INSANITY!

INSANITY!

That’s what we have today (and what we’ve been having all month) as the markets celebrate the fact that neither the US consumer or the Euro is dead – yet. Holiday sales are apparently up 16.4% from last year with 10% of those sales being IPhones and Ipads so we can thank the actually dead Steve Jobs for saving the markets from a total meltdown this month as we were on track for the worst November EVER until today.

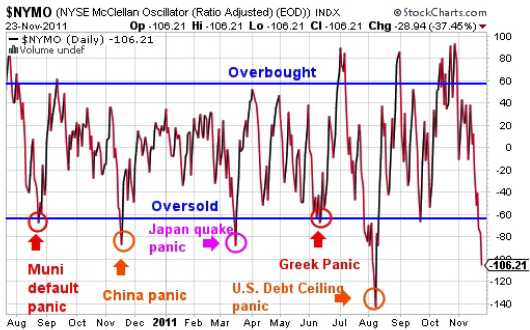

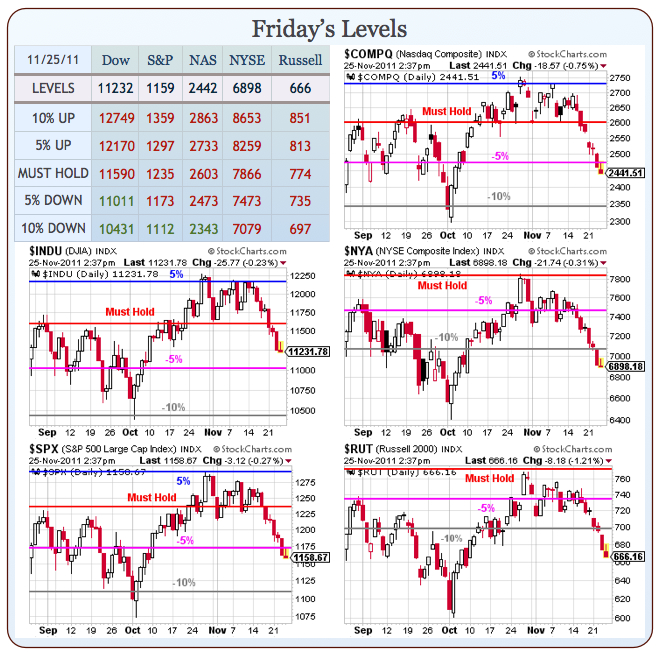

The DOOM meter was certainly set to 100 and, in fact, 100 is about how low the McClellan Oscillator went on Friday – to a state of oversold not matched since August 8th, when the Dow bottomed out at 10,600 so holding 11,200 in this protracted sell-off was a victory, of sorts, for the bulls and certainly a victory for those of you following our Big Chart – which made us perhaps the ONLY newsletter that was bullish on Friday, when I laid out my bullish case and right in the main post – for free – suggested long ideas on:

- Oil Futures (/CL): Was $95, now $100 – up $5,000 per contract

- Gasoline Futures (/RB): Was $2.50, now $2.54 – up $1,680 per contract

And, in Member Chat – our Morning Alert had the following trade ideas:

- FAS Dec $48/55 bull call spread at $3, selling the $40 puts for $2.40 for net .60 on the $7 spread. 5 in the WCP on that one.

- FXE Dec $132/135 bull call spread at $1.20, selling the $129 puts for $1.10 for net .10 on the $3 spread.

- JPM Jan $25 puts can be sold for $1.20

- AA 2013 $7.50 puts can be sold for $1.28.

- VLO June $17 puts can be sold for $2.05

We also speculated on an aggressive AMZN long play with the Dec $200 calls at $2.50 but, overall, we take this 2% bounce after a 10% drop with a grain of salt. As I said to Members in the alert: Just like we watched with amusement while things fell earlier this week, we should take a move up just as lightly until we cross back over our Must Hold Lines – to some extent, we have selling fatigue driving this move – keep in mind my bullish discussion on hyperinflation is more of a macro thing – we won’t miss much by waiting a bit.

We also speculated on an aggressive AMZN long play with the Dec $200 calls at $2.50 but, overall, we take this 2% bounce after a 10% drop with a grain of salt. As I said to Members in the alert: Just like we watched with amusement while things fell earlier this week, we should take a move up just as lightly until we cross back over our Must Hold Lines – to some extent, we have selling fatigue driving this move – keep in mind my bullish discussion on hyperinflation is more of a macro thing – we won’t miss much by waiting a bit.

For the whole story of how we flipped from bearish to much less bearish (I wouldn’t call it bullish just yet) – check out Stock World Weekly, which reviews the week nicely. One comment I made in Thursday’s post that I re-read this weekend in SWW that bears repeating is my thoughts on why we planned to go bullish on Friday:

Technically, of course, we’re breaking down. Fundamentally, I’m not so sure. The fear is palpable as Europe looks terrible and clearly all these austerity measures are taking a toll on the Global economy but it’s simply NOT showing up in the data yet. PMI’s are dropping across the Globe but the Purchasing Manager’s index is a SENTIMENT indicator that reflects the OPINION of the buyers about business prospects.

We talk about data sources all the time and whether or not we should trust them but it’s also important that we UNDERSTAND our data sources – especially the sampling and timing of the information we’re looking at. As I noted above, we were looking at forward looking SENTIMENT based on past concerns – it wasn’t hard data and the outlook could change on a dime with a deal in the EU or MORE FREE MONEY from the Fed.

We talk about data sources all the time and whether or not we should trust them but it’s also important that we UNDERSTAND our data sources – especially the sampling and timing of the information we’re looking at. As I noted above, we were looking at forward looking SENTIMENT based on past concerns – it wasn’t hard data and the outlook could change on a dime with a deal in the EU or MORE FREE MONEY from the Fed.

Speaking of the Fed – Ambrose Pritchard makes the case that the Fed should save Europe because US Money Markets are no longer willing to lend to over-leveraged EU banks. He cites a $2Tn funding gap that is taking the Euribor spreads back to Lehman-like levels, saying: "Unless Germany agrees to the full mobilization of the European Central Bank very fast, the eurozone will spiral out of control. As The Economist put it, “The risk that the currency disintegrates within weeks is alarmingly high."

Bernanke touched on the theme in a speech in November 2002 – “Deflation: making sure it doesn’t happen here” – now viewed as his policy `road map’ in extremis. "The Fed can inject money into the economy in still other ways. For example, the Fed has the authority to buy foreign government debt. Potentially, this class of assets offers huge scope for Fed operations," he said.

In more free money news (and MORE FREE MONEY is pretty much our bullish premise): La Stampa reports the IMF is considering loaning Italy up to €600B to give Mario Monti’s new government a 12-18 month window with which to push through fiscal reforms.

In more free money news (and MORE FREE MONEY is pretty much our bullish premise): La Stampa reports the IMF is considering loaning Italy up to €600B to give Mario Monti’s new government a 12-18 month window with which to push through fiscal reforms.

As this would put a strain on IMF resources, the report suggests assistance from the ECB, i.e. the idea previously floated of the ECB lending to the IMF which in turn lends to needy EU states.

Even Belgium was so excited by this idea that they formed a Government. That’s right, after going without one for 530 days (and a real victory for Libertarians everywhere), the King has asked the Socialists to form a Government – not coincidentally at the same time Belgium needs to sell $2.7Bn worth of bonds in a terrible market.

Now the Euro-zone leaders are negotiating "a potentially groundbreaking fiscal pact" aimed at preventing the currency bloc from fracturing by tethering its members even closer together. The proposal, which hasn’t yet been agreed to, would make budget discipline legally binding and enforceable by European authorities.

Now the Euro-zone leaders are negotiating "a potentially groundbreaking fiscal pact" aimed at preventing the currency bloc from fracturing by tethering its members even closer together. The proposal, which hasn’t yet been agreed to, would make budget discipline legally binding and enforceable by European authorities.

Officials regard the moves as a first step toward closer fiscal and economic coordination within the currency area. In other words, now, in the EU, when a country fails to hit their numbers and their citizens are forced to give up their property and to endure labor-camp conditions – the EU Authorites can now use the excuse that "they were only following orders." Good to see the World finally making some progress, isn’t it?

So, while we enjoy the rally – we will remain cautious as it’s a long way back to our Must Hold lines (11,590 on the Dow is most likely to be tested first) and that is only the top of the LOWER end of our expected trading range so – nothing to be impressed about here – more like relived. Relief is good, though, relief can be the first step towards optimism and a real rally – but let’s not get ahead of ourselves just yet – as you can see from Elliot’s excellent chart from Stock World Weekly, mostly what we have is an oversold bounce. They can be good to play short-term, but not much of a predictor for the long run.