“It’s still absurd and unthinkable in many senses of the word for people who really understand what it means to have a monetary union, it’s really unmanageable and unthinkable.

“Some people that seem to think about it or have the idea of preparing for it, they don’t know what they’re talking about. In my view, it’s still not going to happen.” – ECB Vice President, Vitor Constancio

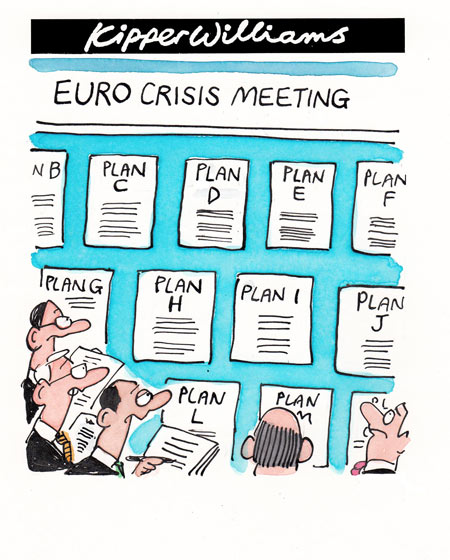

Finally someone official is saying what I’ve been saying for months! The palpable fear that surrounds the Euro-zone is itself the problem – not the EU itself. I pointed out to Members last year, when the Greek crisis first hit, that dumping Greece from the EU would be as silly as the US dumping Florida or California because they missed their budget goals.

Constâncio said the ECB was determined to stick with its current policy of introducing new three-year funds to try to counter the freeze in interbank lending, and support greater fiscal integration in the euro zone. “What we decided is very recent and it’s enough, but we never pre-commit, so we will see,” he said. “So far, we think the decisions we made are very significant and should be enough for the objectives that we are responsible to attain.”

Constâncio said the ECB was determined to stick with its current policy of introducing new three-year funds to try to counter the freeze in interbank lending, and support greater fiscal integration in the euro zone. “What we decided is very recent and it’s enough, but we never pre-commit, so we will see,” he said. “So far, we think the decisions we made are very significant and should be enough for the objectives that we are responsible to attain.”

And what is it the EU has done recently? Up to one TRILLION Euros has been pledged in 3-year funding at the (variable) ECB rate, which is currently 1%. That is enough money to fund ALL the financing needed by ALL of the EU nations for the next two OR THREE years, according to GS analyst Jernej Omahen. Keep in mind that all you have to do is borrow $1Tn at 1% and lend it at 4% and PRESTO! – you make $30Bn. Do that 3 times and lever up the money you borrowed 10 times and suddenly you’re making a Trillion – nice work if you can get it!

Just like the US, the Euro-Fed gives free money to the banks and the banks lend it to the EU nations at much higher rates and to consumers at much, much higher rates and everyone is happy – well, everyone who is a banker, that is… The consumers/taxpayers, on the other hand, both pay the borrowing rate that is 300-1,800% higher than what the banks borrow at AND they pay, through deficits, the difference between what their Government borrows money for and the discount they give to the banks. What a friggin’ scam!

This is why we’re long on Financials (see yesterday’s post) – how can they lose? I mentioned yesterday that we ended up 100% long in our White Christmas Portfolio and yesterday was a real test of our resolve. Just before the close, Spiyer asked if it was worth going short and my answer was: "If we follow though (tomorrow), then plenty of time to jump on short train but hard to trust low-volume sell-off based mostly on Dollar up in more Euro-panic – it’s just getting old."

This morning, Constancio knocked a major leg out from under the bearish stool but it remains to be seen how much effect it will have in this low-volume, pre-holiday period. Keep in mind the year doesn’t end until NEXT week, so still plenty of time to paint the tape and get up back over 1,257 on the S&P, where we started the year. The Dow is already over 11,577, where we began 2011 on that index. The Nasdaq was 2,626 on December 31st, the NYSE was 7,964 and the Russell was 793.

Both the RUT and the NYSE, our broad indexes, are 10% below where they began the year while the Dow is 2% over, S&P 5% under and Nasdaq 4% under. Why the strong outperformance of the Dow? IBM is up $45 and contributed about 350 points so that alone accounts for all of the Dow’s positive performance. Without IBM and with C back in, the Dow would be tracking the S&P almost exactly.

Speaking of C, we thought yesterday’s selling was overdone enough to finally take a plunge on BAC, with the 2014 $2/4 bull call spread at $1.17, which could be offset with the XLF April $12 puts at .90 for net .27 on the $2 spread, which has a 640% upside if BAC manages to hold $4, which is 20% LOWER than it is now.

Speaking of C, we thought yesterday’s selling was overdone enough to finally take a plunge on BAC, with the 2014 $2/4 bull call spread at $1.17, which could be offset with the XLF April $12 puts at .90 for net .27 on the $2 spread, which has a 640% upside if BAC manages to hold $4, which is 20% LOWER than it is now.

That’s what we call a self-hedged entry, which gives us a nice cushion on a long-term play that only ties up, according to ThinkorSwim, $2 of net margin, which is released in April if XLF stays above $12 (now $12.25). After that, you have nothing but the .27 cash in the trade for the next 20 months – a nice, relaxing way to go long on Financials.

As we expected (see 5:48 Alert to Members), the Dollar paused at 80.40 but is now (8:50) down to 80.15 and the futures are much improved, up around 1.5% with oil (/CL) flying up to $96.42 (looks like we picked the right week to go long!) and gasoline (RB) already at $2.54 for some whopping gains off our $93 and $2.50 entries. We will, of course, take this with the same grain of salt we took yesterday’s sell-off as it’s all meaningless until we break out of the narow ranges (see Big Chart) we also talked about in yesterday’s morning post.

We also have a bit of good news this morning with November Housing Starts up 9.3% but, at 685,000 annualized vs well over 2M a few years ago – it’s really nothing to pop the champagne over. We can pop the cork on JEF (we’re long) as they are flying pre-market after reporting EPS of .17, a .03 beat (20%) and, more importantly, in a single quarter they were able to cut leverage 25%, from 12.9x to 9.9x and, more importantly for us Fundamentalists, the tangible book value is $14.40 a share – not bad for a stock that closed at $11.80 yesterday!

We also have a bit of good news this morning with November Housing Starts up 9.3% but, at 685,000 annualized vs well over 2M a few years ago – it’s really nothing to pop the champagne over. We can pop the cork on JEF (we’re long) as they are flying pre-market after reporting EPS of .17, a .03 beat (20%) and, more importantly, in a single quarter they were able to cut leverage 25%, from 12.9x to 9.9x and, more importantly for us Fundamentalists, the tangible book value is $14.40 a share – not bad for a stock that closed at $11.80 yesterday!

I think JEF is the poster child for our view on the Financials, they are sold off to ridiculous lows based on irrational fears that cannot be sustained over time. Not every bank is a winner but right now, they are all priced to be losers and, unless we’re moving back to a cash and gold society and we all begin keeping Trillions of Dollars under our mattresses – some bank, somewhere will find a way to make money on the lending spread.

Meanwhile, the World Governments are funneling Trillions of Dollars, Yen and Euros through the banks to prop up the Global economy – you can complain about it all you want but, with return potentials of 628% on BAC etc – don’t you think you should stop complaining and start participating – at least just a little?

Remember, we don’t care IF the game is rigged, as long as we understand HOW the game is rigged and are able to play along!