Moving up today (pre-market) on no real news but rumors that CHINA! will provide some kind of stimulus (more cash for clunkers was the early story) but both our Futures and European stocks pared gains after China’s Xinhua News Agency said the country has no plan to introduce stimulus measures on the scale deployed during the financial crisis in response to this year’s economic slowdown.

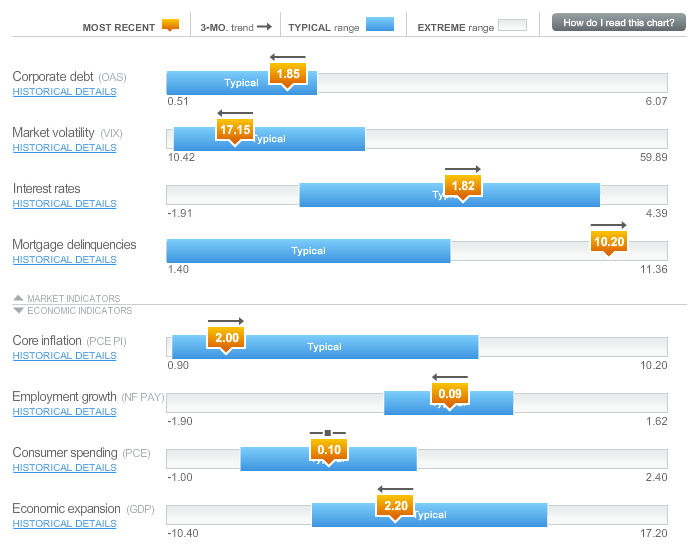

As you can see from Russell's Economic Dashboard, as of 4/30 the US was in a fairly typical range. Our worst performing indicator, Mortgage Delinquencies, have actually come down a bit since this report so again, it's hard to be bearish on US Equities – especially when one considers the question – compared to what?

Spanish Retail Sales were off 9.8% from last year, which is 50% worse than the 6.3% expected by Economorons and a 164% increase over the 3.7% pace they were dropping at the month before (March). Moody's is warning that A LEAST a quarter of 254 unrated European LBO deals with debts totaling $168Bn could default because of refinancing burdens exacerbated by the eurozone debt crisis. The refinancing peak will hit in 2014-2015, and new-issuer pricing will remain costly.

Spanish Retail Sales were off 9.8% from last year, which is 50% worse than the 6.3% expected by Economorons and a 164% increase over the 3.7% pace they were dropping at the month before (March). Moody's is warning that A LEAST a quarter of 254 unrated European LBO deals with debts totaling $168Bn could default because of refinancing burdens exacerbated by the eurozone debt crisis. The refinancing peak will hit in 2014-2015, and new-issuer pricing will remain costly.

"Over half the debt maturing through 2015 is concentrated in 36 companies, each of which has over €1 billion of debt," said Chetan Modi, head of Moody's European leveraged finance. "While this debt is broadly dispersed across industries, there is a concentration of debt to be refinanced in 2014."

And these companies are now one year closer to the 2014-2015 refinancing peak, which is worrisome given the weak macroeconomic environment and generally low credit quality of the debt. Many bigger companies will seek to refinance via high-yield bonds, but will need to be "sufficiently creditworthy" to do this, and the openness of European and U.S. high-yield markets will determine how these companies can navigate the refinancing burden. Moody's said market access will likely remain in "windows," and it expects new-issuer pricing to remain costly.

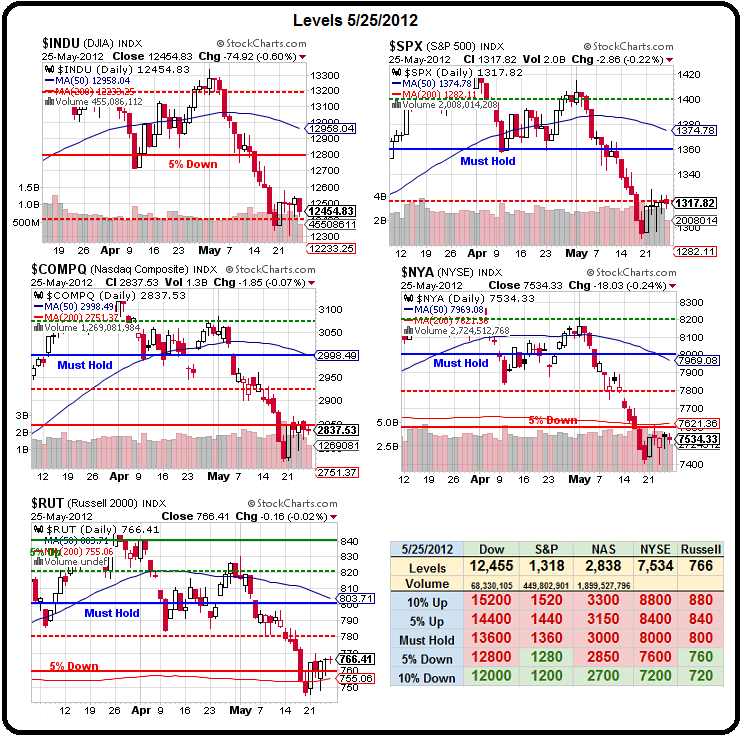

Although we went into the weekend bullish in our short-term portfolios and we're ready to dip our toes in the water long-term again by setting up a brand new virtual $500,000 Income Portfolio – we remain Cashy and Cautious until we see some proper progress over our strong bounce levels and, so far, we're still waiting to see the WEAK bounce levels actually hold:

Although we went into the weekend bullish in our short-term portfolios and we're ready to dip our toes in the water long-term again by setting up a brand new virtual $500,000 Income Portfolio – we remain Cashy and Cautious until we see some proper progress over our strong bounce levels and, so far, we're still waiting to see the WEAK bounce levels actually hold:

- Dow – 12,750 (12,540 is 20% retrace/weak bounce)

- S&P – 1,343 (1,319)

- Nas – 2,900 (2,840)

- NYSE – 7,720 (7,560)

- RUT – 780, (765)

The Russell is just over at 766 and our Futures are up about 0.666% – a sure sign that Lloyd Blankfein is calling the shots this morning! The strong bounces are, by definition, 2% higher than the weak bounces as we're retracing a 10% drop in our indices.

Last week, we got the whole 2% move back to the weak bounce zone on Monday but then we spent the entire week proving we couldn't hold it – this week we're not going to be satisfied with anything less than those strong bounce lines – per last Wednesday's discussion on Stock Market Physics, which we reviewed in the Thursday morning post.

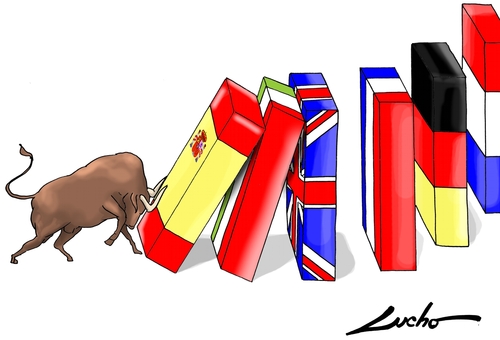

I hate to sound like a broken record but nothing is "fixed" in Europe and our premise for the month has been that there needs to be $1-1.5 TRILLION of genuine stimulus and/or bailouts in order to salvage this mess – whether from the ECB or the BOJ or the PBOC or the Fed or the IMF or even the BOE – ANYONE who has a few hundred Billion to spare needs to step up to the plate NOW – before this thing gets any worse.

I hate to sound like a broken record but nothing is "fixed" in Europe and our premise for the month has been that there needs to be $1-1.5 TRILLION of genuine stimulus and/or bailouts in order to salvage this mess – whether from the ECB or the BOJ or the PBOC or the Fed or the IMF or even the BOE – ANYONE who has a few hundred Billion to spare needs to step up to the plate NOW – before this thing gets any worse.

I said 14 months ago, last April, that "The Pain in Spain will Hardly Be Contained" and today El Mundo reports his inner circle concluding the government is in need of at least some form of a bailout. Bankia – deemed healthy just weeks ago – is now in need of more than €20B while the country's bank restructuring fund has €5.3B, and that's just one bank.

Spain is off almost 50% since I posted my warning and the CAC was at 3,900 that week, now 3,050 (down 22%) and the German DAX at 6,400 is down 12.4% from 7,200 while the FTSE was 5,600, now 5,350 (down 4.4%) – faring a bit better by NOT being a part of the Euro, which is trading at $1.252 this morning. The dollar is officially scarce again, having risen against all 16 of its major peers since late July, putting the dollar index 12% higher than it was when the Fed launched QE in late 2008. New investment guidelines and regulations since the financial crisis leave dollar-denominated securities as one of the few options left as still super-safe.

Last Wednesday, as the Summit in Brussels was going on, Spanish PM Rajoy strongly urged that the ECB be allowed to step in and purchase sovereign debt, saying that their economy can't take much higher rates. Part of the problem on this was the last solution– the last two LTRO's have loaded Spanish banks with Spanish government debt. When the value of this massive pile of debt goes down, the banks take losses. Last week, the value of these bonds went down, costing not only the Spanish state more money to service its debt but it's banks as well in these losses.

Last Wednesday, as the Summit in Brussels was going on, Spanish PM Rajoy strongly urged that the ECB be allowed to step in and purchase sovereign debt, saying that their economy can't take much higher rates. Part of the problem on this was the last solution– the last two LTRO's have loaded Spanish banks with Spanish government debt. When the value of this massive pile of debt goes down, the banks take losses. Last week, the value of these bonds went down, costing not only the Spanish state more money to service its debt but it's banks as well in these losses.

Out in the real world in which we all live, Friday afternoons are very much looked forward to. In the financial world, it is just the opposite– Friday afternoons after market close is when companies and nations unload their really bad news, which at this point is actually expected. Unfortunately for Spain, the Governor of it's biggest state, Catalonia, could'nt wait until market close to crap all over the markets. He announced that his state would need help from the central Spanish government to meets its obligations as Catalonia was essentially now shut out of the bond markets. Catalonia will need help in finding about $16 billion or so. The Spanish 10 year Bond immediately tanked, leaving Spains banks with even more losses thanks to the aforementioned LTRO, nevermind the Catalan State Bonds, which also tanked, producing another flood of red ink at these very same Spanish banks. All of this is happening in a nation who's unemployment rate is now 24% and who's economy is actually contracting.

When (not if) Spain goes under, the EU banking system will be in serious danger of collapsing. In the meantime, don't be surprised to see Rajoy's request that the ECB begin purchases materialize or even another LTRO, of which there were market rumors last week. Another LTRO will simply enable overleveraged Spanish banks to borrow money and use it to purchase even more unstable Catalan and Spanish Gov't debt. The noose is tightening and the stool underneath is looking less steady.

When (not if) Spain goes under, the EU banking system will be in serious danger of collapsing. In the meantime, don't be surprised to see Rajoy's request that the ECB begin purchases materialize or even another LTRO, of which there were market rumors last week. Another LTRO will simply enable overleveraged Spanish banks to borrow money and use it to purchase even more unstable Catalan and Spanish Gov't debt. The noose is tightening and the stool underneath is looking less steady.

Ambrose Evans today in his blog mentions that Spain's newspaper, El Mundo, is reporting that Spain no longer has the power to bring down rates on their 10 year bond. Today it went up sharply to 6.47%. One problem with this is that the 10yr Bond is now 4.5% above Germany's Bund, and when you get to this point, a market trading group called LCH, which determines what margins should be on all commodities, raises the margin on you to trade this commodity.

This amounts to a margin call on all those who are long the Spanish 10 year. This is the point where many traders simply give up– and they sell the Spanish 10 year, this exaserbating the problem. Ambrose also mentions that Spanish PM Rajoy has accepted the inevitability of a bailout.

We're entering dangerous ground here. Don't be surprised to see the ECB step in and quietly purchase Spanish debt as Spain, who contributes a whopping 12% to overall EU-area growth, is a much, much bigger deal than Greece (2%), who are also still a complete disaster (in case you forgot about them).

We're entering dangerous ground here. Don't be surprised to see the ECB step in and quietly purchase Spanish debt as Spain, who contributes a whopping 12% to overall EU-area growth, is a much, much bigger deal than Greece (2%), who are also still a complete disaster (in case you forgot about them).

Bloomberg/Businessweek had a great article this weekend – "What a Return to the Drachma Really Looks Like" in which they remind us:

There’s no question that quitting the euro would be an easy way for Greece to shrink its unsupportable debt. Yet if Greece does leave or is kicked out of the single currency, it will most probably suffer inflation, layoffs, capital flight, shortages of essential commodities, and civil unrest, judging from what happened in Argentina when that country quit its dollar peg a decade ago. “Leaving is difficult and messy, so anyone who thinks it’s easy is just wrong,” says Lorenzo Bini Smaghi, a University of Chicago-trained economist who left the European Central Bank’s executive board last year.

Argentina’s experience does show that devaluation and default don’t have to be disastrous in the long term. The short-term costs are sky-high, however. And if Greece goes off on its own, the useful external pressure for reform (aka meddling) will diminish.

The best outcome would be for Europe to form a fiscal union and switch decisively from austerity to growth—rescuing not only Greece but Ireland, Portugal, Spain, and Italy as well. That, however, doesn’t seem to be in the cards. Greece faces a choice between a bad situation and one that looks even worse.

According to Upside Trader: "Guesstimates on a Greek exit from the Eurozone range anywhere from next week to the end of the year. Oh fun. The market hates uncertainty and we are neck deep right now. We could have a sell off of biblical proportions next week, stay flat or maybe rip higher. As a result, we are all on pins and needles unless you are all cash. No one wants to be caught leaning the wrong way, long or short. Some stocks are oversold and some still need to get drilled into submission. It’s amazing that some coal stocks are trading below 2008 crash levels. They never ring a bell at bottoms or tops, so pay attention."

I think that sets the tone for the week quite nicely. I could go on for many more pages and I probably will in Member Chat as I have a lot of weekend reading to pass on but let's call this a morning post and move on as one thing is for certain this week – it's going to be another wild ride!

Have fun out there.