone are about as insulted by that idiocy as we would be if pundits began saying the US couldn't fund its own rescue program but, since US investors will believe anything with the word "China" in it – this is getting huge play by the MSM and can set us up for a good panic if China indicates they aren't looking to fund Europe's bailouts.

Meanwhile, have retail investors missed the biggest monthly gain in the S&P since 1974? They have if you believe the data from TrimTabs. Americans appear to be in full flight this year, withdrawing over $84B from U.S. equity mutual funds through October 11. But that's not the case, says TrimTabs analyst Leon Mirochnik. It has more to do with the shifting tastes of investors from long-term investing into a short-term ETF trading culture.

On the consumer side, savings as a percentage of personal disposable income dropped to 3.6% – lowest since the recession's onset – but don't ask "experts" why. Theories range from "consumers just need to spend" to the prospect that the numbers (always subject to revision) are just that far off.

Speaking of revisions: You know that cheery feeling of unexpectedly finding a $10 bill down the back of the sofa? Well multiply that by 7.87B. Germany has €55.5B ($78.7B) more than it thought after discovering an accounting error at the bad bank of nationalized lender Hypo Real Estate. Now if only Greece or Italy can get so lucky…

The Dow can fall 315 points today and we're still going to be holding the record for the biggest monthly point gain in history. A wise bull knows when to pull in his horns and we are EXTREMELY cautious at these levels as a 3% pullback here, almost back to our Must Hold lines on the Dow, S&P and Nasdaq would not be in the least bit strange but will energize the Doom and Gloom crowd once again.

The Yen is holding 78 to the Dollar – a huge bump (weaker) than the 75 point at which the BOJ took action but 80 has got to be their minimum goal and that's another 1% drop in the markets from here (about 2.5-3% total drop) so be very careful out there.

Unfortunately, I'm working from a hotel this morning as my whole area (North Jersey) is having severe internet issues due to downed trees from this weekend's amazing snow storm. For those of you not in snowy zones, when there is snow while there are still leaves on the trees, the accumulated weight of the snow can snap the branches and, as this was the biggest October snowfall on record (since the 1860s) we have A LOT of downed trees and branches. This occurring in the same area that was hit by massive flooding last month!