"Death by a Thousand Cuts!"

"Death by a Thousand Cuts!"

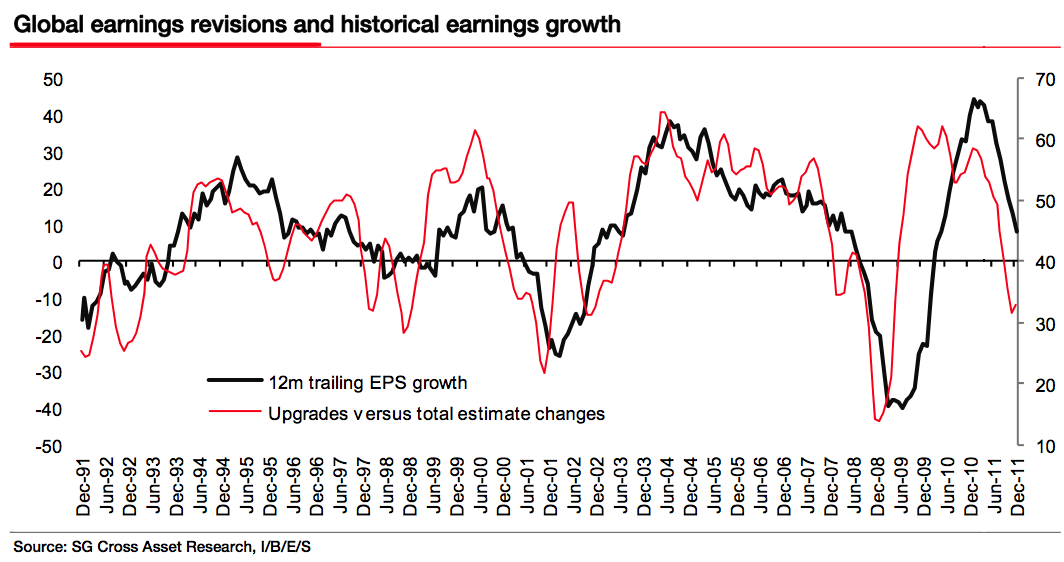

That's the word this morning from Societe Generale, who titled their Global Earnings Estimates Analysis: "Death by a thousand cuts; double digit downgrades for Eurozone and Japan" and included this spiffy graph to make the point that we are now about to cross back into the negative earnings zone that has, in the past, been a great indicator that we were about to have a HORRIFIC market correction.

Per Barry Ritholtz, the "highlights" of the report were:

• Recent earnings forecasts cut by 4.9% and 6.9% for 2011 and 2012, respectively.• Severe downgrading of both 2011 and 2012 consensus forecasts, with Japan and the Eurozone seeing double-digit percentage cuts to next year’s earnings;• US stands out with only minor cuts to 2012 forecasts.

Of course, the EU has just given us a fabulous road map for the next round of QE and they have flooded the World with enough freshly printed Euros that it would hardly make a ripple now if the Fed drops a Trillion here or there in 2012. Not to be outdone, the Swiss have been considering PAYING Banksters to borrow money and the Government actually voted yesterday (defeated so far) on creating a legal framework for negative interest rates.

THAT's how crazy things are getting and THAT's what happens when Banksters run a country – a fate the United States is itself in the early stages of. When the primary purpose of the Government (and that's YOUR elected officials spending YOUR money) becomes finding bigger and better ways to give money (that they don't have) to Banks – THE SYSTEM IS BROKEN! Really, what does it take to wake you people up???

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…I believe that banking institutions are more dangerous to our liberties than standing armies." – Thomas Jefferson

8:30 Update: The 3rd estimate of the Q3 GDP dropped 10% to 1.8% from 2%. If not for the Core PCE rising 5% to 2.1% – it would have been worse. Personal Consumption fell from 2.3% to 1.7% but hey, what's a 26% downward adjustment between friends, right? As noted by SocGen above, Corporate Profits were revised down 25%, from 1.6% to 1.2% so, overall, an anemic report. Fortunately, we were on top of it as I put up a note to Members in the early morning Chat with an idea to short oil ahead of the GDP ($99 on /CL), saying:

My logic on oil this morning is A) A 10Mb draw and $99 is all they can do? B) If our GDP is bad, demand is bad and oil goes down C) If our GDP is good, the Dollar is strong and QE3 less likely and oil goes down. So, on the whole, I think it’s safer to short oil than short the indexes ahead of the GDP but, just like yesterday – the smartest play is actually cash!

Oil actually topped out at $99.30 just ahead of the GDP (someone must have felt the opposite of what I did) but has plunged back below $99 already so the egg McMuffins are safely paid for with a stop at $99 (now $98.90) that can trail by .10 to capture more gains. Oops, even as I write this we're crossing $98.80. At $10 per penny per contract – this is good money!

The Dollar is popping to 80.45 and that's an odd reaction, probably because the upward revision of Core PCE plus the "good" jobs number ("only" 364,000 people lost their jobs last week) pushes QE3 a bit further off the table for the moment. Although the Chicago Fed fell to -0.37 from -0.11 in October, it also showed positive movement in the employment, unemployment, and hours categories.

$98.70!

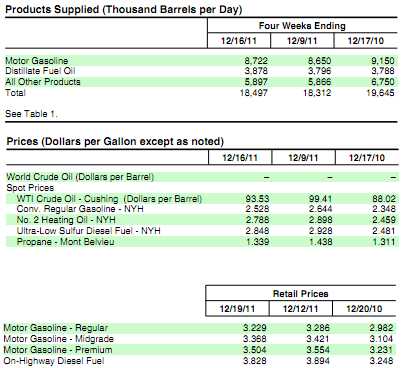

Speaking of oil – We had an exciting decrease of 10.6 Million barrels of oil in yesterday's inventory report and oil shot up from about $97 to $99 on that news. It was, of course, a crock! Looking at the full report (released at 1pm) we can see that imports were down 741,000 barrels PER DAY – so there's 5.2M of our missing barrels right there (2 tankers diverted for a day takes care of that to goose prices into the holiday weekend). Also, we EXPORTED 390,000 barrels of product PER DAY – another 2.7Mb out the door for the week. 390,000 barrels of exports per day ranks us ahead of Sudan as a global oil provider!

Speaking of oil – We had an exciting decrease of 10.6 Million barrels of oil in yesterday's inventory report and oil shot up from about $97 to $99 on that news. It was, of course, a crock! Looking at the full report (released at 1pm) we can see that imports were down 741,000 barrels PER DAY – so there's 5.2M of our missing barrels right there (2 tankers diverted for a day takes care of that to goose prices into the holiday weekend). Also, we EXPORTED 390,000 barrels of product PER DAY – another 2.7Mb out the door for the week. 390,000 barrels of exports per day ranks us ahead of Sudan as a global oil provider!

Even more fun – the refineries produced just 18.5Mbd of product, which may sound like a lot but last year at this time, that number was 19.65Mbd – so the US Energy Cartel has cut production by 8.5 Million barrels per week and THAT is why US Consumers are paying 10% more than we did last year even though we have cut our consumption by 10%. I said to Members this morning:

Oil started the year at $92.50 and demand now is lower than it was then but it too will likely flatline between $97.50 and $100 so not much of a pull on the market either way. Gold is bravely holding $1,600, which is up $200 for the year but they forgot to manipulate Silver, which is down 5% from $31.50 or Platinum, which is rarer than gold but down 22% from $1,800 to $1,400. It’s very historically rare for gold to be higher than platinum (and makes no logical sense) so 22% is the idiot factor in gold, at least.

If you want a reality check – look at copper, which fell from $4.50 in Jan to $3.25 yesterday (down 27%) – that’s the reality of the Global economy!

This whole market may be heading towards a reality check in January but, for now, it's almost Christmas and oil is back over $99 and we're not going to re-short unless the Dollar pops 80.50, which is doubtful as that's below $1.30 on the Euro and the Swiss are willing to pay their Bankers to make sure that doesn't happen!

Let's be careful out there – tempting though it may be to short this nonsense – cash is king!